Techniques of successful traders

Optimizing your trade entry

Getting your entries right is crucial to successful trading. In this lesson, we cover three techniques to improve your timing as you enter positions.

Once you have a trading plan in place, optimizing how you open positions is an excellent way of growing profits and limiting losses. If you can consistently trade at the right level and in the right direction, then you should see your percentage of winning positions grow.

There are multiple different methods to optimize your entries. Here, we’ve going to introduce you to three: spotting breakouts, using timeframes and taking a broader view.

1. Breakouts

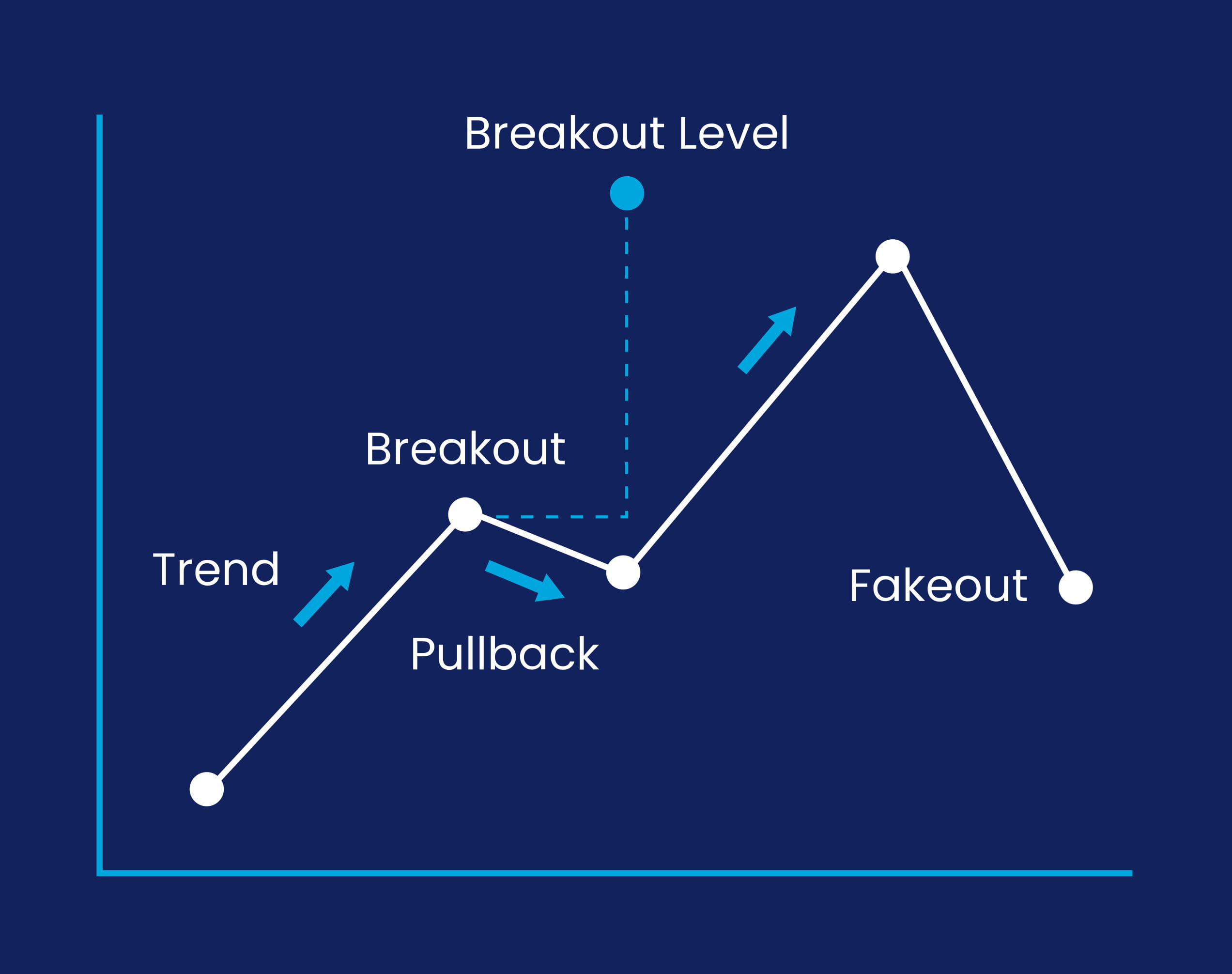

As we learned in the technical analysis course, ‘the trend is your friend’. By using pullbacks and breakouts, you can ensure that you’re getting in at the beginning of uptrends and downtrends – instead of the peak.

How? By using the fact that market movement is rarely linear. Even strong uptrends will contain minor downward moves, while strong downtrends will still feature small bull runs.

These small countertrends are called pullbacks and will tend to form at support and resistance levels.

Breakouts occur when a market 'breaks' through one of these levels. When you see a breakout, it’s a sign that the original trend is reforming. This makes them a useful place to enter a trade – by opening a buy or sell position once the market moves beyond the support or resistance line.

As a general rule of thumb, the more times a support or resistance level is tested, the stronger the breakout that follows once it is broken.

Watching for fakeouts

Just because a market has broken a support or resistance level, though, it doesn’t necessarily mean that a breakout will follow. Sometimes, the market will pullback once again in a fakeout.

Because of this, proper risk management is a must when trading breakouts. By placing a stop just below the breakout level, you can automatically close your position if a fakeout is confirmed.

2. Testing across timeframes

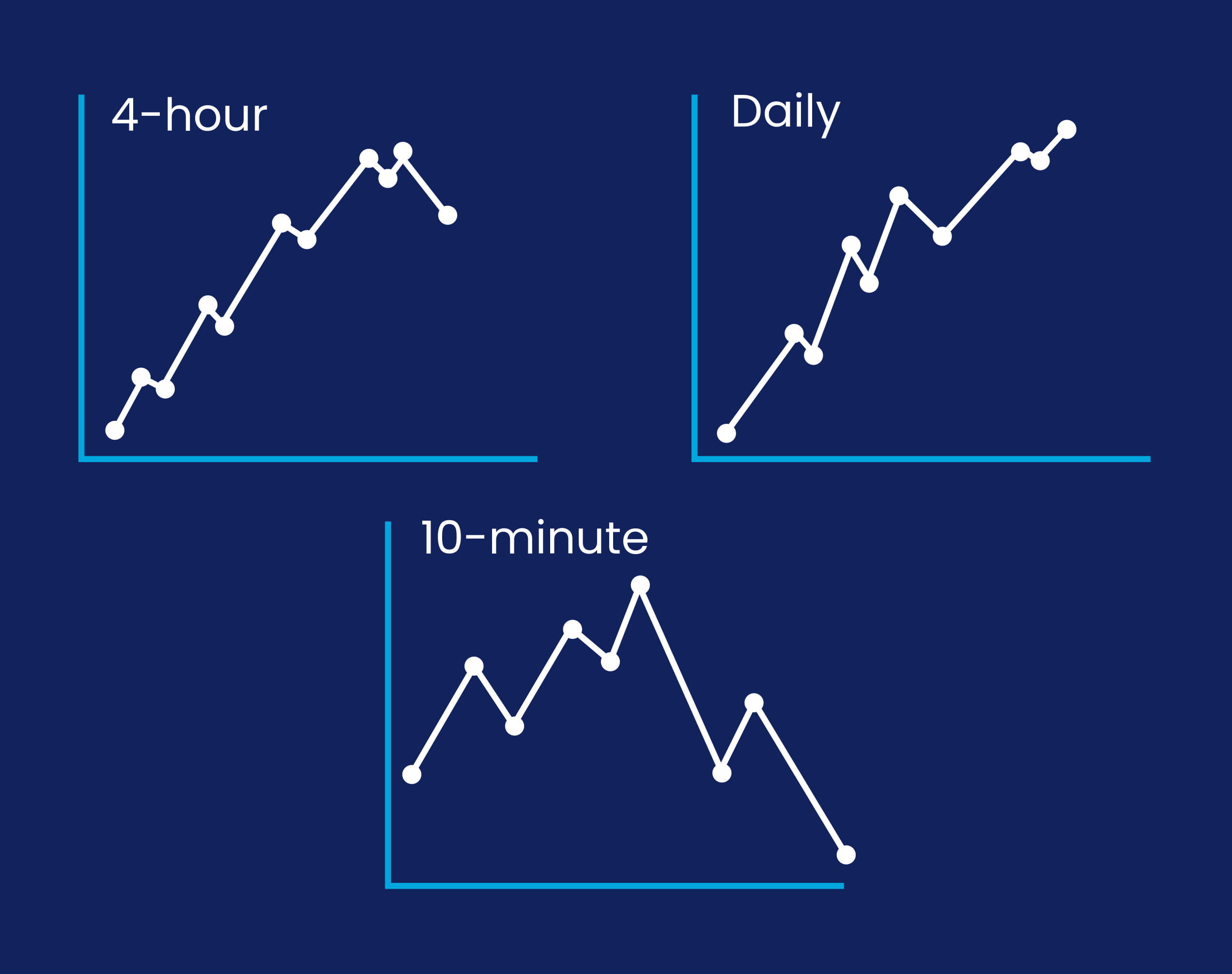

As we covered in the last lesson, jumping around between lots of different chart timeframes isn’t necessarily a good strategy for trading. However, using one or two additional timeframes to confirm the trends you’ve found can help increase your probability of profitable trades.

Say that you’re using a four-hour chart to look for opportunities in AUD/USD, and you’ve identified a pullback that you believe might lead to a significant breakout.

You could double check the broader trend by taking a look at a daily chart, to confirm how long the bull or bear run has lasted. You could also see whether the market has hit any support or resistance levels multiple times in its wider trend.

Alternatively, you might want to check a ten-minute chart to see what is happening on a macro level, so you can check whether buyers or sellers are in charge within the current trading period.

3. Taking a broader view

Our final tip for optimizing your entries is to make sure you are aware of the broader conditions of the market you are trading.

This includes the major trend that the market is in – and whether that trend is sustained, or just forming – as well as a few fundamental factors surrounding it. You could check whether any economic releases might cause volatility in the short term, for example.

By taking a more holistic approach, you can identify potential risks to your position that you might otherwise miss.

You can also outline the market conditions that suit your style of trading best. Note down the conditions for each position in your trading diary, and review it often to see whether any patterns emerge. You might find that you have more success in markets that are rangebound, in swings or experiencing low volatility – which can give you a useful boost.

Market conditions

There are lots of different market conditions that you might want to cover in your trading diary. They can include a longer-term trend, central bank posture, upcoming events or more.