USD/CAD Outlook

USD/CAD appears to have reversed course ahead of the 200-Day SMA (1.3393) as it extends the series of higher highs and lows from last week, and the Bank of Canada (BoC) interest rate decision may do little to curb the recent advance in the exchange rate as the central bank is expected to sit on the sidelines.

USD/CAD forecast: Canadian dollar vulnerable to wait-and-see BoC

USD/CAD approaches the 50-Day SMA (1.3558) as it stages a five-day rally, and the exchange rate may attempt to retrace the decline from the March high (1.3862) as the 236K rise in US Non-Farm Payrolls (NFP) raises the Federal Reserve’s scope to pursue a more restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

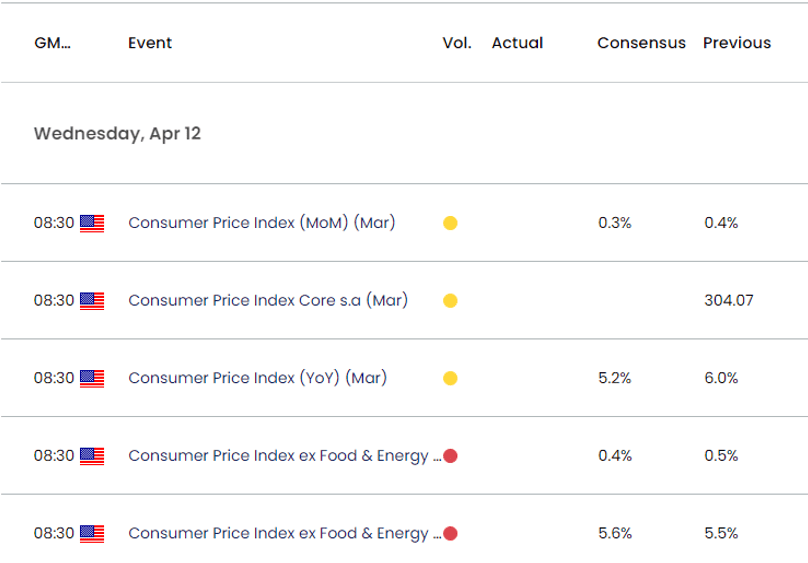

At the same time, the update to the US Consumer Price Index (CPI) may also sway the monetary policy outlook even though the headline reading is expected to narrow in March as the core rate of inflation is seen widening to 5.6% from 5.5% per annum the month prior.

Evidence of persistent price growth may keep USD/CAD afloat as it boosts speculation for higher US interest rates, and the Federal Open Market Committee (FOMC) may take further steps to combat inflation amid the ongoing rise in employment.

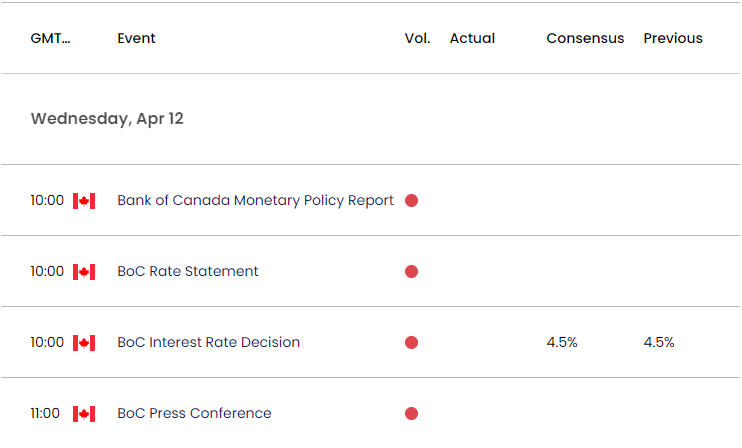

In contrast, the BoC is anticipated to keep the benchmark interest rate at 4.50% as the ‘latest data remains in line with the Bank’s expectation that CPI inflation will come down to around 3% in the middle of this year.’ In turn, more of the same from the BoC may produce a bearish reaction in the Canadian Dollar as Governor Tiff Macklem and Co. pledge to ‘assess economic developments and the impact of past interest rate increases.’

With that said, the BoC rate decision may do little to curb the recent advance in USD/CAD as the central bank carries out a wait-and-see approach, and the exchange rate may attempt to retrace the decline from the March high (1.3862) as it appears to have reversed course ahead of the 200-Day SMA (1.3393).

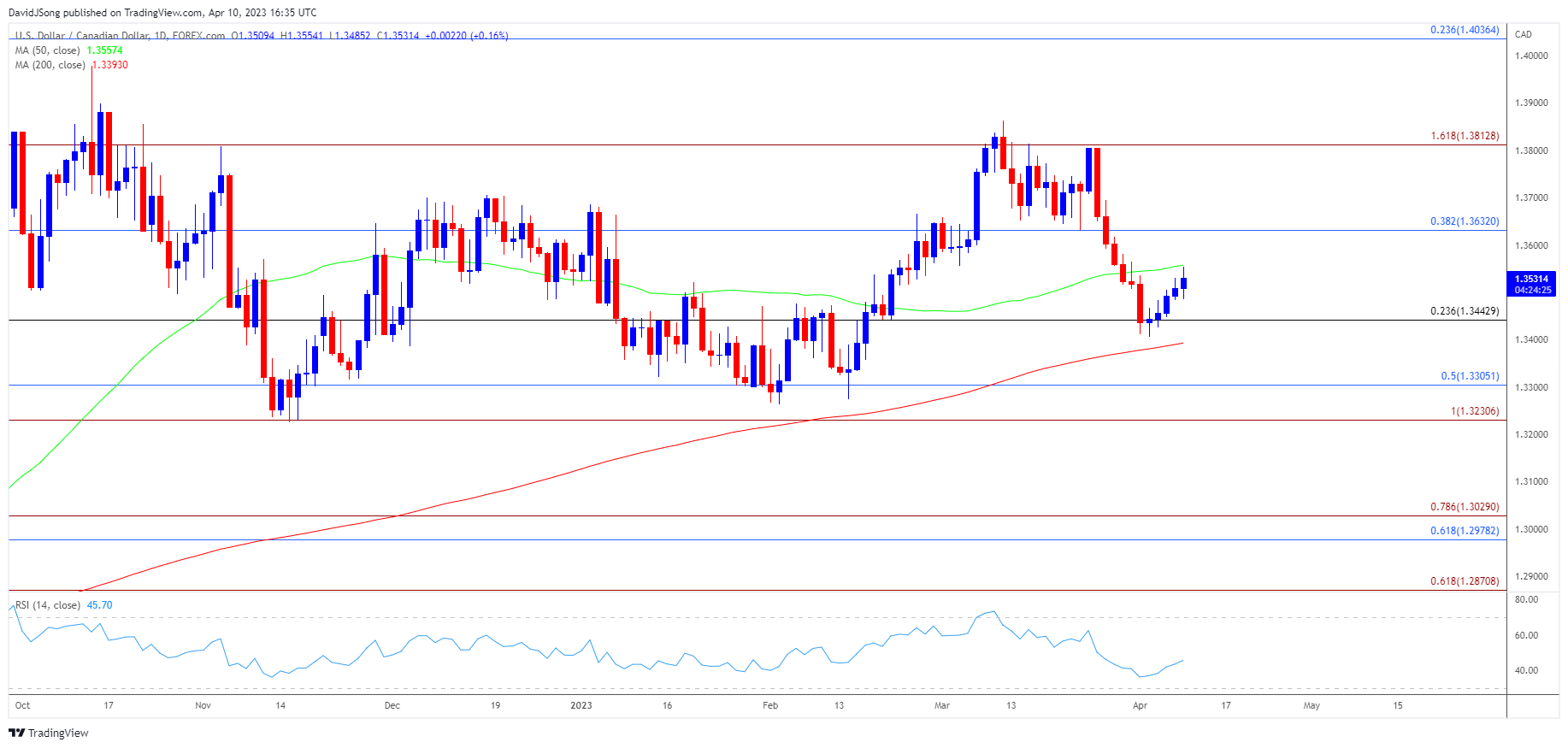

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may track the positive slope in the 200-Day SMA (1.3393) as it bounces back ahead of the moving average, with a move above the 50-Day SMA (1.3558) raising the scope for a move towards 1.3630 (38.2% Fibonacci retracement).

- Next area of interest comes in around 1.3810 (161.8% Fibonacci extension), with a move above the March high (1.3862) bringing the 2022 high (1.3978) on the radar.

- However, failure to push above the 50-Day SMA (1.3558) may undermine the recent series of higher highs and lows in USD/CAD, with a move below 1.3440 (23.6% Fibonacci retracement) raising the scope for a test of the monthly low (1.3407).

Additional Resources:

EUR/USD struggles to test yearly high ahead of NFP report

Gold price forecast: RSI flirts with overbought territory

--- Written by David Song, Strategist