The USD/JPY has lost more than 1.5% of its value over the last six trading sessions, allowing the Japanese yen to regain ground against the prolonged bullish trend favoring the US dollar. This short-term bearish correction is driven by expectations that the Bank of Japan will raise interest rates in its upcoming decision this week.

Central Banks

In order to understand the behavior of the USD/JPY since mid-September 2024, it is important to evaluate the interest rate outlook in both the United States and Japan.

On one hand, the Federal Reserve (Fed) faces new economic uncertainties with the change in administration in the United States. The arrival of Donald Trump has introduced tariff proposals and tax cuts that could increase long-term inflation by strengthening domestic consumption. This scenario could pose a new challenge for the Fed, extending the pause in the current interest rate of 4.5%.

According to the CME Group, there is a 99.5% probability that the interest rate will remain at its current level (4.25% - 4.5%) for the January 29 decision. Following this trajectory, for the next decision on March 19, the probability of keeping rates unchanged has risen to 73.6% in recent days. This reflects a more aggressive stance by the central bank for the first quarter of 2025, primarily due to uncertainty surrounding inflation. It is important to note that these probabilities may change depending on economic conditions.

Interest Rate Probability Chart January - CME Group

Source: CMEGroup

Interest Rate Probability Chart March - CME Group

Source: CMEGroup

The neutral stance in the United States, reinforced by the probabilities mentioned, has fueled a wave of buying in the USD/JPY in recent weeks. This, combined with the lack of clarity in the Bank of Japan's monetary policies, has consistently weakened the Japanese yen and sustained the bullish trend in USD/JPY.

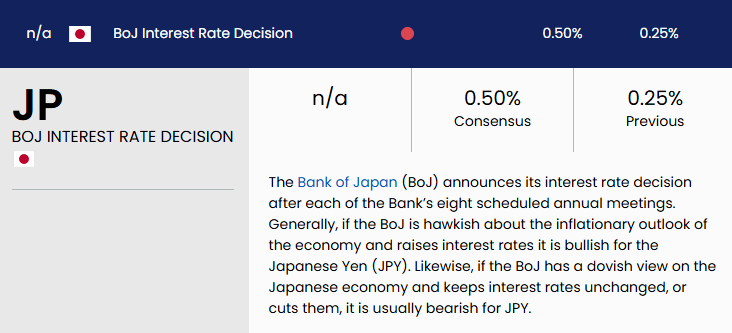

On the other hand, on January 23, the Bank of Japan's next official decision is expected to be announced. The latest inflation data published in Japan stands at 2.9% (November), above the 2% target. This has led the market to anticipate an interest rate hike from 0.25% to 0.5%, which has slightly strengthened the yen in the short term (due to higher expected returns on Japanese assets), driving the current bearish correction in USD/JPY.

Source: Data - FXSTREET

The critical factor moving forward will be to determine whether this new hawkish stance by the Bank of Japan will persist, something that could be confirmed by the comments following the rate decision. If the market is already accustomed to high rates in the United States but anticipates greater aggressiveness in Japan, the current bearish pressure could evolve into a more significant movement.

USD/JPY Technical Forecast

Source: StoneX, Tradingview

- Bullish Trend: Currently, the pair maintains the bullish trend established since September 2024. So far, there have been no bearish corrections strong enough to break the trendline support. However, the latest correction in favor of the yen has brought the price very close to this line. If bearish pressure persists, it could jeopardize the long-standing bullish formation.

- Neutral Indicators:

- The RSI line has recently oscillated around the neutral level of 50, reflecting a consistent balance between buyers and sellers.

- The ADX line remains near the neutral level of 20, indicating a lack of strength in recent USD/JPY movements.

Both indicators reflect a lack of clear direction in the market, driven by price indecision at the current support level.

Key Levels:

- The RSI line has recently oscillated around the neutral level of 50, reflecting a consistent balance between buyers and sellers.

- 157.927: The nearest resistance, corresponding to the most recent high. Oscillations above this level could strengthen bullish momentum and extend the upward trend.

- 155.229: Key support where the trendline and the lower band of the Bollinger Bands converge. Oscillations below this level could cast doubt on the bullish trend and pave the way for increased bearish pressure.

- 152.796: Final support, corresponding to a neutral zone from October 2024. Oscillations near this level would definitively break the current bullish formation.

Written by Julian Pineda, CFA – Market Analyst