USD/CAD Outlook

USD/CAD appears to be reversing course ahead of the April high (1.3668) as the Federal Reserve shows a greater willingness to pause its hiking-cycle, and data prints coming out of the US and Canada may influence the near-term outlook for the exchange rate as both labor markets remain tight.

USD/CAD reverses ahead of April high with monthly open in focus

USD/CAD gives back the advance from the start of the month even as Fed Chairman Jerome Powell tames speculation for a rate cut in 2023, and the exchange rate may track the yearly range as the Federal Open Market Committee (FOMC) looks poised to join the Bank of Canada (BoC) on the sidelines.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Nevertheless, the update to the US Non-Farm Payrolls (NFP) report may put pressure on the FOMC to implement higher interest rates as the economy is expected to add 179K jobs in April, while Average Hourly Earnings are expected to hold steady at 4.2% during the same period.

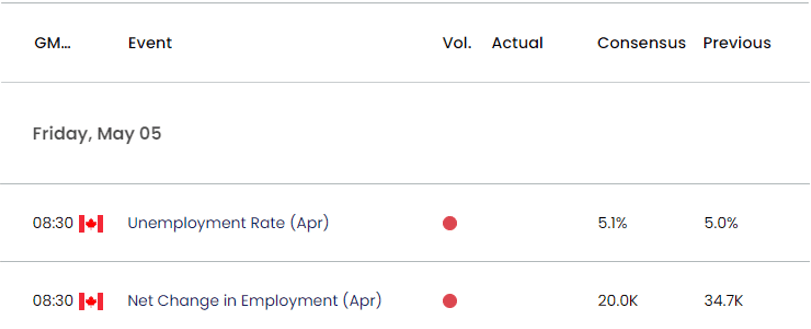

At the same time, Canada is also anticipated to show a further improvement in the labor market as employment projected to increase 20.0K in April, and it remains to be seen if the developments will sway the monetary policy outlook as both the Fed and BoC look poised to keep interest rates on hold over the coming months.

With that said, the monthly opening range is in focus for USD/CAD as it appears to be reversing ahead of the April high (1.3668), and the exchange rate may struggle to retain the rebound from the April low (1.3301) as it gives back the advance from the start of the week.

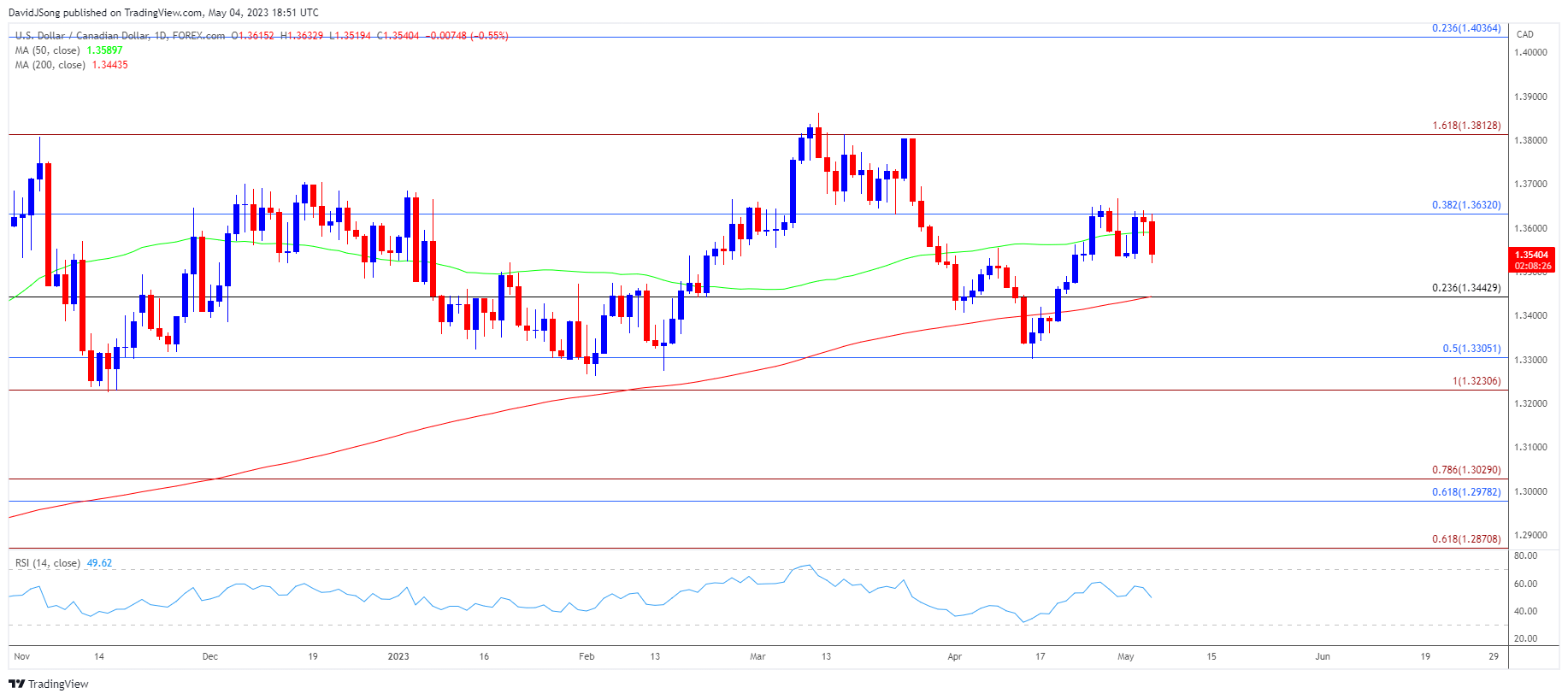

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be reversing ahead of the April high (1.3668) as it trades back below the 50-Day SMA (1.3590), with the opening range for May in focus as the exchange rate slips to a fresh weekly low (1.3519).

- USD/CAD initiates a series of lower highs and lows as it extends the decline from the monthly high (1.3640), with a break/close below 1.3440 (23.6% Fibonacci retracement) opening up the April (1.3301).

- At the same time failure to break/close below 1.3440 (23.6% Fibonacci retracement) may keep USD/CAD within a defined range, with a move above 1.3630 (38.2% Fibonacci retracement) bringing the April high (1.3668) back on the radar.

Additional Resources:

Oil price forecast: crude susceptible to oversold RSI

EUR/USD forecast: monthly low in place ahead of Fed and ECB?

--- Written by David Song, Strategist