- China’s stock market open and RBA minutes may be influential on AUD/USD and ASX 200 today

- Both markets sit in established uptrends, making the near-term bias to buy dips

- Watch for potential hawkish overtones in the RBA minutes

The performance of Chinese stock indices and minutes from the Reserve Bank of Australia’s (RBA) May monetary policy meeting should be on the radar for anyone trading AUD/USD or ASX 200 futures on Tuesday. With little top tier data or event risk to navigate, they loom as the most likely drivers of Australian financial markets.

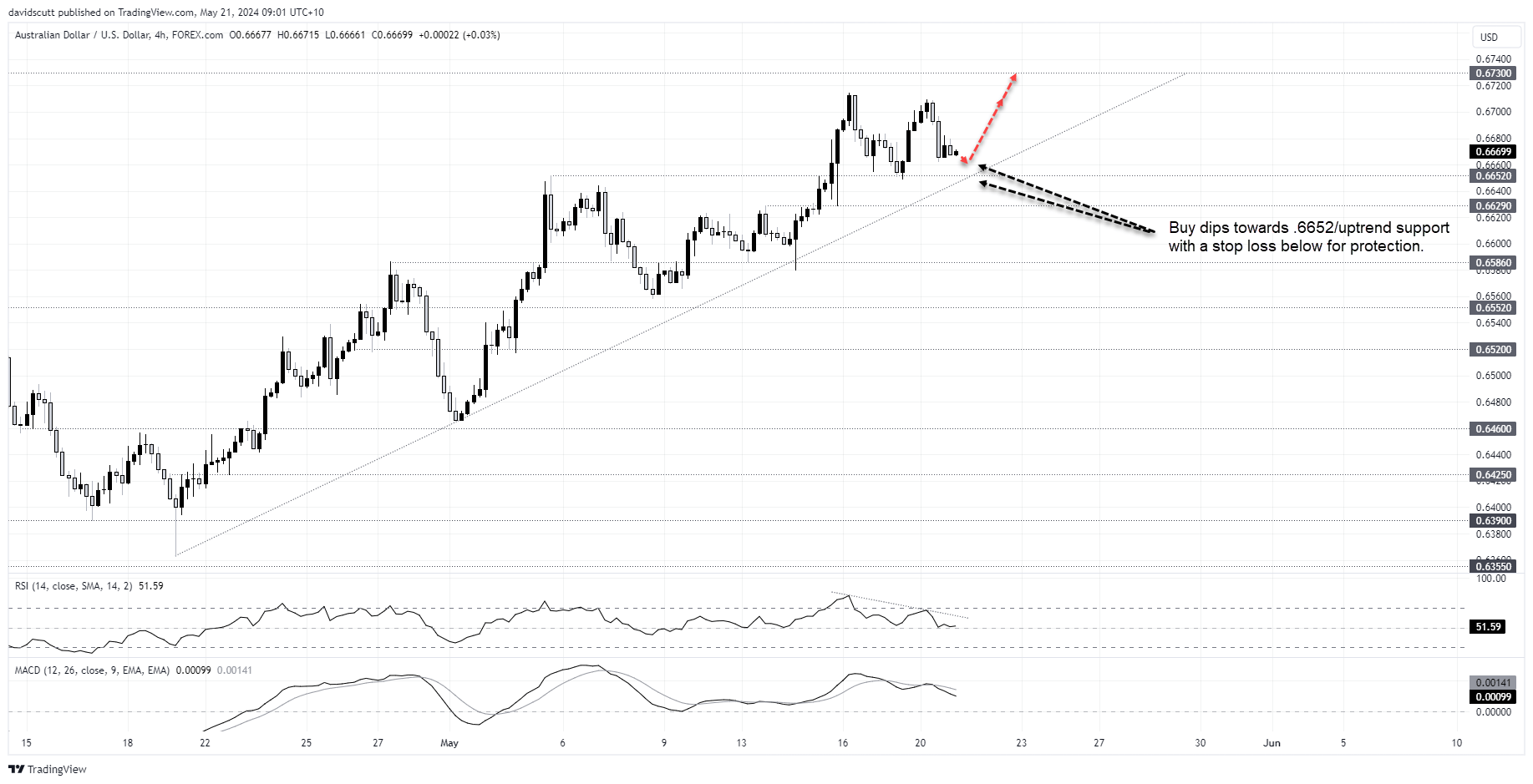

AUD/USD pullback offers improved entry levels

Starting with AUD/USD, you can see the pair remains in a solid uptrend dating back to late April, continuing to find bids on dips towards the level. Having struggled above .6700 in recent days, in part due to markets paring Fed rate cut expectations following last Wednesday’s US inflation and retail sales reports, it has now pulled back towards the level providing opportunities for bulls and bears depending on how the price interacts.

Until the price action suggests otherwise, the near-term bias is bullish given the prevailing trend. With horizontal support located nearby at .6652, traders may consider buying dips towards the level with a stop loss order below targeting the .6710-15 zone, where the price topped out in recent sessions. With near-term price momentum moving to the downside, there may be opportunities for better entry levels.

Above the .6710-15 resistance zone, AUD/USD struggled to break above .6730 earlier this year, making that a topside level to watch. .6870 looms as the next level after that.

Under a scenario where support at .6652 or the prevailing uptrend fails, the bias would switch to selling rallies rather than buying dips. Below the levels mentioned above, .6629 and .6586 are the initial downside targets.

Key catalysts for Australian markets on Tuesday

As for catalysts to watch during Tuesday’s session, this short video explains how influential the China stock market open can be on AUD/USD on occasion. With so much focus on measures introduced by Chinese policymakers to support the property sector on Friday, there’s every chance this may be a key driver for the Aussie midway through the session.

Adding a layer of complexity, the minutes of the RBA May policy meeting will be released at 11.30am AEST. While they already come across as dated given Australia’s Federal budget and key labour market data were released after, traders should be looking out for hawkish overtones. It didn’t receive much attention at the time, but during her post meeting press conference, RBA Governor Michele Bullock acknowledged the board discussed either holding or hiking rates, not cutting them. That points to hawkish risks, something that should be supportive of AUD/USD.

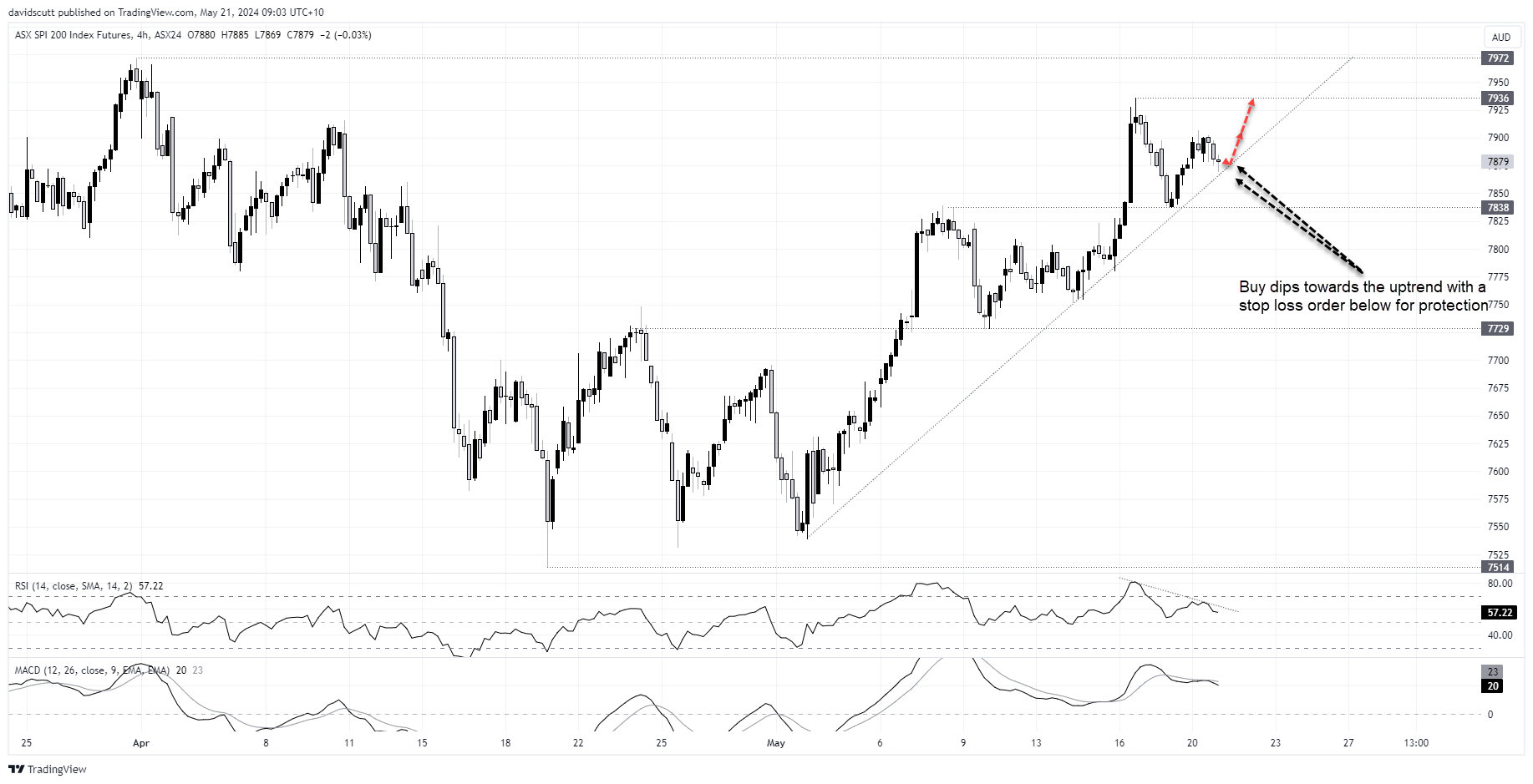

Commodity gains remain supportive of ASX upside

Like the Australian dollar, ASX 200 futures may also be influenced by the RBA minutes and China market open.

Mirroring AUD/USD, SPI futures sit in an established uptrend dating back to early May. With the pullback overnight, futures are within touching distance of the trendline, allowing for traders to set longs with decent risk-reward.

Until proven otherwise, buying dips is preferred to selling rallies. Traders could establish longs on the open with a stop loss below the trendline for protection. The initial trade target would be 7907, the high hit on Monday. Above, 7936 and 7972 are the key levels to watch.

Should the uptrend give way, traders could sell the break with a stop above the trendline for protection. 7838, 7780 and 7762 are potential downside targets, the latter coinciding with the 200-day moving average.

While near-term momentum is biased lower, continued strength in commodity markets – including iron ore – point to the possibility for dips to be bought.

-- Written by David Scutt

Follow David on Twitter @scutty