- USD/JPY has been highly correlated with near-term US rate expectations over the past three months

- Market pricing for Fed rate cuts is starting to increase again

- USD/JPY reversal on Friday warns of potential near-term top

Quick USD/JPY take

The large reversal in USD/JPY on Friday following the Bank of Japan (BOJ) interest rate decision could be the start of a far larger move in the weeks and months ahead, unless you think the Federal Reserve may be forced to abandon the prospect of rate cuts this year.

Given asymmetrical risks for the US rate outlook and increasingly tepid US economic data, selling USD/JPY rallies is preferred given how poorly it has traded around these levels recently.

Fed rate cut bets influential on USD/JPY

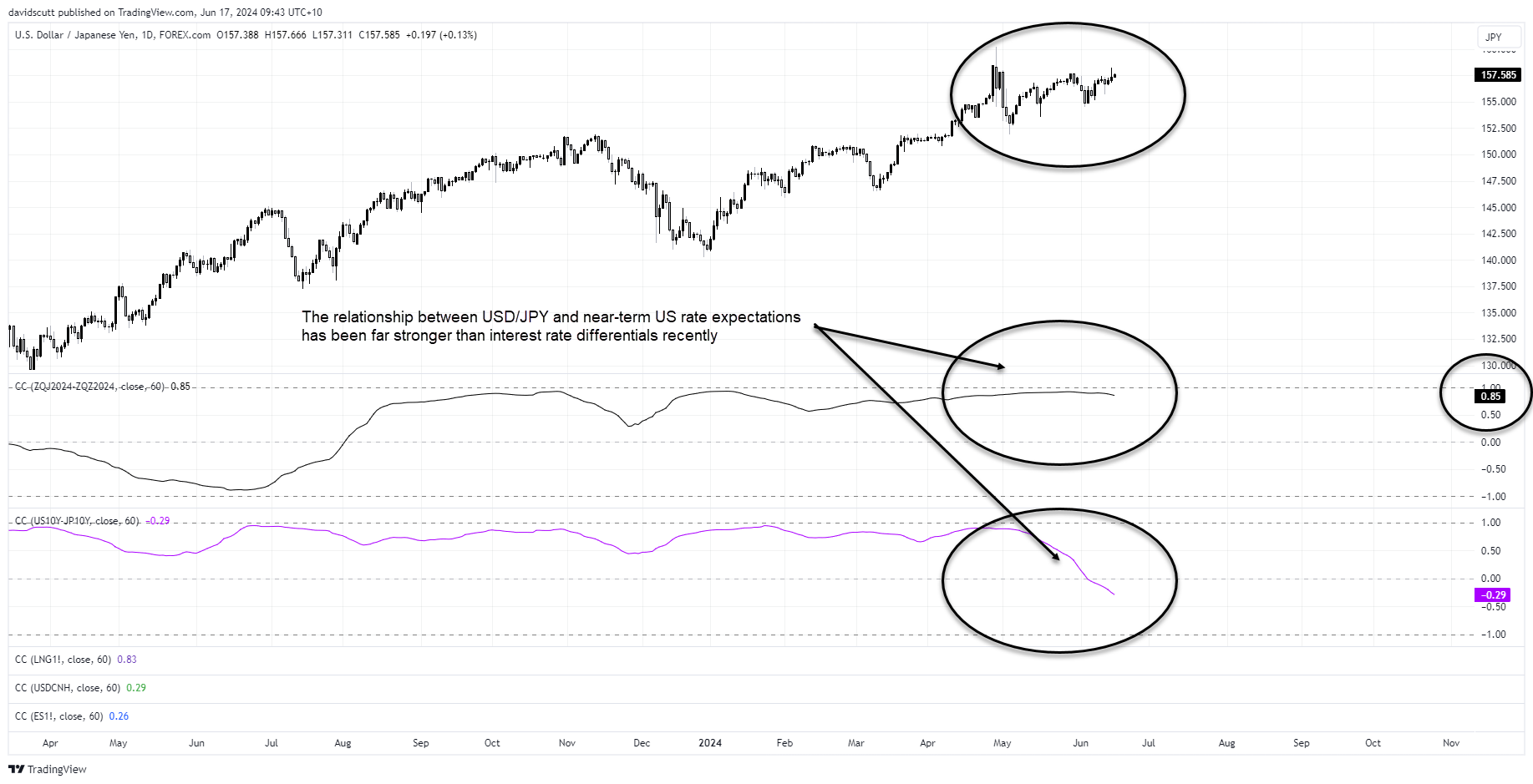

Interest rate differentials have long been a key driver of USD/JPY movements, but not over the past three months.

As shown in the chart below tracking the rolling daily correlation between USD/JPY and numerous market indicators, it’s been Fed rate expectations in 2024, proxied in this instance by the shape of the Fed funds futures curve, that has been highly influential on USD/JPY, sitting with a correlation of 0.85.

In contrast, the vice-like grip yield differentials had over the pair earlier in the year has all but been obliterated, suggesting it’s the ultra-short end of the US interest rate curve you need to be watching if you’re trading USD/JPY right now.

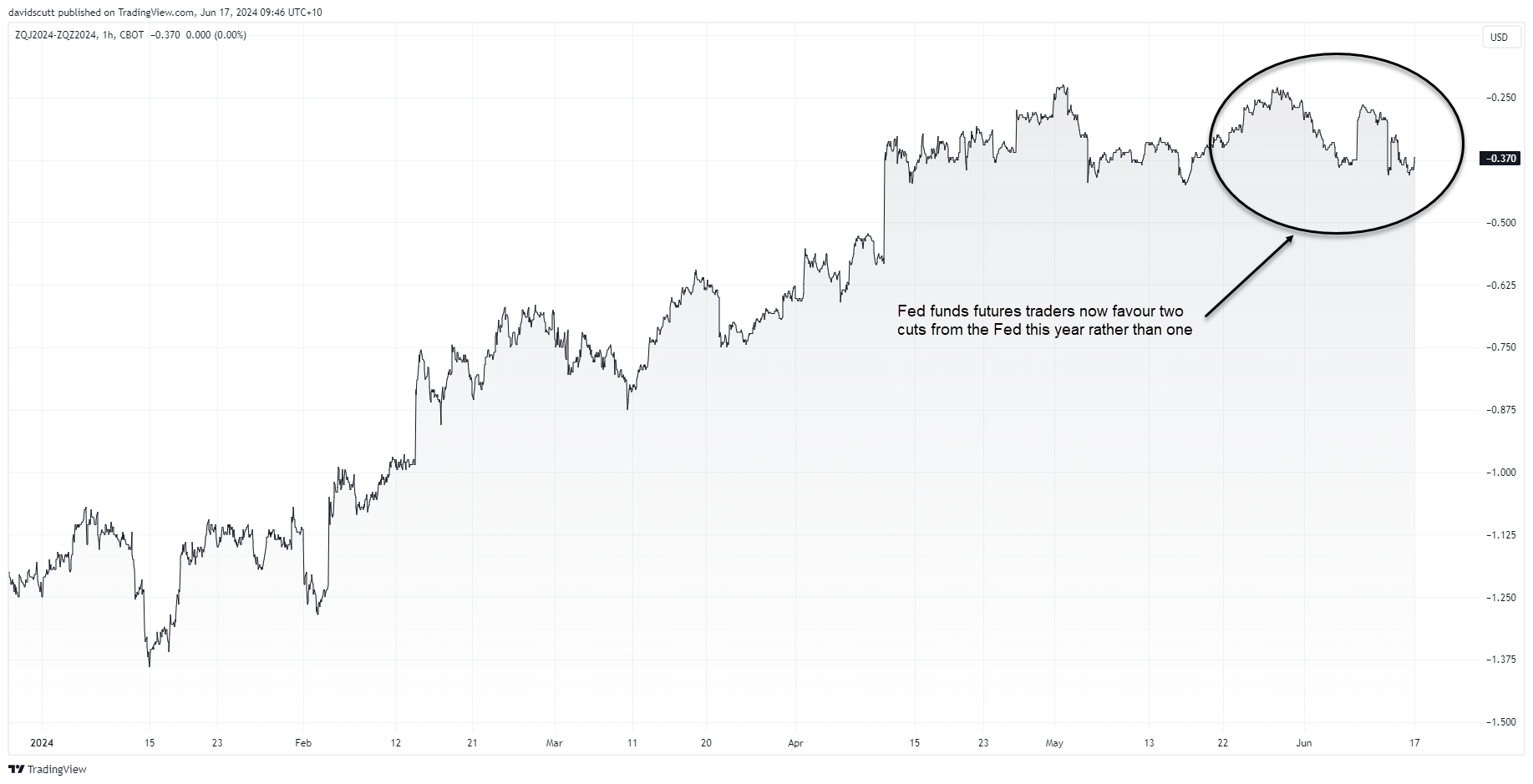

Markets favour two Fed rate cuts in 2024

While it can’t be described as definitive, it looks like the unwind of significant Fed rate cut bets earlier in the year has stalled, with traders now favouring two cuts from the Fed this year rather than one.

When you look at how spotty the US economic data has been, it’s arguable risks for the US rate outlook are asymmetric given how much easing has been stripped out as the higher for longer narrative took hold. The prospect of the Fed having to hike again looks extremely remote. In contrast, the chance of earlier cuts is building, adding to the risk the Fed may be forced to cut not only earlier but harder if activity starts to roll over.

USD/JPY reversal post BOJ noteworthy

Given it’s the USD side of the equation that dominates USD/JPY movements, it was surprising to see the initial reaction to the BOJ decision last Friday where it failed to announce a reduction in the amount of Japanese government bonds its purchases as part of its qualitative and quantitative easing (QQE) program.

Yes, there had been some speculation it may have made the announcement at this meeting. And delaying it by six weeks signals the BOJ is in no rush to normalise monetary policy settings further. But with expectations for further tightening so low, with not even two full 10 basis point rate hikes priced for this year, the move reeked of opportunism to initiate a stop run above 157.71, the highs hit in late May.

Once those orders went, it’s not surprising to see how quickly USD/JPY reversed.

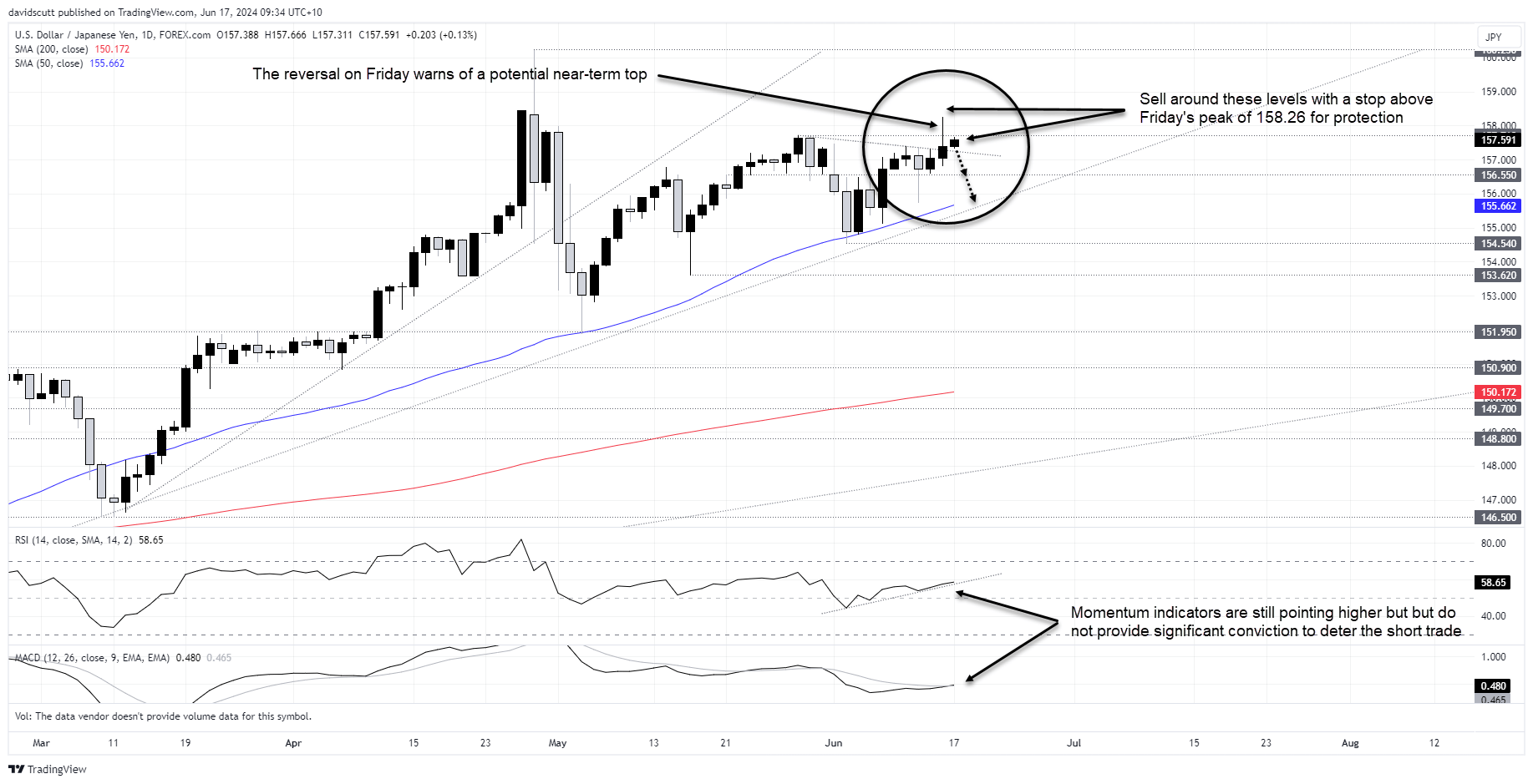

Even before the fundamentals discussed above are taken into consideration, the price action alone warns of a potential near-term top that could grow to something far more significant should the Fed be forced to pull forward rate cuts.

USD/JPY shorts favoured

For those keen to take on the short USD/JPY trade you could sell around these levels with a stop above Friday’s high of 158.26 for protection. The initial target would be 156.55, a level that acted as support and resistance in May and June. Should that give way, the 50-day moving average and long-term upside support would be the end downside target. That comes across as a far harder test for shorts.

As ever, should the trade work in your favour, consider lowering your stop to entry level, providing a free hit on downside.

-- Written by David Scutt

Follow David on Twitter @scutty