In short, because of the ongoing reverse carry trade, which is still ongoing after the Bank of Japan finally turned hawkish and raised interest rates. But a weaker US dollar and lower yields have also been contributing factors behind the USD/JPY’s slide. Last week, it was all about the US jobs data. As well as the nonfarm payrolls report, various labour market indicators had disappointed expectations, leading to calls for a 50-basis point rate cut at the Fed’s next meeting in a couple of weeks’ time. While Friday’s US jobs report did initially cause a panic in the rates markets, the market then decided to lean more towards a standard 25 basis point cut for September, while increasing the pricing for a more aggressive rate cuts later in the year, even after comments about “front-loading” of rate cuts was floated by a Fed official. Shortly after the US jobs report came out, the US dollar rallied after an initial drop against all major currencies bar the Japanese yen. The USD/JPY fell as the yen found haven flows after equity markets sold off. With US data weakening, stocks struggling and the Fed turning dovish, and the BoJ remaining modestly hawkish, the USD/JPY forecast remains bearish for at least the start of the week ahead.

What factors have contributed to USD/JPY’s slide?

Part of the reason behind the rally in the yen in recent weeks has been the ongoing weakness in US bond yields, reducing the yield differential between US and Japanese debt. One other reason for the outperformance of the yen has been the fact that the Bank of Japan has finally started to raise interest rates, while the rest of the world is now cutting. Yet a third reason for yen’s recent rally is the fact that the response in the equities space hasn’t been great to recent US data misses. This again proved to be the case after the non-farm payrolls report came in weaker on Friday. It looks like recession fears are becoming more pronounced, with investors fearing that companies are facing reduced profits and that this could lead to potential downward pressure on stock prices. The bears would argue that even without these factors, there are no compelling reasons for continued buying without a correction, with companies about to head into their earnings buyback blackout periods. Investors are also cautious for various other reasons. These include geopolitical risks, such as the upcoming US elections and potential for more US-China trade tensions.

Upcoming data for USD/JPY forecast

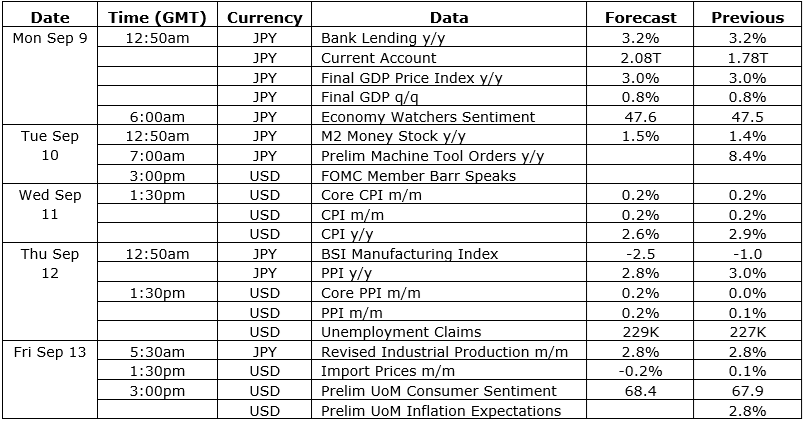

In the week ahead, the macro calendar highlight includes US CPI on Wednesday, the last major US data release before the Fed’s rate decision in the following week. Here are the week’s data releases relevant only for the USD and JPY, which will thus be important in as far as the USD/JPY forecast is concerned:

USD/JPY forecast: Technical levels to watch

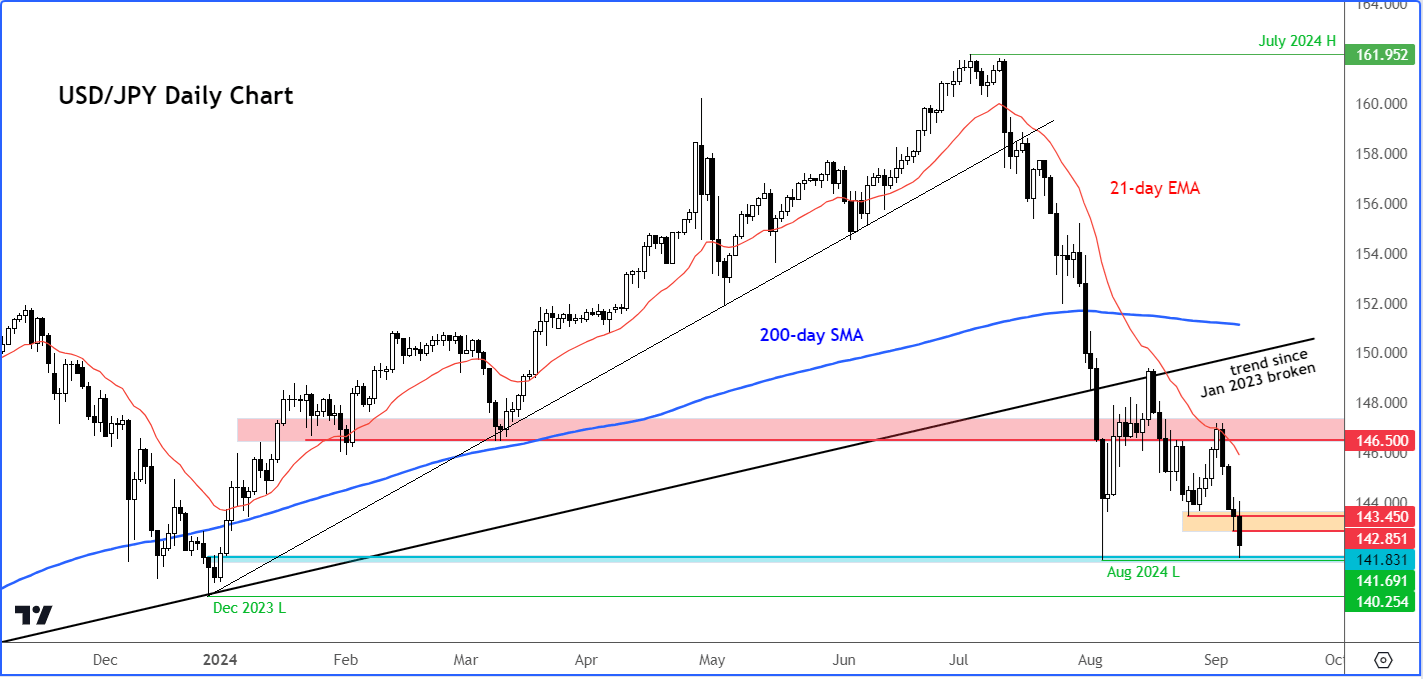

Source: TradingView.com

The technical USD/JPY forecast is bearish owing to the lower lows and lower highs it has been printing in the recent weeks. It will stay that way until and unless we see a bullish reversal formation. Thus, as things stand, looking for bearish setups at or near resistance makes more sense than looking for bullish setups at support.

Short-term resistance comes in between 142.85 to 143.45. This range was previously support and it could now turn into resistance, potentially leading to a fresh drop.

Support around the 141.70-142.00 area has now been tested at least a couple of times – once in August, and again on Friday. A decisive break below this range now could pave the way for a move targeting liquidity beneath the December 2023 low at 140.25. Thus, a drop to 140.00 handle looks quite likely from here.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R