- This week is undeniably a busy one with four major central bank meetings, including the heavily anticipated FOMC on Wednesday and the Bank of Japan on Thursday.

- On top of the central banks this week, major global political factors will also be front and center, including the likely triggering of Article 50 to begin the process of UK/EU separation (Brexit), Dutch elections in which the populist candidate is running a close race, and the G20 meetings towards the end of the week.

- Despite these geopolitical factors, risk assets continue to be well-supported while safe-havens like gold and the Japanese yen remain subdued for the time being.

- The US dollar has been pressured since Friday despite a better-than-expected US jobs report. Much of this pressure can be attributed to technical factors and that a March Fed rate hike, which is a near-inevitability at the current time, had likely already been priced-in to the previously rallying dollar.

- The Fed meets on Tuesday and Wednesday, and will issue its monetary policy decision followed by a press conference on Wednesday. Since a rate hike is so widely expected then, the focus has shifted to the pace of rate hikes going forward. Any hints or indications of a faster pace than the three in 2017 that were estimated by the Fed in December could lead to resumed US dollar strength.

- The Bank of Japan will announce its own policy decision on Thursday. No substantive changes to the BoJ’s generally dovish policies are expected to be made at this time. However, any indication of further alleviation in the central bank’s QE program could have a marked positive effect on the yen.

- Amid these potentially market-moving factors, USD/JPY continues to be driven mostly by Fed tightening policy and risk appetite as reflected in the still-buoyant equity markets.

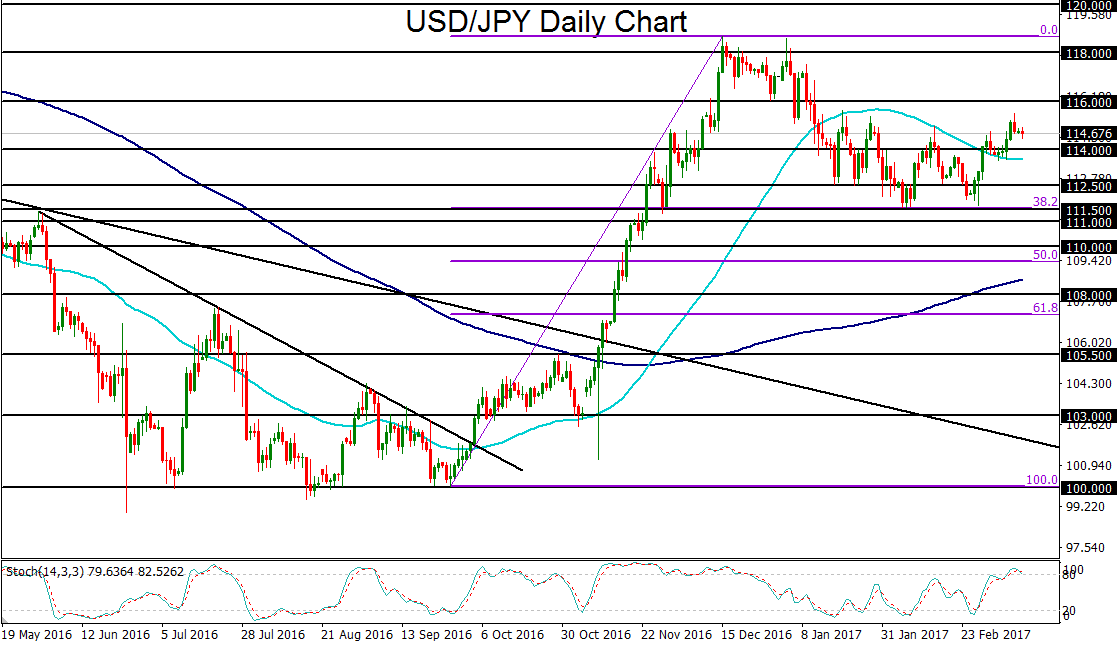

- From a technical perspective, USD/JPY has made significant strides in March after having formed a key double-bottoming pattern around 111.50 in February. This has resulted in a move above 114.00. With any indications of accelerated tightening by the Fed, coupled with a continued risk-on market environment, USD/JPY is likely to extend its rebound and begin targeting higher price objectives at the key 116.00 and 118.00 resistance levels.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM