US stocks experienced a volatile week but the S&P 500 ended the week at roughly the same level that it started. The market weighed up stronger than expected PMI data, hawkish FOMC minutes, and warnings from Fed speakers that rates must stay high for longer against stellar Nvidia earnings, which kept the AI trade alive.

Looking ahead to next week, the focus is firmly on inflation, with inflation reports from Europe, Australia, and the US, which could influence sentiment.

Stickier than expected, US core PCE could see the market further push back rate cut expectations, which could weigh on risk sentiment.

As well as inflation OPEC+ will be meeting to discuss the oil production outlook for the coming months.

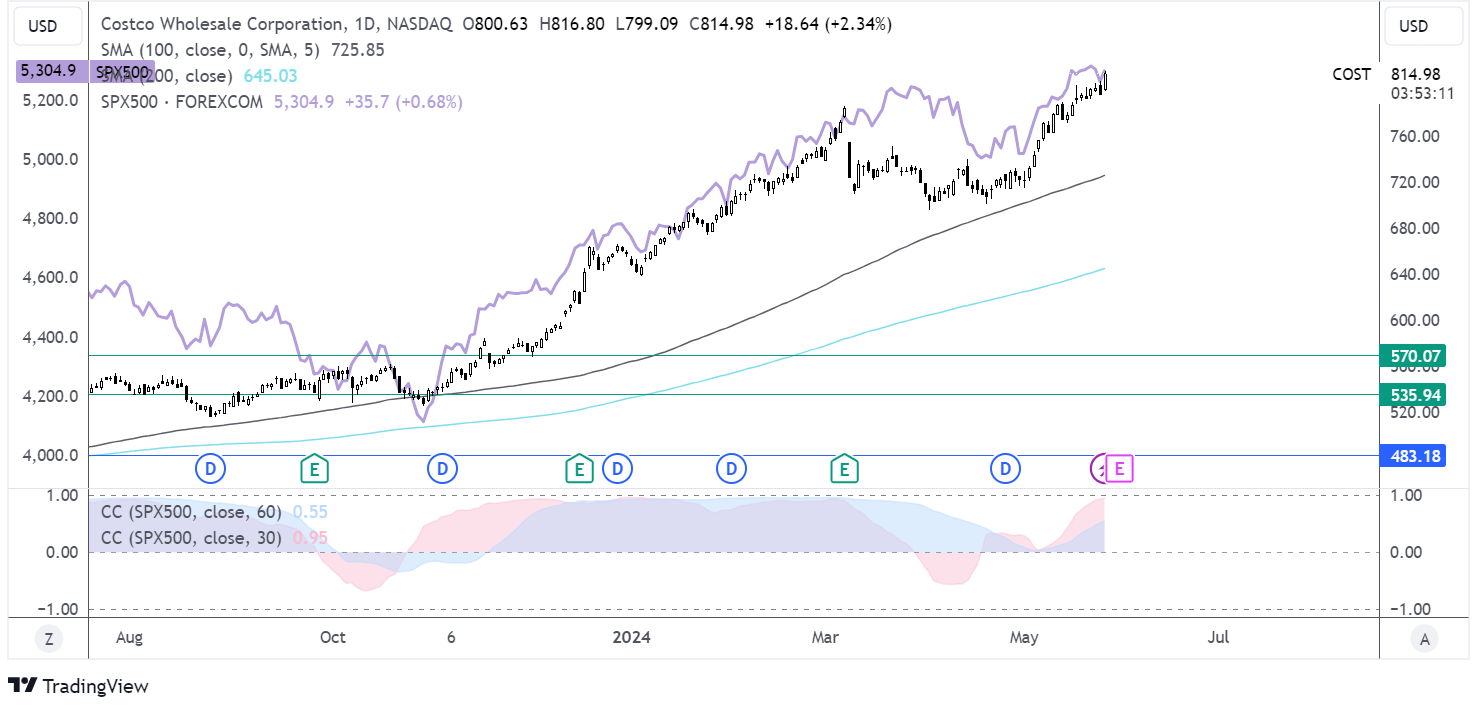

Costco earnings preview

Costco reports its fiscal Q3 earnings after the bell on Thursday 30 May. Wall Street expects Costco to report:

- 7.9% rise in revenue YoY to $57.89 billion

- 25% increase in net income to $1.63 billion.

Memberships are forecast to rise to 73.55 million vs 69.1 million a year earlier.

Earnings from Costco come at the tail end of earnings season for US retailers. With around 70% of the US economy driven by consumer spending, changes and patterns in spending at these large US retailers are important. Earnings results from Walmart, Home Depot, and Target were mixed but highlighted some notable trends.

Walmart, the world’s largest retailer and a bellwether, beat on top and bottom lines but noted a shift in consumer spending from discretionary to essential products. Costco, like Walmart, is known to attract price-conscious customers and could see a similar trend of customers opting for essential groceries rather than discretionary items.

Costco uses a membership system for customers to gain access to its store. Price increases are coming soon, and investors will watch closely for further details on membership pricing plans.

The earnings come after Costco announced a deal with Uber Eats was announced last month.

The Costco share price has risen 21% this year, rising to a record high after recovering from a 10% selloff in the wake of fiscal Q2 results, which saw weaker-than-expected sales.

The share price is closely correlated to the S&P 500, with the 30-day correlation at 95, its highest level since early March.

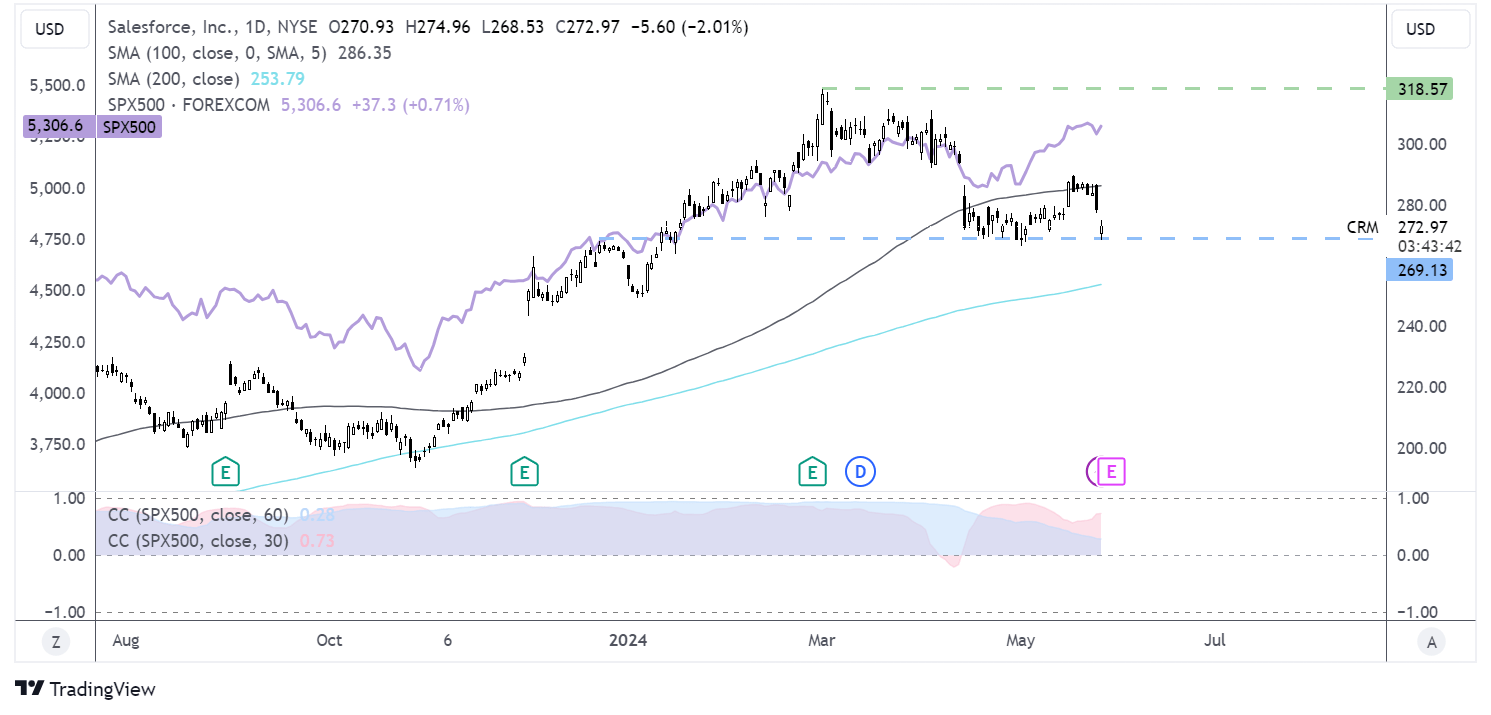

Salesforce earnings preview

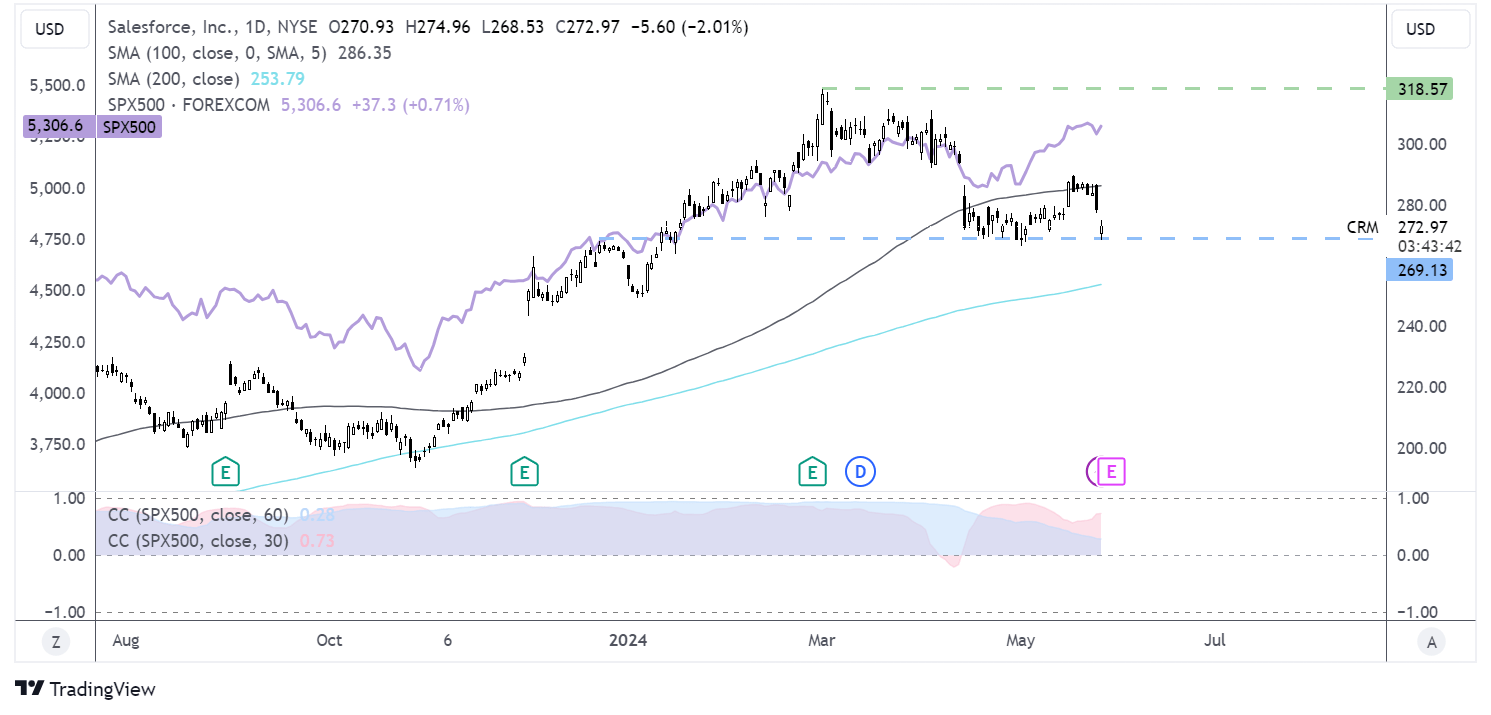

Salesforce will report on Wednesday, May 29. The earnings come as the share price has risen 7% this year, underperforming the broader market, which has increased 12% this year.

Wall Street expects:

- 11% rise in revenue YoY to $9.15bn

- 40.8% increase in EPS to $2.83

- CRPO is expected to climb 11% to $26.76 billion.

Salesforce, a cloud-based customer relationship managers service provider, has delivered stable revenue growth in recent years, driven organically and through acquisitions. Its near-term growth strategy is centred on monetizing AI by integrating technology into its Einstein platform. Just last week, the firm introduced new AI-assisted features. The recent launch of more AI-enhanced tools should translate into higher revenue in the coming years. However, for now, revenue growth could be restricted by cautious business spending on technology due to macroeconomic headwinds.

Expectations are low heading into the earnings as economic uncertainties have weighed on performance and spurred Salesforce to embark on a cost-cutting program.

After a solid start to the year, the share price reached a record high of $318 in March before falling lower to support at $270. Sellers will look for a break below 270 to extend losses toward the 200 SMA at 254. Meanwhile, strong earnings could help the recovery extend beyond resistance at $286 the 100 SMA.

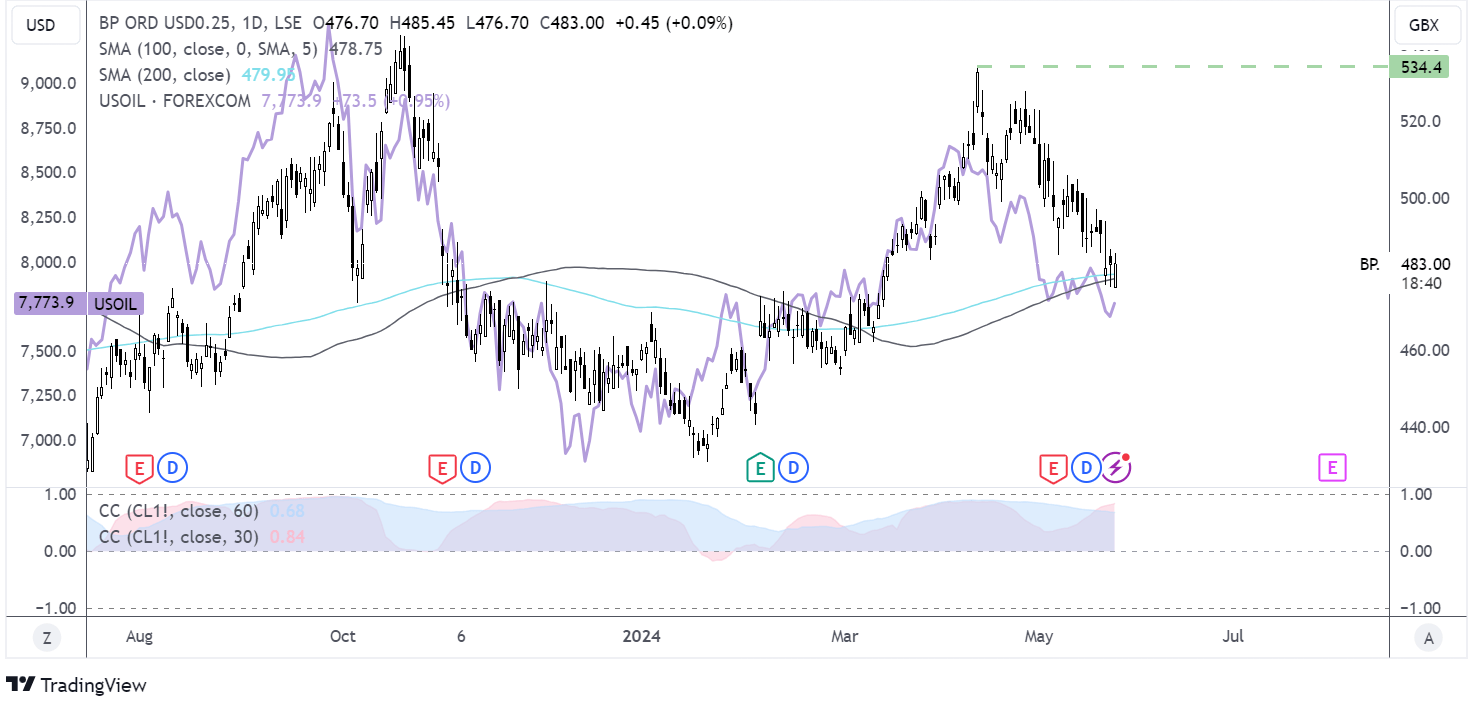

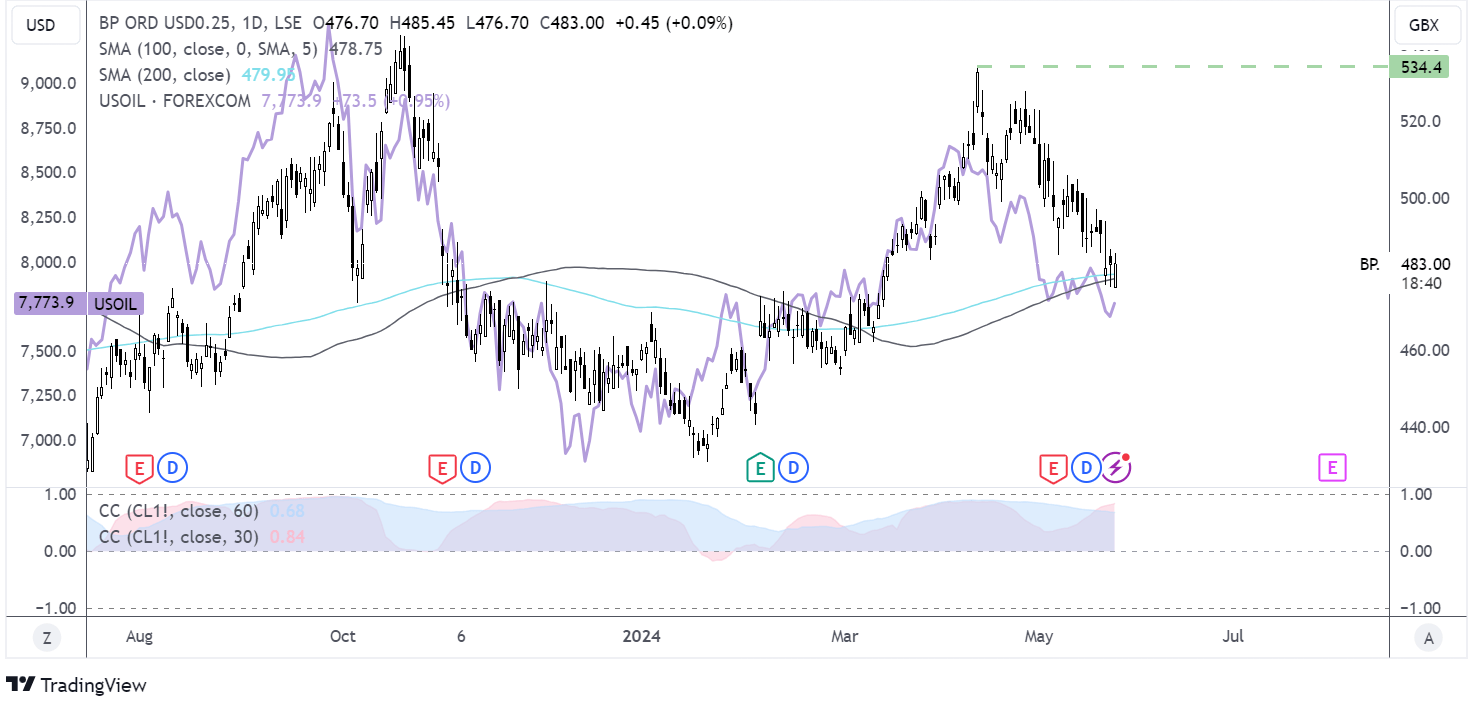

BP looks to oil prices & the OPEC+ meeting.

BP fell 1.7% last week as it tracked oil prices lower. Oil fell 3.5% on concerns over the oil demand outlook. Stronger than expected PMI data and hawkish commentary from Federal Reserve officials raised expectations that the Fed will leave rates high for longer, which could slow economic growth in the US, the world's largest oil consumer.

Attention now turns to the OPEC+ meeting on June 2nd, at which the group will discuss whether to extend voluntary production cuts of 2.2 million barrels per day. A move to extend oil output cuts across the rest of the year could boost oil prices after recent weakness.

Following the OPEC+ meeting, attention will likely return to oil demand as the summer driving season starts after Memorial Day on Monday, May 27.

BP is strongly correlated to the oil price. The chart shows that the 30-day correlation coefficient is at 0.84, its highest level for a month.

After reaching a high of 534p, BP has trended lower to 477p and is testing the 200 SMA. A recovery in the oil price could see BP stage a recovery.

BP looks to oil prices & the OPEC+ meeting.

BP fell 1.7% last week as it tracked oil prices lower. Oil fell 3.5% on concerns over the oil demand outlook. Stronger than expected PMI data and hawkish commentary from Federal Reserve officials raised expectations that the Fed will leave rates high for longer, which could slow economic growth in the US, the world's largest oil consumer.

Attention now turns to the OPEC+ meeting on June 2nd, at which the group will discuss whether to extend voluntary production cuts of 2.2 million barrels per day. A move to extend oil output cuts across the rest of the year could boost oil prices after recent weakness.

Following the OPEC+ meeting, attention will likely return to oil demand as the summer driving season starts after Memorial Day on Monday, May 27.

BP is strongly correlated to the oil price. The chart shows that the 30-day correlation coefficient is at 0.84, its highest level for a month.

After reaching a high of 534p, BP has trended lower to 477p and is testing the 200 SMA. A recovery in the oil price could see BP stage a recovery.