There are a lot of investors scrambling for a tiny exit if price action in today’s Asian session is anything to go by. Nikkei futures tripped the circuit break with an -8% decline earlier in the day, and at the time of writing down a cool -12% during its worst day since 2011. Taiwan’s stock exchange has just posted its worst single-day loss of -10%, its worst in history. And that makes the ASX 200 futures current loss of -3.6% pale by comparison. China's markets and copper seemingly being propped up with the Hang Seng down just -1.8%, China A50 and copper futures flat for the day.

Friday’s NFP report undershot already low expectations and fanned further fears of a US recession. The headline NFP print of 114k was the second lowest gain since December 2020, unemployment increased to 4.3% from 4.1%, which is its highest level since October 2021. That also makes it the fifth rise out of the past six reports, four of which are in a row. And this was the icing on a bearish cake given traders had already seen another weak ISM manufacturing report.

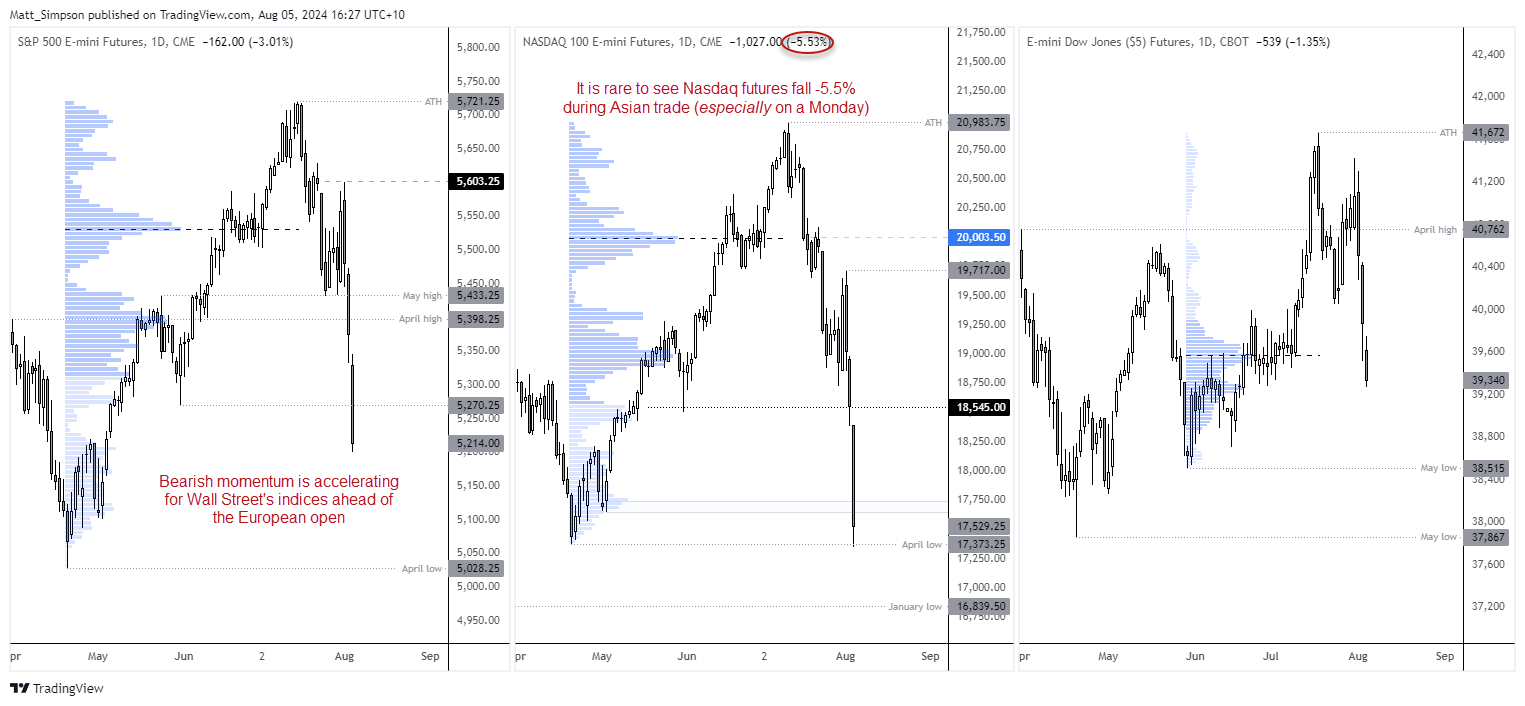

With APAC traders responding to Friday’s news, perhaps the worst of the downside volatility is behind us. But it is not often we see Nasdaq futures fall -5.5% during Asian trade (least of all on a Monday), and that tells us that markets really are in panic mode. And when investors panic, they tend to stand on each other’s heads to get to the lifeboat. Therefore, traders may want to buckle up as this could be another volatile week indeed.

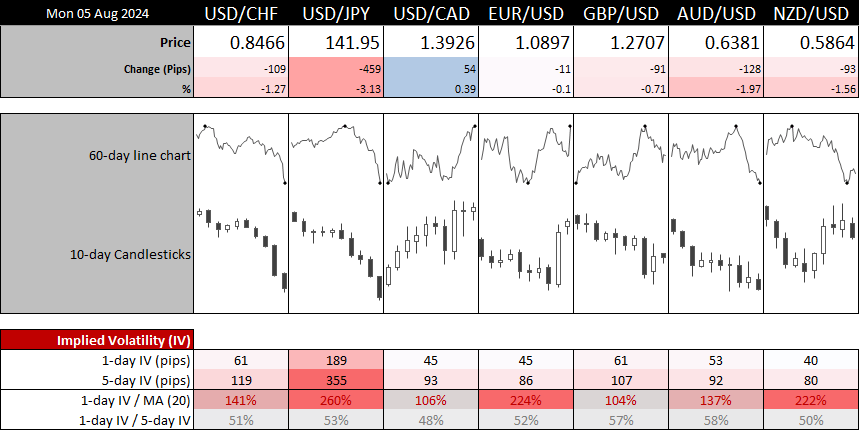

Implied volatility has spiked higher for USD/JPY, EUR/USD and NZD/USD. USD/JPY has fallen a further -3.1% to fresh 7-month low and USD/CHF to a 7-month low of its own as traders flock to the safety of the Japanese yen and Swiss franc. Interestingly, AUD/USD was not having a volatile session until just over an hour ago, where it plunged 2.3% in less than 60 minutes and has since rebounded back above 64c. We don’t need to really explain the moves, but it is clear that stops are getting triggered and volatility will cut both ways during the current bout of market turbulence.

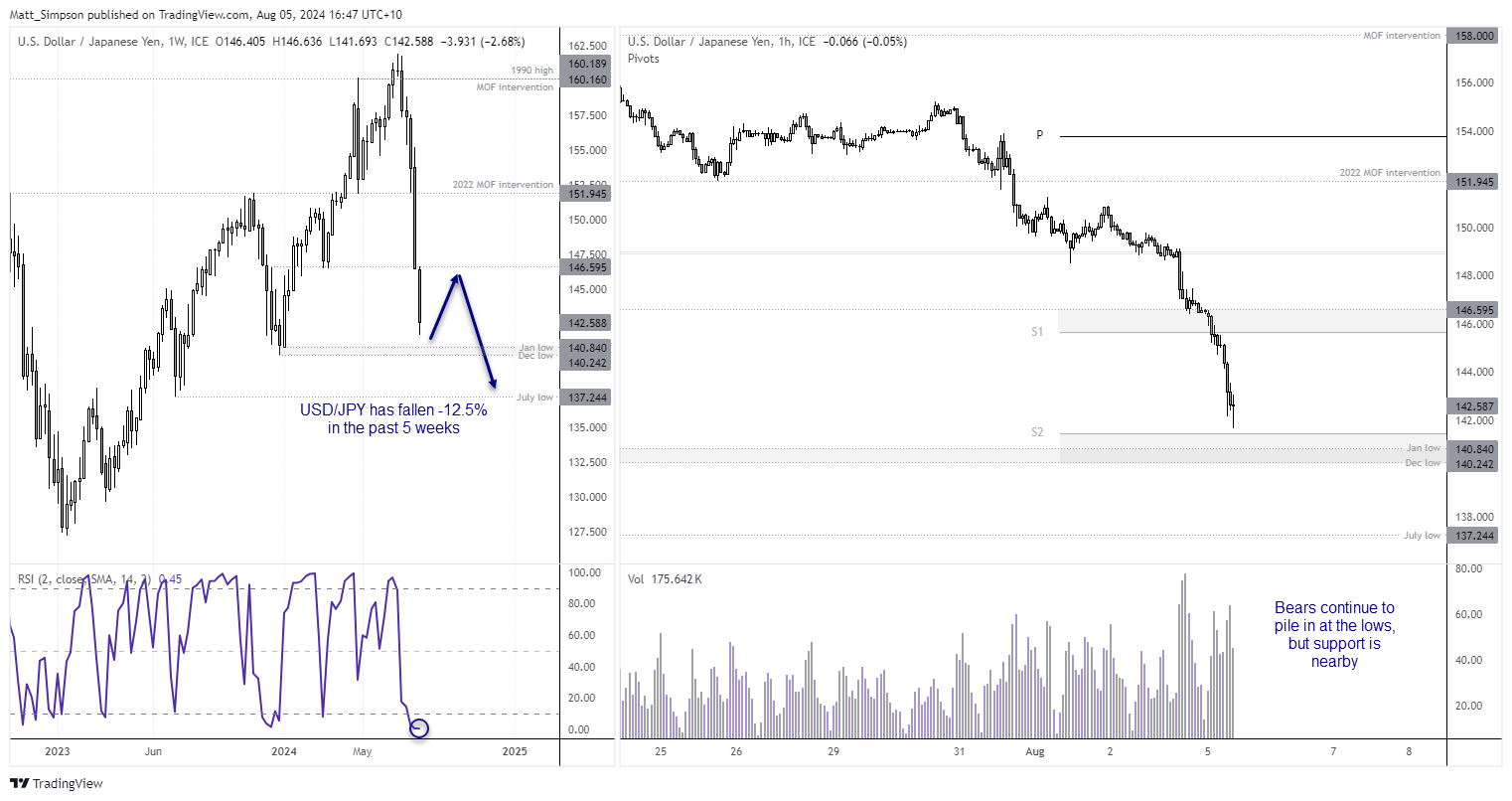

USD/JPY technical analysis:

Over the past five weeks USD/JPY has dropped an impressive 12.5%. More than half of that has been over the past two weeks. While momentum clearly points lower, bears may want to ask themselves if they want to chase the move just above support levels such as the December and January lows. That is not to say trying to catch a falling knife is a good idea, but bears may want to manage their trades closely after such an extended move to the downside, and a diminishing reward-to-risk ratio. Also note that the monthly S2 sits just beneath today’s current low at the time of writing. Bears therefore may want to wait for a bounce and seek to fade into strength for a move towards 138 or the July low.

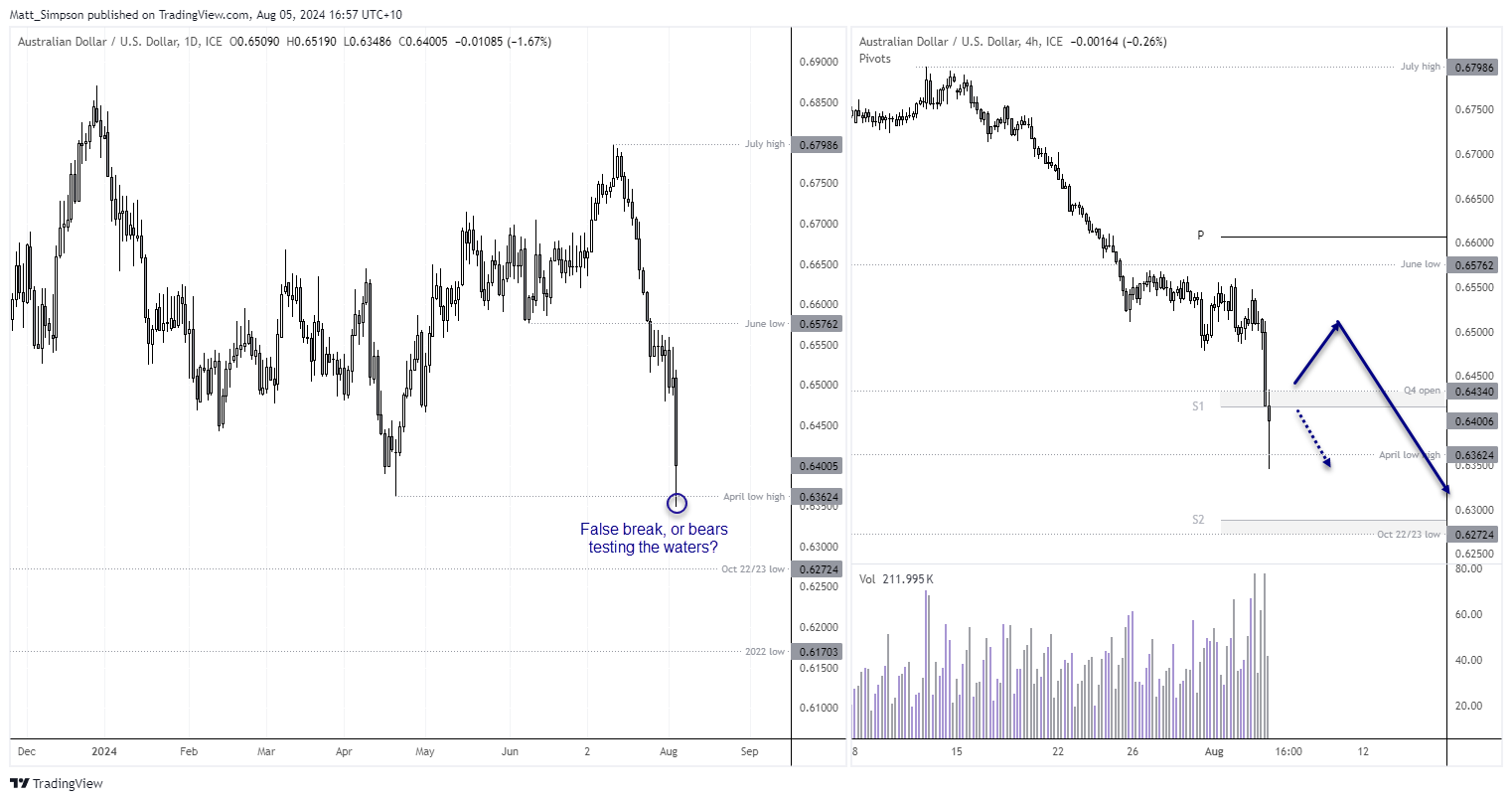

AUD/USD technical analysis:

There was quite a delayed reaction on AUD/USD falling lower today. But when it fell, it did so in style. The day’s high to low range spans over 170 pips, although its break of the April low has since seen prices bounce. Like USD/JPY, bears may want to warrant caution around the low and get a feel for how European and US trade plays out. But with momentum favouring bears overall, they may want to wait for a bounce and seek evidence of a swing high to rejoin the bearish move at more favourable prices.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge