Japanese Yen Outlook: USD/JPY

USD/JPY carves lower highs and lows ahead of the Bank of Japan (BoJ) interest rate decision as it slips to a fresh monthly low (154.78).

USD/JPY Slips to Fresh Monthly Low Ahead of BoJ Rate Decision

USD/JPY may continue to give back the advance from the December low (148.65) as it no longer trades within the opening range for January, and swings in the carry trade may influence the exchange rate as the Federal Reserve appears to be on track to further unwind its restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Japan Economic Calendar

Meanwhile, the BoJ is expected to deliver a 25bp rate-hike at its first meeting for 2025 after removing its negative interest rate policy (NIRP) last year, and the central bank may continue to normalize monetary policy as ‘Japan's economy is likely to keep growing at a pace above its potential growth rate.’

With that said, speculation surrounding BoJ policy may influence the carry trade as the Japanese Yen serves as a funding-currency, but the recent decline in USD/JPY may turn out to be temporary should Governor Kazuo Ueda and Co. show little intentions of pursing a rate-hike cycle.

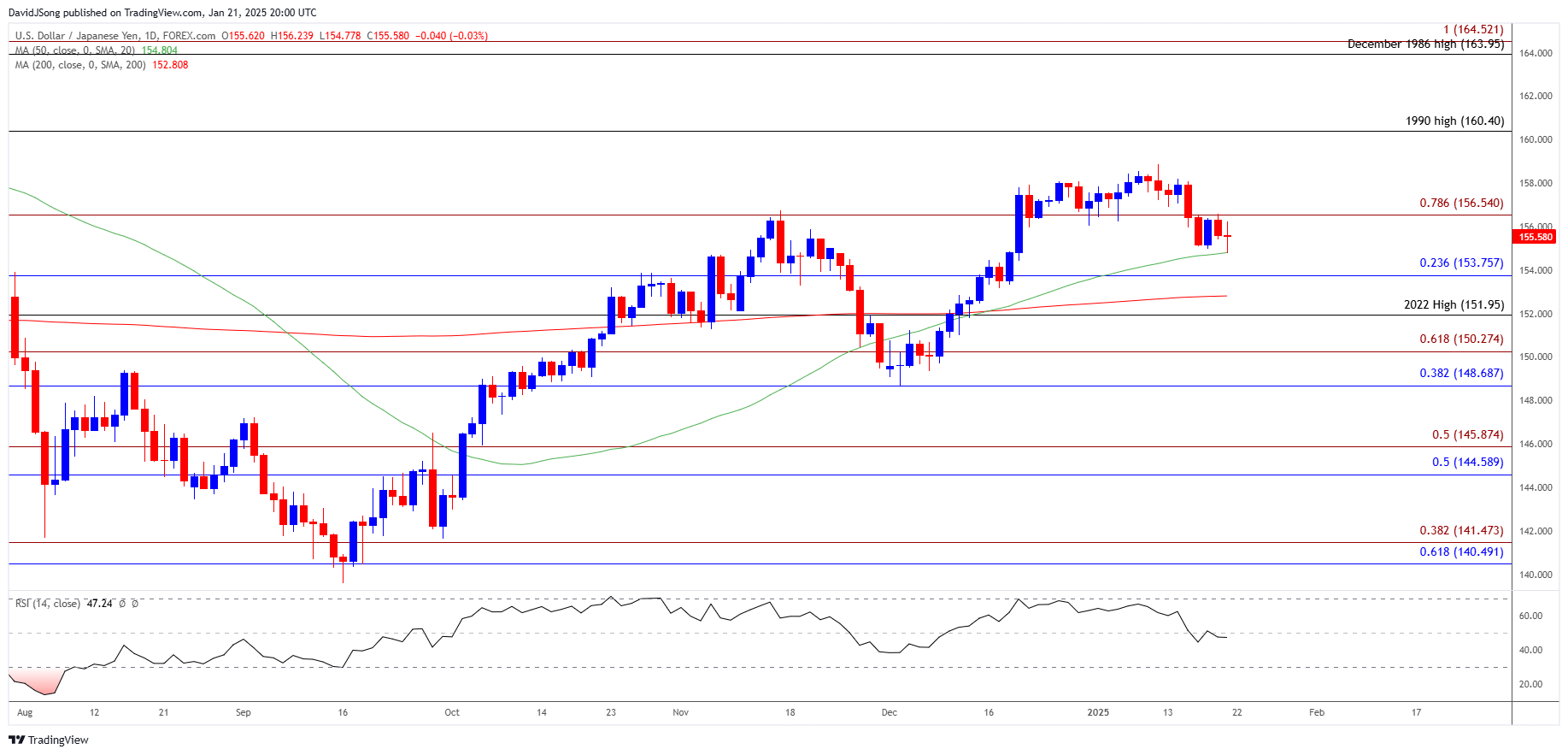

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY trades to a fresh monthly low (154.78) after struggling to trade/close back above 156.50 (78.6% Fibonacci extension), and a break/close below 153.80 (23.6% Fibonacci retracement) may push the exchange rate towards 151.95 (2022 high).

- Next area of interest comes in around 148.70 (38.2% Fibonacci retracement) to 150.30 (61.8% Fibonacci extension), but USD/JPY may attempt to retrace the decline from the start of the week should it struggle to extend the recent series of lower highs and lows.

- Need a close above 156.50 (78.6% Fibonacci extension) to bring the monthly high (158.88) on the radar, with a reach above 160.40 (1990 high) bringing the 2024 high (161.95) on the radar.

Additional Market Outlooks

USD/CAD Spikes to Fresh Monthly High as Trump Prepares Canada Tariff

GBP/USD Pullback Pushes RSI Toward Oversold Territory

AUD/USD Vulnerable amid Struggle to Push Above Weekly High

USD/CHF Snaps Bearish Price Series to Hold Above Weekly Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong