Canada Dollar Outlook: USD/CAD

USD/CAD pulls back ahead of the November high (1.4178) after clearing the opening range for December, but the Bank of Canada (BoC) meeting may produce headwinds for the Canadian Dollar as the central bank is anticipated to deliver another rate-cut.

USD/CAD Forecast: Canadian Dollar Vulnerable to BoC Rate Cut

USD/CAD gives back the advance following Canada’s Employment report, which showed the jobless rate climbing to 6.8% in November from 6.5% the month prior, with the pullback in the exchange rate keeping the Relative Strength Index (RSI) below 70.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

As a result, the RSI may show the bullish momentum abating as the oscillator seems to be reversing ahead of overbought territory, but the BoC meeting may sway USD/CAD as officials ‘expect to reduce the policy rate further.’

Canada Economic Calendar

The BoC is projected to lower the benchmark interest rate to 3.25% from 3.75%, and another 50bp rate-cut along with a dovish forward guidance may drag on the Canadian Dollar as Governor Tiff Macklem and Co. keep the door open to implement lower interest rates in 2025.

With that said, more of the same from the BoC may curb the recent pullback in USD/CAD, but a shift in the forward guidance for monetary policy may generate a bullish reaction in the Canadian Dollar as the central bank appears to be nearing the end of its rate-cutting cycle.

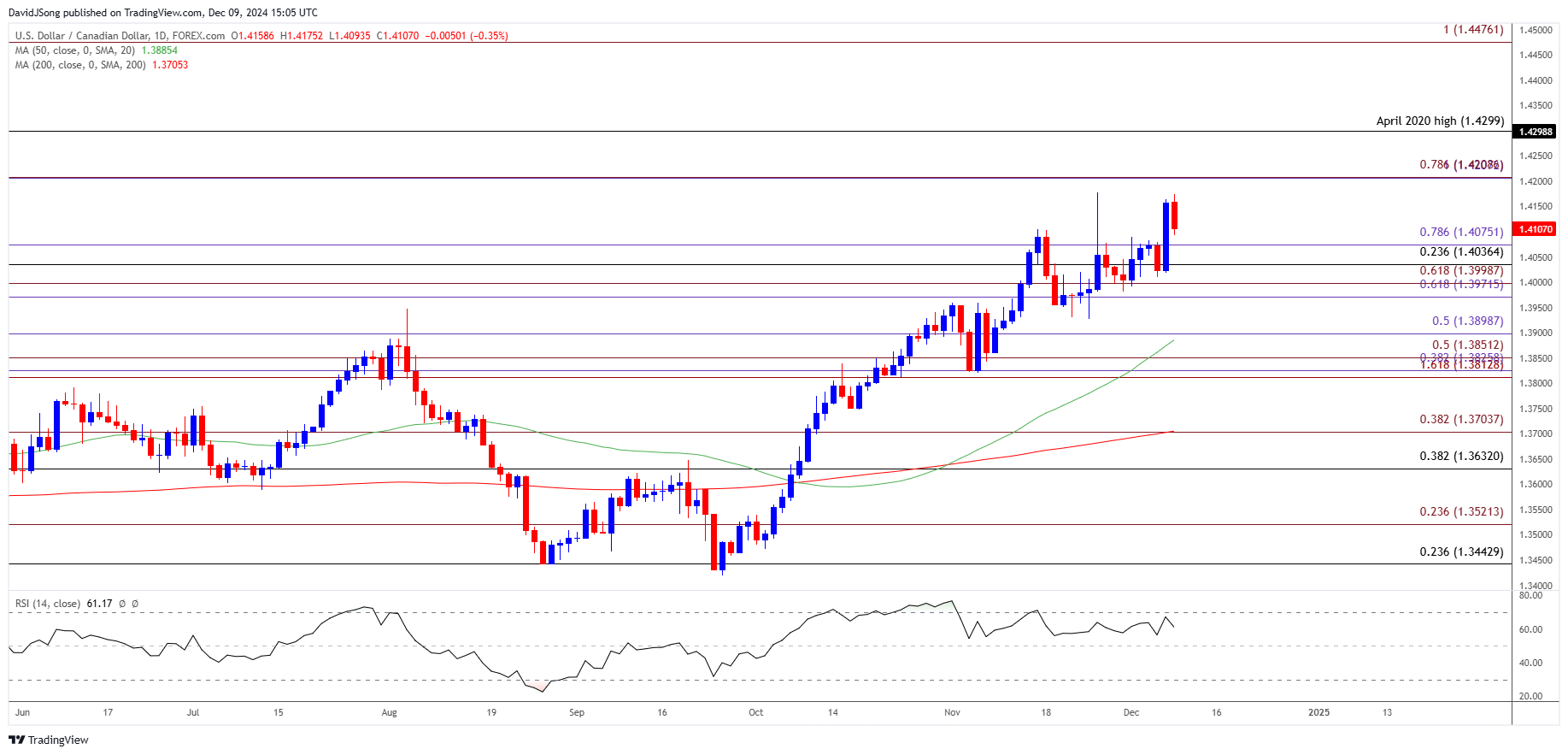

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may face range bound conditions as it pulls back ahead of the November high (1.4178), with a move below the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) area raising the scope for a move towards the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) zone.

- A break/close below 1.3900 (50% Fibonacci extension) brings the November low (1.3821) on the radar, but USD/CAD may track the positive slope in the 50-Day SMA (1.3886) should it defend the December low (1.4090).

- A breach above the November high (1.4178) brings 1.4210 (78.6% Fibonacci extension) back on the radar, with the next area of interest coming in around the April 2020 high (1.4299).

Additional Market Outlooks

GBP/USD Remains Susceptible to Bear Flag Formation

Australian Dollar Forecast: AUD/USD Eyes Yearly Low Ahead of RBA

Gold Price Outlook Mired by Flattening Slope in 50-Day SMA

EUR/USD Struggles to Trade Back Above Former Support Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong