US Dollar Index Technical Forecast: USD Weekly Trade Levels (DXY)

- US Dollar poised to mark four-week rally of yearly low to fresh multi-month high

- USD approaching resistance into April downtrend- risk for exhaustion / inflection

- DXY resistance 104.87/97 (key), ~105.60s, 106.04/11– Support ~103.70, 102.99, 102.35 (key)

The US Dollar has been on a tear since the start of the month with DXY up 3.8%. The index has seen only one daily decline this month with the rally extending to highs not seen since July today in New York. A four-week recovery off downtrend support is now approaching trend resistance and the battle lines are drawn heading into the close of the month. These are the updated targets and invalidation levels that matter on the DXY weekly technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD setup and more. Join live on Monday’s at 8:30am EST.US Dollar Price Chart – USD Weekly (DXY)

Chart Prepared by Michael Boutros, Sr. Technical Strategist; DXY on TradingView

Technical Outlook: In my last US Dollar Technical Forecast we noted that DXY had, “responded to the 2011 support slope with the recovery now testing initial resistance at the 2023 parallel- the focus is on a breakout of this week’s range for guidance. From a trading standpoint, losses should be limited to the yearly-open IF price is heading higher on this stretch with a pivot / weekly close above this slope needed to keep the recovery viable.” The index broke through resistance the following week with a fourth weekly-advance breaking through the 61.8% retracement of the yearly range today at 104.08.

Note that the rally has already extended more than 4.4% off the yearly low with weekly momentum back above 50 for the first time since June. That said, the immediate focus is a potential stretch towards confluent resistance into the upper parallel near 104.87/97- a region defined by the February swing high and the July high-week close. Look for a larger reaction there IF reached.

Look for initial weekly support along the 52-week moving average (currently ~103.70) backed by the 2016 high-close / 2020 high at 102.99. Key support now raised to the March low at 102.35 with a break / close below the median-line ultimately needed to mark downtrend resumption.

A topside breach of this formation would suggest a larger trend reversal is underway with such a scenario exposing the 2023 trendline (red- currently ~105.60s) and key resistance at the 2023 / 2024 high-week closes (HWC) at 106.04/11.

Bottom line: The US Dollar rebound off downtrend support is now approaching downtrend resistance- looking for a reaction up here with the rally vulnerable into 105. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to the yearly moving average IF price is heading for a breakout here with a close above 105 needed to suggest a larger trend reversal is underway.

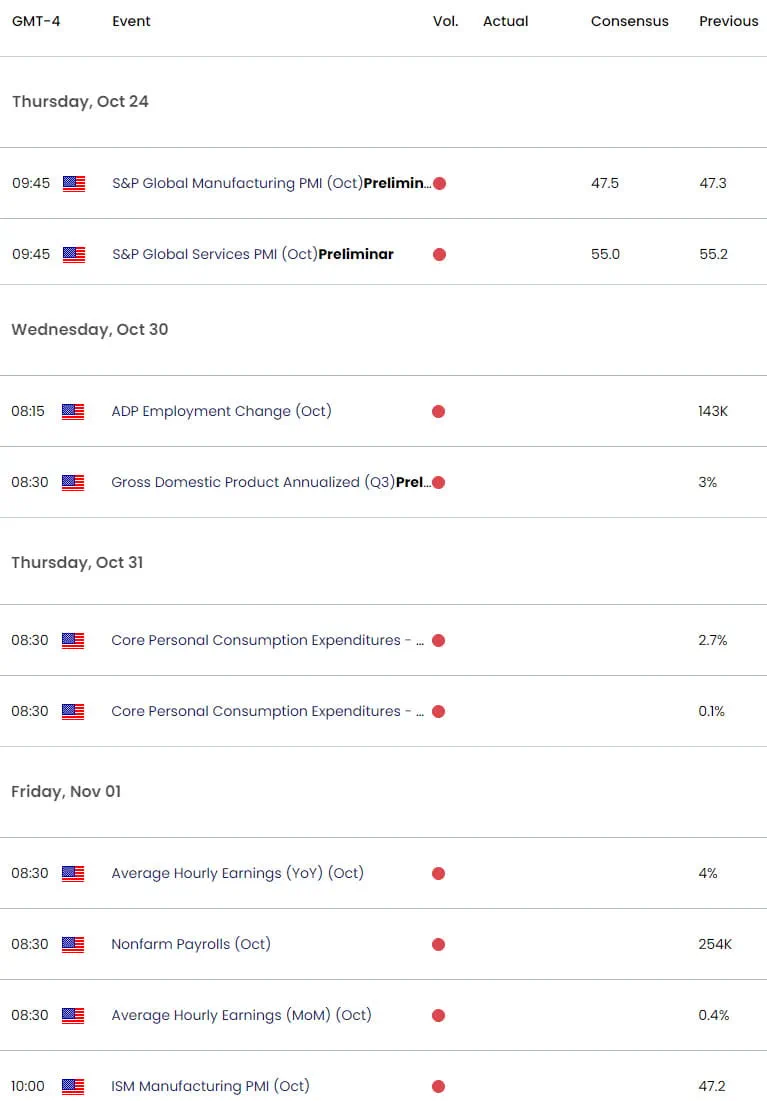

Keep in mind that we have key inflation data next week with non-farm payrolls on tap Friday into the monthly open. Stay nimble into the monthly cross here and watch the weekly closes for guidance. I’ll publish an updated US Dollar Short-term Outlook once we get further clarity on the near-term DXY technical trade levels.

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Australian Dollar (AUD/USD)

- Gold (XAU/USD)

- British Pound (GBP/USD)

- Japanese Yen (USD/JPY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex