- Traders were their most bullish on USD since December 2015, at $34.9bn ($39.6bn net-long against G10 currencies

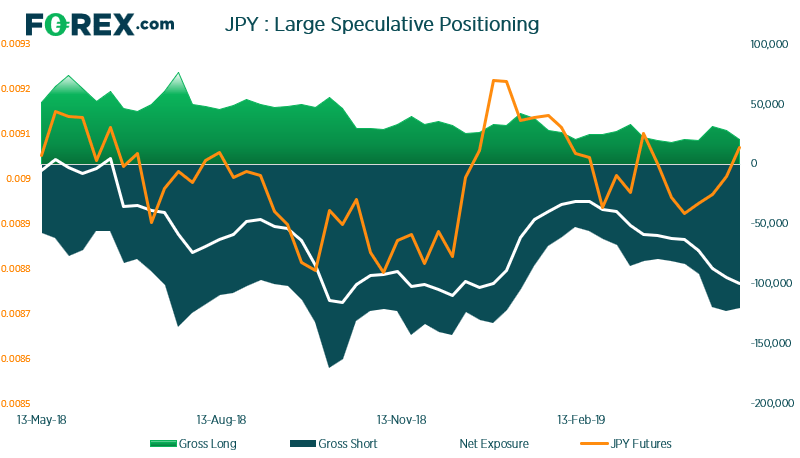

- JPY traders extended their net-short exposure to their most bearish level since December 2018

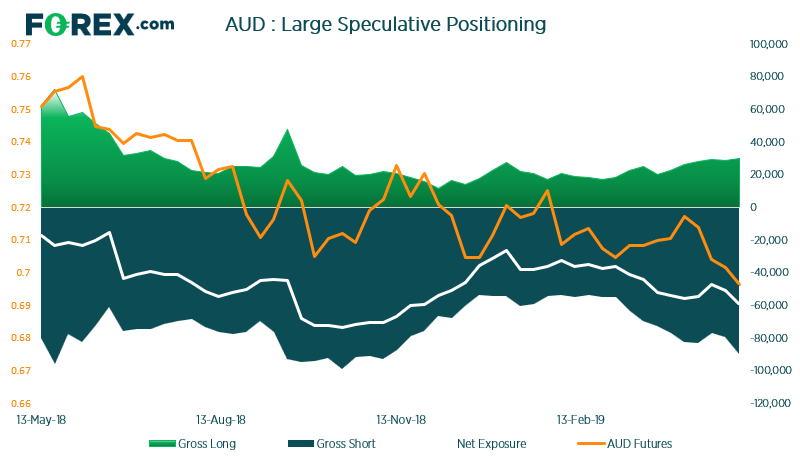

- AUD traders were their most bearish since November 2018

- NZD traders increased their bearish exposure at their fastest pace since September 2018

Despite extending their net-short exposure, JPY futures have continued to rise which could catch a lot of traders off-guard. Most notably, Trump’s trade tweet has seen JPY rally today which piles extra pressure on the bear-camp. It’s also worth noting that the extended bearish positioning has been achieved on lower volumes, driven mostly by a reduction of gross longs. This also brings into question the ‘bearishness’ of the net positioning as this is not a move of confidence.

Bears added 10.3k new short bets last week, dragging net-short exposure to its most bearish level this year. We don’t think positioning is yet at a sentiment extreme, and prices have crashed lower today in response to renewed trade tensions. Tomorrow’s RBA meeting could have a large impact on positioning. If they do cut, there’s still plenty of longs to be closed out.

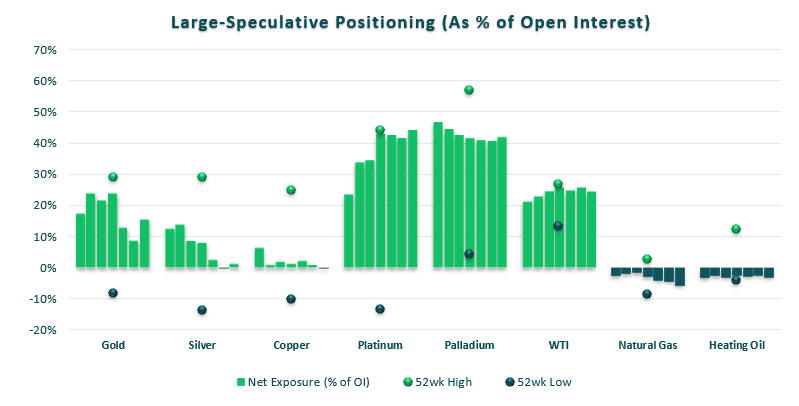

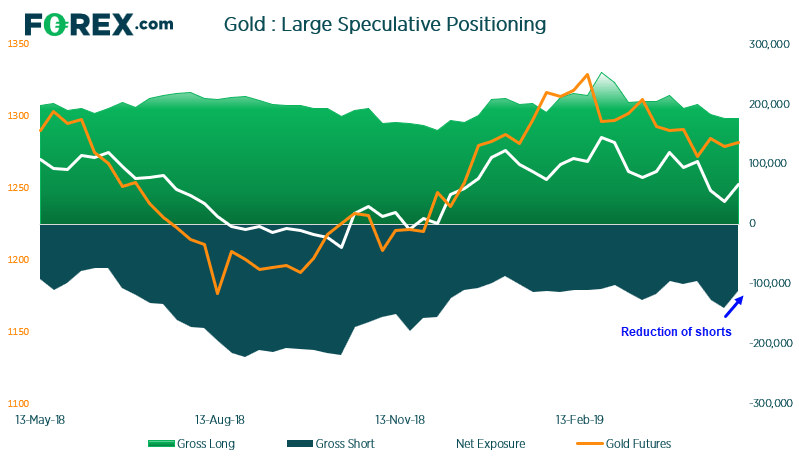

- Gold traders shed -28,2k short contracts, yet bulls added just 584k contracts

- Sliver traders flipped to net-log after a 1-week hiatus net-short

- Copper traders flipped to net-short

- Platinum traders extended their net-long exposure to their most bullish level since March 2018

The increased net-long exposure last week was driven mostly by short covering, with -28.2k shorts closed (its largest short reduction since early December). With prices failing to break lower, we’re monitoring gold’s potential for a bullish wedge to develop.

Net-long exposure saw its largest weekly reduction since early February, ahead of further declines seen since last Tuesday.

The move was driven by an increase of short bets (+16.9k contracts) and a reduction of longs (-6.4k contracts), which could point towards a deeper correction.