US Dollar Outlook: USD/CAD

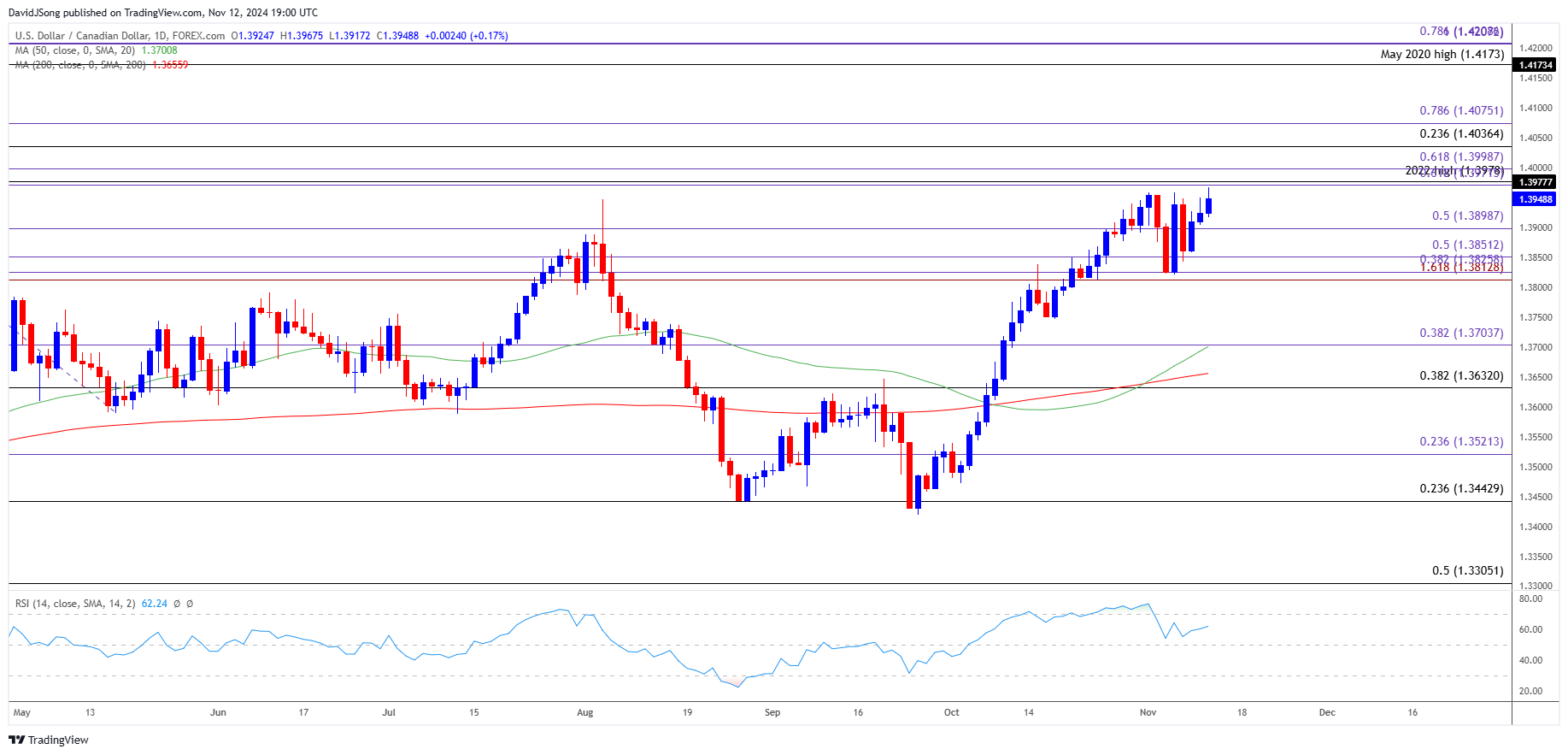

USD/CAD is on the cusp of testing the 2022 high (1.3978) as it pushes above the opening range for November, but lack of momentum to extend the recent series of higher highs and lows may keep the Relative Strength Index (RSI) out of overbought territory.

US Dollar Forecast: USD/CAD on Cusp of Testing 2022 High

Unlike the price action from October, the RSI holds below 70 even as USD/CAD registers a fresh yearly high (1.3968), and the oscillator may show the bullish momentum abating as it appears to be diverging with price.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, USD/CAD may struggle to retain the advance from the start of the week, but the update to the US Consumer Price Index (CPI) may keep the exchange rate afloat as the report is anticipated to show persistent inflation.

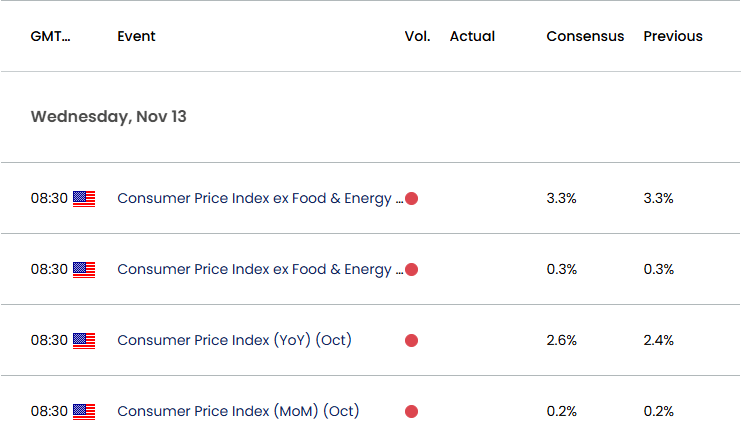

US Economic Calendar

The headline CPI is expected to increase to 2.6% in October from 2.4% per annum the month prior, while the core rate of inflation is anticipated to hold steady at 3.3% during the same period.

In turn, signs of sticky price growth may put pressure on the Federal Reserve to unwind its restrictive policy at a slower place, and the update may generate a bullish reaction in the US Dollar as it undermines speculation for another rate-cut at the Fed’s last meeting for 2024.

With that said, USD/CAD may attempt to test the 2022 high (1.3978) as it stages a three-day rally, but a softer-than-expected CPI report may curb the recent advance in the exchange rate as it fuels expectations for lower US interest rates.

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD extends the advance from the start of the week to register a fresh yearly high (1.3968), with a break/close above the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) region opening up the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) zone.

- Next area of interest comes in around the May 2022 high (1.4173) but USD/CAD may struggle to extend the recent series of higher highs and lows should it fail to push above the 2022 high (1.3978).

- Lack of momentum to hold above 1.3900 (50% Fibonacci extension0 may push USD/CAD back towards the 1.3810 (161.8% Fibonacci extension) to 1.3850 (50% Fibonacci extension) zone, with the next region of interest coming in around 1.3700 (38.2% Fibonacci extension).

Additional Market Outlooks

US Consumer Price Index (CPI) Preview (OCT 2024)

GBP/USD Outlook Hinges on Break of Monthly Opening Range

US Dollar Forecast: USD/JPY Defends Post-US Election Rally

US Dollar Forecast: EUR/USD Opening Range in Focus Ahead of US CPI

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong