- AUD/JPY and NZD/JPY are on the cusp of decade highs

- JPY remains offered as the BOJ maintains large scale bond purchases

- Greater upside may be generated if the Fed signals two rate cuts in 2024, although three cuts would be expected to assist risk appetite

Most traders associate the Australian and New Zealand dollars as short targets given how poorly they’ve performed against the US dollar recently. However, the Japanese yen has fared even worse than the antipodean FX names, undermined by divergent monetary policy settings from the Bank of Japan relative to other central banks and continued buoyancy in risk appetite.

Almost by stealth, the unloved and under pressure Aussie and Kiwi are not far off hitting decade highs against the yen. With the near-term price action in AUD/JPY and NZD/JPY pointing to upside, and with momentum indicators sending a similar message, the risk of a topside break appears to be growing as we head towards the March Federal Reserve rate decision.

We’ll cover that event later, along with Australia’s February jobs report due out Thursday.

AUD/USD eyeing decade high

Even with the weakness in the Australian dollar after the RBA dropped its explicit tightening bias at its March monetary policy meeting, that was more than offset by weakness in the Japanese yen after the Bank of Japan said it will maintain widespread Japanese government bond purchases despite delivering the first rate hike since 2007. The net effect was to send AUD/JPY surging through resistance located above 98.00, continuing the move on Wednesday.

Already sitting in an ascending triangle, the bullish price action, coupled with MACD crossing over from below and solid uptrend in RSI, suggests a retest and break of the February high is on the cards. If it does, AUD/USD will trade at levels not seen since late 2014.

Some may be tempted to buy in anticipation of the break but I’d prefer to wait to see if it happens before entering a long position. You could then use the former high as protection, placing a stop-loss order below in case the trade moves against you. The target would be 100, where the price found support for a period back in 2014.

Should the price fail to break 99.05, pullbacks towards the uptrend established earlier this month could be used to establish longs, allowing for a stop to be placed below for protection against reversal. The initial target would be 99.05 with 100 above that.

