US Dollar Outlook: USD/CAD

USD/CAD attempts to retraces the decline from the start of the week as it stages a three-day rally, and the exchange rate may track the positive slope in the 50-Day SMA (1.4139) as it holds above the moving average.

US Dollar Forecast: USD/CAD Stages Three-Day Rally

Keep in mind, USD/CAD registered a fresh monthly low (1.4280) as Canadian Prime Minister Justin Trudeau announced his resignation at the start of the week, with the market reaction keeping the exchange rate within the December range.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, USD/CAD may negate the bull-flag formation carried over from last month should it trade within a defined range, and the Relative Strength Index (RSI) may continue to show the bullish momentum abating as it moves away from overbought territory.

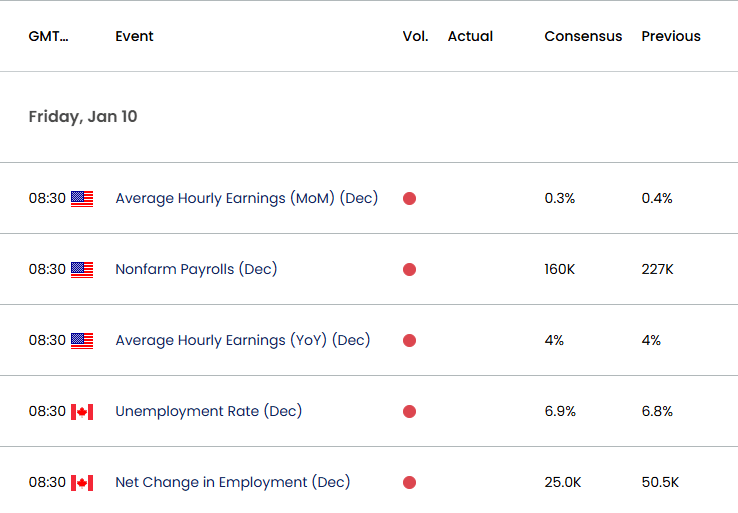

US/Canada Economic Calendar

Nevertheless, developments coming out of the US and Canada may sway USD/CAD as the Federal Reserve and Bank of Canada (BoC) pursue a neutral policy, and the exchange rate may threaten the opening range for January following the employment reports should the data prints deviate from the consensus forecast.

With that said, a limited reaction to the US/Canada employment report may keep USD/CAD within the December range, but a continuation pattern may unfold should the exchange rate track the positive slope in the 50-Day SMA (1.4139).

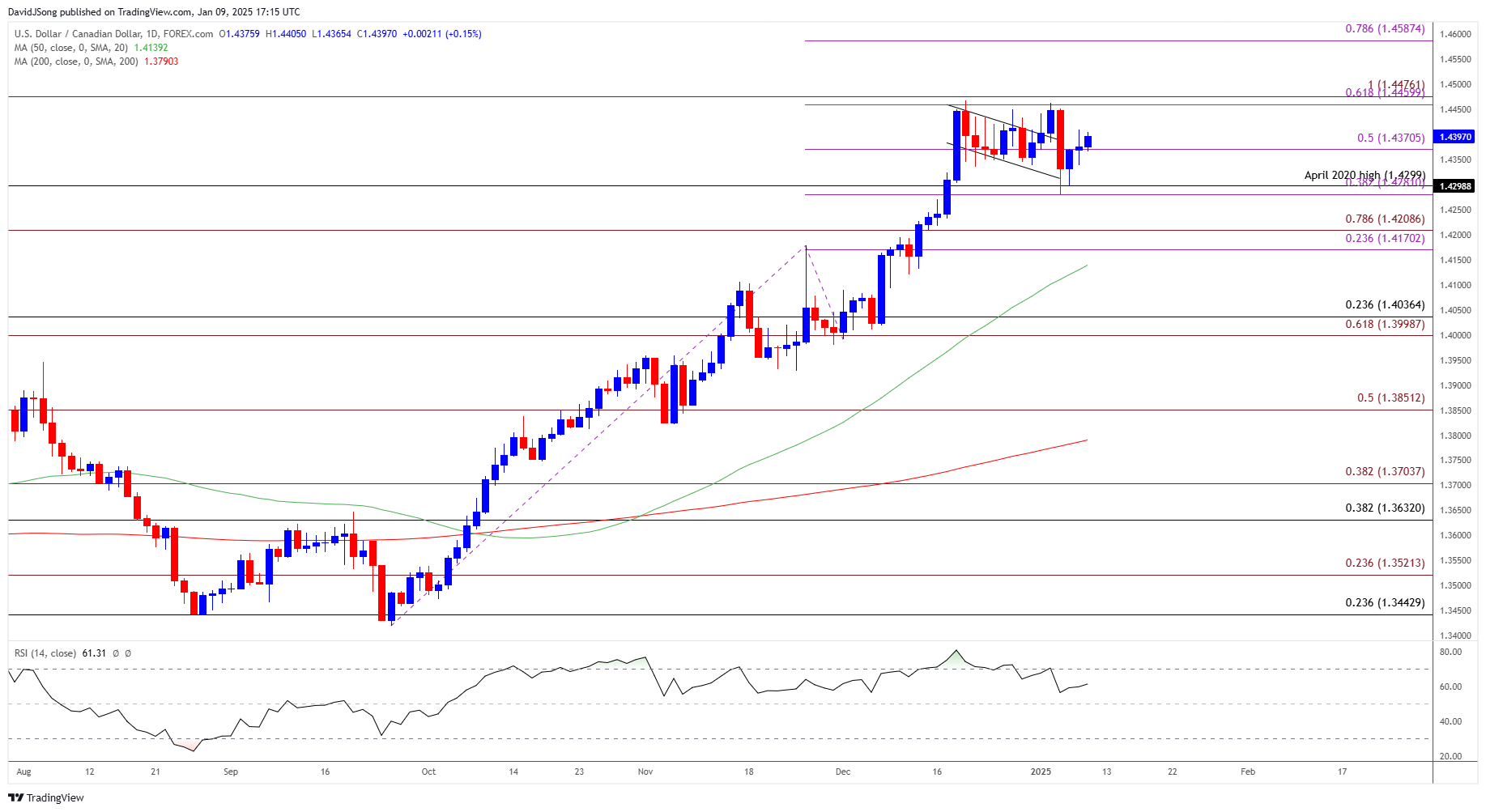

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CAD Price on TradingView

- USD/CAD retraces the decline from the start of the week as it bounces back from the 1.4280 (38.2% Fibonacci extension) to 1.4299 (April 2020 high) zone but need a break/close above the 1.4460 (61.8% Fibonacci extension) to 1.4480 (100% Fibonacci extension) area to open up 1.4590 (78.6% Fibonacci extension).

- Next region of interest comes in around 1.4750 (100% Fibonacci extension) but USD/CAD may continue to negate the bull-flag formation from last month should it struggle to push above the December high (1.4467).

- Lack of momentum to hold above the 1.4280 (38.2% Fibonacci extension) to 1.4299 (April 2020 high) zone may push USD/CAD back towards the 1.4170 (23.6% Fibonacci extension) to 1.4210 (78.6% Fibonacci extension) region, with the next area of interest coming in around 1.4000 (61.8% Fibonacci extension) to 1.4040 (23.6% Fibonacci retracement).

Additional Market Outlooks

EUR/USD Weakness Brings January Opening Range in Focus

US Non-Farm Payrolls (NFP) Report Preview (DEC 2024)

USD/JPY Clears December High Ahead of US NFP Report

GBP/USD Recovery Keeps 2024 Range Intact

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong