- The threat of BOJ intervention to support the Japanese yen has kept USD/JPY in a tight range

- The spillover has been the rally in many yen crosses has also stalled

- AUD/JPY and EUR/JPY are sandwiched between range highs and uptrend support, making bullish or bearish breakouts possible this week

The overview

AUD/JPY and EUR/JPY are sandwiched between range highs and uptrend support, meaning traders should be on alert for potential bearish and bullish breakout this week with big event risk in the United States and Europe approaching fast.

The background

With Bank of Japan intervention risk keeping USD/JPY rangebound despite increasingly hawkish US economic fundamentals, it’s seen rallies in many yen crosses stall near range highs, placing uptrends dating back months and even years under possible threat.

Given their positions on the charts, traders should be alert for potential bullish or bearish breaks this week, especially with two major US inflation reports and an ECB interest rate decision arriving in the days ahead.

We look at two favorite yen crosses; AUD/JPY and EUR/JPY

The trade setup

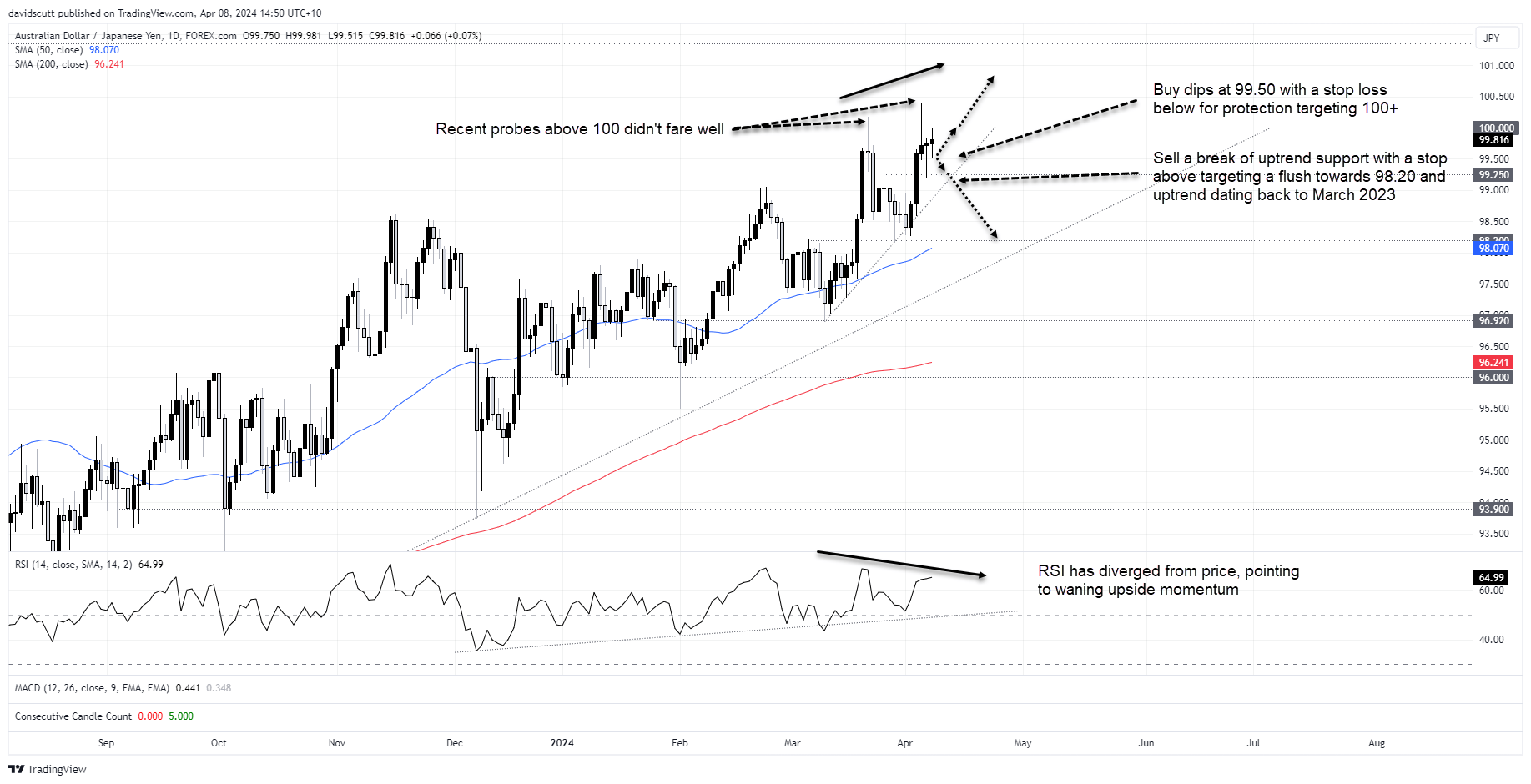

AUD/JPY

AUD/USD has made two unsuccessful ventures above 100 in the past month, both ending in reasonably large reversals.

The daily candles over recent days reveal a ding-dong battle is underway between bulls and bears with an inverted hammer on Thursday followed up by a bullish hammer on Friday.

On the downside, minor support is located at 99.50, 99.25 and uptrend dating back to start of March. Should the latter give way it points to a potential deeper retracement towards support at 98.20 and uptrend dating back to March 2023. Even though RSI is warning of waning upside momentum, I’d want to see a break of the minor uptrend before initiating a short position, allowing for a stop loss order to be placed above for protection.

In the interim, the price found bids on pullbacks towards 99.50 recently, making that a potential level to initiate long positions with a stop loss below 99.20 for protection targeting another push above 100.

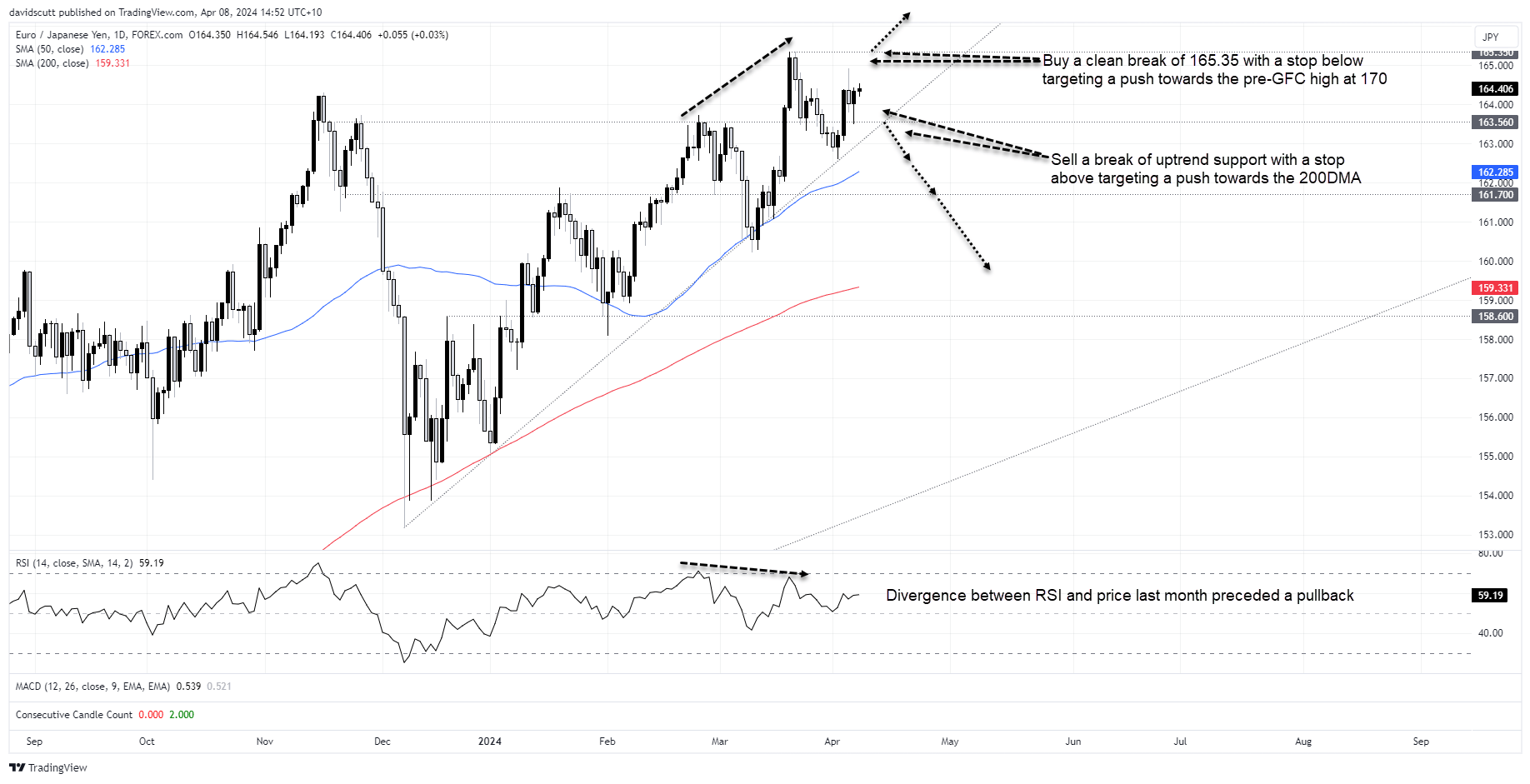

EUR/JPY

EUR/JPY sits in a similar position to AUD/JPY, trading close to range highs and uptrend dating back to December 2023 with relatively inconclusive price action in recent days.

It had divergence between RSI and price in February and March with a modest pullback duly following, explaining why it was mentioned in the AUD/JPY setup. However, after testing the uptrend below 163, it has bounced back to the centre of the range between support at 163.56 and resistance at 165.35.

While Friday’s bounce from 163.56 points to near-term upside risk, I’d prefer to wait for a definitive break before initiating a position. A clean break of the uptrend brings a deeper pullback towards support at 161.70, 160.30 and 200-day moving average at 159.33 into play. The 50-day moving average is located just below the uptrend, creating the potential for a false break given its checkered track record for being respected.

Alternatively, should the price break above 165.35, it allows for a stop to be placed below for protection targeting a push towards the pre-GFC highs just below 170.

The wildcards

If the BOJ were to intervene suddenly, much of what you just read will be worth close to nothing as the crosses would likely decline hundreds of pips in seconds, bringing a whole raft of lower levels into play. With US CPI and PPI reports out this week, large upwards moves in USD/JPY may exacerbate the threat of intervention to support the yen.

-- Written by David Scutt

Follow David on Twitter @scutty