The AUD/USD forecast has been bolstered today as financial markets experienced a notable recovery, with all major indices rebounding into positive territory, led by the Japanese Nikkei.

Risk assets rebound

Financial markets have been a lot calmer thanks partly to reassuring words from the Deputy Governor of the Bank of Japan yesterday. This has had a positive impact across the financial markets, including global equity markets, Bitcoin, and metals prices. We have also had stronger-than-expected US jobless claims data today, helping to ease concerns over an economic slowdown in the US. This comes after a stronger ISM services PMI on Monday, both helping to offset weaker macro pointers last week.

There’s not much in the way of US data for the remainder of this week, although Chinese CPI and Canadian employment report on Friday could move certain markets. US inflation figures will be in focus in the week ahead, as well as Chinese industrial data and various economic reports from the UK.

US dollar weakens amid calmer financial conditions

Following today’s stronger US jobless claims data, you might be wondering why the US dollar hasn’t caught a bid. Well, it is because the greenback lost some of its appeal from a yields perspective following the release of weaker-than-expected economic data last week. Due to the turbulence in the equity markets, we hadn't seen risk-sensitive commodity currencies like the Aussie, or the Kiwi show any sign of bullishness until the start of this week. Now, with the equity markets stabilizing somewhat, we are seeing the Aussie making a comeback, as well as the New Zealand dollar, pound, Canadian dollar and cryptos too for that matter.

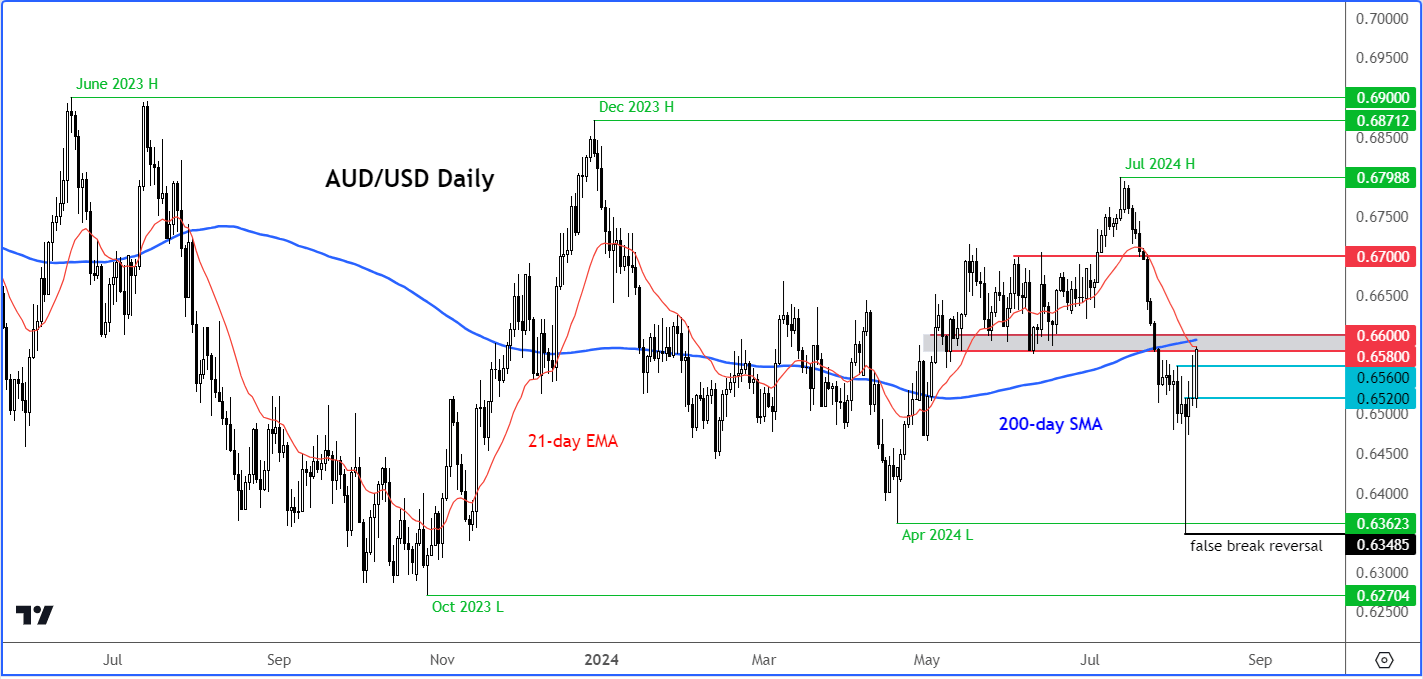

AUD/USD forecast: Technical analysis

Source: TradingView.com

Looking at the AUD/USD chart, it looks like it wants to reclaim the 200-day moving average and resistance in the zone between 0.6580 to 0.6600 area. If it can do that and rise back above the 0.6600 handle, I think that would create a strong bullish reversal pattern, following a double bottom or a false break reversal against the April low of 0.6362 we saw on Monday. That scenario would certainly boost the AUD/USD forecast, especially if the equity markets can sustain their gains. Meanwhile, short-term support is seen around 0.6560, followed by 0.6520.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R