Asian Indices:

- Australia's ASX 200 index fell by -42.5 points (-0.57%) and currently trades at 7,350.60

- Japan's Nikkei 225 index has fallen by -10.15 points (-0.03%) and currently trades at 35,467.60

- Hong Kong's Hang Seng index has risen by 97.44 points (0.64%) and currently trades at 15,374.34

- China's A50 Index has fallen by -55.46 points (-0.51%) and currently trades at 10,790.05

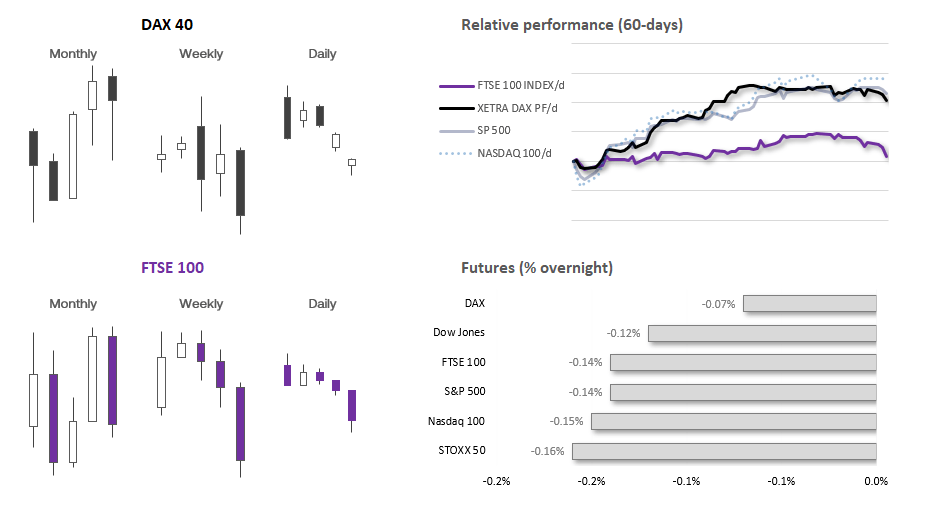

UK and European indices:

- UK's FTSE 100 futures are currently down -9.5 points (-0.13%), the cash market is currently estimated to open at 7,436.79

- Euro STOXX 50 futures are currently down -7 points (-0.16%), the cash market is currently estimated to open at 4,396.08

- Germany's DAX futures are currently down -11 points (-0.07%), the cash market is currently estimated to open at 16,420.69

US index futures:

- DJI futures are currently down -41 points (-0.11%)

- S&P 500 futures are currently down -5.75 points (-0.12%)

- Nasdaq 100 futures are currently down -22.75 points (-0.13%)

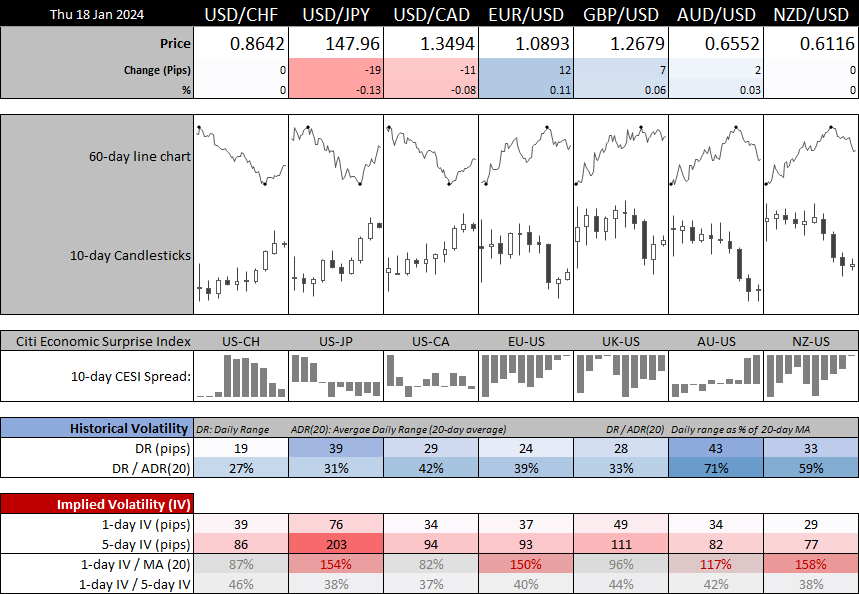

Volatility was on the low side during Thursday’s Asian session across most asset classes, with any markets trading within tight ranges around Wednesday’s highs or lows. Gold remains within the doldrums yet remains above $2000 – a likely support level without another bout of USD dollar strength. Index futures for Europe and Asia are effectively flat, as are the currency majors.

The selloff for APAC equity markets also lost steam on Thursday. And as bearish as the Hang Seng is, it is trying to find support around 15,300 after an extended move lower. Whilst I see no immediate reason to be a buyer of China's equities, bears may want to warrant cation, especially as the index moves towards 15k and the 2022 low – which they strike me as obvious support levels to trigger a shakeout.

Australia’s employment change fell by -65.1k in December, its fastest pace since October 2021. Perhaps more striking is that -106.6k full-time jobs were slashed, leaving the 61.4k part-time job increase to prop the headline number up. The participation rate also fell by -0.4% percentage points – its fastest pace since September 2021, leaving the relatively low unemployment rate of 3.9% to not make the report a complete write off.

This certainly plays into those calling for rate cuts this year, yet AUD held up relatively well. But then the Australian dollar had suffered its worst 3-day run since October on Wednesday and found support at the December low and September high ahead of the report. So there's clearly some technical support around 0.6520 which bears are hesitant to short above. Yet the jobs report doesn't provide any meaningful reason to be long AUD, especially now it sits beneath its 200-day average. And that means it's next directional move remains in the hands of Fed expectations and therefore the US dollar.

Events in focus (GMT):

- 12:30 – Fed Bostic speaks

- 13:00 – US trade balance

- 13:30 – US housing starts, building permits, jobless claims, Philly Fed

- 15:15 – ECB President Lagarde speaks

- 16:30 – Fed Bostic speaks

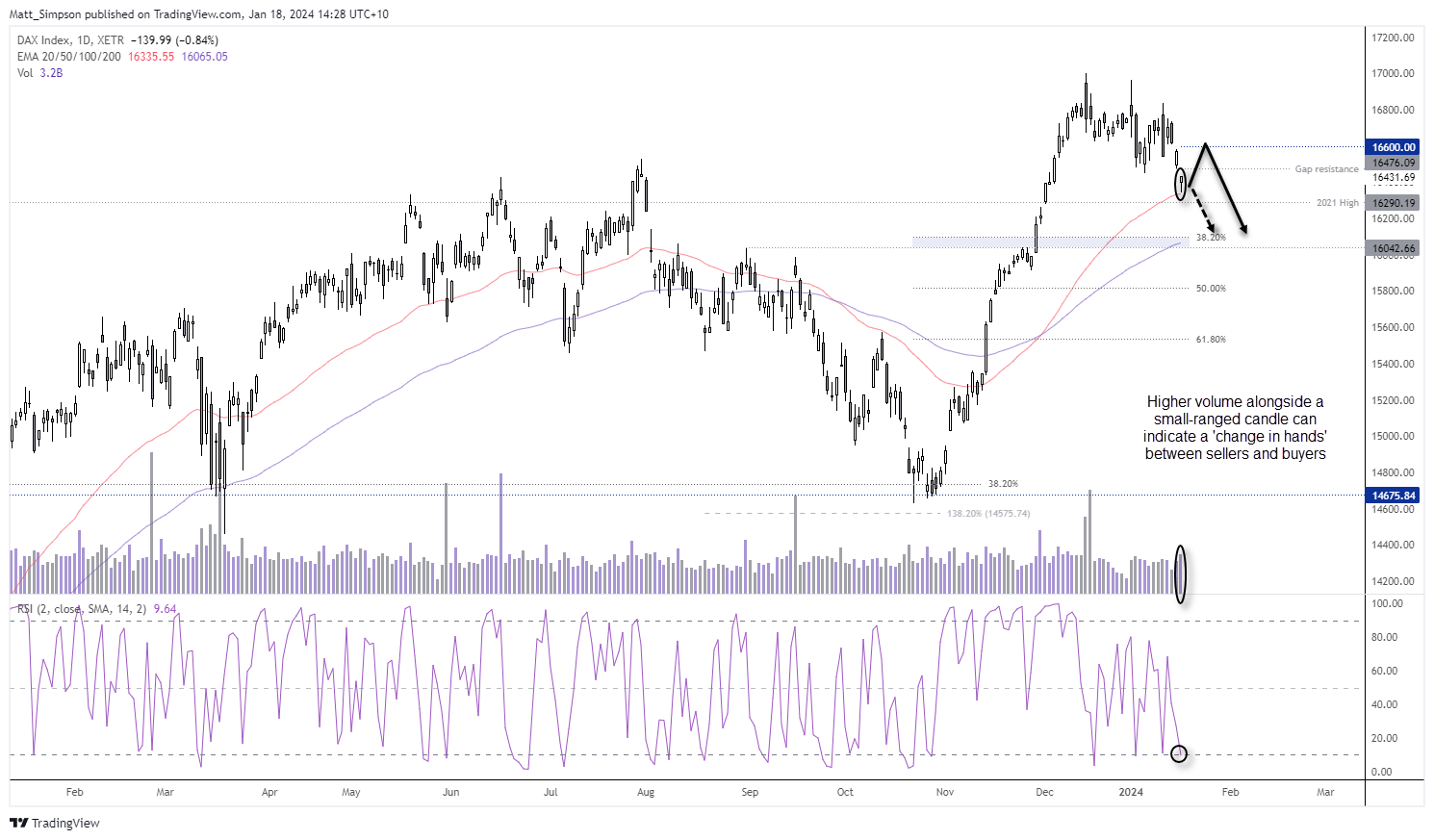

DAX technical analysis (daily chart):

European indices have pulled back from their stubborn highs, and there may be further downside potential over the coming weeks if incoming data supports central bankers attempts to push back on imminent rate cuts. Yet we have a relatively quiet news flow today with no major economic data points scheduled, and there may be a case building for a minor bounce for risk given the extended moves already seen elsewhere.

As for the DAX, it found support at its 50-day EMA on Wednesday with a lower wick that forms a bullish hammer candle. And as its range was relatively small alongside higher volume, it could mean a ‘change in hands’ between bears to bulls. And as we’ve seen downside volatility subside in Asia and index futures across Europe and US hold their ground overnight, I suspect we’re at or close to a bounce.

Bulls could seek retracements within yesterday’s range with a stop beneath the 2021 high, with an initial target around the upper gap near Tuesday’s close. A break above here assumes a broader relief rally could be under way and bring 16,600 into focus for bulls.

Should prices break lower, the 100-day EMA and 38.2% Fibonacci ratio come into focus, just above 16,000.

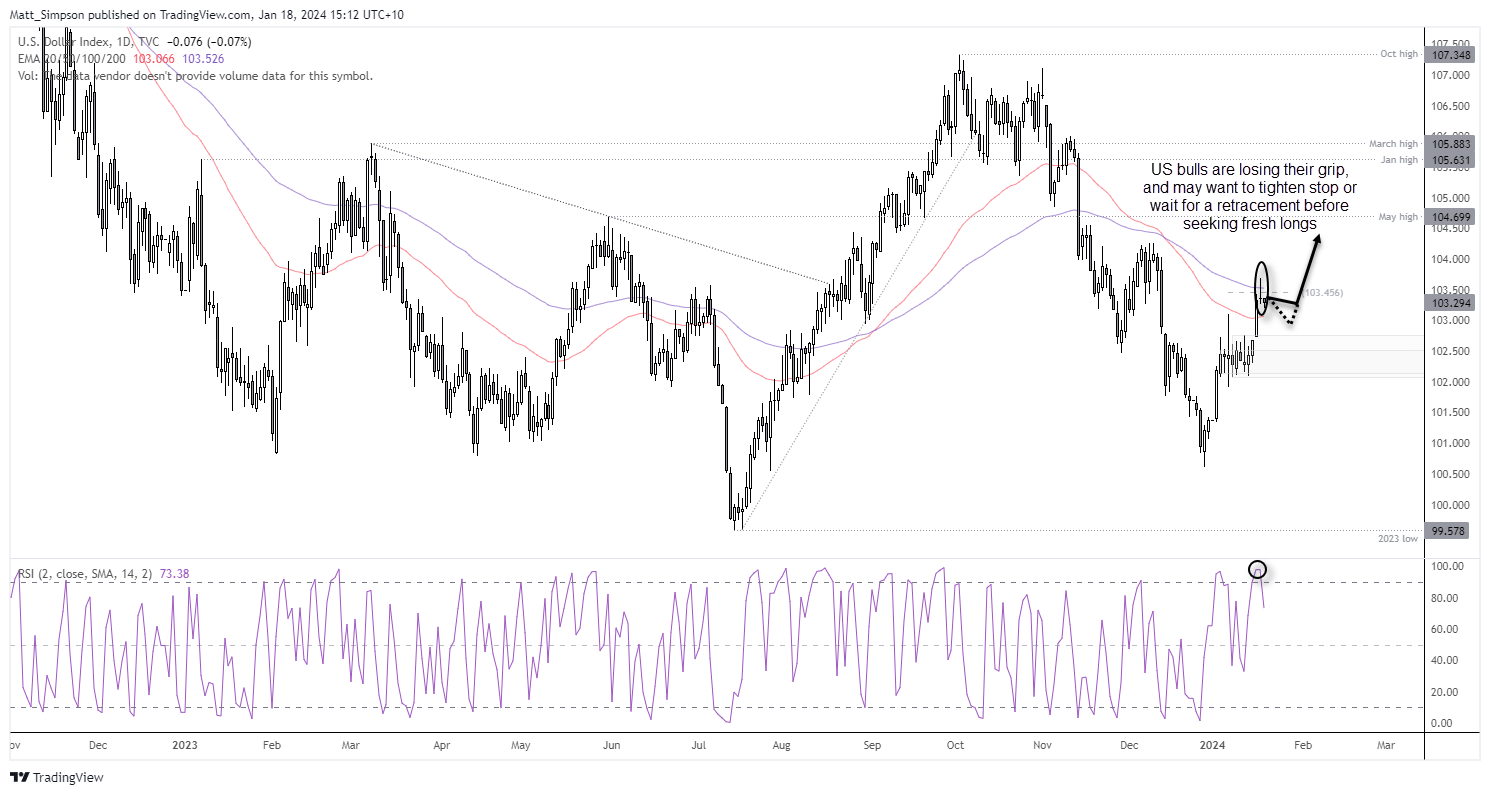

US dollar index technical analysis (daily chart)

Over the past 14 days the US dollar index has rallied 3%. Yet we’re seeing early signs that dollar strength is pausing for breath on the dollar index and other FX majors. A bearish pinbar formed on Wednesday which closed back beneath the 100-day EMA and 61.8% Fibonacci projection. Does this mean it is a top? Not necessarily, but it shows that bulls are losing their grip. And USD bulls may want to tighten stops, or step aside and wait for a retracement before seeing fresh longs.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge