- Risk assets have enjoyed strong gains over the past fortnight, although signs of rally fatigue are creeping in

- Markets want their cake and to eat it too, pricing in eight Fed rate cuts by June while simultaneously betting on a soft economic landing

- Fed chair Jerome Powell speaks on Friday

- NZD/JPY, AUD/JPY rallies stall around former uptrends

Risk assets have enjoyed a strong fortnight following Japan’s market meltdown, recovering much of the ground lost during those wild days earlier in the month. But there are some signs of caution creeping in ahead of Jerome Powell’s speech at the Jackson Hole economic symposium on Friday. With eight Fed rate cuts priced by June, even though markets continue to bet on a soft landing for the US economy, a lot of perfection has been priced back in rapidly.

This note looks at two short setups involving NZD/JPY and AUD/JPY, should risk start to rollover again.

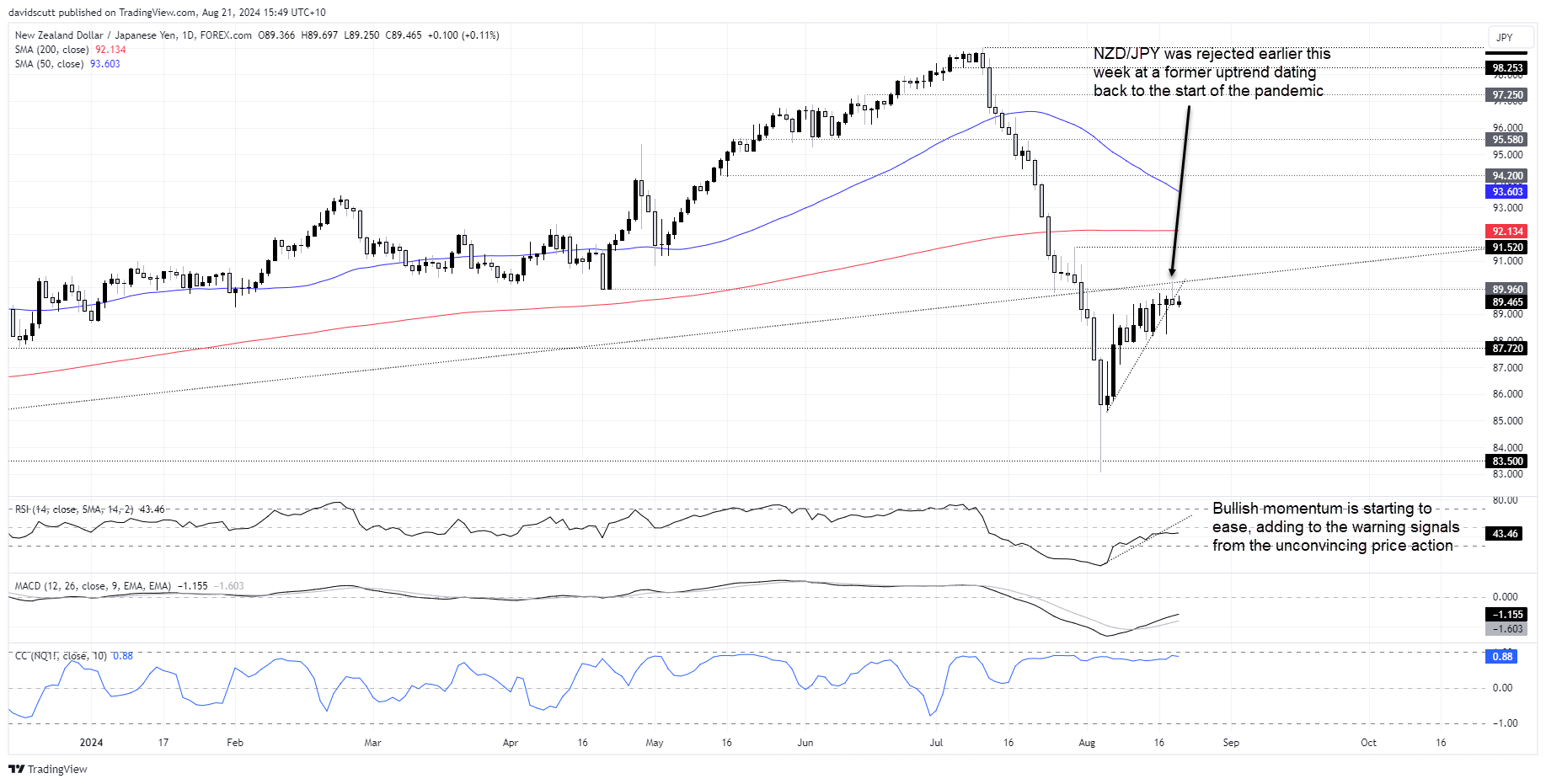

NZD/JPY rally fails at former pandemic uptrend

NZD/JPY has rebounded over six big figures from its August nadir, enjoying relative calm in markets which has enabled carry trades to be reestablished. But the bullish price action is showing signs of fatigue; RSI (14) has broken its uptrend while Tuesday’s daily candle looks suspiciously like a topping patten, rejected from the intersection of horizontal resistance at 89.96 and former uptrend running from the pandemic lows in early 2020.

I’m not ready to short just yet knowing buyers are parked above 88.00 based on the price action seen over the past week. Liquidity is also likely to wane ahead of Jerome Powell’s speech on Friday. But if NZD/JPY were to fail again at the former uptrend, especially post Powell, the conviction behind the trade would increase considerably.

Stops could be placed above the uptrend with shorts targeting a push towards 87.72. If that level gives way, there’s little major support to speak of until you get down to 83.50.

I’ve included correlation analysis in the bottom pane, looking at the rolling daily relationship NZD/JPY has had with Nasdaq 100 futures over the past fortnight. At 0.88, the strength of the correlation suggests a short setup is far more likely to succeed if risk appetite rolls over.

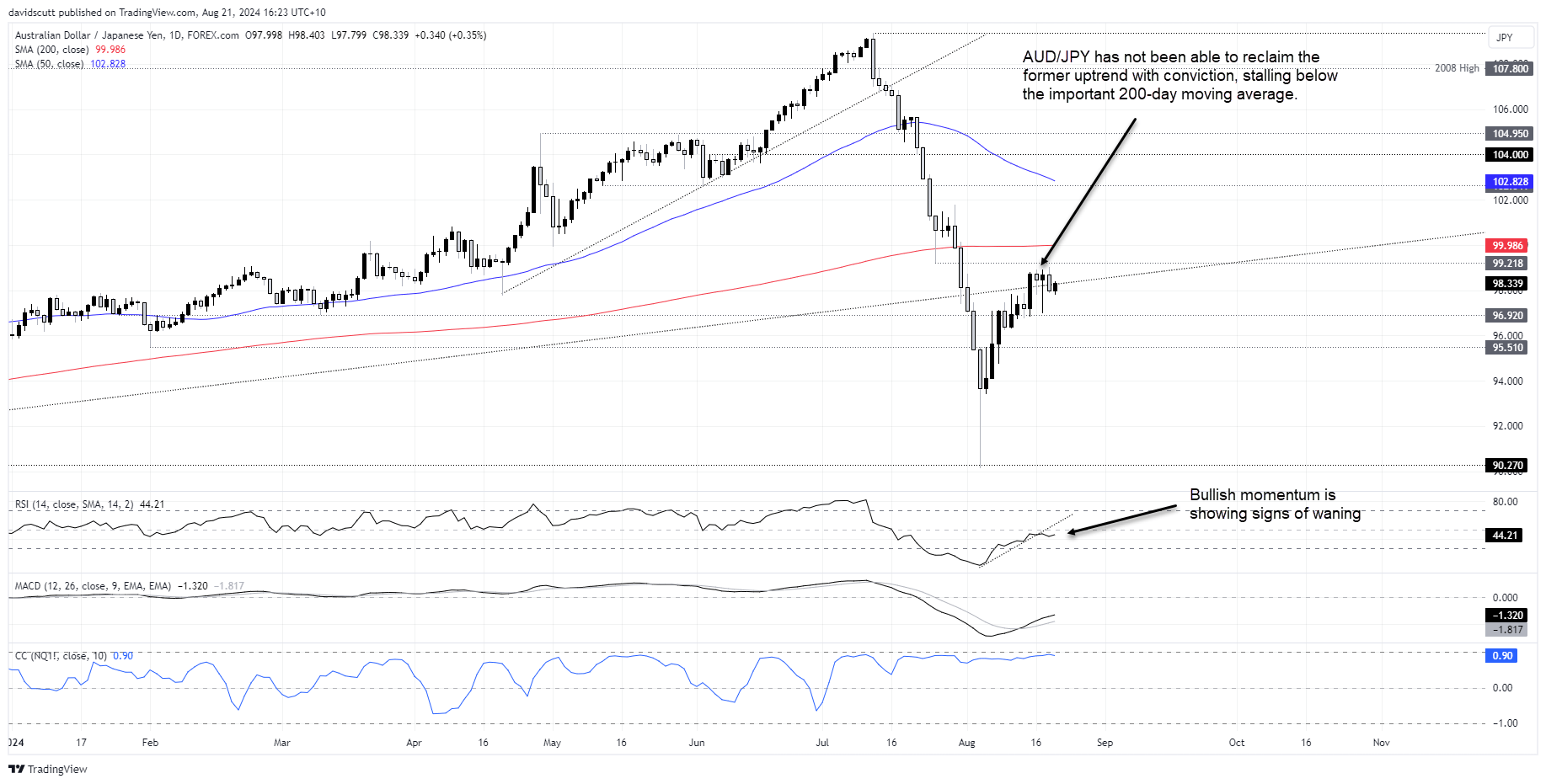

AUD/JPY fortunes tied to risk assets

The setup for AUD/JPY is similar to that of NZD/JPY, although it managed to reclaim the former pandemic uptrend late last week. The price action since has been unconvincing, with advances towards 99.00 knocked back in the four trading sessions prior to today. There’s no obvious topping pattern, but the inability for the price to push higher corresponds with RSI (14) breaking the uptrend established during Japan’s meltdown.

Like with the Kiwi, shorting now comes across as a lower probability play before Powell. However, should risk appetite rollover, confidence in the setup will improve considerably. The daily correlation AUD/JPY has had with Nasdaq 100 futures over the past fortnight stands at 0.90.

If the price is unable to build upon the rally pre or post Powell, shorts could be established with stop loss orders placed above the highs hit earlier this week. 96.92 is the first support layer of note, with another minor level found at 95.51. 90.27, where the pair bounced earlier this month, is one potential target should we see a real unwind in risk appetite.

If either NZD/JPY or AUD/JPY were to resume their rallies, the option would be to flip the setups around, but that’s a post for another day.

-- Written by David Scutt

Follow David on Twitter @scutty