USD/CAD Outlook

USD/CAD struggles to retain the advance from the monthly low (1.3555) following the failed attempt to test the 2022 high (1.3978), but the update to Canada’s Consumer Price Index (CPI) may prop up the exchange rate as the report is anticipated to show a further slowdown in inflation.

USD/CAD faces Canada CPI ahead of Fed rate decision

USD/CAD tests last week’s low (1.3652) as the US Dollar weakens against most of its major counterparts, and the Federal Reserve interest rate decision on March 22 may influence the near-term outlook for the exchange rate as the central bank comes under pressure to conclude its hiking-cycle.

Join David Song for the next Live Economic Coverage webinar to cover the Federal Reserve rate decision on Wednesday, March 22. Register Here

Until then, data prints coming out of Canada may sway USD/CAD as the headline reading for inflation is expected to narrow for the fourth consecutive month, with the core CPI expected to print at 4.6% per annum in February which would mark the lowest reading since April 2022.

Evidence of easing price pressures may generate a bearish reaction in the Canadian Dollar as it encourages the Bank of Canada (BoC) to retain a wait-and-see approach for monetary policy, and Governor Tiff Macklem and Co. may stick to the sidelines at the next meeting on April 12 as ‘the latest data remains in line with the Bank’s expectation that CPI inflation will come down to around 3% in the middle of this year.’

With that said, another downtick in Canada’s CPI may keep USD/CAD above the monthly low (1.3555) ahead of the Fed rate decision, but the failed attempt to test the 2022 high (1.3978) may lead to a near-term correction in the exchange rate as the Relative Strength Index (RSI) continues to fall back from overbought territory.

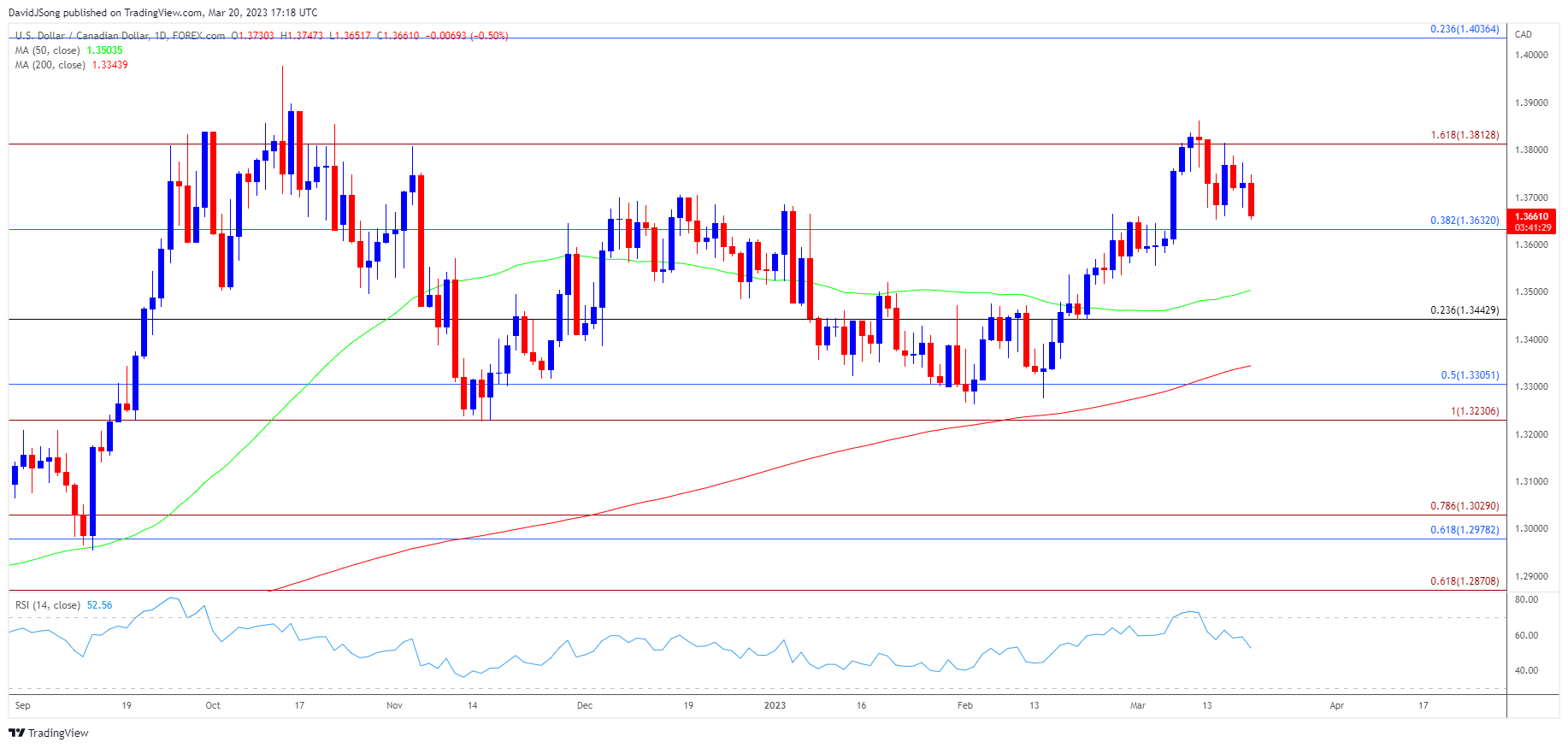

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be reversing course following the failed attempt to test the 2022 high (1.3978), with the Relative Strength Index (RSI) registering a textbook sell signal last week as it moved below 70.

- Failure to hold above 1.3630 (38.2% Fibonacci retracement) may push USD/CAD towards the monthly low (1.3555), with a move below the 50-Day SMA (1.3504) opening up the 1.3440 (23.6% Fibonacci retracement).

- However, USD/CAD may face range bound conditions after testing last week’s low (1.3652), with a move above the 1.3810 (161.8% Fibonacci extension) region raising the scope for a run at the monthly high (1.3862).

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong