Market positioning from the COT report – Tuesday, 19 November 2024:

- Large specualtors increased gross-longs to yen futures 23% (14.9k contracts) and while specualtive volumes increased to a 17-week high

- They also increased gross-shorts to EUR/USD futures by 18% (29.4k contracts) and trimmed longs by -4% (-5.7k contracts)

- While they remained net-long GBP/USD futures by 40.3k contracts, gross longs were were reduced by -15% (-18.3k contracts)

- Short interest against NZD/USD futures increased by 16% (5.7k contracts) to send net-short exposure to an 11-month high

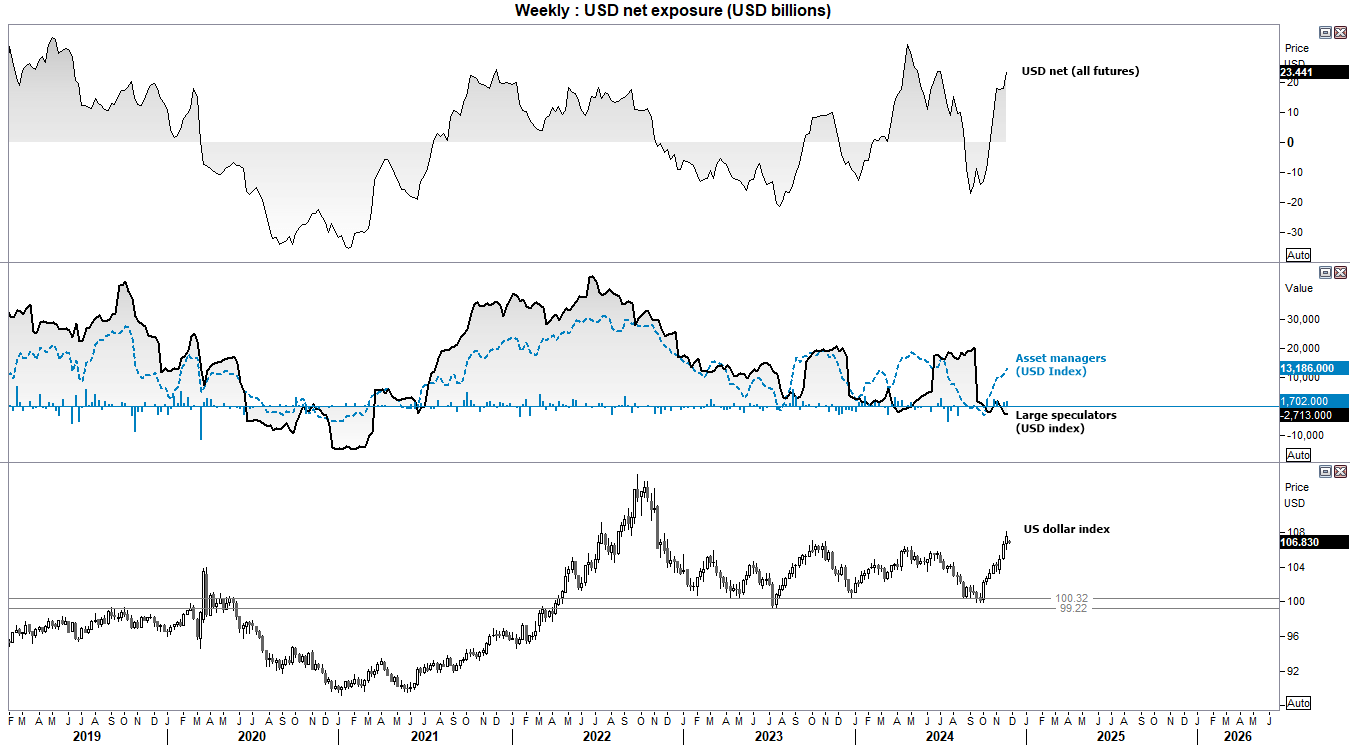

US dollar positioning (IMM data) – COT report:

Traders were their most bullish on the USD in 20 weeks, looking at how their were positioned across all currency futures contracts last week. The $5.6 billion increase saw traders net-long by $23.4 billion.

Asset managers remained on the correct side of the USD bullish thesis, with their net-long exposure also rising to a 20-week high. Large speculators remain in the pain trade, being net-short for a second consecutive week.

The USD index saw its highest weekly close in two years. Although it may hit a bump in the road after Scott Bessent was nominated for the US Secretary position, who is deemed to be a more cautious addition to Trump’s cabinet.

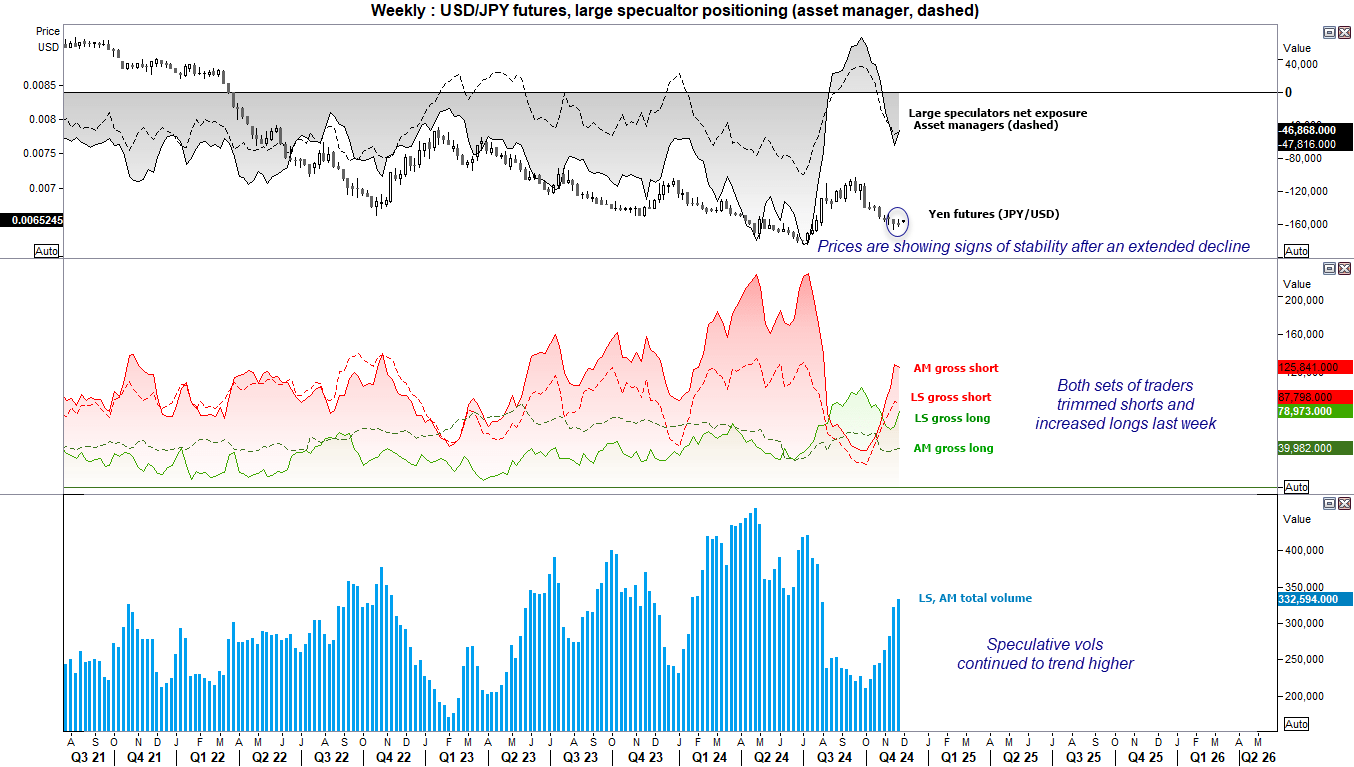

JPY/USD (Japanese yen futures) positioning – COT report:

The yen fell just over -10% from the September high to November low over an eight-week period. Yet a small Rikshawman Doji (which was an inside week) and a bullish hammer the week prior suggest bearish momentum is waning.

And while speculative volumes continued to increase to show power behind the bearish move overall, the was a slight adjustment to sentiment last week. Both asset managers and large speculators short exposure and increased longs. The fact that their combined speculative volume increased to a 17-week high now has me questioning whether we’ve seen an important swing low on the yen, which could be bearish for USD/JPY if correct.

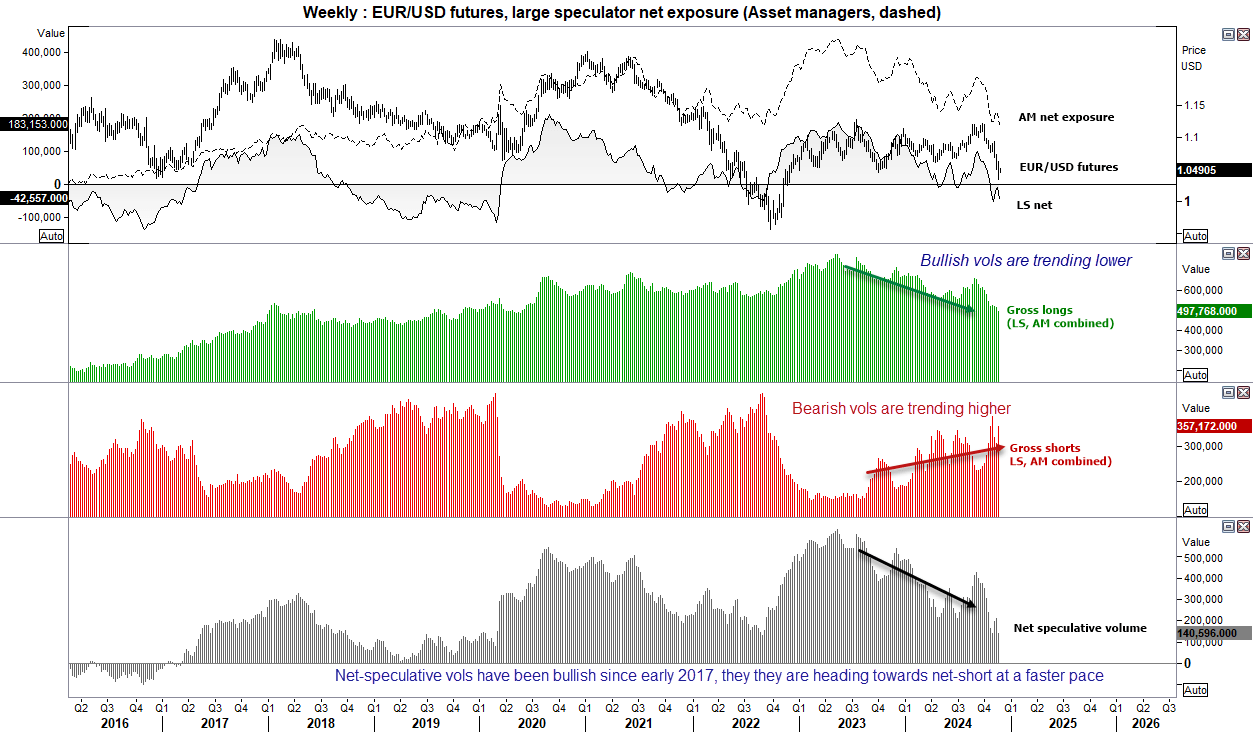

EUR/USD (Euro dollar futures) positioning – COT report:

Large speculators increased their net-short exposure for the first week in three, and close to being their most bearish since March 2020. Asset managers reduced their net-long exposure to their least bullish level in two years.

Taking a step back to view speculative volume (asset managers and large speculators combined) shows that gross longs have been trending lower and gross shorts are rising. This has sent net-long speculative volumes to their least bearish level since 2022. But that has been trending lower at a fast pace, which is sustained could see spec vols flip to net short for the first time since early 2017. Could EUR/USD be looking at another parity party?

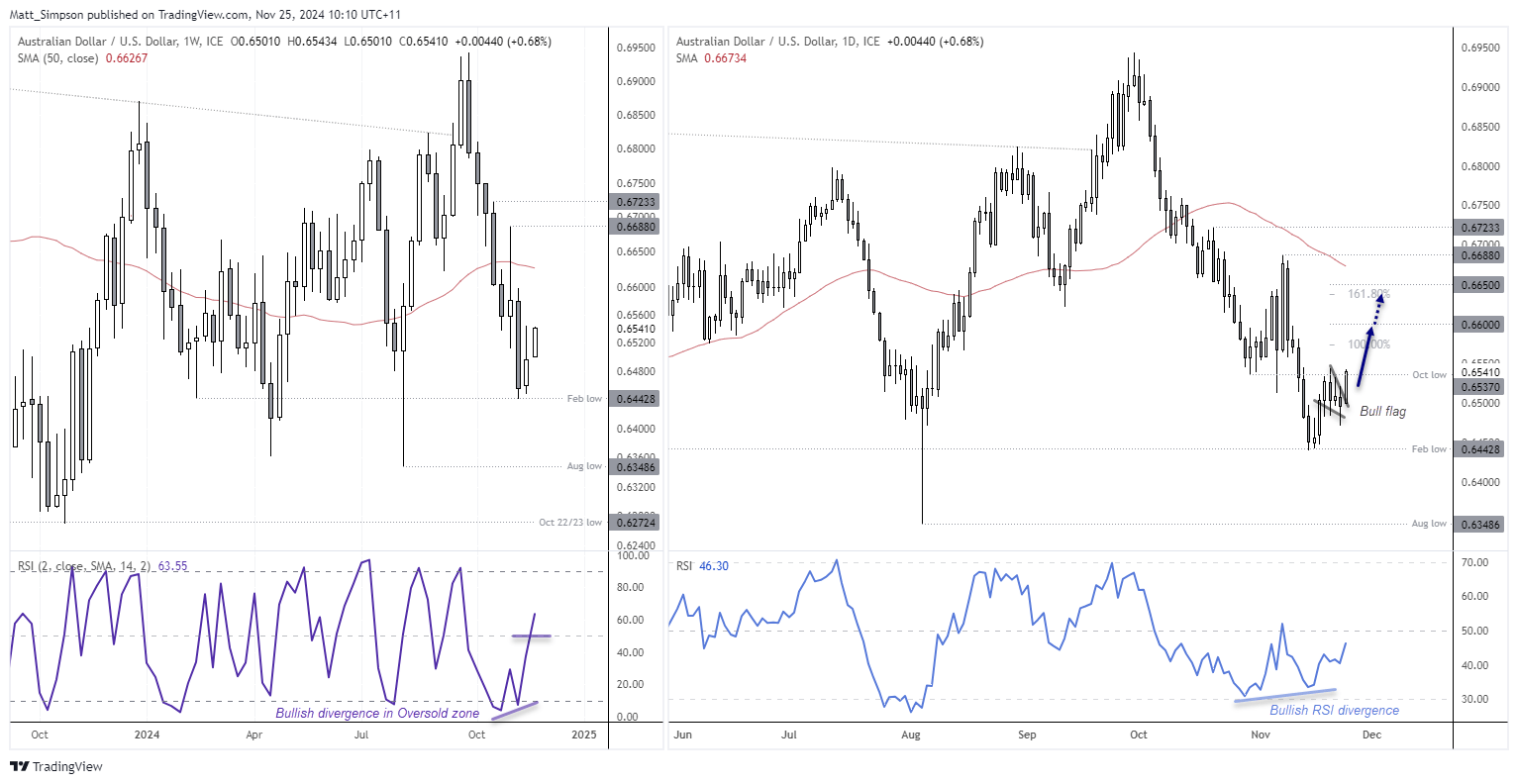

AUD/USD (Australian dollar futures) positioning – COT report:

Total open interest increased for the first week in seven to show the general derisking of AUD/USD may have come to an end. Speculative open interest (large speculator and asset managers) also increased alongside prices last week, to suggest an important swing low for AUD/USD may have been seen.

Large speculators remained net-long and close their most bullish level in nearly seven years. And while asset managers increased their net-short exposure slightly, they’re not overly bearish relative to their positioning over the past year.

websites!

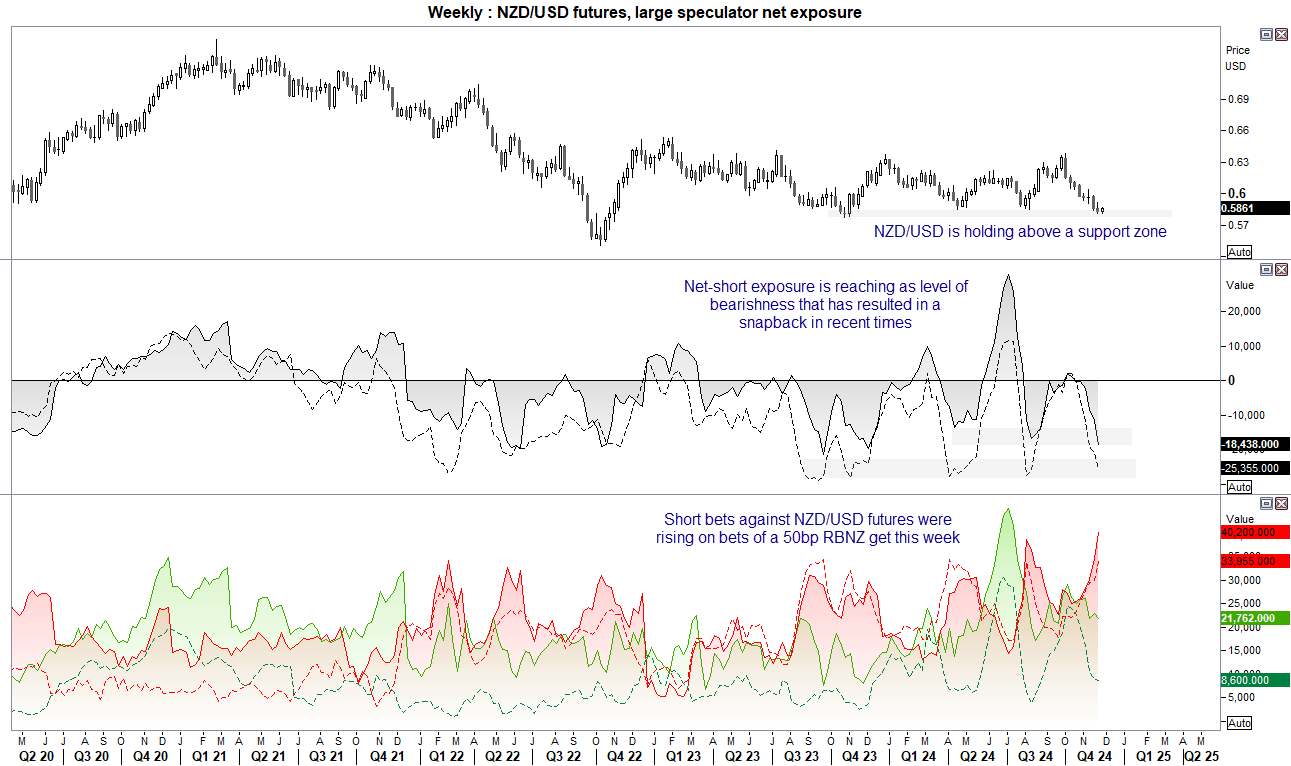

NZD/USD (New Zealand dollar futures) positioning – COT report:

Large speculators increased short bets against NZD/USD futures for a sixth week, and at their most aggressive pace in 16 weeks. Asset managers added to shorts for a fifth week and at their most aggressive pace in seven. Bets are on that the RBNZ will cut by 50bp, and a potentially dovish one at that.

Yet net-short exposure is reaching a level of bearishness that has preceded a snapback in recent times. And there is the risk that the 50bp cut is priced in and the RBNZ hold back on further cuts, given the uncertainty surrounding the Trump Presidency. Prices on NZD/USD are also holding above the 2023 low for now.