US Dollar Outlook: USD/JPY

USD/JPY climbs to a fresh monthly high (153.75) as it stages a five-day rally for the first time since June, but the Federal Reserve interest rate decision may sway the exchange rate as the central bank is expected to further unwind its restrictive policy.

USD/JPY Stages Five-Day Rally for First Time Since June

USD/JPY appears to be mirroring the rise in long-term US Treasury yields as it extends the advance from the start of the week, and the exchange rate may continue to retrace the decline from the November high (156.75) on the back of US Dollar strength.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Looking ahead, the Federal Open Market Committee (FOMC) is expected to deliver another 25bp rate-cut at its last meeting for 2024, and more of the same from the Fed may produce headwinds for the US Dollar as the central bank continues to move toward a neutral stance.

At the same time, the FOMC may adjust the forward guidance for monetary policy as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP), and the central bank may project a more gradual path in unwinding its restrictive policy should the SEP reveal an upward revision in the Fed’s interest rate dot-plot.

With that said, a hawkish Fed rate-cut may keep USD/JPY afloat as the central bank insists that ‘monetary policy decisions were not on a preset course,’ but a further shift in the carry trade may curb the recent in the exchange rate as major central banks continue to switch gears.

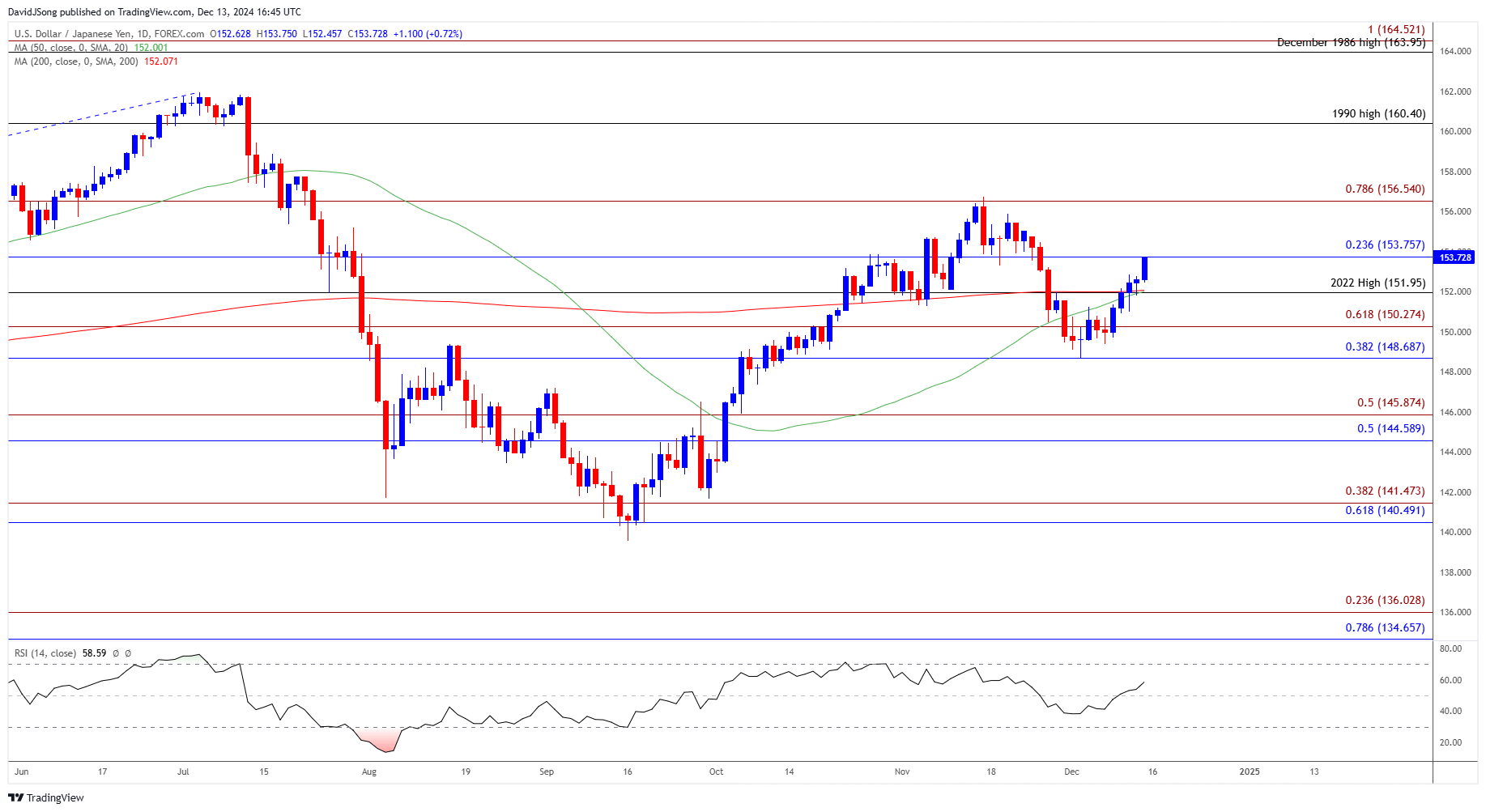

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY extends the advance from the start of the week to register a fresh monthly high (153.75), and a close above 153.80 (23.6% Fibonacci retracement) may push the exchange rate towards 156.50 (78.6% Fibonacci extension).

- A breach above the November high (156.75) opens up 160.40 (1990 high), but USD/JPY may struggle to retain the advance from the monthly low (148.65) should if fail to trade back above 156.50 (78.6% Fibonacci extension).

- A breach below 151.95 (2022 high) may push USD/JPY back towards the 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension) zone, with the next area of interest coming in around 144.60 (50% Fibonacci retracement) to 145.90 (50% Fibonacci extension).

Additional Market Outlooks

Gold Price Forecast: Bullion Remains Below Pre-US Election Prices

Canadian Dollar Forecast: USD/CAD Climbs to Fresh Yearly High

GBP/USD Outlook Hinges on Break of December Opening Range

Australian Dollar Forecast: AUD/USD Falls to Fresh Yearly Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong