The yen was broadly weaker on Friday after the central bank held interest rates at 0 to 0.1%. Whilst this itself did not come as a surprise, markets seemingly expected them to trim bond purchases further at this meeting. Instead, the BOJ announced they would trim bond buying “in future”, sending JBS’s spiking higher to supress yields and the Japanese yen.

- USD/JPY broke to a 6-week high

- CHF/JPY rose to a record high

- Nikkei 225 futures are up 0.7% for the day

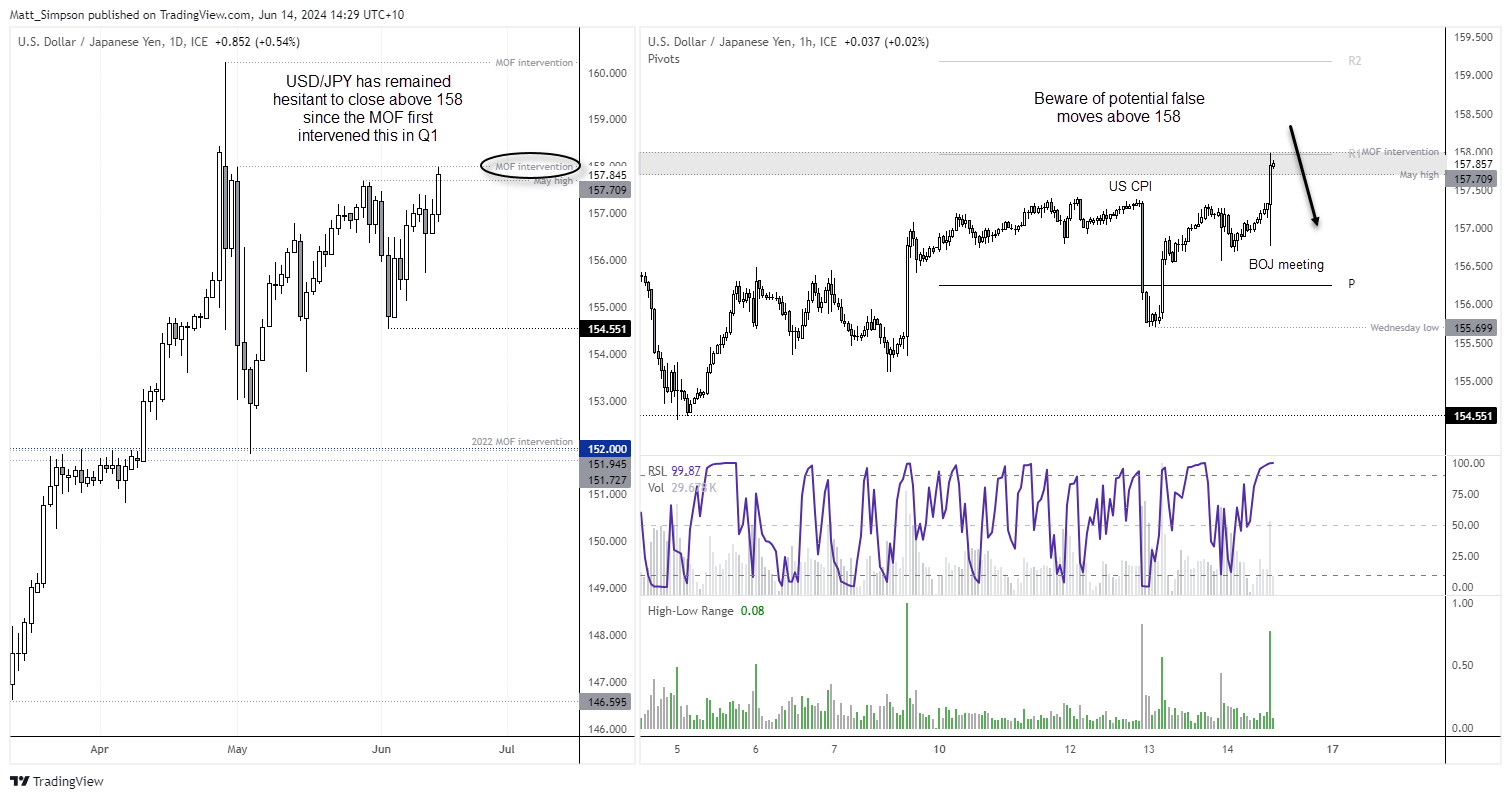

With a high-to-low span of 121 pips, USD/JPY just saw its most volatile candle since Wednesday's soft CPI print. Only this time to the upside. Prices pierced the May high with ease, yet the market is clearly keeping a close eye on the most recent 'MOF intervention' level. Remember, the MOF claims to not focus on the exchange rate level – but they do keep an eye on levels of volatility. Should the yen depreciate too quickly for their liking, they're more likely to intervene.

Traders are clearly keeping a close eye on the 158 handle after USD/JPY spiked up to it. Note that we're yet to see a daily close above 158 since late April, which landed one day before the MOF first intervened this year. Therefore, I remain skeptical that any initial move above 158 will be sustained. It's more likely we'll see some noise around this level as the market probes 158 like a kid might prod roadkill with a stick. We've likely seen the best part of the move, so this could be a better market to try and fade for a retracement lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge