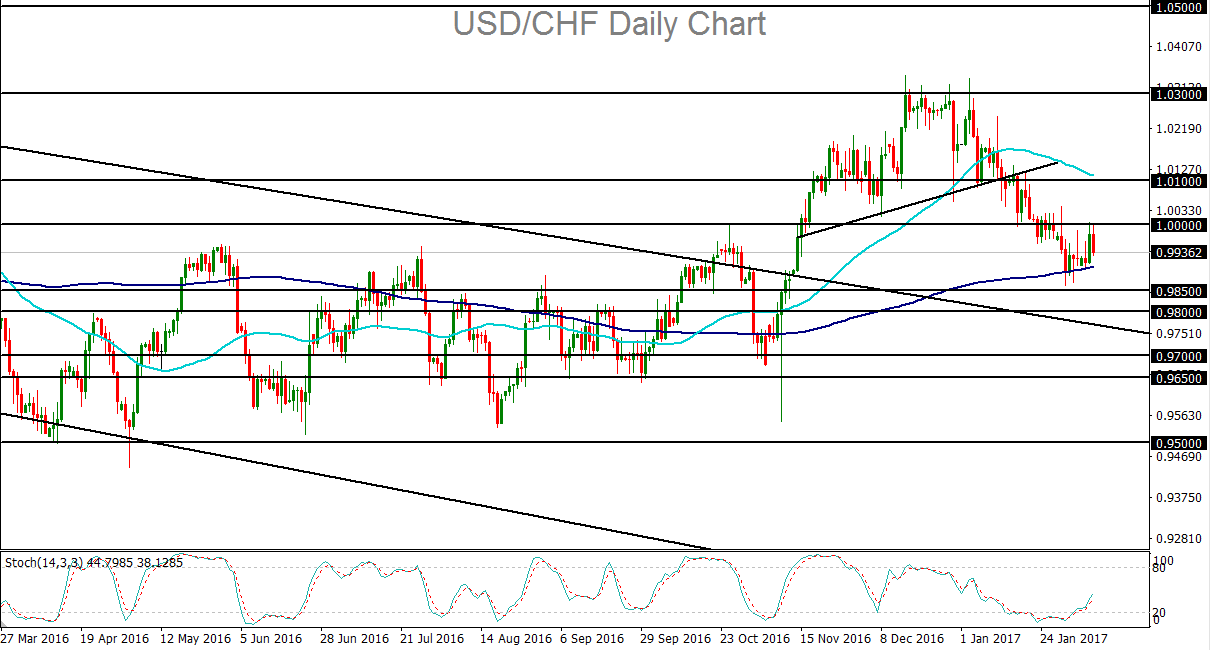

- USD/CHF tested and then turned back down from parity (1.0000) on Wednesday as the US dollar continued to be weighed down.

- Pressure on the dollar since the beginning of the year – after the dollar-rally of late-2016 – has been exacerbated by several different conditions revolving around the Federal Reserve and the new Trump Administration.

- Last week’s US jobs report for January revealed lower-than-expected wage growth (a key measure of inflation), which has decreased expectations of a March interest rate hike by the Fed, thereby slowing recent demand for the dollar.

- Also weighing on the dollar have been concerns over US President Donald Trump’s protectionist trade policies and uncertainties regarding the implementation of his fiscal stimulus plans.

- Additionally, Trump and some of his key advisers have publicly bemoaned the strength of the dollar as well as launched verbal attacks on several countries for the alleged devaluing of their currencies, including the euro and yen.

- Any continued dovish hesitation on the part of the Fed in normalizing monetary policy, combined with the Trump Administration’s concerted push to weaken the dollar against its major rivals, could very well lead to further downside for the dollar, at least in the short-term.

- Trump meets with Japanese Prime Minister Shinzo Abe on Friday, when the US President is likely to broach the topic of his staunch opposition to a strong dollar and weak yen. This could help prompt another bearish leg to the dollar’s current downtrend.

- USD/CHF dropped below the key psychological level at parity in late January. Since then, 1.0000 has turned into a major resistance level. Soon after the breakdown, the currency pair began to consolidate in a rough, inverted flag pattern just above its 200-day moving average. This pattern suggests a further potential bearish bias, IF price manages to stay below parity. In this event, a breakdown below the pattern should extend the current month-long downtrend, with key downside targets around the 0.9800 and 0.9650 support levels.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM