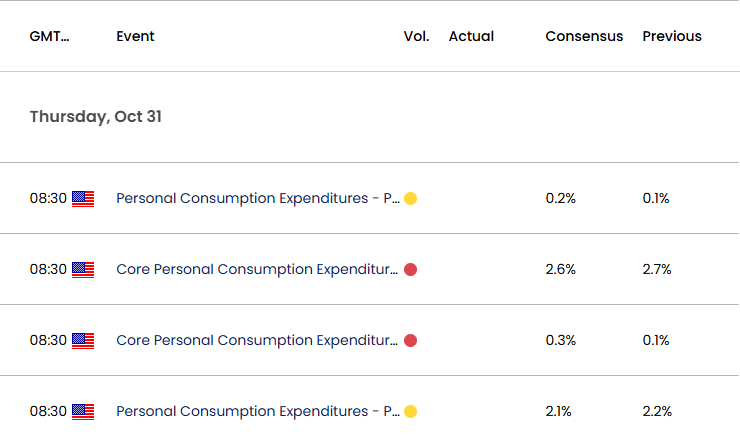

US Personal Consumption Expenditure (PCE) Price Index

The US Personal Consumption Expenditure (PCE) showed the headline reading narrowing to 2.2% in August from 2.5% per annum the month prior.

US Economic Calendar – September 27, 2024

Nevertheless, the core PCE increased to 2.7% from 2.6% during the same period, with the update from the US Bureau of Economic Analysis revealing that ‘personal income increased $50.5 billion (0.2 percent at a monthly rate) in August.’

A deeper look at report showed that ‘prices for goods decreased 0.9 percent and prices for services increased 3.7 percent,’ with the BEA going onto say that ‘food prices increased 1.1 percent and energy prices decreased 5.0 percent.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

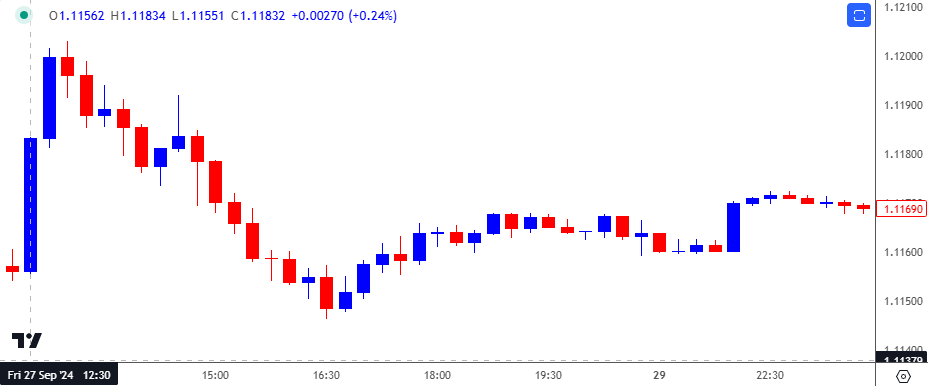

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

The US Dollar came under pressure following the mixed development, with EUR/USD climbing to a fresh session high of 1.1203. Nevertheless, the market reaction was short-lived as EUR/USD ended the day at 1.1163, with the weakness into October as the exchange rate closed the week at the 1.0976.

Looking ahead, the update to the US PCE is anticipated to show a slowdown in both the headline and core reading for inflation, and further evidence of easing price growth may drag on the US Dollar as it encourages the Federal Reserve to pursue a rate-cutting cycle.

At the same time, a higher-than-expected PCE print may generate a bullish reaction in the Greenback as signs of a resilient labor market curbs speculation for another 50bp Fed rate cut.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

British Pound Outlook: GBP/USD Recovery Emerges Ahead of UK Budget

USD/CAD Eyes August High as RSI Holds in Overbought Territory

AUD/USD Vulnerable amid Failure to Defend September Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong