Appetite for risk took a hit on Tuesday on reports that the US government is considering limiting exports of AI-chip exports. Tech stocks led Wall Street indices lower, simply taking their cue from Nvidia and AMD shares whose exports are set to be limited. Nvidia fell -4.5% from its record high set on Monday, which also faced selling pressure as ASLM holdings – a manufacturer of AI equipment – reported lower-than-expected orders. AMD was down -5.2% and closed beneath 160.

Bearish engulfing candles formed on the Nasdaq 100 and the Dow Jones futures while a bearish outside day formed on S&P 500 futures, the last two of which were toppled at their record highs alongside Nvidia. It is unclear whether this is the beginning of a proper pullback, but the news was perfectly timed for investors to book profits at frothy prices ahead of key economic data including an ECB meeting, US retail sales and jobless claims figures on Thursday.

But given asset managers remain fully invested in the S&P 500 futures market and have shown a renewed love for tech stocks, for now I suspect this to be a blip in the trend. With that said, VIX futures have risen for four weeks and we have a US election pending, so we may find risk is more prone to bumps as traders question if they want to reload as events unfold.

Perhaps the yen has reached an inflection point:

The Japanese yen was the strongest major on Tuesday thanks to safe-haven flows, which also benefited gold and bond prices, with yields moving lower. But with risk events on the horizon after an extended move lower for the yen, perhaps we’re witnessing an inflection point for the yen. It is something to at least consider.

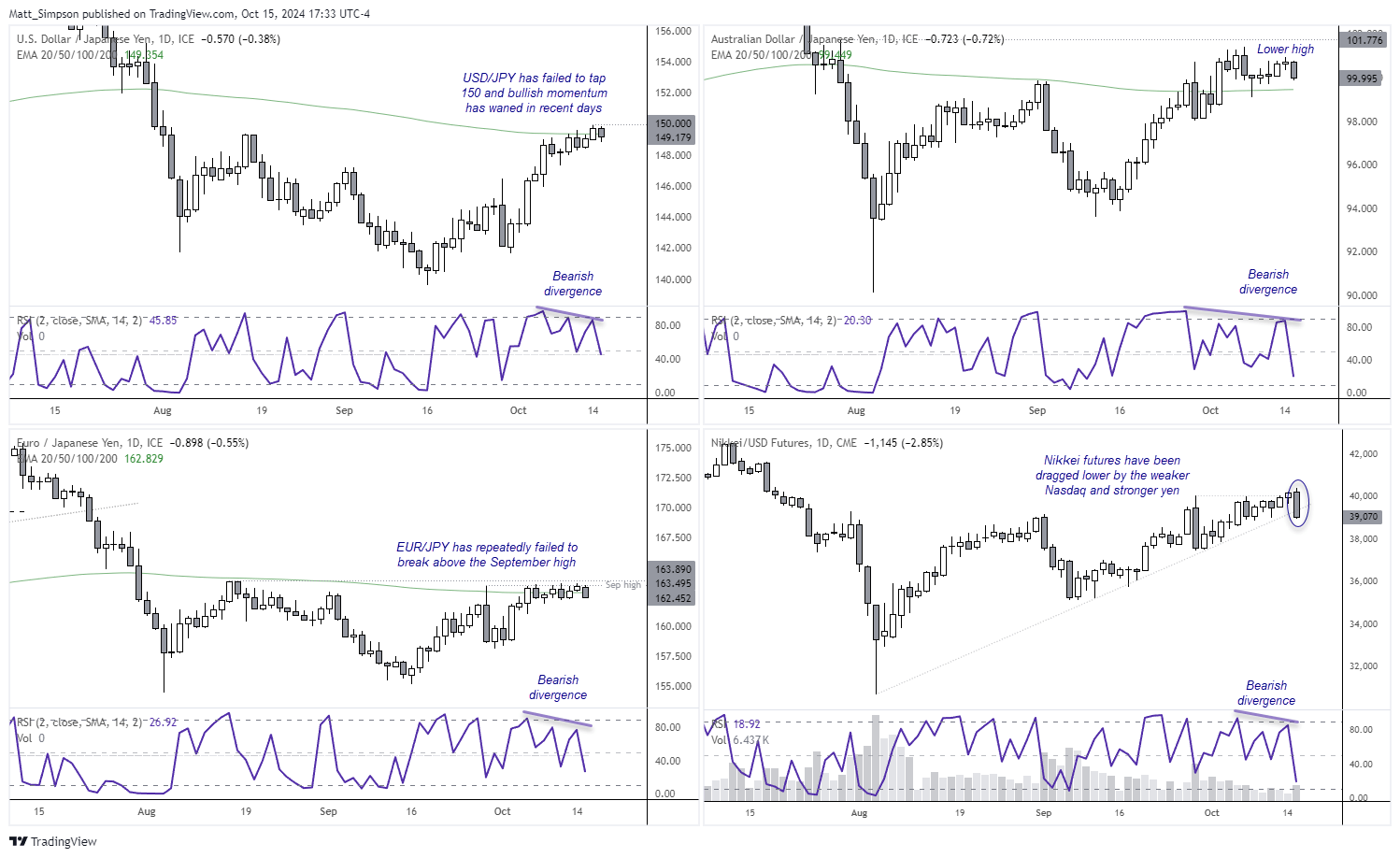

USD/JPY has risen over 7% over the past four weeks, yet bullish momentum has clearly declined in recent days as the market tried (but failed) to even touch 150. A bearish divergence has also formed on the daily RSI (2) and prices are back beneath its 200-day EMA.

AUD/JPY has formed a lower high on the daily chart alongside a bearish divergence. While the 200-day EMA sits nearby for potential support, this is a key market to monitor as it is considered a barometer of risk.

EUR/JPY also looks to be turning lower after repeated attempts to break above the September high. A bearish divergence is also apparent. Should the ECB deliver a dovish cut tomorrow while risk-off remain in place, EUR/JPY has the potential to roll over.

Nikkei 225 futures are sharply lower ahead of the Tokyo open and on track for a bearish engulfing / outside day. A multi-week bearish divergence is also at play and prices are back beneath the September high. Also note the marginal daily close beneath the August trendline. Traders should keep an eye on Nasdaq futures alongside the Nikkei to assess its downside potential.

Events in focus (AEDT):

- 10:00 – FOMC member Bostic speaks

- 10:50 – JP core machinery orders

- 12:30 – BOJ member Adachi speaks

- 17:00 – UK CPI

- 23:30 – US import, export price indices

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge