- USD/CHF has been heavily influenced by the US rates outlook recently

- Markets expect seven rate cuts from the Fed by June 2025

- USD/CHF eyeing potential downside break

- Many near-term FX moves have not been confirmed by interest rates markets

USD/CHF comes across as a play on the US interest rate outlook, often moving in lockstep with the evolution of market pricing. So, where Fed rate cut expectations move, the Swissy is likely to follow. Here’s proof.

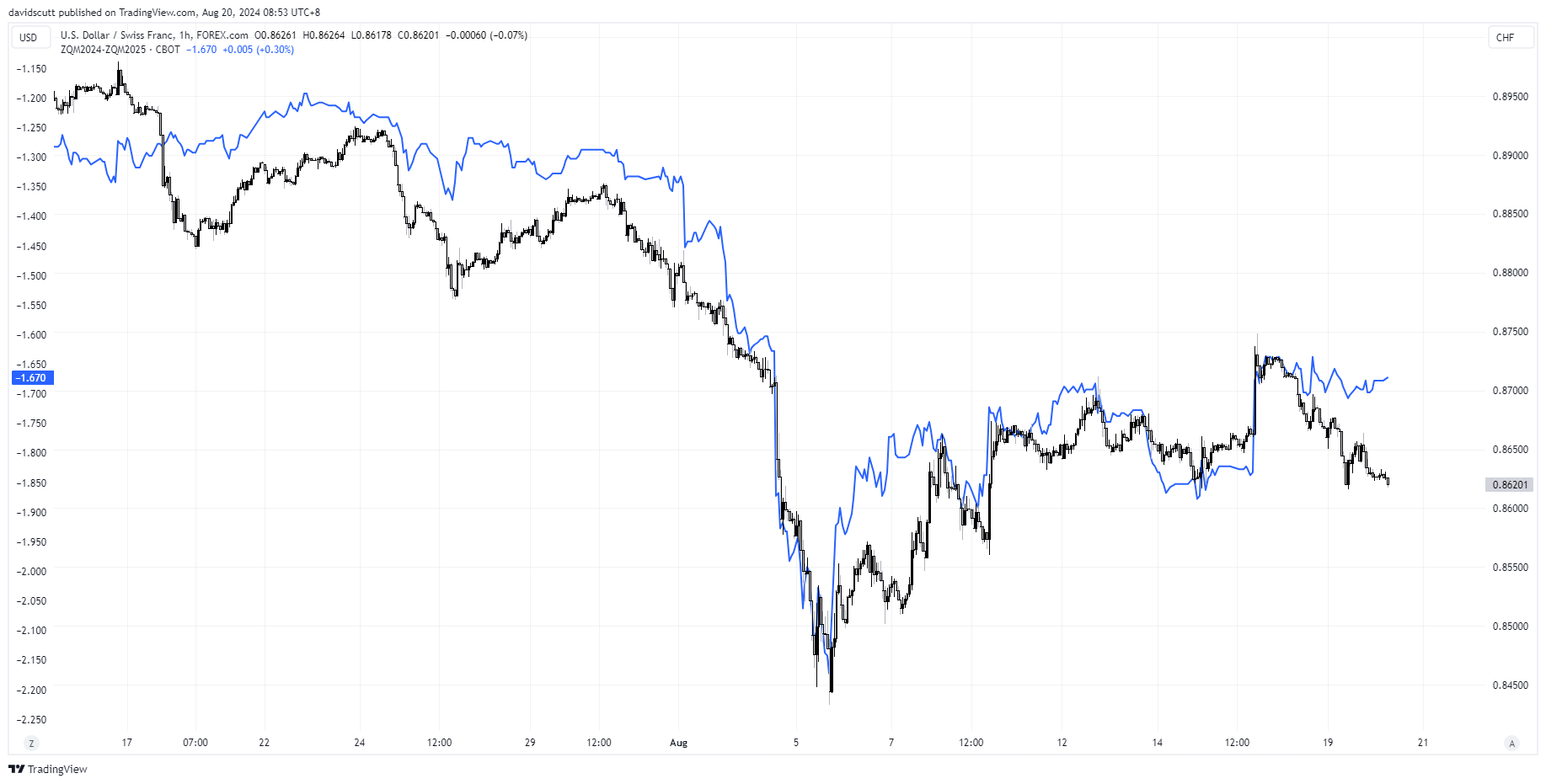

The chart below shows USD/CHF hourly candles on the right axis with the shape of the Fed funds futures curve between June this year and next on the left in blue. The latter is a proxy for market pricing on what the Fed is expected to do with interest rates over the next year. Visually, you can tell there’s a strong relationship between the two variables.

Zooming out a little, you can see the evolution in market pricing for Fed rate cuts over the next year in the top pane with the rolling daily correlation with USD/CHF over the past month in the bottom pane. With a score of 0.93, it suggests the US interest rate outlook has been particularly influential on USD/CHF recently. It’s not always the case, but it is right now.

Rates markets a useful filter for USD/CHF setups

Assuming we don’t see a significant weakening in the correlation between the two in the near-term, it allows traders to use shifts in market pricing to filter trade setups involving USD/CHF.

As seen on the chart below, USD/CHF is taking a peek below minor support at .8617, reacting to another wave of dollar selling in Asia. But there hasn’t been any meaningful shift in Fed rate cut pricing to confirm the bearish price signal, providing reason to be cautious towards the break.

A lot of moves in FX names heavily influenced by rate differentials have diverged from rates pricing so far this week, pointing to either the establishment of new trends or the risk of reversal. The narrative is that Jerome Powell may signal cuts at Jackson Hole but there are already seven priced by June 2025!

USD/CHF trade ideas

If the move were to reverse, traders could buy with a stop under .8617 for protection targeting the resistance zone between .8722 and .8750. Above, the 50 and 200-day moving averages would be the next logical upside targets.

Alternatively, if the downside break were to stick, traders could initiate shorts with a stop above .8617 for protection. USD/CHF did plenty of work around .8550 earlier this year, so that’s one potential trade target. Beyond, .8504 and .8450 are other levels of note.

-- Written by David Scutt

Follow David on Twitter @scutty