USD/CAD rises after Trump’s tariff threat

- Trump threatened 25% tariffs on Canada and Mexico and 10% on China

- FOMC minutes are due later

- USD/CAD rises to 1.4178, a 4-year high

USD/CAD has risen to its highest level almost four years after President-elect Trump's pledge to impose 10% tariffs on Chinese goods and 25% on goods from Canada and Mexico (despite the free trade deal). The tariffs would be in retaliation to illegal immigrants and drug trafficking.

With 75% of Canadian exports heading to the US, a tariff rise could disrupt businesses and hurt the economy.

Meanwhile, a commodity-linked currency is also under pressure as oil prices fall on news of a possible ceasefire between Israel and Hezbollah. Such an agreement will reduce the risk of supply being impacted and lower the geopolitical risk premium on oil prices.

Meanwhile, the US dollar is driving higher against its major peers following Trump's announcement. The dollar is rebounding from losses yesterday when Trump nominated Scott Bessent as Treasury Secretary.

Bessent was seen as a measured choice who would be more likely to take a gradual approach to tariffs. However, Trump wanted to show the market he was in control, with the tariff announcement just a day later. Timing is everything.

Attention now turns to the Fed minutes from the November meeting. At the meeting, the Fed cut rates by 25 basis points, its second straight rate cut, and the statement pointed to policymakers being confident that inflation was cooling to a 2% target.

Since then, stronger than expected US data, more hawkish commentary from Fed speakers, and Trump's election has seen the market lower rate cut expectations.

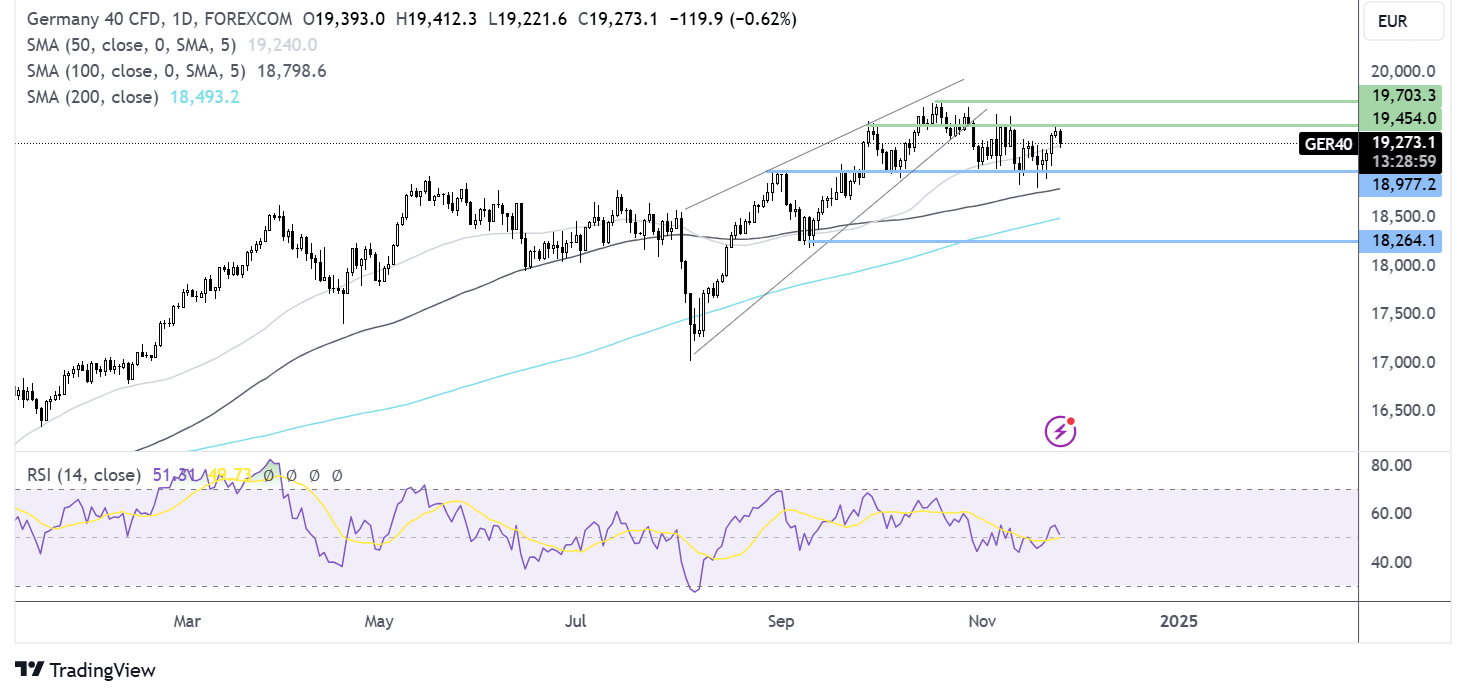

USD/CAD forecast – technical analysis

USD/CAD trades within a rising channel dating back to late September. The price recently recovered from the 1.3950 lower band of the channel and the August high jumping higher to a peak of 1.4178, a level last seen in 2020.

The bullish engulfing candle and the RSI over 50 keep buyers hopeful of further gains. Buyers will need to take out 1.4178 to extend gains towards 1.42 and fresh multi-year highs.

Support can be seen at 1.41 round number and 1.4050, the lower band of the rising channel. A break below 1.3950 is needed to create a lower low.

DAX falls on trade worries

- Trump pledges tariffs raising worries over global trade

- Automakers are the hardest hit on the DAX

- DAX trades within a holding pattern capped by 19.5k and limited by 19k

The DAX, along with its European peers, is falling on Tuesday in response to Donald Trump doubling down on his threats to raise tariffs.

President-elect Donald Trump pledged a 10% increase in tariffs on China and 25% on Canada and Mexico, further raising concerns over the impact of a second Trump administration on global trade, particularly in Europe. Automakers on the DAX are the sector hardest hit, with Daimler Trucks down 5% and VW down 3%.

China is a key trade partner for Germany, so any tariffs causing an economic slowdown in China could impact trade with Germany. Furthermore, fears of direct tariffs on Europe are also hitting risk appetite.

Today’s developments come after markets yesterday got a boost from the nomination of Scott Bessent as U.S. Treasury secretary, who is considered a more moderate choice on the tariffs front. However, that enthusiasm has quickly faded.

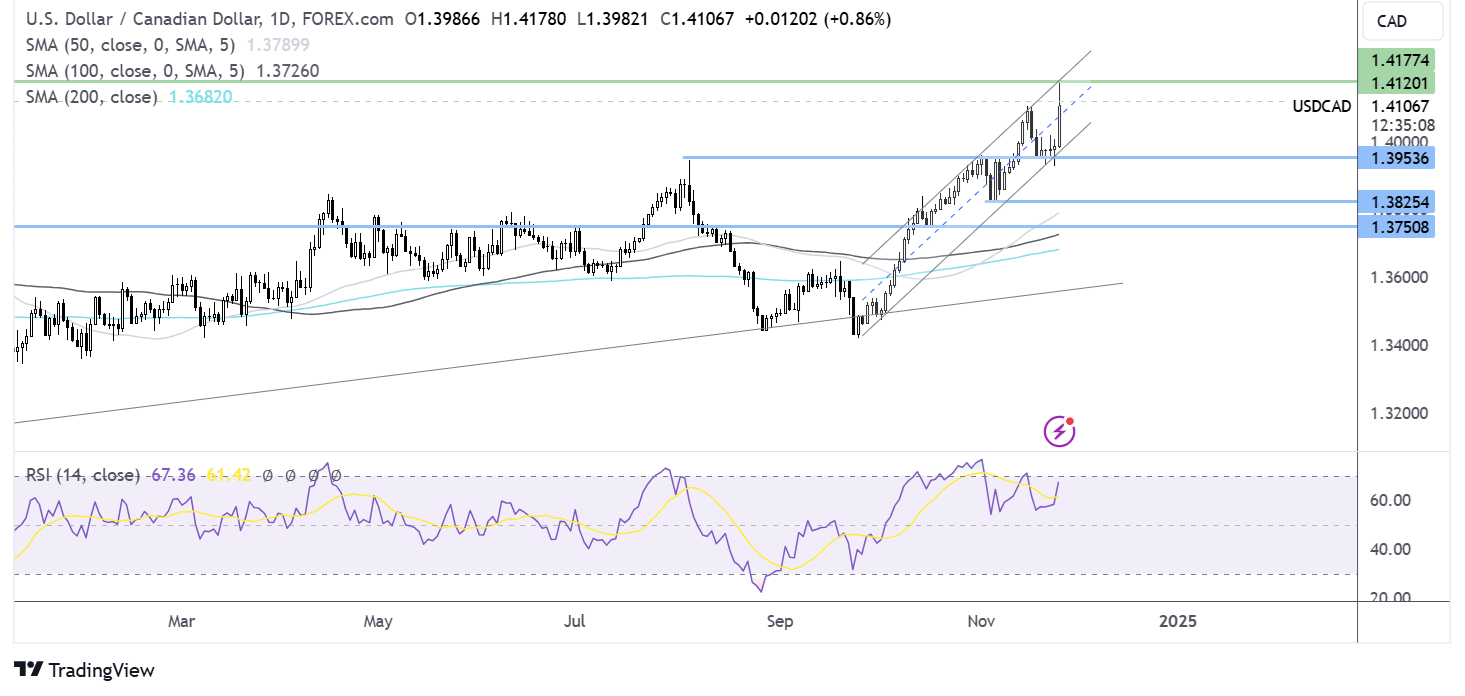

DAX forecast – technical analysis

The DAX continues to trade in a holding pattern, capped on the upside by 19500 and 19000 on the lower side. The RSI remains near neutral, giving away few clues. This setup lends itself to a breakout trade.

Buyers will look to rise above 19500 to extend towards 19680 and fresh all-time highs.

Sellers will look to take out 19k support to expose the 100 SMA at 18,800, and below here, the 200 SMA at 18,500 comes into play.