US Dollar, Gold, EUR/USD, USD/JPY Talking Points:

- It was another week of strength for the US Dollar but resistance showed up on Thursday, and has so far held as we near the end of the week.

- Gold provided a rather clean pullback and defense of the 2600 level. I looked at this as the pullback began in the webinar on Tuesday, and again on Wednesday and Thursday. The move on Thursday was especially strong after a higher-low printed at the 2616.96 spot as bulls then pushed forward for a test of resistance in a bull flag formation.

- Below I look at USD from a few different perspectives which is key considering that DXY is merely a composite of underlying currencies, with a 57.6% allocation towards the Euro.

- I follow these setups in the weekly webinar each Tuesday. Click here for registration information.

As a rule, I try not to question trends. This doesn’t mean that I’ll never look at counter-trend setups but, by and large, I try to respect a market’s price action in effort of staying in the flow of overriding biases and trends.

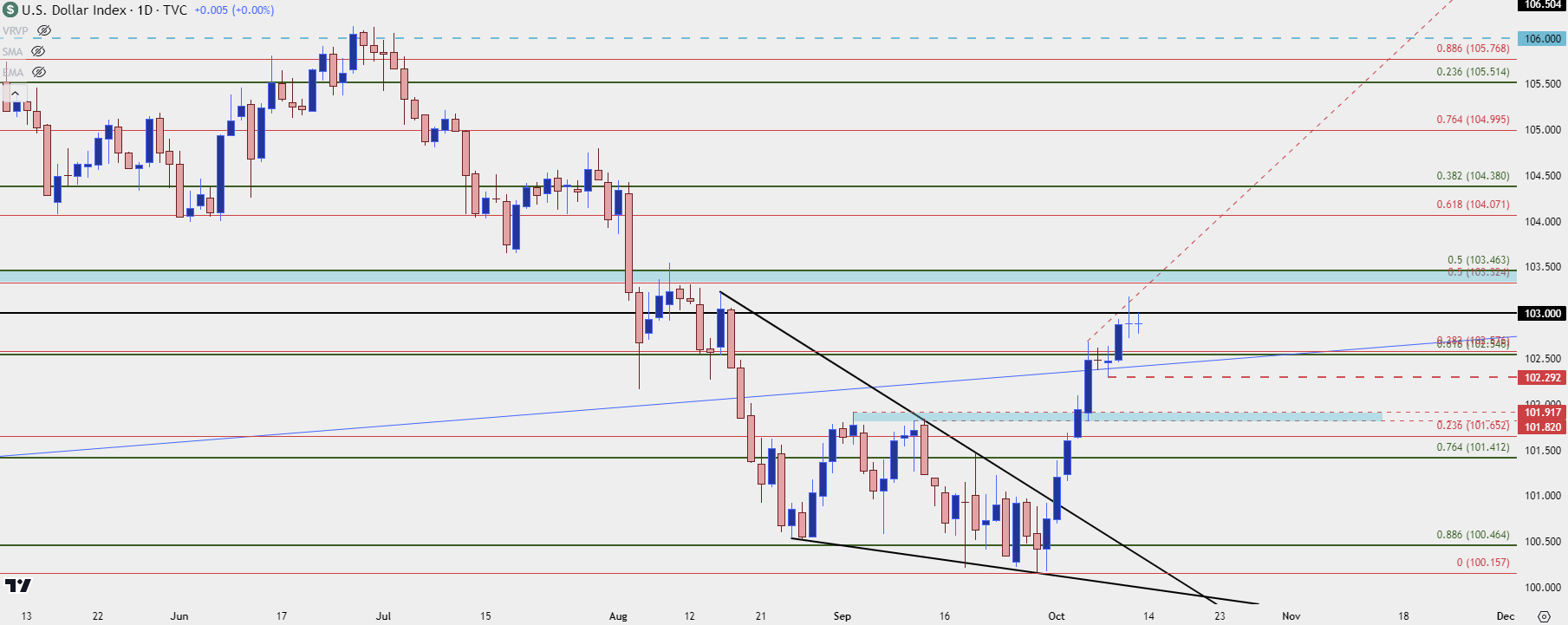

There are situations, however, that could denote a building counter-trend backdrop, such as I tracked in the US Dollar for pretty much the entire second-half of Q3. While sellers were still pushing after the oversold reading on the weekly chart, that impact was lessening, and this was highlighted by both the build of a falling wedge and a case of RSI divergence on the daily chart.

It certainly wasn’t automatic but as the door opened to Q4 the USD reversed that prior bearish trend and this highlights the value of deduction; taken from the fact that sellers had ample motive to push bearish trends at fresh lows for the month before yet continually failed to do so. The Fed cut by 50 bps, sellers pushed a fresh low – and then price hurriedly reversed. In the week that followed that low remained defended and the week after that finally yielded another fresh low yet, again, sellers failed to run with it. That final failed breakout led to another bounce and buyers then made a statement the week after with a strong bullish breakout.

That bullish theme has run again through the past week but, at this point, there’s growing potential for a pullback. There’s been a building case of RSI divergence on the four-hour chart and in the DXY’s largest component of the Euro, there’s been a build of a falling wedge along with RSI divergence.

At this point, I wouldn’t look for a full-fledged reversal of the USD move but rather a pullback. Whether buyers defend higher-low support in DXY or lower-high resistance in EUR/USD, it will be telling as to how future strategy should be approached.

From the daily chart in DXY below, we can see a well-defined area of prior resistance at the 102.55 zone that I had looked at last Friday. That held the highs through the first couple days of this week, until bulls pushed up to the 103.00 handle. And while that looked as though it was going to give way on Thursday, it was unable to hold a daily close above, similarly showing an element of resistance that highlights that some profit taking may be near.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

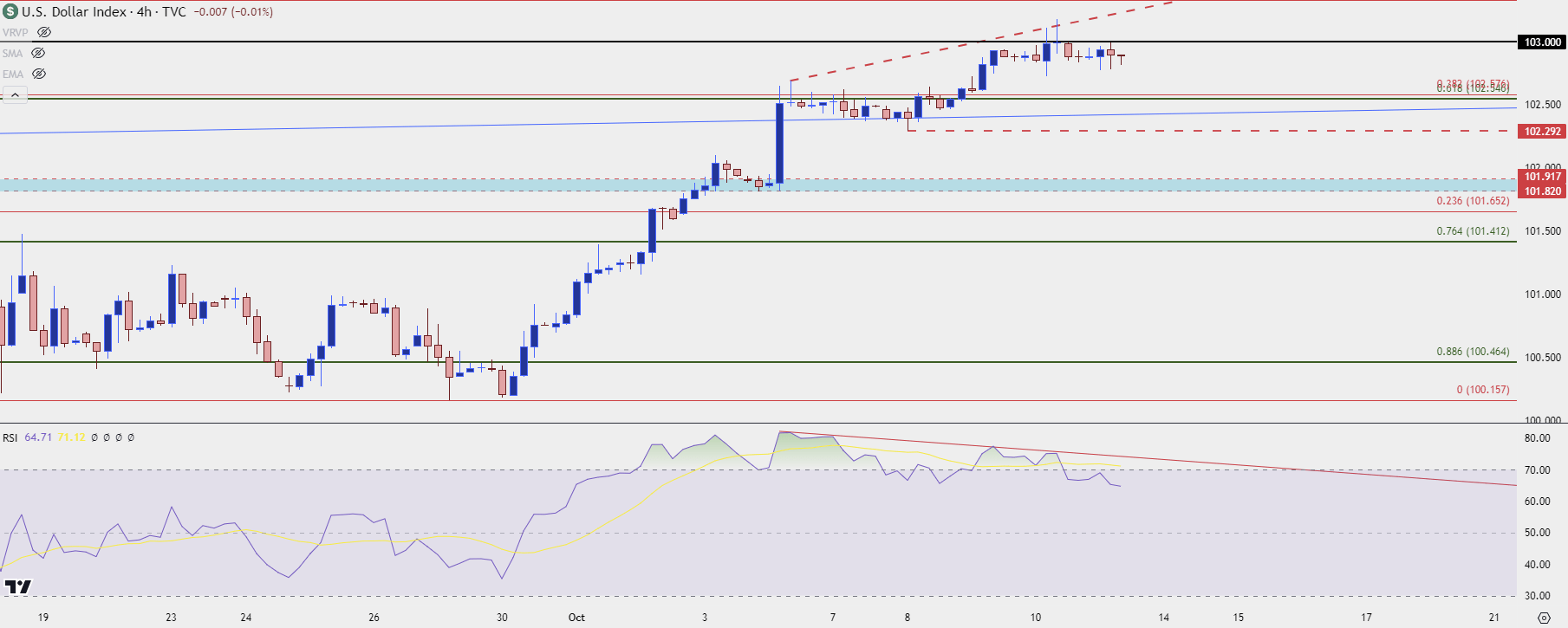

US Dollar Four-Hour RSI Divergence

I don’t look at RSI as an automatic strategy component but the context is important, such as we saw through the second-half of Q3. Below, we can see a building case of RSI divergence on the four-hour chart which points to bearish potential. There’s also highlight on support potential at that prior resistance of 102.55, with 102.29, the swing low for this week just below that. And then the 101.82-101.92 area remains of interest with Fibonacci levels at 101.65 and 101.41 below that.

For resistance, 103 seems rather obvious at this point but, overhead, there’s a zone of Fibonacci levels from 103.32-103.46.

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

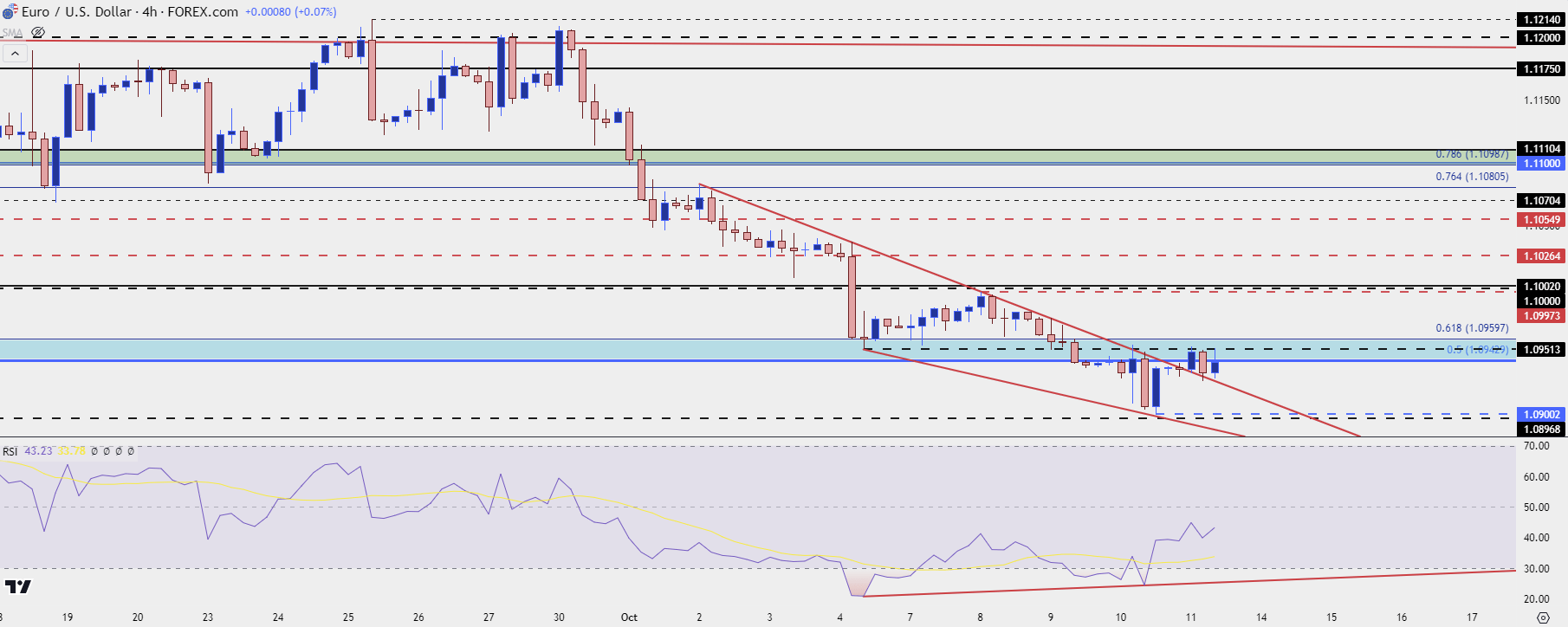

EUR/USD

EUR/USD spent the latter-portion of Q3 struggling at the 1.1200 handle. A dip developed in September and buyers defended the 1.1000 level quite well ahead of the ECB rate decision, with a swing low printing just two pips above the big figure. After that, a rate cut rally developed in the pair with EUR/USD moving right back to 1.1200 at which point the struggle ensued.

Interestingly, the peak high for the pair printed right around a long-term Fibonacci level, which I talked about at the time. There was even another attempt from bulls at last week’s open to prod a 1.1200 break but that time, not only did it fail but sellers started to take-over. And then as the door opened into Q4 and the USD broke out of the wedge, EUR/USD put in a vigorous downside move.

The end of last week saw a key support zone come into play at 1.0943-1.0960 and that held lows on Friday, Monday and then Tuesday; but the bounce from that showed a similar dynamic as what showed a month prior: Sellers defended the big figure of 1.1000 and the peak high for the past week printed just 2.7 pips below that price. Sellers then went for extension and that’s where the plot thickened.

At this point the 1.0900 level was defended and that’s led to the build of a falling wedge. There’s also a case of RSI divergence on the four-hour chart, which indicates that the short-side move has come on quite quickly. There’s still resistance playing at the prior support zone of 1.0943-1.0960, but there may be more pullback yet to be seen and this is something that syncs with the above scenario in the USD.

But I remain of the mind that EUR/USD is one of the more attractive major FX markets to look for a continuation of USD-strength. The big question now is a matter of timing.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

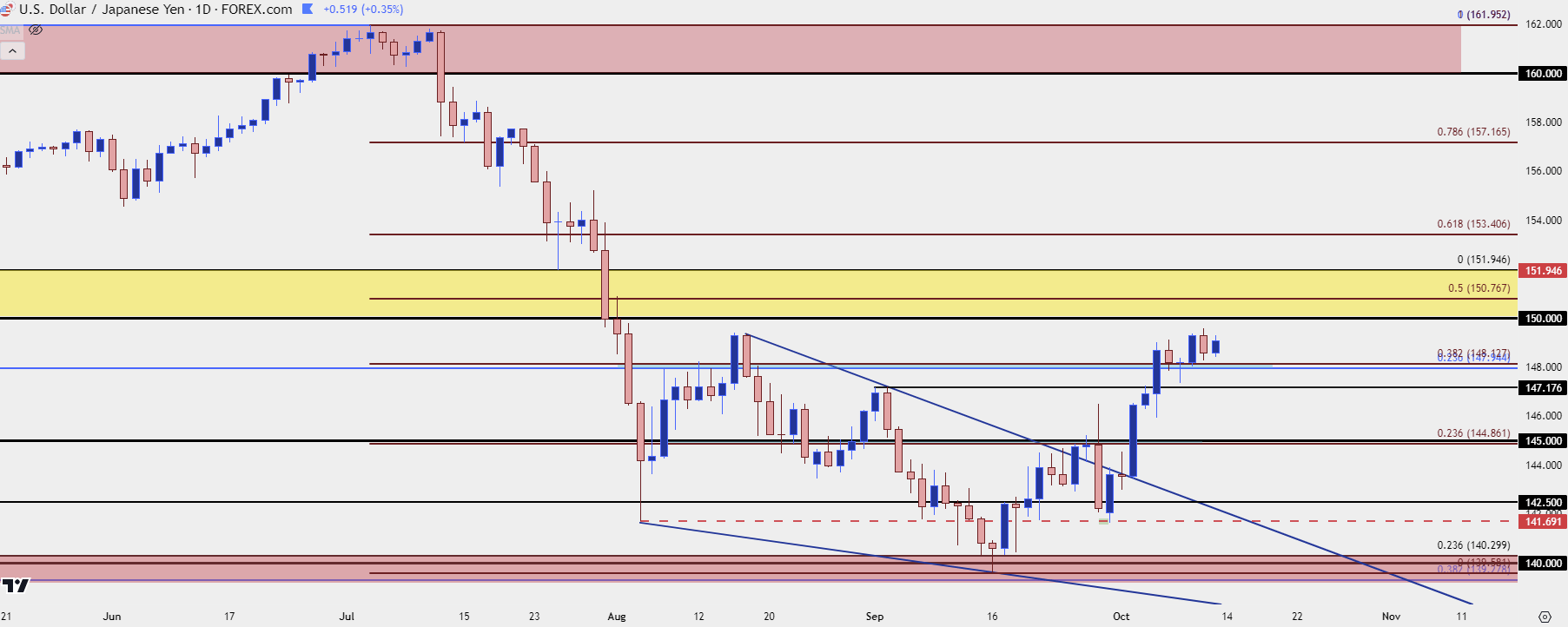

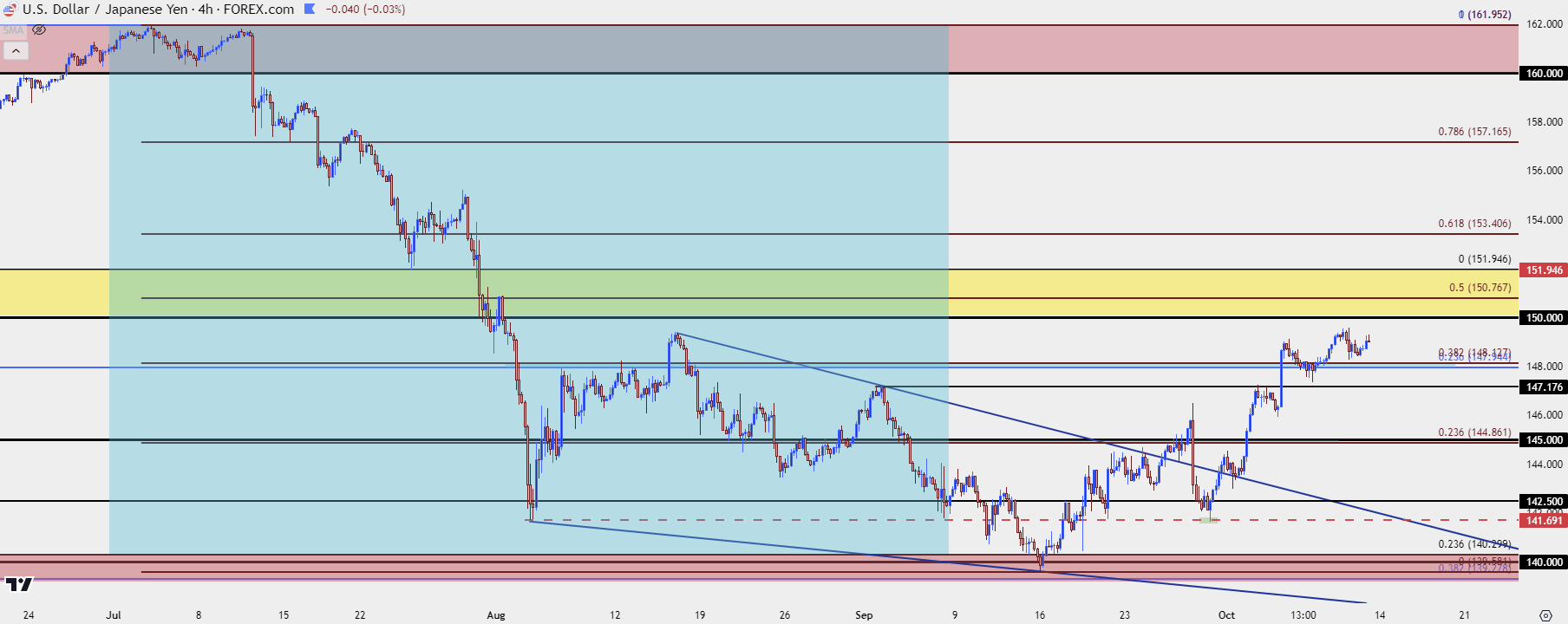

USD/JPY

I think the big push point for USD-weakness in the first two months of Q3 was coming from carry unwind and a rather aggressive selling drive in USD/JPY. As US rate cut expectations were hurriedly jumping, traders and market participants were looking to capitalize. To be sure, I think there was quite a bit of closing long positions that were initially opened for carry trades during the 2,000-plus pip plunge. But, I also think there was the build of a sizable short positioning across the market as traders tried to get in-front of what felt like inevitable rate cuts from the Fed.

But interestingly, it was around that rat the cut that the pair started to put in more bullish tones. The week of the cut opened with USD/JPY testing and failing to drive below 140.00 (there’s another one of those deductions). A higher-low printed the following day and then on Wednesday, when the Fed actually cut, another higher-low.

Prices then went on to break the topside of a falling wedge formation, but there was an aggressive snap back shortly after driven by the results of Japanese elections (more on that in a moment), and price ran down for a re-test of 141.69 before bulls could get back in order.

Since then, there’s been a strong push-higher to go along with the USD-strength at the Q4 open. As looked at yesterday, USD/JPY is fast nearing a key zone of resistance, spanning from 150-151.95, and I think there could be a major decision point in there.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

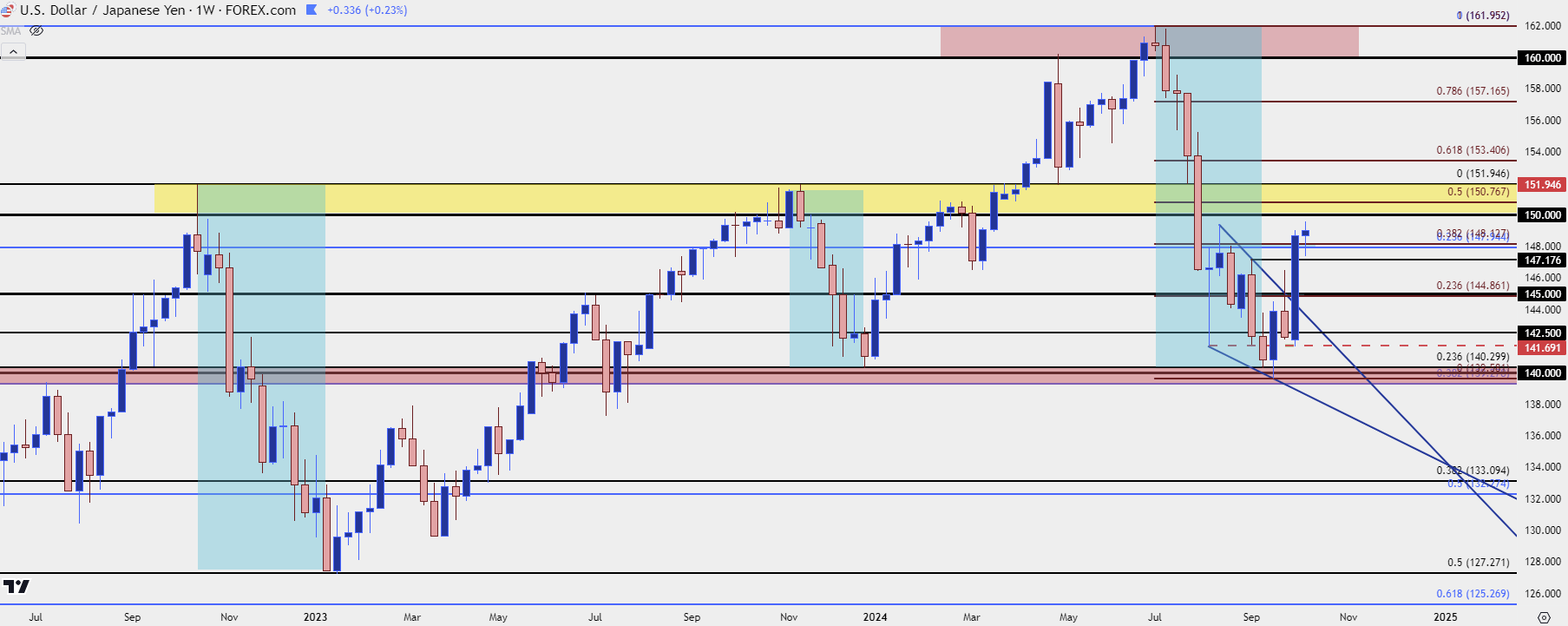

In my view the carry trade can be one of the most attractive trading backdrops available across asset classes: Traders can clip daily rollover in the direction of the high-yielder, and then as more and more traders pile in for the same the price of the asset can appreciate in a rather consistent fashion.

This is what explains the 56.4% move in USD/JPY from the 2021 lows to the 2024 highs, and this is in a major currency pair without leverage. That’s a massive move by any account but also consider the fact that there were daily rollover payments that longs could earn on the way up.

When the carry trade is in order, it can truly be a beautiful thing. But – the unwind of those situations can be brutal and nasty as a one-sided position builds in the market, and the reversion from that doesn’t even need to come with actual rate moderation to create counter-trend moves. It comes down to the ‘smelling smoke in a crowded movie theater’ analogy, at which point many don’t want to wait around for confirmation.

As a case in point, a pullback developed in Q4 of 2022 that erased 50% of the prior trend in three months, after the bullish move took 21 months to build. And then in Q4 of 2023, 23.6% of that move was retraced in just a couple months and, again, there was only the possible prospect of change. In both situations the Fed was nowhere near cuts and this is why bulls were able to return to the matter and drive the trend right back up to resistance.

In April of this year another breakout developed and, again, this was driven by US CPI, with an above-expected print driving a breakout beyond the 151.95 level. The BoJ was forced to act shortly after, defending the 160.00 level in the pair.

It was July when matters began to shift and this is when the BoJ intervened on the morning of a CPI print, leading to a fast-spiraling effect in the pair. This is also around the time that markets became convinced that US rate cuts were near, and the pair plunged in a few short weeks. There was likely some of that stampeding effect as longs ducked for cover: But I think there were also some rather opportunistic shorts that were trying to get in-front of potentially faster US rate cuts.

At this point, rollover remains positive in USD/JPY but expectations are high for the Fed to continue cutting, so that rate divergence is widely-expected to narrow more and more in the months and year ahead. In my view, the bounce that we’ve seen over the past month has been driven by short-cover as rate cuts get priced further into the future. But I’m not so sure that we’re seeing fresh carry trades opened as much as shorts covering and, in essence, getting squeezed by a counter-trend move.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY Bigger Picture

For those still holding long carry, looking at the horizon with expected FOMC rate cuts, even in the face of what’s been strong data, that could look to be an attractive place to close out of carry trades. The 50% retracement of the recent sell-off plots inside of that zone at 150.77 and, this week, as prices moved more and more near that area, buyers have started to show a bit more trepidation.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

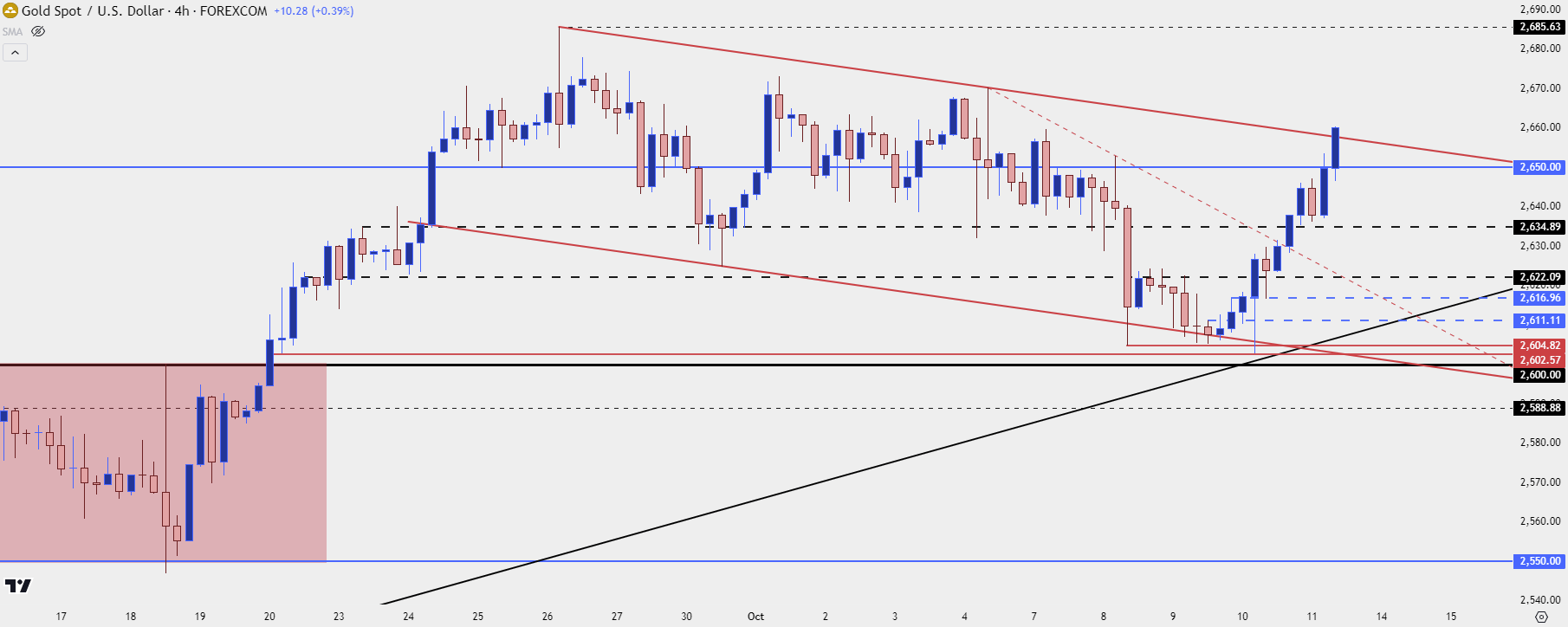

Gold

I’ve written a lot about gold this week as we finally had some element of pullback showing. That pullback started just ahead of my webinar on Tuesday and as I shared there, I was looking to see how bulls defended the 2600 level.

There was continued support grind through Wednesday and then again on Thursday, when CPI came out hot on both counts. But – buyers would not allow for a re-test of 2600, and soon higher-highs and lows started to show with near-term price action.

It was the 2616.96 level that I wrote about on Thursday that ended up holding the higher-low, leading to a push back-above 2650 and, at this point, a green weekly bar that resembles a hammer formation.

As I’ve been saying, I have little interest in bearish biases in gold even if I think a pullback may be near. But, along with that, trying to establish long exposure while near resistance or at fresh highs isn’t exactly a great way to implement strategy.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

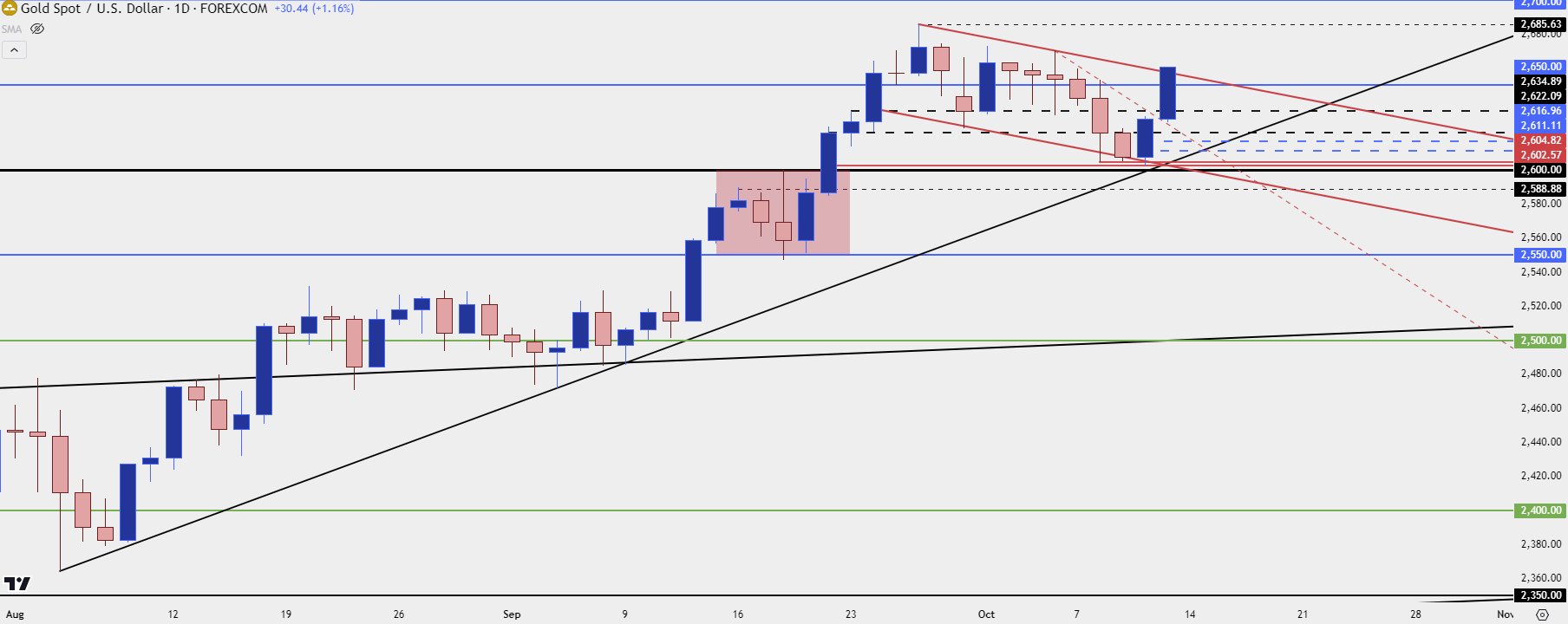

Gold Strategy

I think the reason the pullback started was bulls’ avoidance of a test at 2700. This would make that a key point of resistance potential in breakout scenarios. But for next week, the 2650 level remains key and a show of higher-low support here could be looked at for trend continuation purposes. And the 2635 level is also of interest, and even 2622 could be argued as a spot of higher-low support for shorter-term strategies.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist