Key Events This Week

- US Flash Manufacturing and Services PMIs (Wednesday)

- US Advance GDP (Thursday)

- Tokyo CPI Figures (Friday)

- US Core PCE (Friday)

As the market anticipates the next Bank of Japan (BOJ) meeting on Wednesday, monetary tightening policies are expected to be discussed in light of rising inflation rates. According to Japan’s Governor Ueda, the BOJ's decision on whether to raise rates or reduce bond purchases involves two distinct operations.

The primary driver behind the elevated inflation levels in Japan is not direct consumer demand, but rather the increased prices of imports along with stagnant wage and service levels. This scenario likely postpones any rate hike by the BOJ until October given the lack of sustainability behind their 2% inflation rate target

The upcoming Tokyo CPI figures will be crucial for the BOJ as they assess their projections for the next quarter and evaluate the potential date for a rate hike. Additionally, details regarding the bond taper plan, covering a period of approximately two years, will be released in the upcoming meeting on July 30-31. The BOJ is also closely monitoring the Fed's potential rate cut, as it could favor the Japanese Yen without the need for drastic interventions.

The market widely expects the Fed to cut rates by September, given the persistent cooling of inflation levels. The upcoming US Advance GDP and Core PCE figures will further clarify the timing of the rate cut, as an earlier rate cut could help mitigate potential recession risks.

From a Technical Perspective:

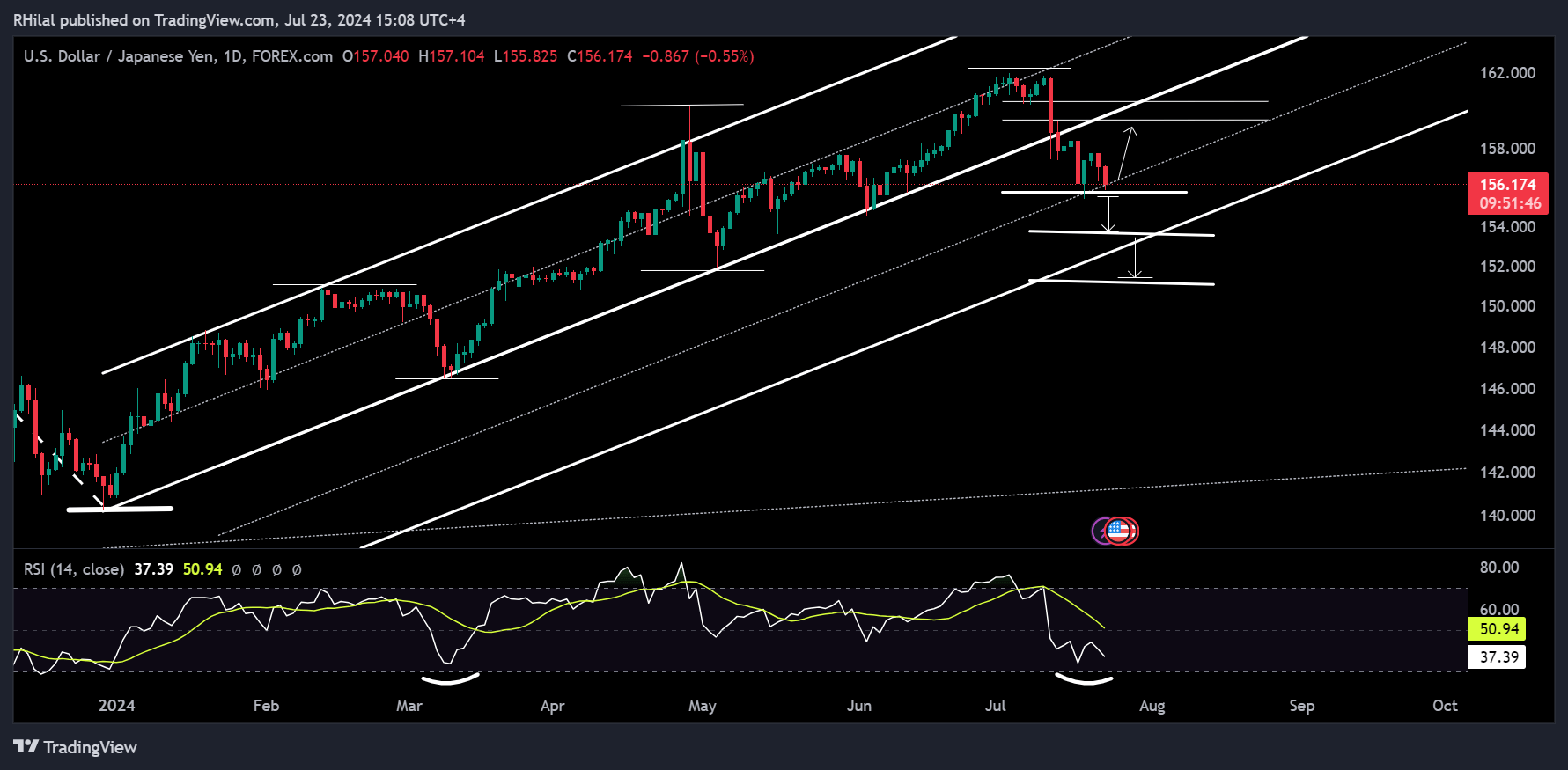

USDJPY Forecast: USDJPY – Daily Time Frame – Log Scale

Source: Tradingview

While the US Dollar index steadies above the 104 level, USDJPY is heading back towards July lows, retesting the 155 zone once again. This zone is crucial as it represents the mid-level of the projected yearly channel and the 0.272 Fibonacci retracement level of the yearly trend.

The current support level is pivotal for determining whether the USDJPY will see a reversal or continue dipping towards the lower border of the channel.

Momentum Perspective:

The oversold Relative Strength Index (RSI) suggests a potential reversal on the near horizon. The projected support and resistance levels are as follows:

Bullish Scenario

A reversal from the 155 zone could push USDJPY back up towards levels 159.50 and 160.50 consecutively. These levels align with the 0.618 retracement of the drop between the July high and low, and the upper border of the projected channel. Further penetration into the primary yearly channel could shift the trend sentiment back to bullish.

Bearish Scenario

A drop below the 155 level could lead USDJPY towards the 0.382 and 0.5 retracement levels of the primary trend, near 153.60 and 151.20 respectively.

--- Written by Razan Hilal, CMT