USD/CAD Outlook

USD/CAD gives back the advance from earlier this week as Canada’s Gross Domestic Product (GDP) report shows a larger-than-expected rebound in economic activity, but the exchange rate may stage further attempts to test the April high (1.3668) as it snaps the series of lower highs and lows from last week.

USD/CAD Rate Outlook Rests on Test of April High

USD/CAD appeared to be mirroring the weakness in commodity bloc currencies as it approached the monthly high (1.3655), and it remains to seen if the exchange rate will attempt to break out of the April range amid growing speculation for another Federal Reserve rate hike.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

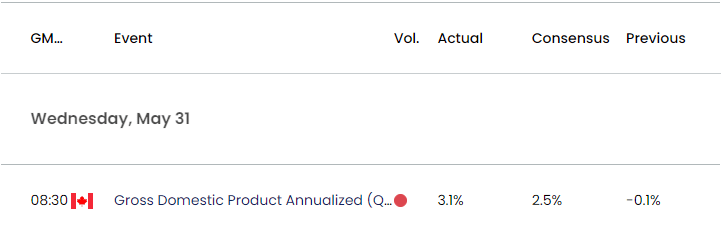

At the same time, the Bank of Canada (BoC) may come under pressure to restore its hiking-cycle as Canada’s 1Q GDP report shows a 3.1% rise versus projections for a 2.5% print, and Governor Tiff Macklem and Co. may prepare Canadian households and businesses for higher interest rates as the central bank acknowledges that ‘demand is still exceeding supply.’

In turn, USD/CAD may track the April range ahead of the next BoC meeting on June 7 as the central bank ‘remains prepared to raise the policy rate further if needed,’ but speculation surrounding US monetary policy may sway the exchange rate as Fed officials show a greater willingness to implement higher interest rates.

During an interview with the Financial Times, Cleveland Fed President Loretta Mester emphasized that ‘I don’t really see a compelling reason to pause,’ with the official going onto say that ‘we may have to go further’ as inflation remains above the central bank’s 2% target.

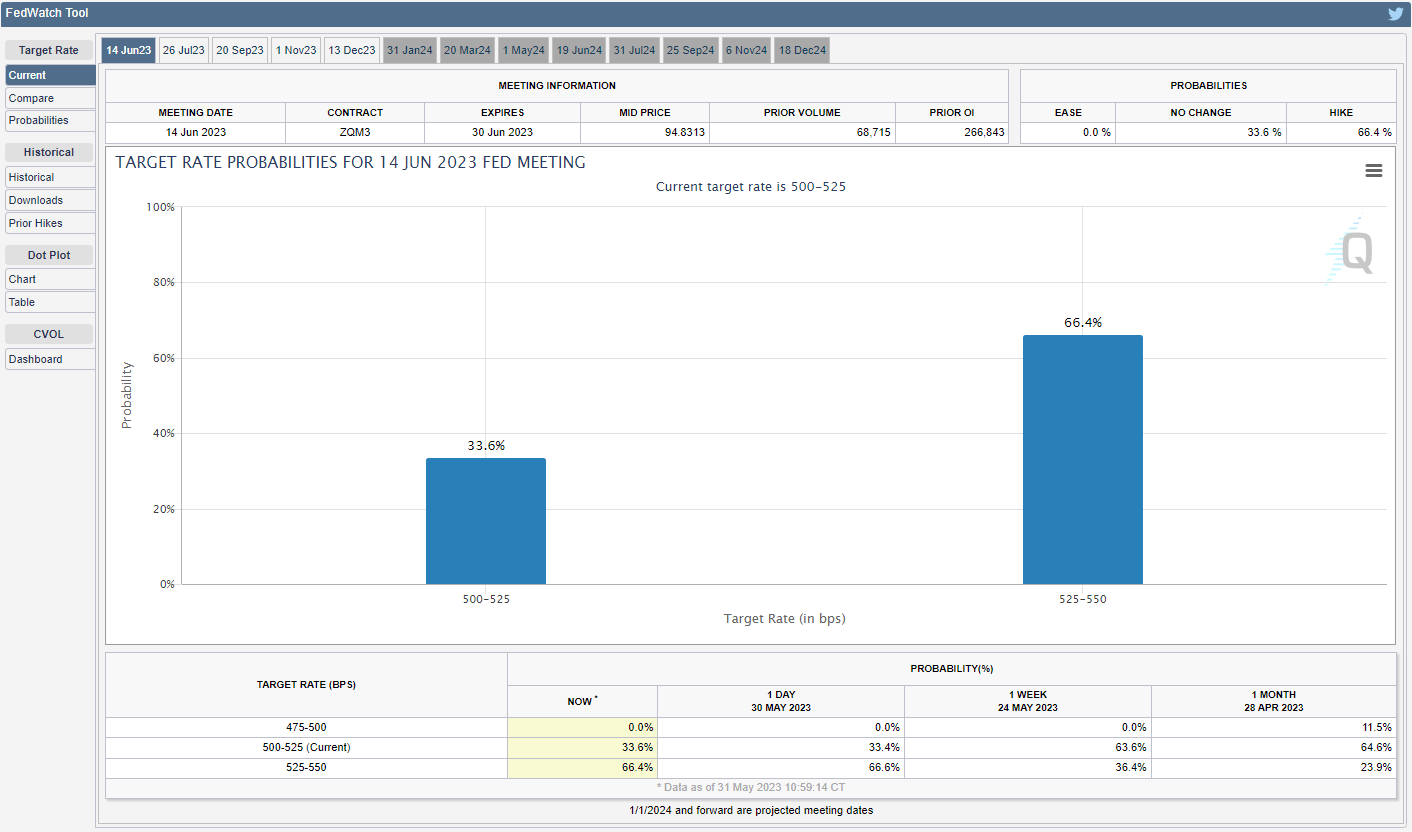

Source: CME

The comments suggest Fed officials will revise the Summary of Economic Projections (SEP) as US lawmakers plan to suspend the debt-ceiling, and expectations for higher interest rates may keep USD/CAD afloat ahead of the next rate decision on June 14 as the CME FedWatch Tool reflects a greater than 60% probability for another 25bp rate hike.

With that said, speculation surrounding US monetary policy may influence USD/CAD as Fed officials show a greater willingness to implement higher interest rates, and the exchange rate may stage further attempts to test the April high (1.3668) as it snaps the series of lower highs and lows from last week.

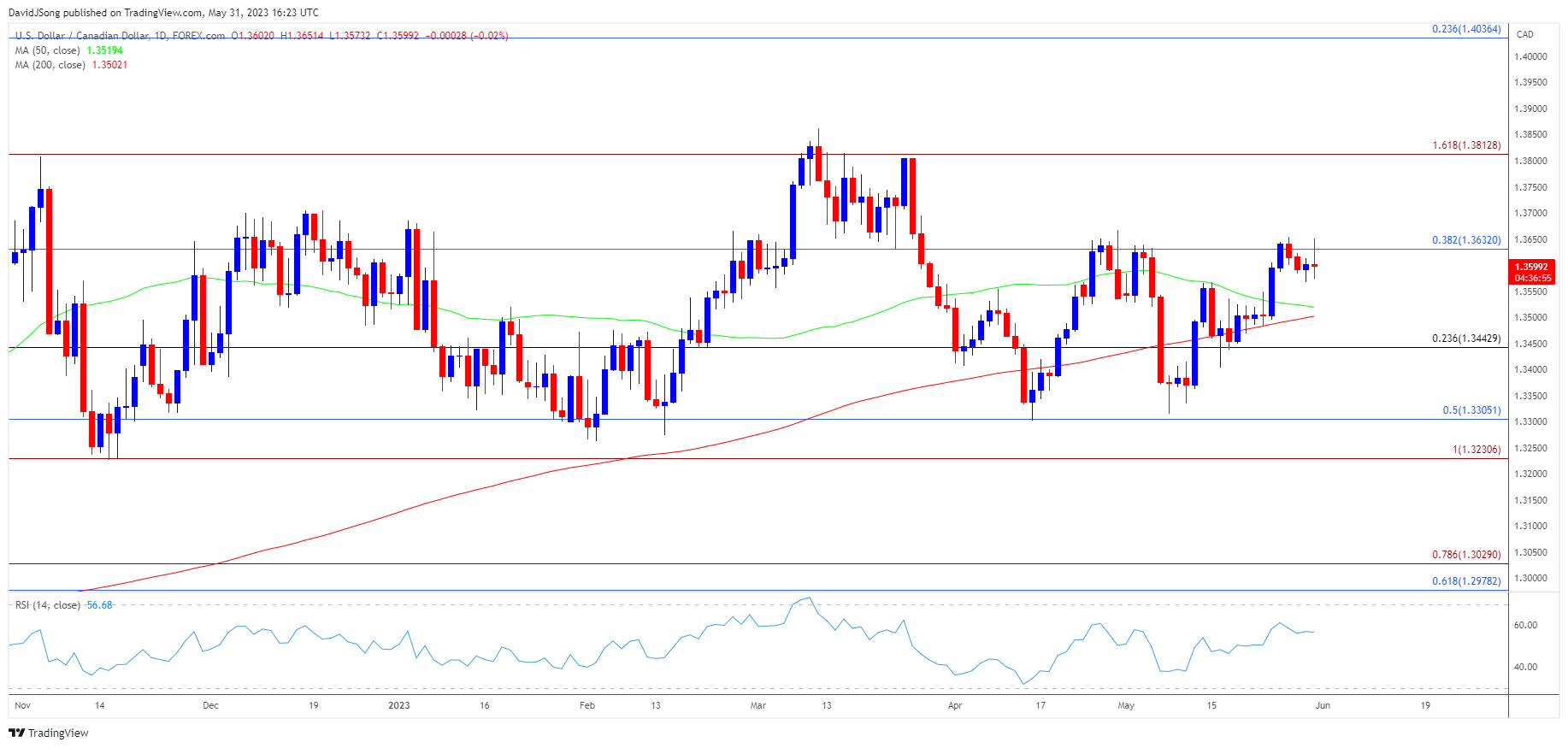

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD registered a fresh monthly high (1.3655) after climbing back above the 50-Day SMA (1.3520), and the exchange rate may stage another attempt to test the April high (1.3668) as it no longer reflects the recent series of lower highs and lows.

- A break above the April range may push USD/CAD towards 1.3810 (161.8% Fibonacci extension), with the next area of interest coming in around the March high (1.3862).

- However, lack of momentum to hold above the 1.3630 (38.2% Fibonacci retracement) region may keep USD/CAD within the April range, with a move below the moving average bringing the 1.3440 (23.6% Fibonacci retracement) area back on the radar.

Additional Resources:

USD/JPY Forecast: RSI Flashes Overbought Signal for First Time in 2023

AUD/USD Breaches March Low to Bring November Low on Radar

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong