BTC/USD & ETH/USD Key Points

- Bitcoin broke $100K…only to fall a quick -14% to below $90K in a mini “flash crash” before recovering back above $100K.

- Continued inflows into cryptoassets should keep pullbacks in Bitcoin and Ether limited.

- Ether had a strong week, both on an absolute basis and relative to Bitcoin, taking the ETH/BTC ratio back to 0.04, near its highest level since the start of October.

Cryptoasset Market News

- Bitcoin broke $100K…only to fall a quick -14% to below $90K in a mini “flash crash” before recovering back above $100K as of writing.

- Ripple/XRP briefly surpassed Tether/USDT to become the token with the third highest market cap

- Microstrategy acquired an additional 15.4k BTC for $1.5B at $95,976 per Bitcoin. MicroStrategy has accumulated a total of 402,100 bitcoins, with a total cost of approximately $23.4 billion and an average price of $58,263.

- South Korea’s Democratic Party agreed to delay crypto tax by 2 years.

- South Korea’s Democratic Party agrees to delay crypto tax by 2 years.

- Bitcoin dominance fell more than -4% on the week to below 56% as of writing

- President Trump has tapped Paul Atkins to chair the SEC, though he has yet to accept.

Sentiment and Flows

The sentiment gauge we watch most closely, the “Crypto Fear and Greed Index,” feel to 72 last week, resetting sentiment to a level more in-line with a healthy, balanced uptrend. At the margin, the high level of greed in the market hints at elevated risk for a pullback in the coming week, especially if momentum rolls over:

Source: Alternative.me

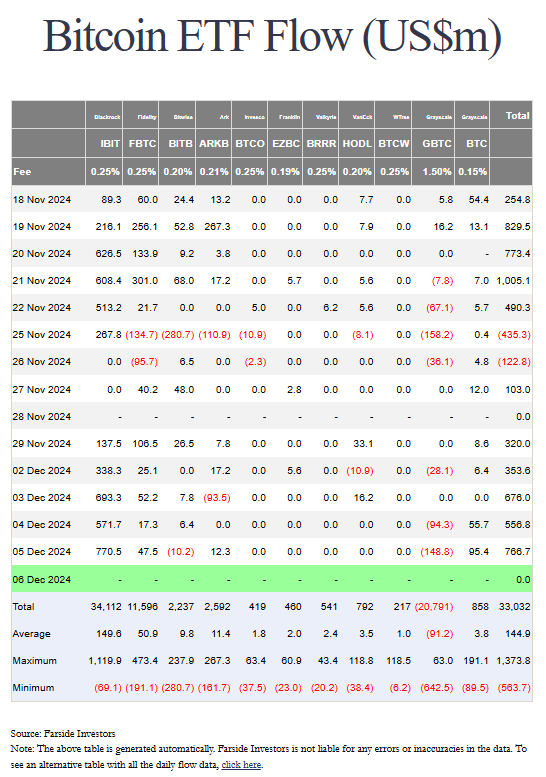

Another way of gauging sentiment, flows into exchange-based cryptoasset investment vehicles, have remained near record highs over the last week. As of writing before the release of Friday’s data, Bitcoin ETFs have seen stellar inflows of over $2.5B over the last four days alone. Over the long-term, inflows from “tradfi” investors provide incremental demand for Bitcoin and could help support the price, as we’ve seen in recent weeks.

Source: Farside Investors

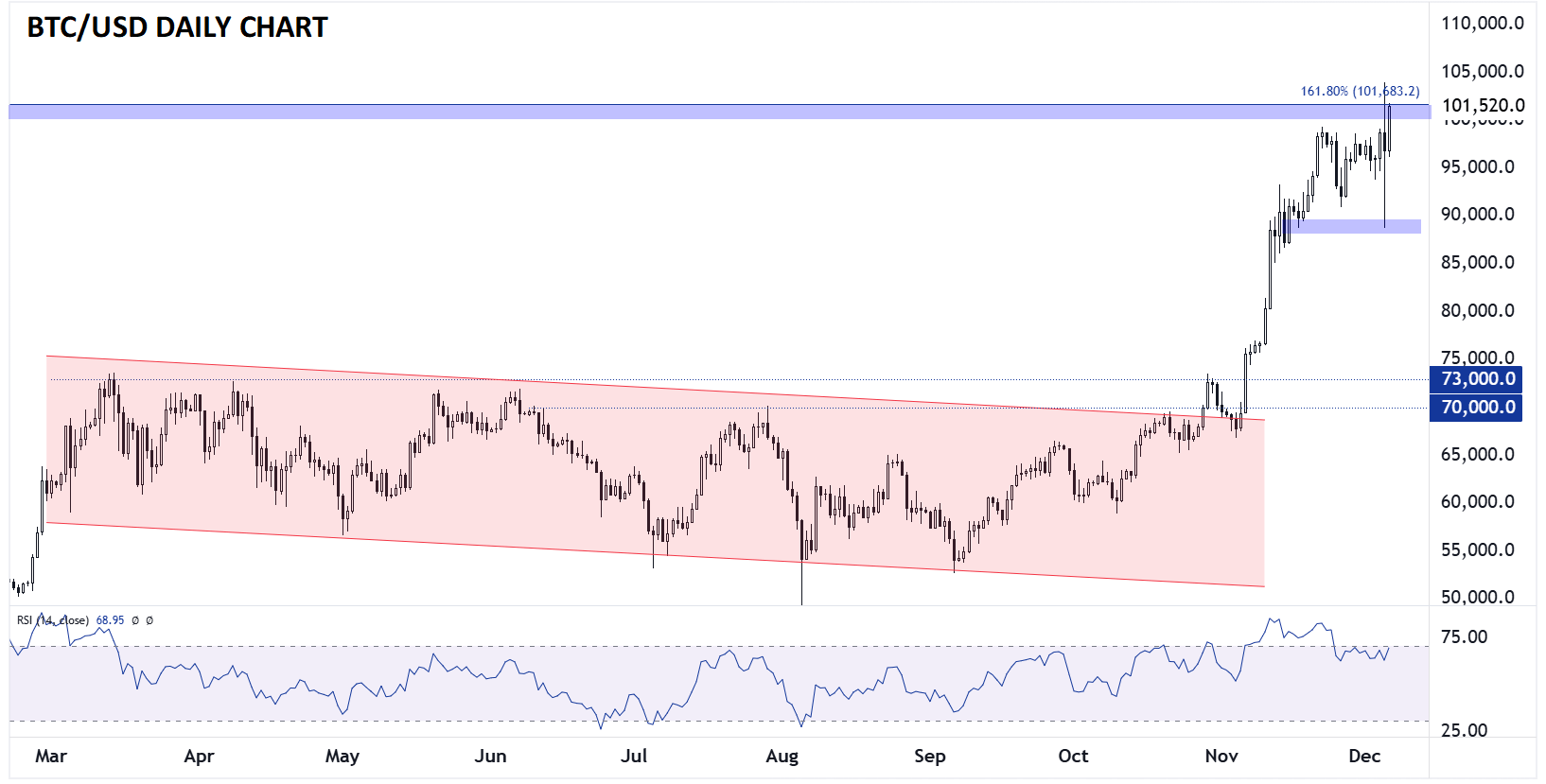

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: StoneX, TradingView

It was an eventful week for Bitcoin, with the cryptocurrency breaking the psychologically-significant $100K level for the first time in its 15-year history…only to fall a quick -14% to below $90K in a mini “flash crash” before recovering back above $100K as of writing. As we noted last week, the 127.2% Fibonacci extension of the 2021-2022 drop is now the key resistance level to watch, though after washing out the leverage in the system in Thursday night’s drop. Longer-term, the established uptrend remains intact, with strong inflows into the asset class leading to relatively short-lived pullbacks, and that state of affairs is likely to remain in place for now.

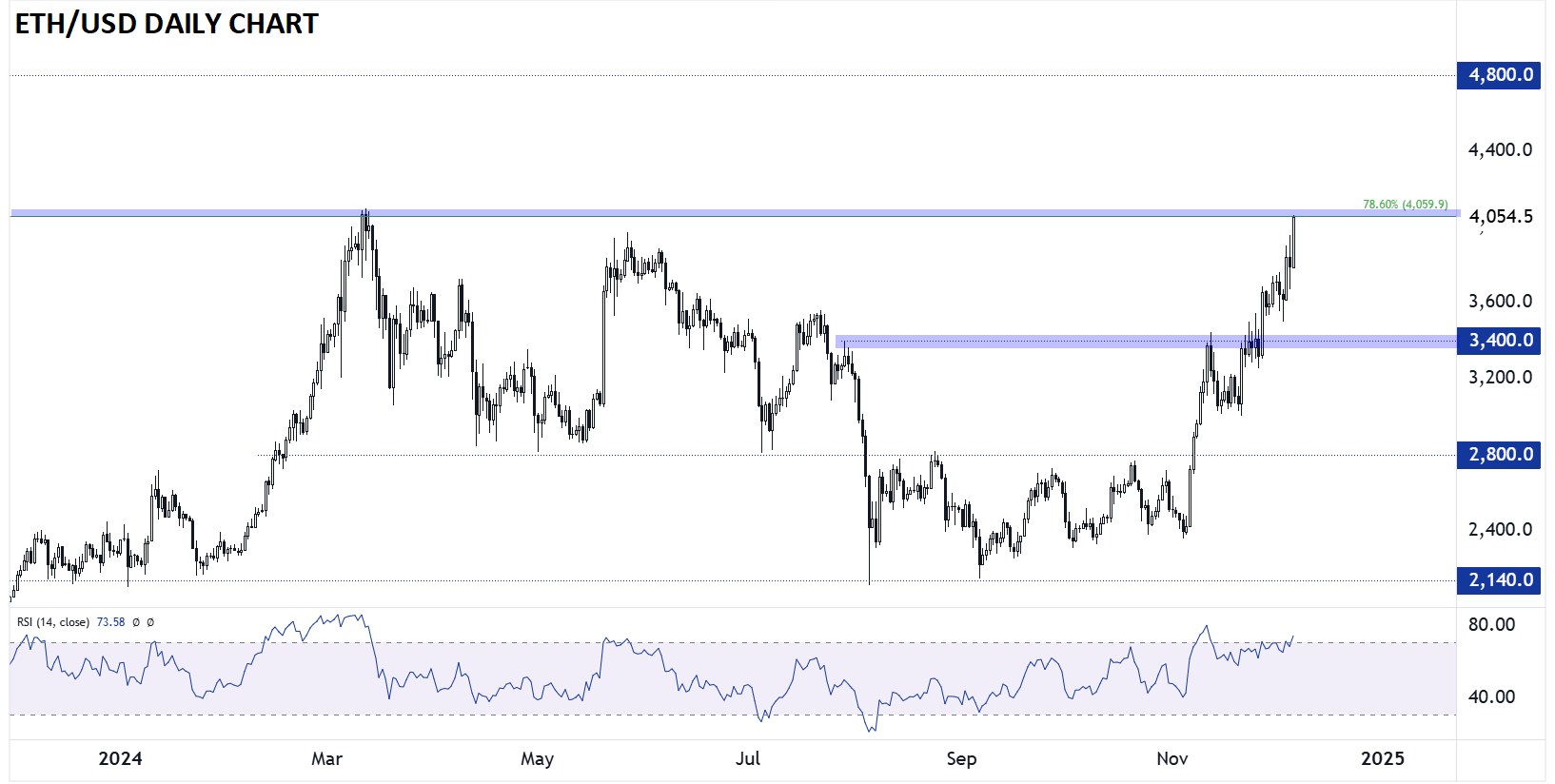

Ethereum Technical Analysis: ETH/USD Daily Chart

Source: StoneX, TradingView

Ether had a strong week, both on an absolute basis and relative to Bitcoin, taking the ETH/BTC ratio back to 0.04, near its highest level since the start of October. The world’s second-largest cryptoasset is now trading above $4K to test the 78.6% Fibonacci retracement of its 2021-2022 drop.

Moving forward, resistance near $4K represents a key technical hurdle, with a potential break above that level leaving little in the way of technical resistance until the record highs near $4800. Meanwhile, previous-resistance-turned-support at $3400 remains the level to watch to the downside, with the uptrend remaining intact as long as prices hold above that level.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos and be sure to follow Matt on Twitter: @MWellerFX