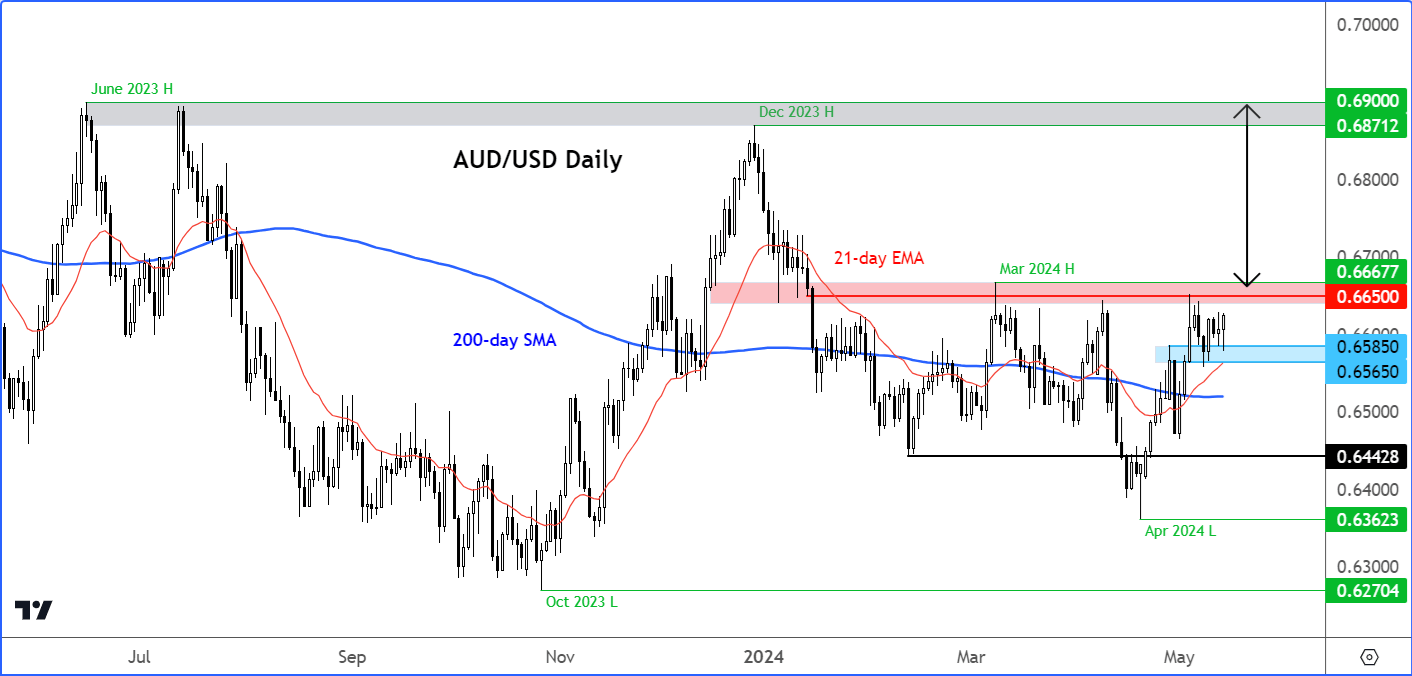

The AUD/USD forecast is turning somewhat positive, both from a macro perspective and technical viewpoint. The recent upsurge in copper prices, optimism about China’s ongoing recovery and the reintroduction of a tightening bias by RBA (even though another rate hike appears to be unlikely for this year) have all helped to limit the downside for the Aussie dollar. In the US, softening economic data have helped to put back rate cuts on the table, although concerns about sticky nature of inflation remains ahead of the release of US CPI data on Wednesday. We are eyeing a potential breakout above the 0.6650, to confirm our short-term bullish view on the AUD/USD.

AUD/USD forecast: Technical levels and factors to watch

Source: TradingView.com

The Aussie is looking constructive from a technical point of view. Although it is yet to break out, it looks like the AUD/USD is about to create a higher high, the first one for this year above the March 2024 high of 0.6667.

More specifically, the key area of resistance to watch is between 0.6650 to 0.6667 area where, as you can see on the chart, rates have struggled to get past on several occasions this year. But more recent price action appears to be bullish, suggesting that a potential breakout could be on the cards.

The AUD/USD has held support in the 0.6565 to 0.6585 support area in recent trade, which was resistance in the past and in doing so, it has kept above the 21-day exponential moving average.

Following the PPI data from the US, the bulls stepped back in around the zone to send the AUDUSD to a fresh high on the session.

So, heading towards Asian session, there is a chance we could see a potential breakout ahead of the CPI report on Wednesday. For as long as CPI doesn't raise inflationary alarm bells again, a bullish breakout appears to be on the cards.

In the event that the Aussie breaks through the abovementioned resistance area then that could pave the way for an initial move towards 0.6750, followed by the December high at 0.6870ish.

But before we get too far ahead of ourselves, for confirmation, we do need to see the break above that 0.6650 to 0.6667 area because so far we don't have a clear bullish signal to work with.

US dollar drops post PPI

The AUD/USD rose on Tuesday ahead of the release of the US consumer price index on Wednesday. Ahead of it, a gauge of producer inflation rose more than expected. But downward revisions to the prior month’s data as well as more muted key categories that feed into the Fed’s preferred inflation measure – i.e., Core PCE Price Index – meant the market largely ignored the headline jump.

On a month-over-month basis, PPI increased 0.5% both on the headline and core fronts, which was stronger than expected. The hotter data was driven largely by services and follows a sharp downwardly revised 0.1% drop in March (initially +0.2%). The revisions meant that the year-over-year rate would come in line with the expectations, rising from 2.1% to 2.2%, to match its highest reading since last May. What’s more, a few of the categories in the PPI report that are used to calculate the core PCE index eased.

The mixed signals from the PPI report means it is up to the CPI report to deliver a more conclusive inflation picture on Wednesday.

Analysts expect CPI to have moderated in April for the first time in six months. If so, it will offer hope that price pressures will start to ease again after back to back upside surprises throughout 2024. CPI is projected to have eased to 3.4% year-on-year in April, down from 3.5% the previous month. On a month-over-month basis, a 0.4% increase is anticipated. The Core CPI, which excludes food and fuel, is seen rising 0.3% m/m and 3.6% y/y.

Investors are keenly awaiting the consumer inflation data to gain a clearer understanding of when and to what extent the Fed might adjust interest rates. Ahead of it, Jerome Powell reiterated that although there was little inflation progress in the first quarter, he anticipates prices will gradually decline on a monthly basis.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R