NZD/JPY trending higher

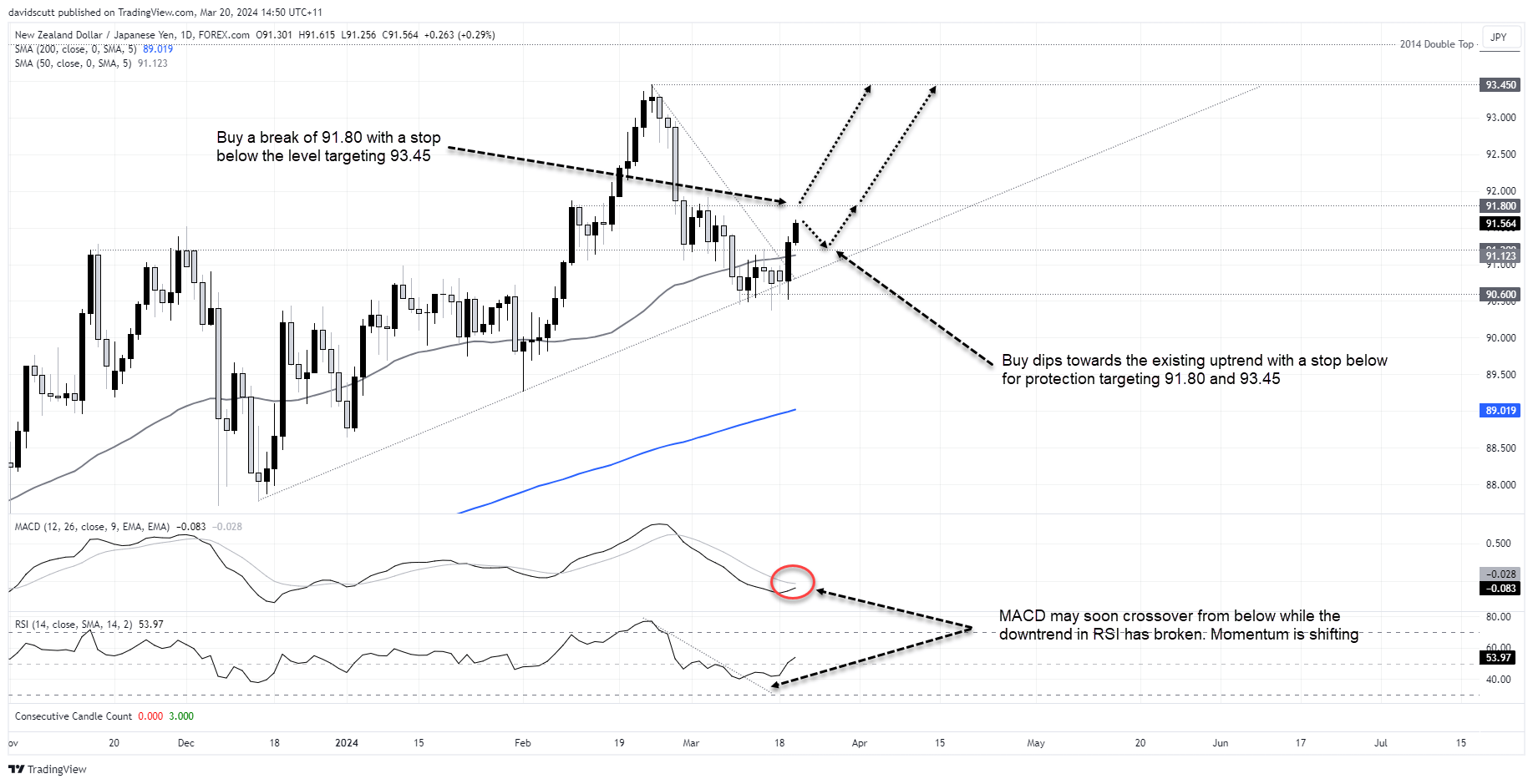

Unsurprisingly, the setup for NZD/JPY is much the same as AUD/JPY right now.

It sits in an established uptrend, bouncing hard from its intersection with horizontal support around 90.60 on Tuesday following the BOJ rate decision, taking out resistance at 91.20 on the way through. The price is now eyeing a test of 91.88, a level it tagged on multiple occasions during February and March.

I’d prefer to wait for a break of 91.88 or pullback towards 91.20 before establishing longs.

For the former option, the initial target would be 93.45 with a potential test of the multi-decade high 94.05 the next after that. A stop-loss order below 91.88 would provide protection against a reversal.

For the latter option, you could buy dips towards 91.20 or lower targeting an initial move to 91.88 with 93.45 after that. You could use the existing uptrend for protection, placing a stop-loss order below.

Fed, Australia jobs report considerations

The key events over the next 24 hours are the US Federal Reserve meeting and Australia’s jobs report for February. Regarding the Fed, AUD, NZD and JPY are likely to move in the same direction depending on how many rate cuts the median FOMC member forecast signals in updated dot plot. Two or fewer would likely see the three weaken while three or more would see them strengthen.

While that suggests movement in AUD/JPY and NZD/JPY may be negligible with the three currencies expected to move in the same direction, I’ve looked at the rolling quarterly correlation with the pairs on a daily timeframe and the strongest relationship evident is with US 2 and 10-year bond yields with readings in the mid to high 0.7s.

That suggests AUD/JPY and NZD/JPY often move in the same direction as US yields, hinting it’s the JPY-leg that’s more dominant when it comes to determining overall direction. If that continues, it points to a larger upside reaction should the Fed signal two cuts this year. However, three cuts or more would boost risker assets, creating an alternate tailwind.

As for Australia’s employment report, markets have been primed to expect a rebound in hiring after remarks from Australia’s statistics agency suggested there were a large number of people in January waiting to start a job. The prospect of a big hiring spree may see traders attempt to front-run the data being released, pointing to the potential for AUD strength.

-- Written by David Scutt

Follow David on Twitter @scutty