A strong rejection of support places a clear line in the sand for bulls, who appear set to target the December 2016 highs.

As Matt Weller noted in our FOMC recap the Fed left policy mostly unchanged (bar a 0.05% reduction of the IOER rate) yet remain concerned over price pressures. However, markets were positioned for a more dovish meeting, so short-covering ensued whilst rate-cut expectations were lowered. So we may well have seen the end of the dollar’s correction after retracing from near- 2-year highs over the past week.

We outlined our expectation for EUR/USD to retrace from its 22-month lows on Friday and, whilst the correction was a little deeper than expected, proved to be timely and now appear to have formed a swing high with a similar hammer to USD/CHF. However, given that USD/CHD has remained supported above its breakout level and led the US dollar breakout by several days, USD/CHF remains our preferred pair to trade around the stronger USD theme.

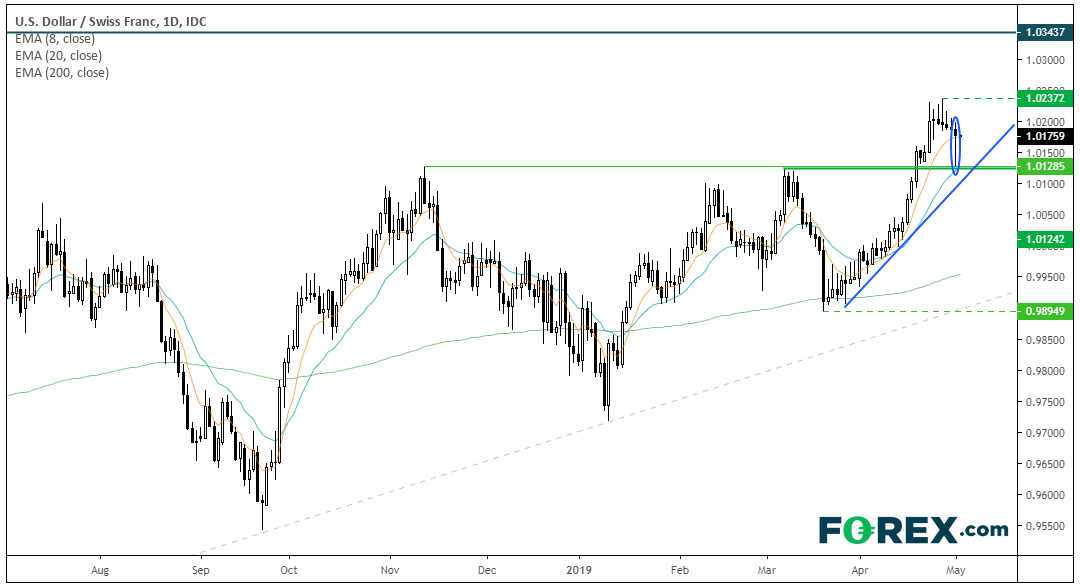

Structurally, USD/CHF trend is undeniably bullish with the 0.99 lows bouncing nicely from the 200-day eMA. We can see on the daily chart that an elongated bullish hammer has formed and perfectly respected 1.0128 support. Furthermore, the 20-day eMA also sits right on the 1.0124 high, placing a tight zone of support between 1.0124/28 which provides a clear level for bulls to focus on.

After such a volatile session, it possible volatility could remain subdued ahead of tomorrow’s NFP report but, as long as the support zone hold, we think US/CHF could be headed for the December 2016 highs.