- US labour market data will be important for Fed rate cut expectations moving forward

- Jerome Powell made it clear that inflation is now a secondary consideration for rates

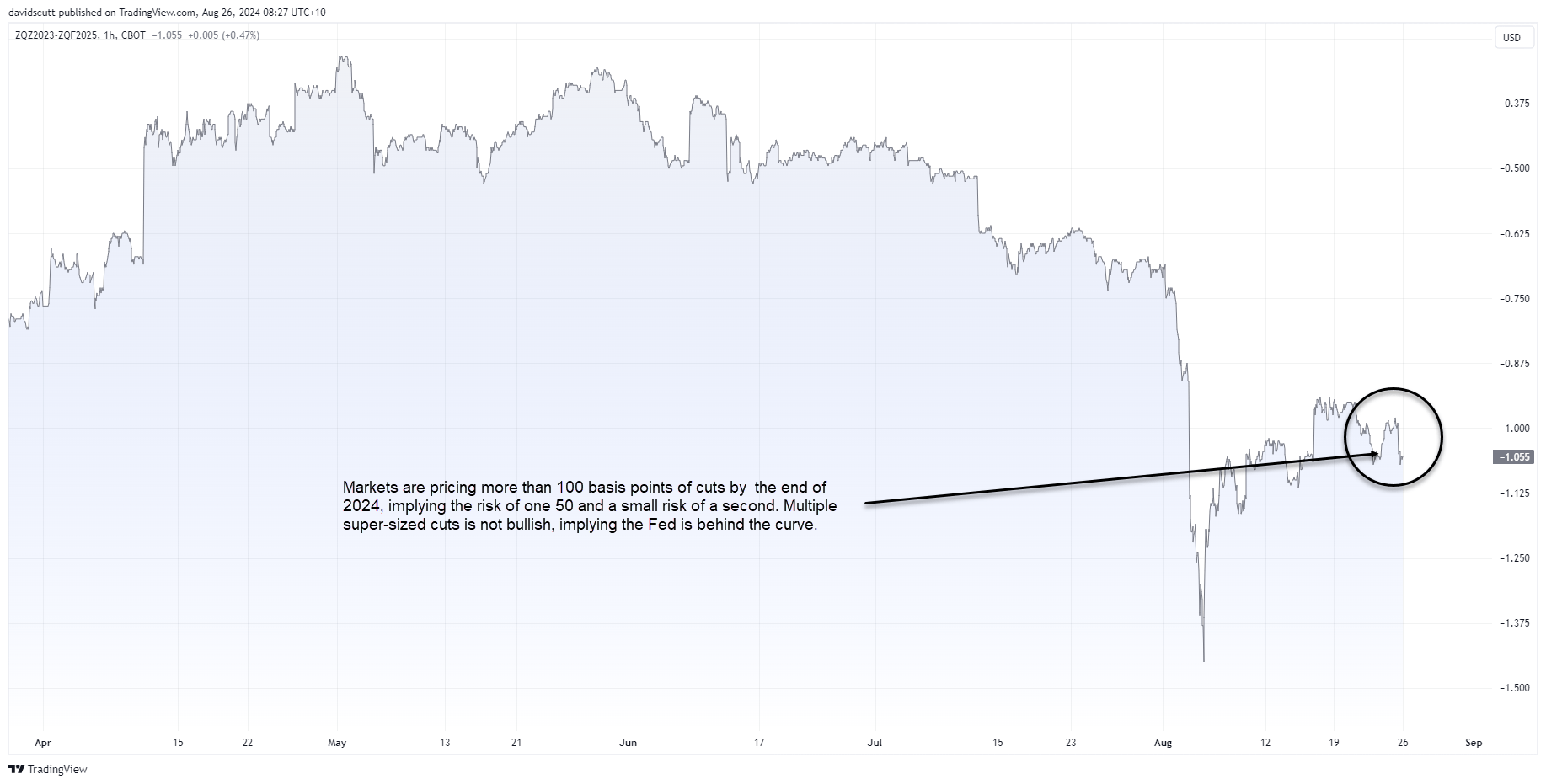

- Markets are pricing in more than 100 basis points of rate cuts this year, implying at least one 50 with the risk of a second

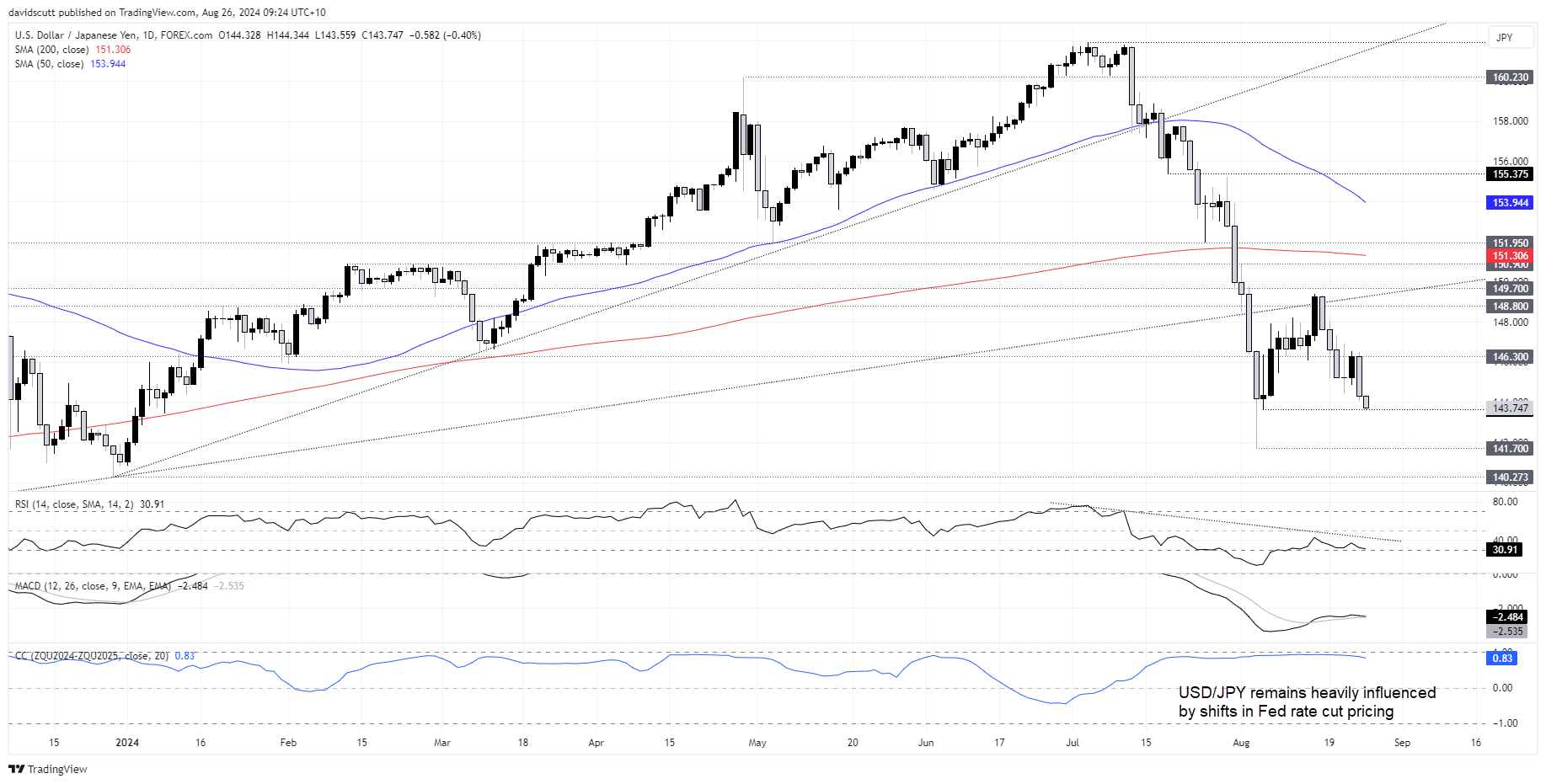

- USD/JPY may unwind further if rate cut pricing swells further

- NZD/USD upside underpinned by soft landing hopes

Overview

With rate cut priced at every FOMC meeting over the next year, markets are betting on the Fed being able to deliver a soft economic landing. For currency pairs such as USD/JPY and NZD/USD, whether that morphs into a hard landing will have vastly divergent ramifications, making incoming US economic data incredibly important.

Powell’s speech had echoes of 2022

I’m not going to add too much more to the conversation about the message Fed Chair Jerome Powell delivered at Jackson Hole, other than the driver of what the FOMC does next will almost certainly be driven by what happens in the labour market, not inflation.

As he did when he rattled markets in 2022 by providing a history lesson on the perils of loosening policy prematurely given the threat that inflation may quickly reemerge, Powell started his speech on Friday by stating the Fed did not want to see a sharp pickup in unemployment as seen in prior disinflationary episodes. He went on to discuss how unemployment had already risen nearly a full percentage point from the cyclical lows with most of that increase coming in the past six months. Telling.

Even though he clarified that much of the increase was driven by a slowdown in hiring, not outright job losses, the message was crystal clear: it’s now about protecting the labour market, not slaying inflation. And by suggesting a further softening in conditions would be unwelcome, and that the Fed has ample room to move should the need arise, it signals not only has the time come to cut rates, but potentially aggressively. The bar for super-sized cuts appears low.

Market pricing for Fed rate cuts bordering on hard landing territory

The market reaction was unsurprising as Powell continued to talk up the strength in the economy, helping the soft landing narrative to flourish. But you couldn’t help by get the sense a degree of concern from Powell that the unemployment surge the FOMC is looking to avoid may have already begun, leaving them behind the curve and facing the prospect of initiating yet another hard economic landing.

Markets are attune to this risk, pricing in more than 100 basis points worth of rate cuts over the next three meetings, according to Fed funds futures, implying the Fed will deliver at least one 50 basis point move this year with a small risk of a second.

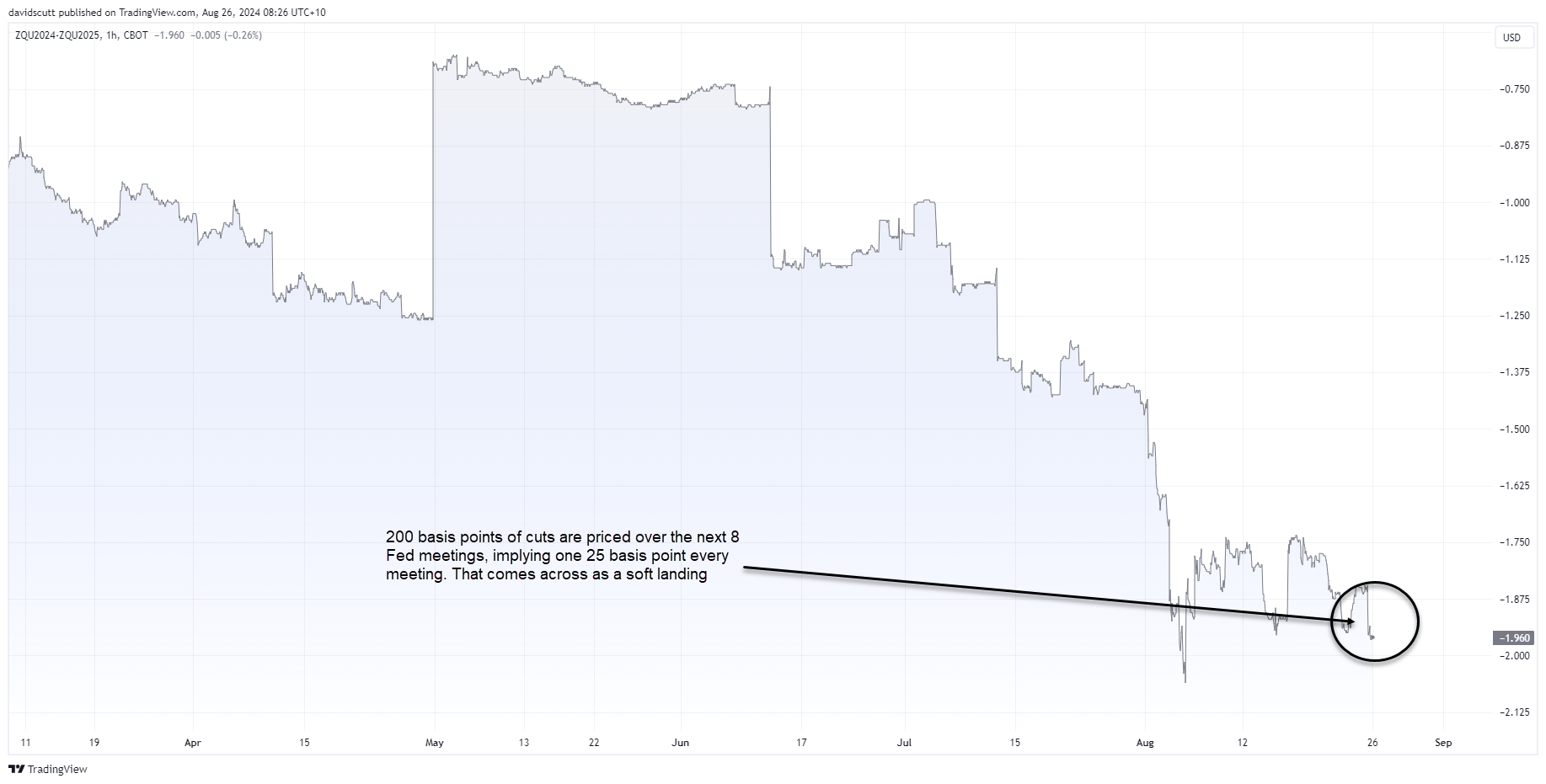

Looking further out, a 25 basis point cut is priced for every meeting until September next year, a view that’s arguably a decent border between hard and soft landing pricing. Any more than that implies the Fed may have to take policy rates through neutral to stimulate the economy, helping to pull the economy out of what would likely be a downturn.

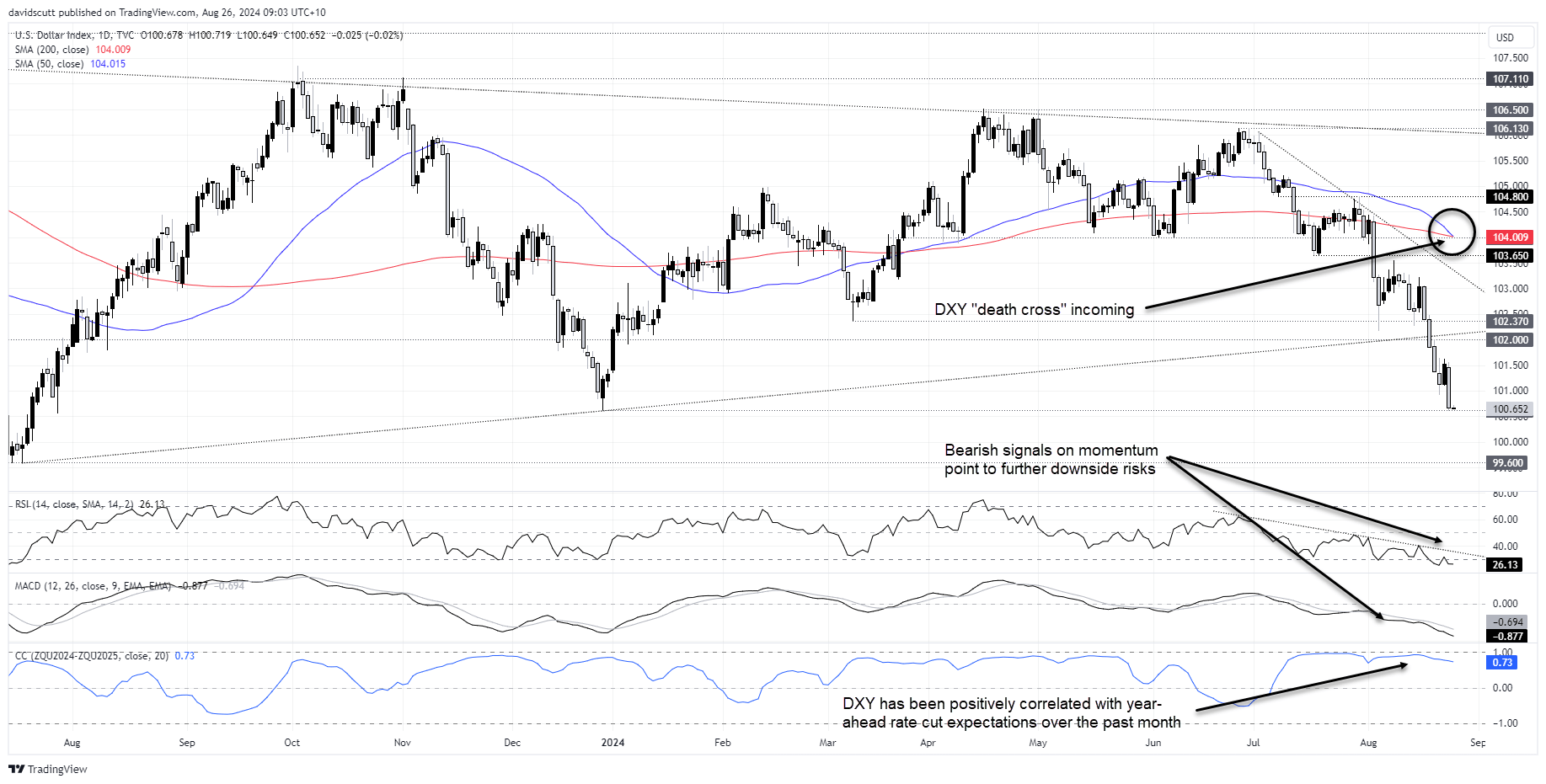

How market pricing evolves around this subjective “hard” and “soft” landing border will have a major impact on how broader FX markets fare over the next year. The increase in Fed rate cut pricing over the next year has been very inferential over the US dollar index recently (DXY), as seen by the sustained strength in the positive correlation with the Fed funds curve.

US dollar index (DXY) downside risks build

Having broken important uptrend support early last week, the DXY has weakened rapidly since, falling to horizontal support at 100.60. With RSI (14) and MACD providing bearish signals, a looming death cross as the 50-day moving average crosses the 200-day from above, and little top tier US economic data on tap until later in the week, momentum is entirely with the bears.

JPY a hard landing specialist

Whether we see further downside may be determined by what happens with USD/JPY, the second-largest weighting in the DXY behind EUR. Along with the Swiss franc, the yen is an ultimate US hard economic landing play, likely to benefit not only from narrowing interest rate differentials but also the repatriation of carry trades back into JPY.

You only have to look at the price action earlier in early August when the soft US nonfarm payrolls report sparked a meltdown in Japanese markets as the yen strengthened rapidly on repatriation flows.

If we see markets start to price in even more rate cuts over the next 12 months, a similar scenario could easily occur given it would imply an increased risk of the Fed having to respond to an economic downturn by slashing rates aggressively.

USD/JPY has seen sustained strength in the positive correlation with the Fed funds curve between September this year and next over the past month, suggesting moves at the front of the US rates curve remain extremely important. RSI (14) remains in a bearish trend while MACD looks like it may swing to generating a fresh bearish signal too.

On the downside, a break of minor support at 143.63 would open the door to a retest of the August 5 low of 141.70. Beyond, 140.27 and 138.00 are downside levels to watch. On the topside, the price has done a lot of work either side of 146.30 this year, making that a level of note should we see an unlikely sustained bounce in USD/JPY.

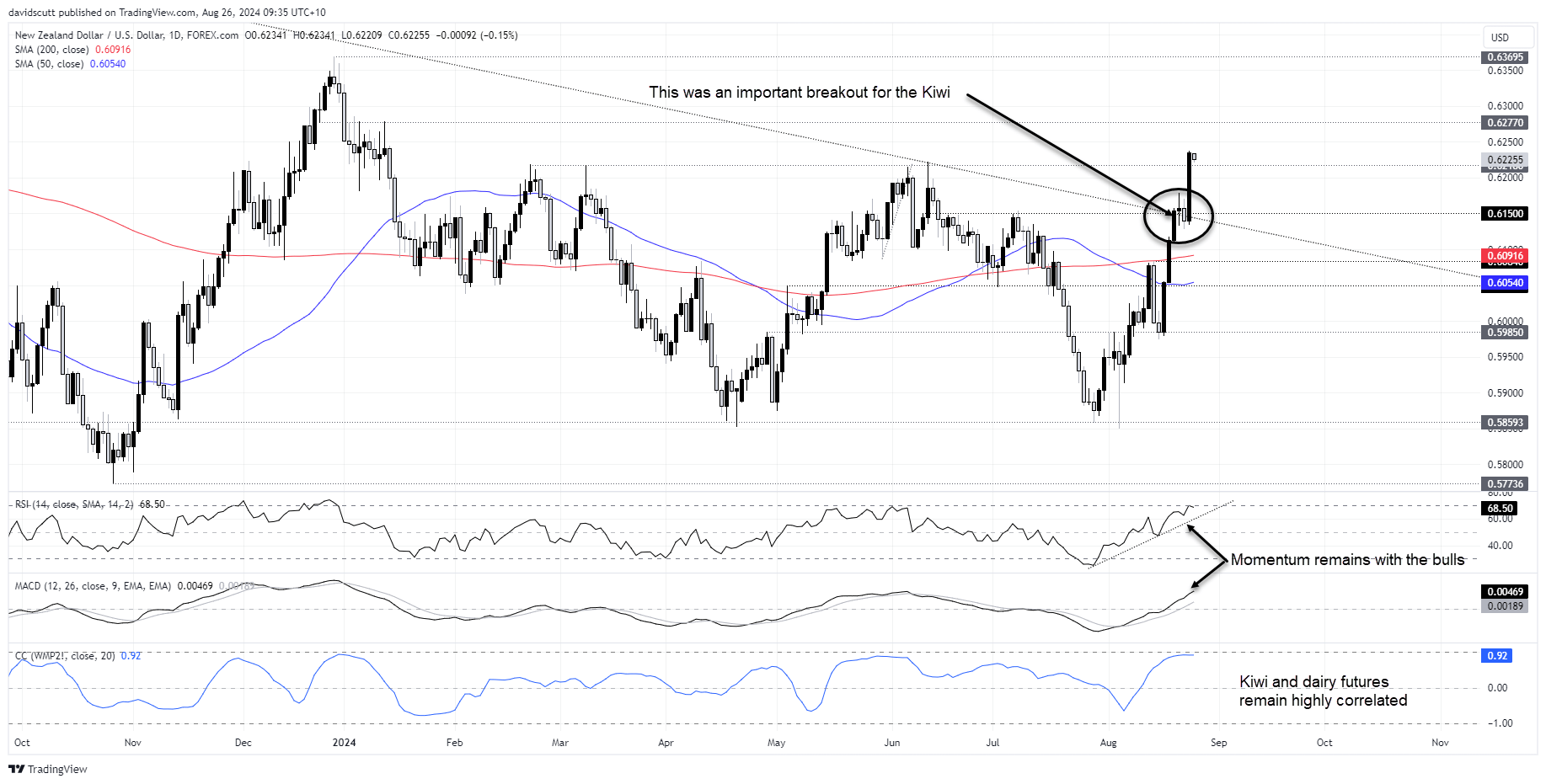

NZD/USD provided tailwinds from soft landing narrative

In contrast to the JPY, NZD/USD is as good a soft landing play as any FX name, benefitting from not only narrowing interest rate differentials but also the prospect for a pickup in the global economy, boosting cyclical assets. However, if markets swing from a soft landing to hard landing, the Kiwi will likely get crushed as we saw earlier this month.

NZD/USD has seen a strong, positive relationship with dairy futures recently, underlining its status as a high beta play on the global economic outlook.

Friday’s close for NZD/USD was potentially important for its medium-term trajectory, breaking through downtrend resistance dating back to the pandemic highs in 2021 before taking out .6218, a level that had thwarted attempts at bullish breakouts on multiple occasions earlier this year.

As long as the soft landing narrative prevails, Kiwi has likely reverted to being a buy on dips play rather than a sell on rallies prospect. RSI (14) and MACD continue to generate bullish signals on momentum, bolstering this view.

On the topside, .6277 and .6370 are levels of note. Same too for .6218, .6150 and the former downtrend on the downside.

Aside from US durable goods orders out later Monday, there is almost nothing of note on the economic calendar in the States, Japan or New Zealand until Thursday, meaning it may be difficult to shift sentiment away from the soft economic landing over the next few days.

-- Written by David Scutt

Follow David on Twitter @scutty