- AUD/USD snapped its 2-week losing streak with a 05% gain, having found support ~67c

- It was up against all major currencies, except the Japanese yen

- The Australian dollar was also the strongest commodity currency, rising against CAD and NZD

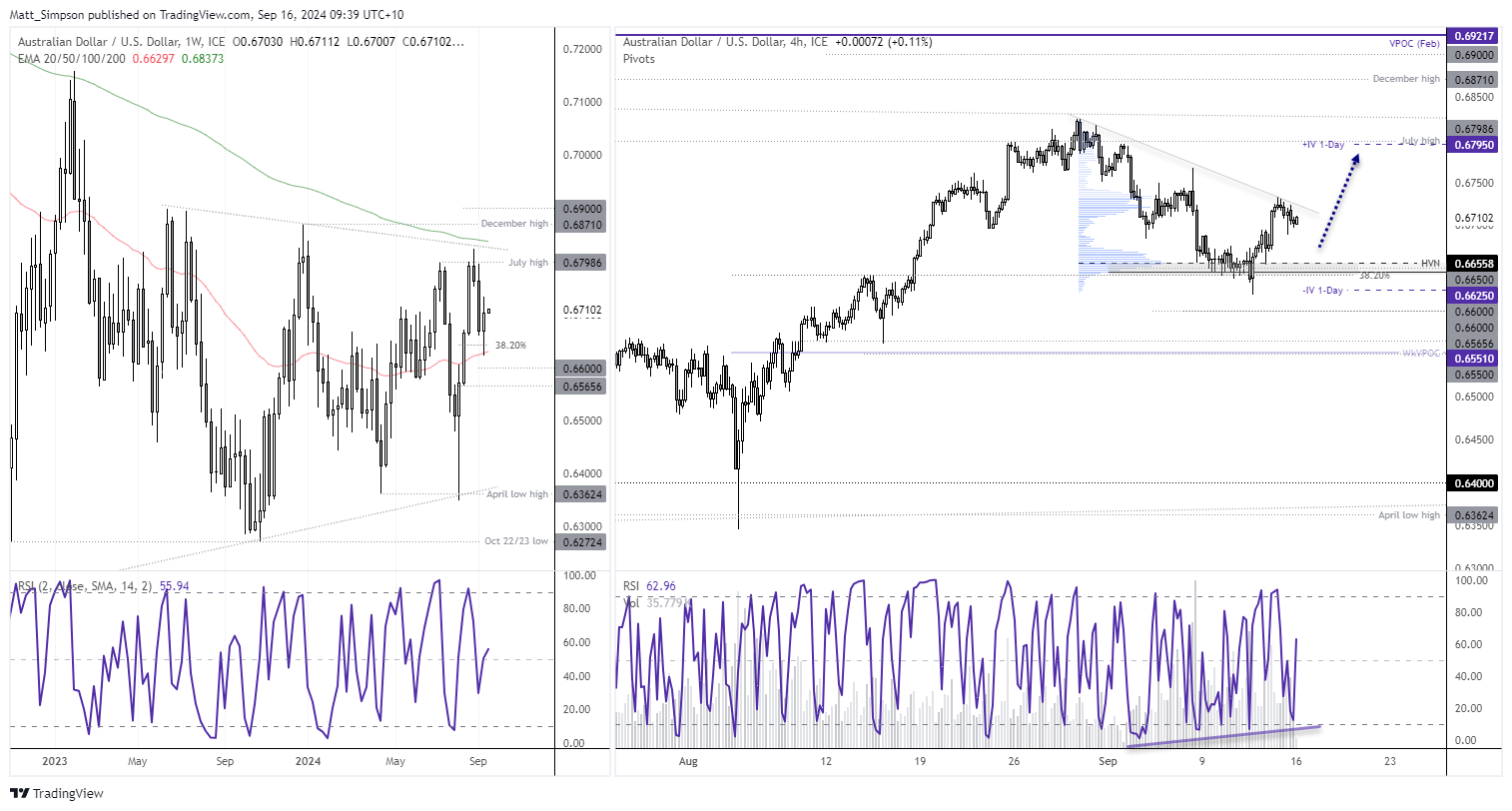

It will be another quiet start to the week with China and Japan on public holiday Monday, with China’s extending through to Tuesday. And as the highlight of the week will be the FOMC meeting in the early hours of Thursday and potentially BOJ’s meeting on Friday, ranges could be small in the leadup top them.

The Fed are expected to cut rates by 25bp next week. The move has been expected for some time, making the act itself a non event. The big question is whether they will provide a dovish enough signal to warrant another 75bp this year markets have been trying to price in or be more cautious and hint at 25bp cuts. My guess is the latter, given core CPI and producer prices ticked higher this week. Unemployment was also lower in the recent NFP report and ISM services was also decent overall. And that runs the risk of USD short covering and a weaker AUD/USD.

Australia’s employment figures are released on Thursday, but once again I do not see it move the needle for RBA rates. Unless the report delivers a shocking set of figures via an unemployment spike and lower job growth.

The BOJ might hike rates on Friday. They also might not. Members have upped their hawkish narrative these past two weeks, so they’re at least preparing markets for action this year. If there are to be fireworks at the meeting (or from Ueda’s press conference later on Friday afternoon), AUD/USD could get caught in the crossfire should appetite for risk get hit. Yet it is unlikely to be impacted should the BOJ make no changes to their policy.

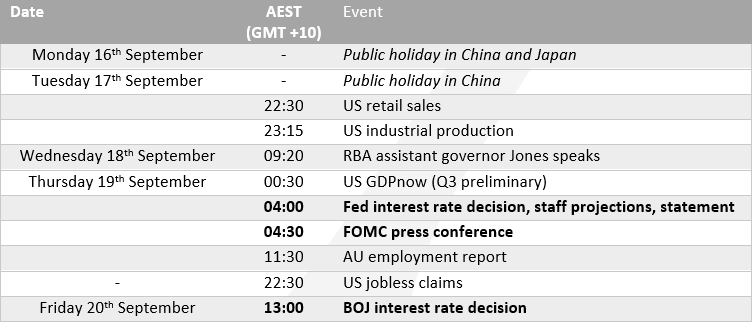

AUD/USD 20-day rolling correlation

- AUD/USD continues to hold a tight correlation with the CRB commodities index

- In particular, the correlation with WTI remains strong and iron ore and China’s CSI 2090 index is on the rise

- The correlation with the US dollar index remains low at ~0.5

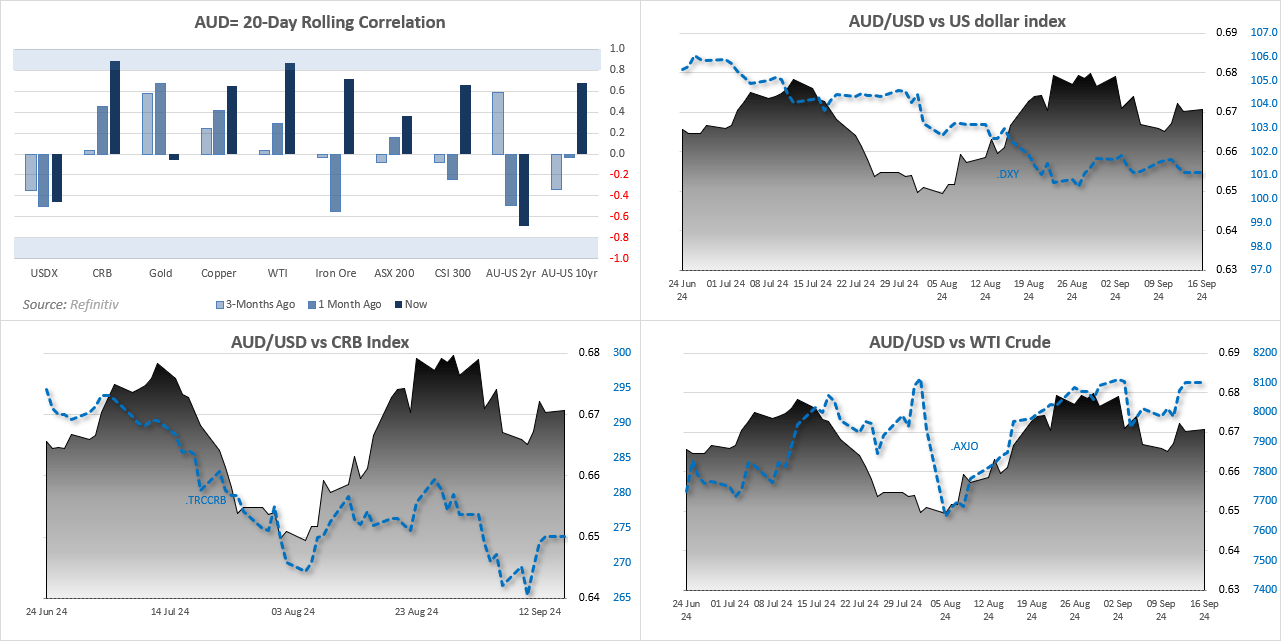

AUD/USD futures – market positioning from the COT report:

- Net-short interest on AUD/USD futures increased for the first week in three, as of last Tuesday

- However, traders reduced their exposure overall with both longs and shorts being trimmed

- Should the rally on Wall Street continue, further short covering could support AUD/USD

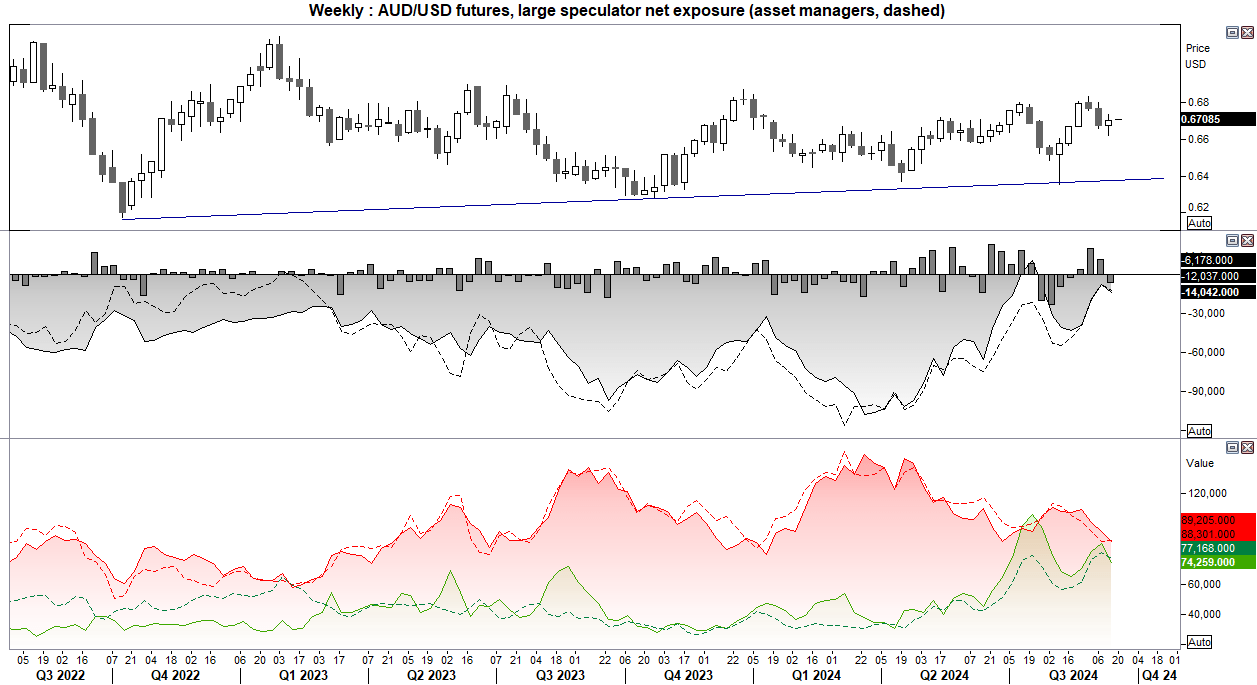

AUD/USD technical analysis

Price action continues to suggest that we may see an upside break of the multi-month triangle. The strong rally from the April low has seen a two-week pullback, which then saw a small bullish week form at the 50-day EMA.

The 4-hout chart also shows decent support levels around 0.6650 have been respected, and momentum has turned higher. The Bias this week is to seek dips and for another bullish week to form, while prices hold above last week’s low.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge