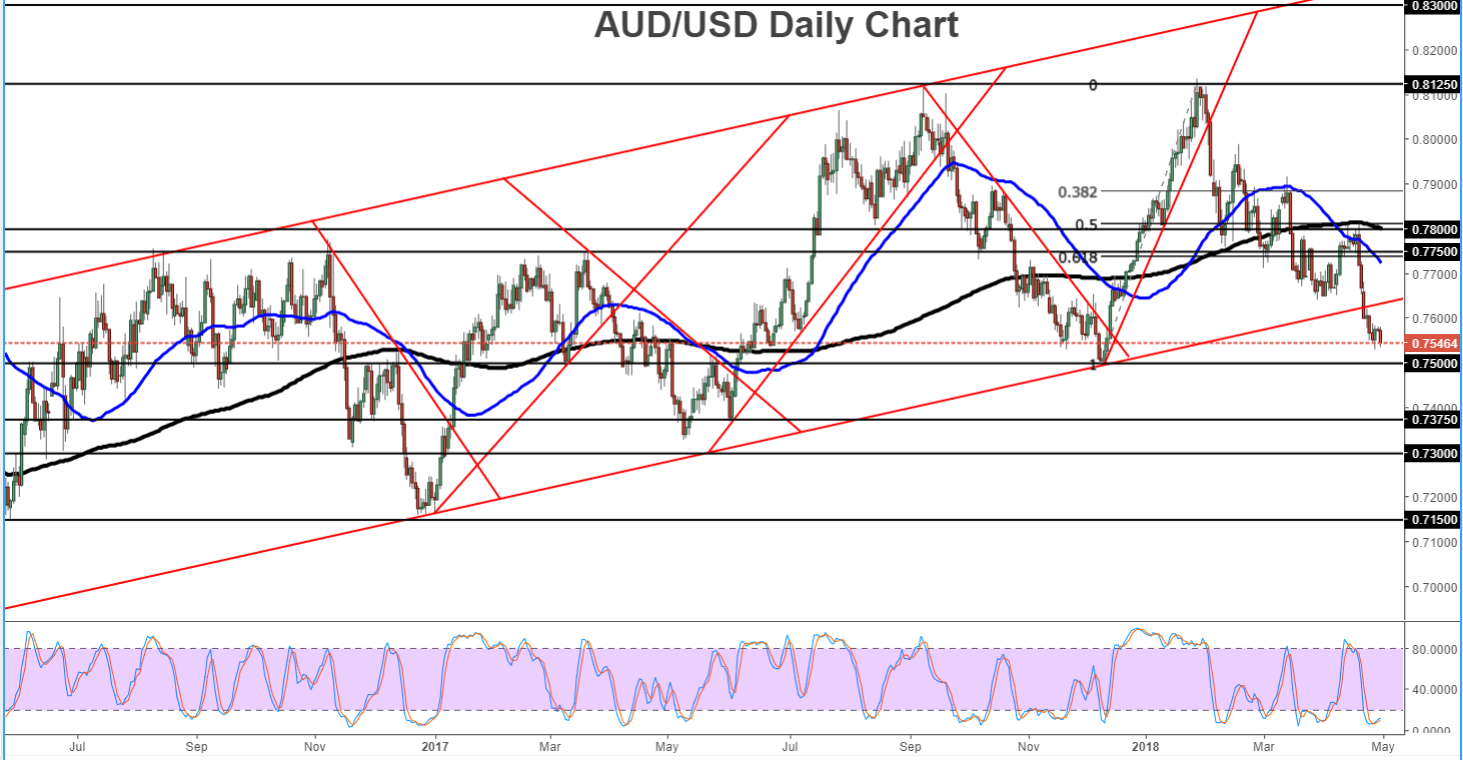

This week could potentially be pivotal for AUD/USD, as the Reserve Bank of Australia and the US Federal Reserve will both be announcing key interest rate decisions – the RBA on Tuesday and the Fed on Wednesday. In the run-up to these two decisions, AUD/USD has been falling steadily in a medium-term downtrend since its late-January highs. This downtrend initially occurred within a longer-term bullish trend going back more than two years. Earlier this month, price broke down below a key trend line representing this longer-term uptrend, potentially opening the way for further downside pressure.

Neither the RBA nor the Fed is expected to raise interest rates this week, but their policy statements will undoubtedly make an impact on their respective currencies. The US dollar has recently been boosted not only by rising government bond yields and interest rate expectations, but also by its relatively lagging counterparts, most notably the euro, pound, and yen. Though the Fed is not expected to raise interest rates on Wednesday after its last rate hike in March, expectations have been rising that the central bank may likely be on track to deliver four rate hikes this year instead of the three that were targeted in the March meeting. If such a likelihood is acknowledged or indicated in any way on Wednesday, the US dollar could be boosted significantly further.

As for the RBA, while the general consensus points to no interest rate increases until next year at the earliest, there is a small possibility that the central bank will begin tightening earlier. The RBA has not hiked rates since late-2010, and its last rate change was a 25-basis-point cut to its current level of 1.50%, back in August 2016. RBA meetings in the recent past have generally tilted to the dovish side, with concerns over weak inflation, low wage growth, and the relative strength of the Australian dollar helping to preclude a more hawkish outlook. If the RBA continues this dovish trajectory on Tuesday, the Australian dollar will likely continue to weaken against the US dollar.

From a technical perspective, as noted, AUD/USD recently broke down below a key long-term uptrend line extending back to the January 2016 lows just above the 0.6800 handle. Currently, this breakdown has extended further down to approach major support around 0.7500, which represents the December 2017 lows. Amid the upcoming RBA and Fed decisions, any further pressure on AUD/USD that potentially pushes the currency pair below 0.7500 could be a significantly bearish signal. In that event, the next major downside target is around the 0.7375 support area.