USD/CAD Outlook

USD/CAD appears to have reversed ahead of the February low (1.3263) as it snaps the series of lower highs and lows from last week, and the exchange rate may continue to retrace the decline from the monthly high (1.3554) as it trades back above the 200-Day SMA (1.3407).

USD/CAD climbs above 200-Day SMA to approach monthly high

USD/CAD trades to a fresh weekly high (1.3454) after showing a limited reaction to the downtick in Canada’s Consumer Price Index (CPI), and the exchange rate may broadly track the positive slope in the long-term moving average as Bank of Canada (BoC) Governor Tiff Macklem expects ‘Canadian GDP growth to be weak for the rest of this year before beginning to pick up gradually in 2024 and through 2025.’

It seems as though the BoC will retain a wait-and-see approach as Governor Macklem reiterates that ‘we view the risks around our inflation forecast to be roughly balanced’ while speaking in front of the House of Commons Standing Committee on Finance, and the comments suggest the central bank is in no rush to reestablish its hiking-cycle as Governing Council official ‘are encouraged with the progress so far.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

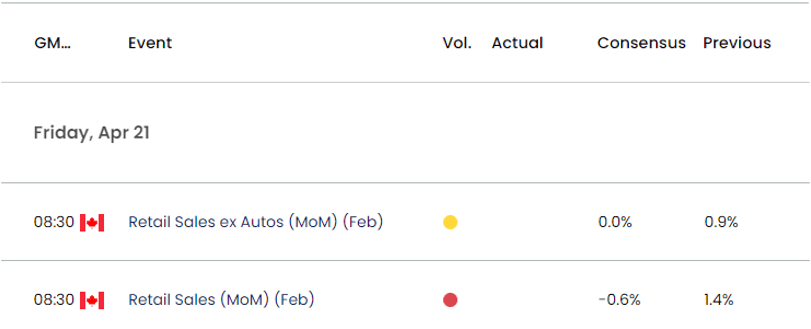

In turn, the update to Canada’s Retail Sales report may keep the BoC on the sidelines as household spending is projected to fall 0.6% in February, and signs of a slowing economy may produce headwinds for the Canadian Dollar as it encourages the BoC to keep the policy interest rate at 4.50% at the next meeting on June 7.

Until then, the diverging paths between the BoC and Federal Reserve may keep USD/CAD afloat as Chairman Jerome Powell and Co. appear to be on track to deliver another 25bp rate hike in May, and the exchange rate may broadly track the positive slope in the 200-Day SMA (1.3407) as it appears to be reversing course ahead of the February low (1.3263).

With that said, a decline in Canada Retail Sales may generate a bullish reaction in USD/CAD as the BoC pauses its hiking-cycle, and the exchange rate may continue to retrace the decline from the monthly high (1.3554) as it snaps the series of lower highs and lows from last week.

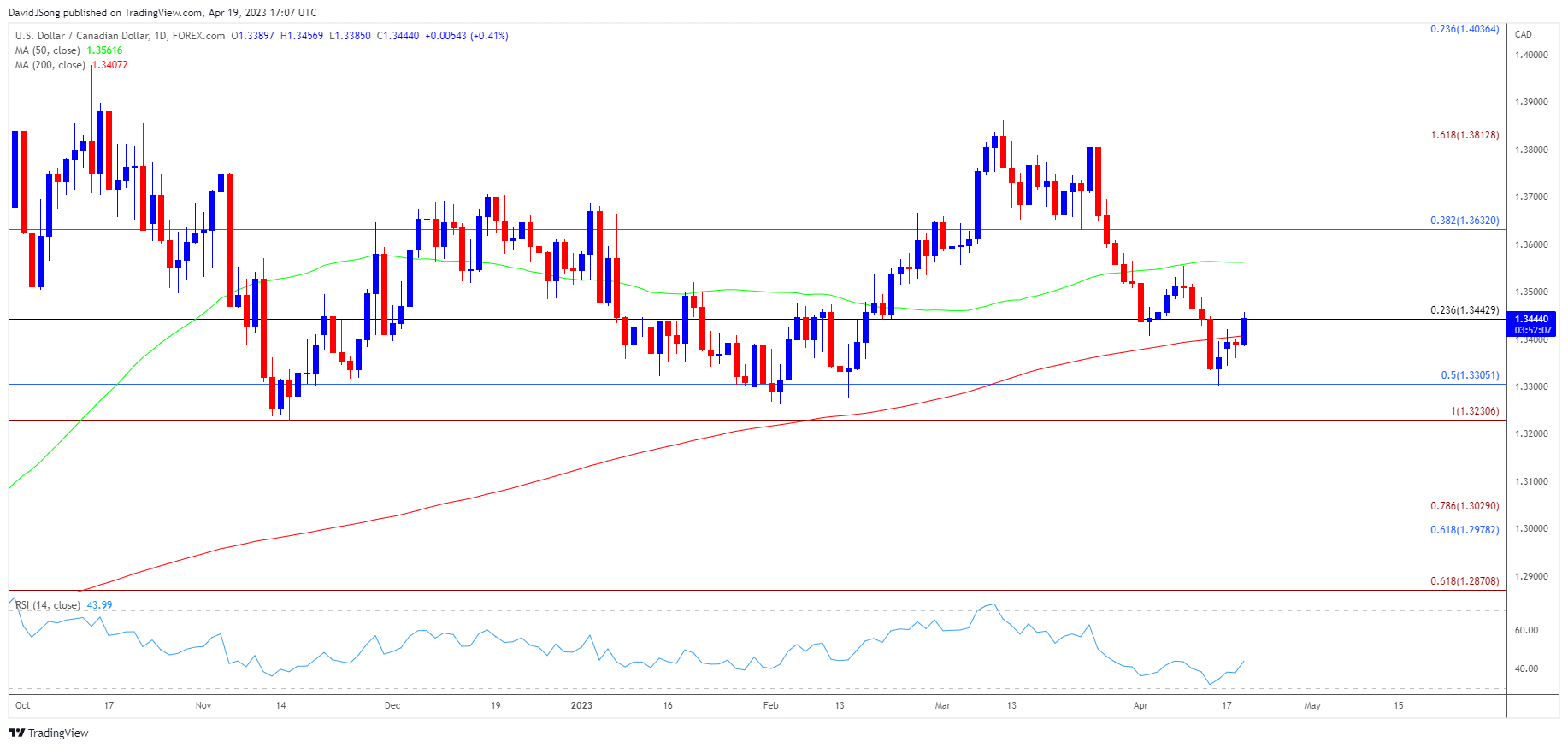

Canadian Dollar Price Chart – USD/CAD Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD trades back above the 200-Day SMA (13407) as it reverses ahead of the February low (1.3263), and the exchange rate may extend the rebound from the monthly low (1.3301) as it appears to be responding to the positive slope in the long-term moving average.

- Need a close above 1.3440 (23.6% Fibonacci retracement) to raise the scope for a move towards the monthly high (1.3554), with a move above the 50-Day SMA (1.3562) opening up the 1.3630 (38.2% Fibonacci retracement) region.

- Next area of interest comes in around 1.3810 (161.8% Fibonacci extension), but failure to close above 1.3440 (23.6% Fibonacci retracement) may push USD/CAD back towards the 200-Day SMA (13407), with a move below the monthly low (1.3301) bringing the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) region back on the radar.

Additional Resources:

EUR/USD struggles to test yearly high ahead of NFP report

Gold price forecast: RSI flirts with overbought territory

--- Written by David Song, Strategist