While US inflation remained unchanged and landed in line with expectations, it remains elevated from its cycle low at 3.3% y/y and the 0.3% m/m reminds us that inflationary pressures persist. And as this is unfolding before Trump has even officially started as President, dovish hopes for the Fed are fading.

Just after the CPI figures were released, FOMC member Kashkari thinks the Fed are on the right path for inflation, although he warned there are six weeks until their next decision with plenty of data to follow. So a cut in December is all but certain. Still, bond traders at the short end stepped in to bid the 2-year prices higher and send the yield lower, which saw a rare divergence between the 2-year yield and US dollar.

The dollar’s bullish freight-train continued at full speed on Wednesday, with the USD index rising for a fourth day and closing firmly above 106 for the first time in two years. Its rally is reminiscent of the one seen in July which saw it rise 8.4% over 11 weeks. If that is to be repeated, the USD index could reach 108.29 by mid-December, although at its current trajectory it could reach there sooner unless incoming US data underperforms.

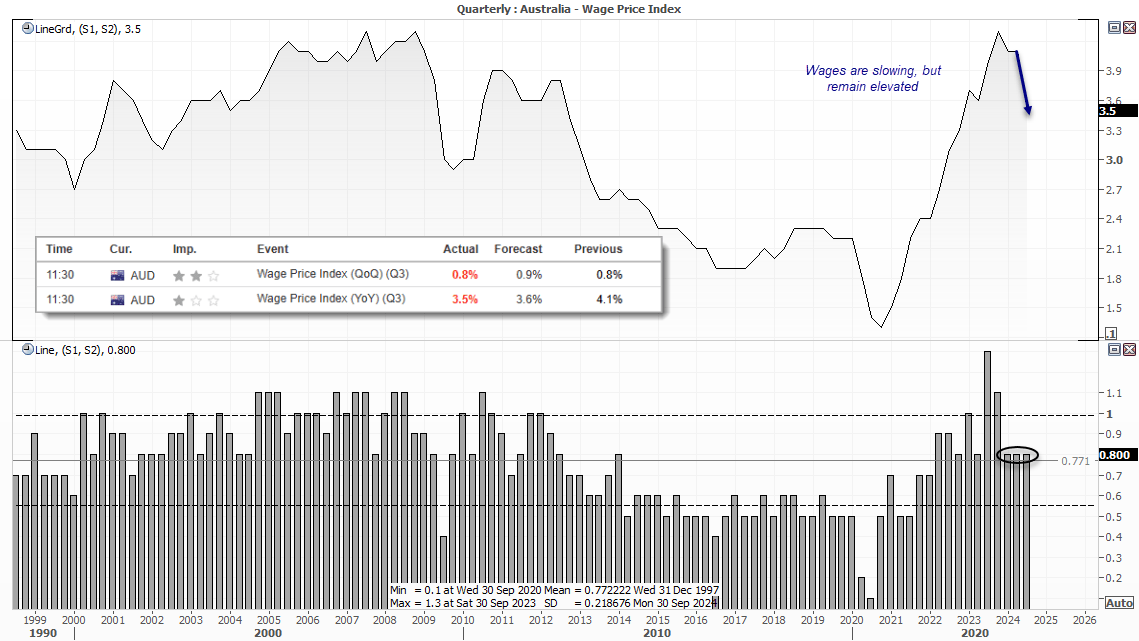

Australia’s wage price index slowed to 3.5% y/y and remained steady at 0.8% q/q, both of which below markets expectations by 0.1 percentage point. While this is what the RBA will want to see, wages remain elevated and its decline is slow. And with business and consumer sentiment perking up and retail sales holding up, a strong employment report today will likely overshadow this set of figures and see the central bank retain their hawkish bias.

Events in focus (AEDT):

RBA governor speaks at the ASIC annual forum, although I’m not expecting anything profound regarding policy clues given she thinks it is too soon to tell how Trump 2.0 will impact Australia. Attention then shifts to the AU jobs report, and if recent trends are to persist we can expect job growth to increase, made up mostly of full-time workers, participation to hit a new record and unemployment to remain around 4%. None of which will allow the RBA to cut rates.

GBP/USD bears will be seeking further weak data from today’s data dump given the softness with wages earlier in the week, which revived bets of another BOE cut this year.

Keep an eye on producer figures, because if they perk up then it adds to the USD bid theme.

- 08:45 - NZ food price index

- 10:00 - RBA Bullock speaks

- 11:00 - AU inflation expectations

- 11:30 - AU employment report, RBA assistant governor speaks

- 18:00 - UK GDP (Q3), industrial production, manufacturing production, construction output, business investment, trade balance

- 19:00 – ES CPI

- 21:00 – EU GDP, employment, industrial production (Q3)

- 21:00 – International Energy Agency (IEA) monthly report

- 23:00 – FOMC Kugler speaks

- 00:30 – US PPI, jobless claims

- 23:30 – ECB minutes

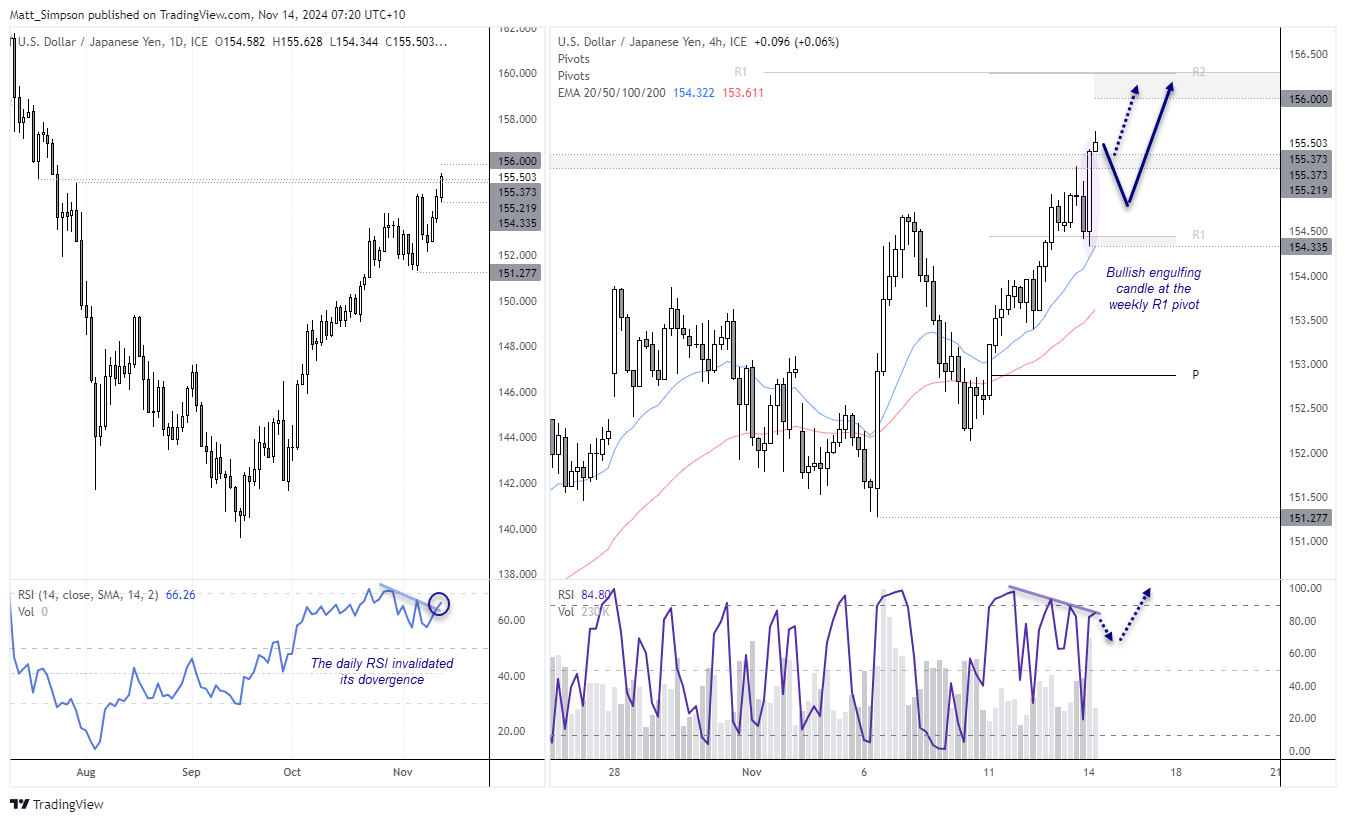

USD/JPY technical analysis:

Where the USD goes, USD/JPY follows. And that saw USD/JPY reach its highest level since July and close above 155 and places 156 within easy reach. The daily RSI invalidated a small bearish divergence which leaves room for some further upside on the daily chart.

A strong bullish engulfing candle formed on the 4-hour chart, and any pullbacks within the top half of its range could appeal to bulls seeking a move to either 156 or the monthly R1 or weekly R2 pivot at 156.30.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge