US Dollar Talking Points:

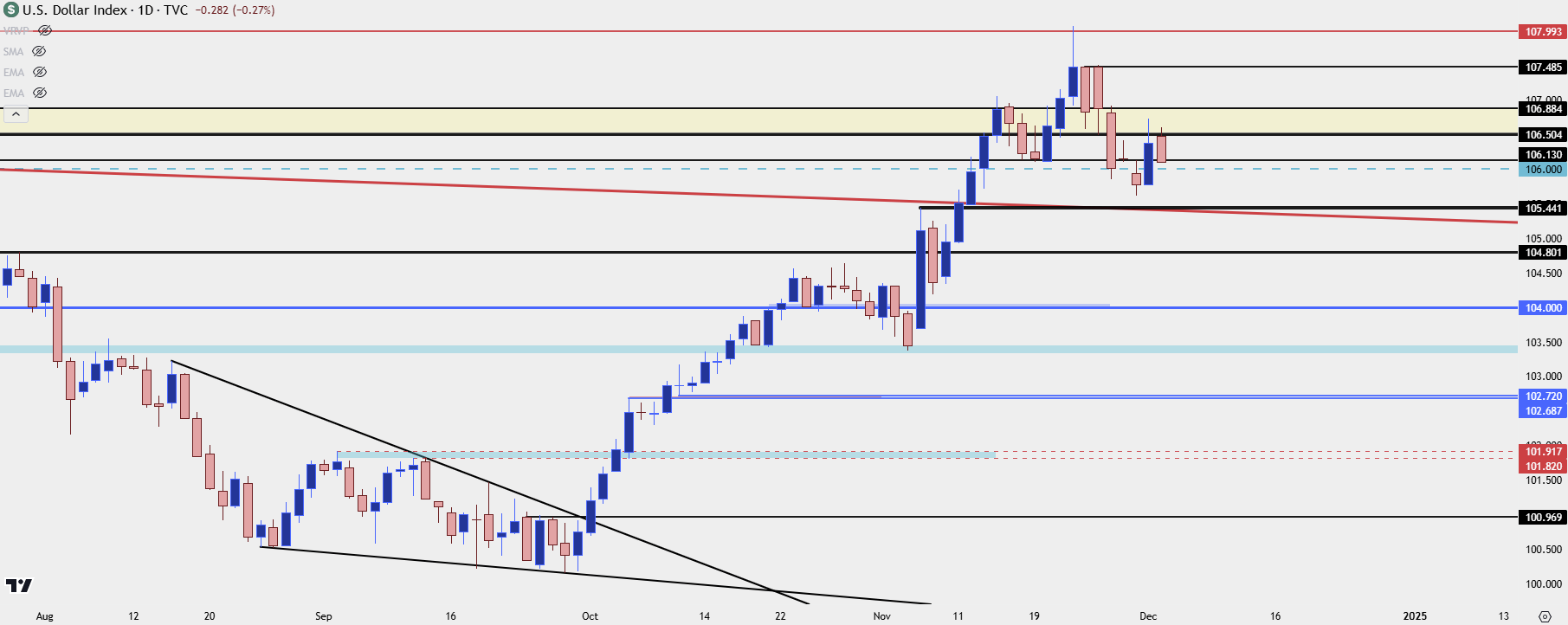

- The US Dollar pulled back last week, helped along by the strongest week in EUR/USD in two years. And so far this week, it’s the same prior gap from 106.50-106.88 that’s held the highs in DXY.

- While the claim can still be made for longer-term range dynamics in the US Dollar, USD/JPY may be a more attractive venue for USD-weakness such as I had looked at in last week’s webinar. And to that front, EUR/JPY could be a more attractive area for Euro-weakness scenarios. The concern at this point with the pair would be the now oversold conditions flashing on the daily chart.

- This is an archived webinar and you’re welcome to join the next one: Click here for registration information.

The last week of November finally showed some pullback for the US Dollar in a bullish trend that had priced-in aggressively from the Q4 open. From the weekly DXY chart, the USD came very close to overbought conditions with a 69.98 read via the RSI indicator, which would be full circle from the oversold readings that had shown in Q3 as the indicator had started to diverge ahead of the Q4 open.

US Dollar Weekly Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

USD Daily

From the daily chart, we can see that prior gap from last November’s FOMC meeting still playing a role in DXY price action. The 106.50 level, the same that set the double top in the currency in April and May, has so far set the highs again today; and the top of the zone at 106.88 set the highs last Wednesday before sellers pushed down to a near-term lower-low.

For additional context, the 105.44 level is of interest for deeper support in DXY and this is currently confluent with a prior resistance trendline.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

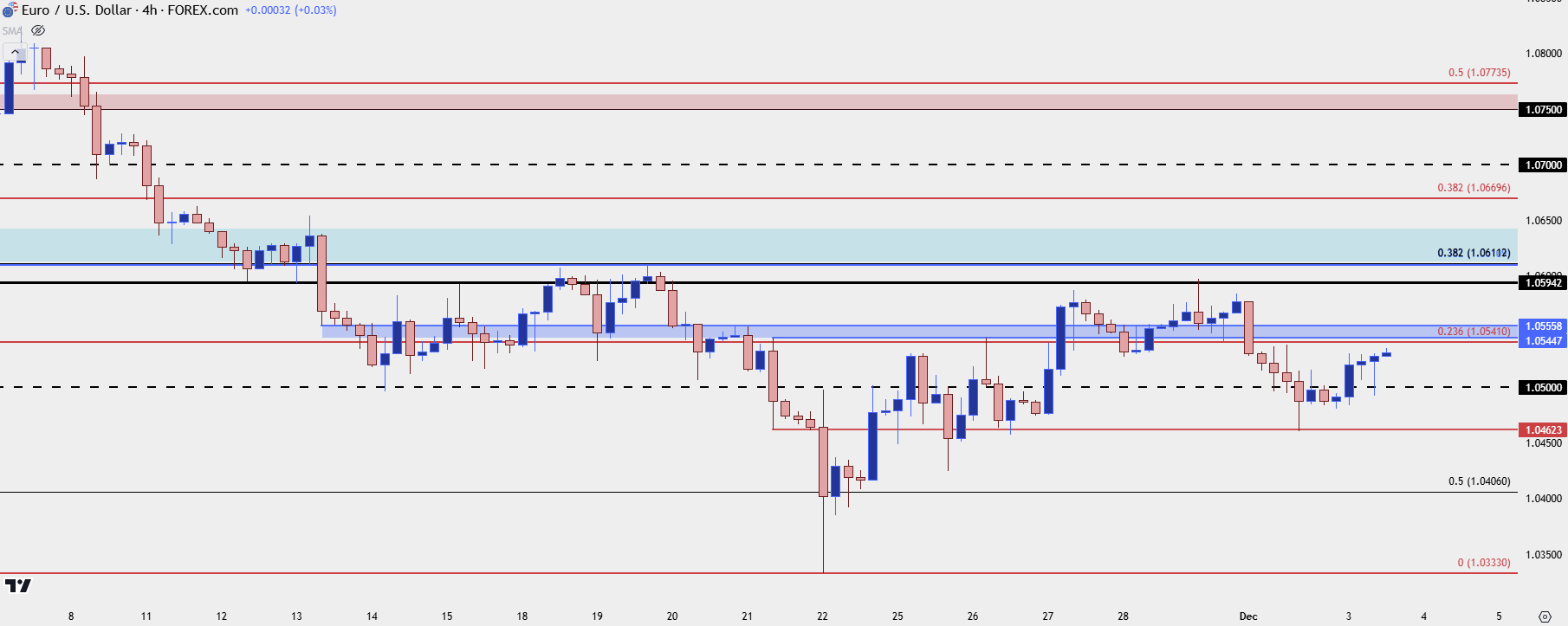

EUR/USD Still Working on 1.0500

Last week was the strongest weekly showing in EUR/USD since November of 2022, right around the time the pair was re-claiming the parity handle following a steep sell-off. Resistance ultimately showed at a prior point of support at 1.0595, and sellers took another swing to start this week. And while they were able to nudge below 1.0500, they were unable to take out the 1.0462 level and prices have since bounced, with the pair pushing back above the psychological level.

While there seems little to be optimistic about on the fundamental front for the Euro-zone, or the Euro currency, the pair has exhibited a series of higher-lows and it appears as though there could be remaining pullback potential. Although, as I said in the webinar, I think there could be more attractive venues for scenarios of USD-weakness, which I’ll look at next.

In EUR/USD, there’s resistance potential around the 1.0550 zone, followed by 1.0595 and then the 1.0611 Fibonacci level.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

USD/JPY

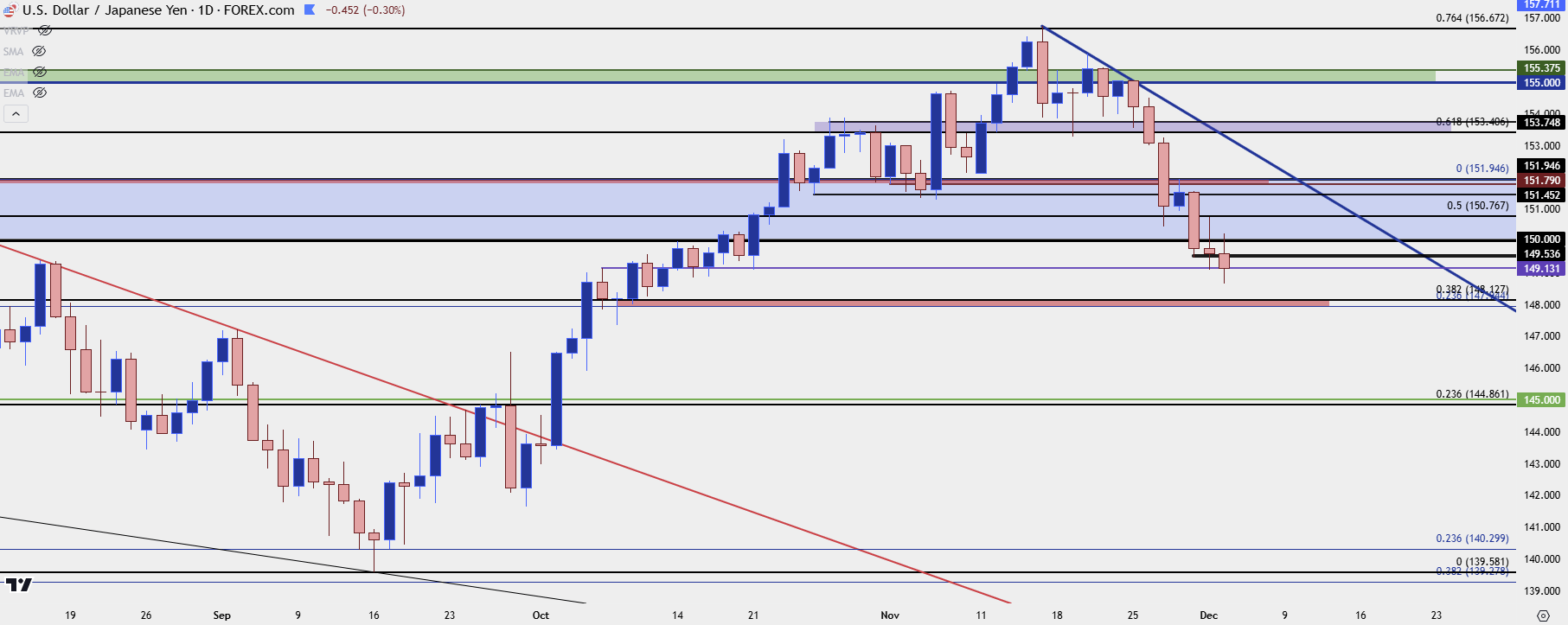

The massive sell-off in DXY in Q3 of this year was heavily driven by USD/JPY as carry trades unwound. That caused volatility across the macro landscape including the third highest ever spike in the VIX indicator.

But, as the USD exhibited signs of stalling and then turning in late-Q3 and into Q4, so did USD/JPY. This drove a 76.4% retracement of the July-September trend until resistance started to show in USD/JPY in mid-November.

But it’s what happened a week later that started to make this more interesting, as a spike to a fresh two-year-high in DXY brought a mere lower-high to USD/JPY. And in last week’s webinar, I looked at a descending triangle formation that had built on the back of that lower-high, and that filled in shortly after.

Now a week later, bears have taken out quite a few more supports, including the 151.95 level, the 150.77 Fibonacci level and even the 150.00 psychological level.

If we are to see the USD remain within its two-year-range, I think that dynamic will need to be driven by continued bearish action in the USD/JPY pair, and this remains of interest as we move towards the end of the year and into 2025 trade.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist