US Dollar Outlook: EUR/USD

EUR/USD extends the rebound from the monthly low (1.0496) to pull the Relative Strength Index (RSI) above 30, but the recent recovery in the exchange rate may end up short-lived should the former-support zone around the April low (1.0601) act as resistance.

US Dollar Forecast: EUR/USD Rebound Pulls RSI Out of Oversold Zone

EUR/USD appears to be bouncing back ahead of the 2023 low (1.0448) as it starts to carve a series of higher highs and lows, and the RSI may show the bearish momentum abating as it moves away from oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, EUR/USD may attempt to further retrace the decline from the monthly high (1.0937), but fresh remarks from Federal Reserve officials may sway foreign exchange markets as Chairman Jerome Powell acknowledges that ‘the strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.’

US Economic Calendar

Fed officials may mirror the comments from Chairman Powell after unanimously voting for a 25bp rate-cut earlier this month, and the central bank may reflect a greater willingness to keep interest rates on hold at its last meeting for 2024 as the economy shows little signs of an imminent recession.

With that said, less-dovish remarks from Fed officials may curb the recent recovery in EUR/USD as it tames speculation for a December rate-cut, but the upcoming speeches may do little to derail the recovery in the exchange rate as the central bank pursues a neutral stance.

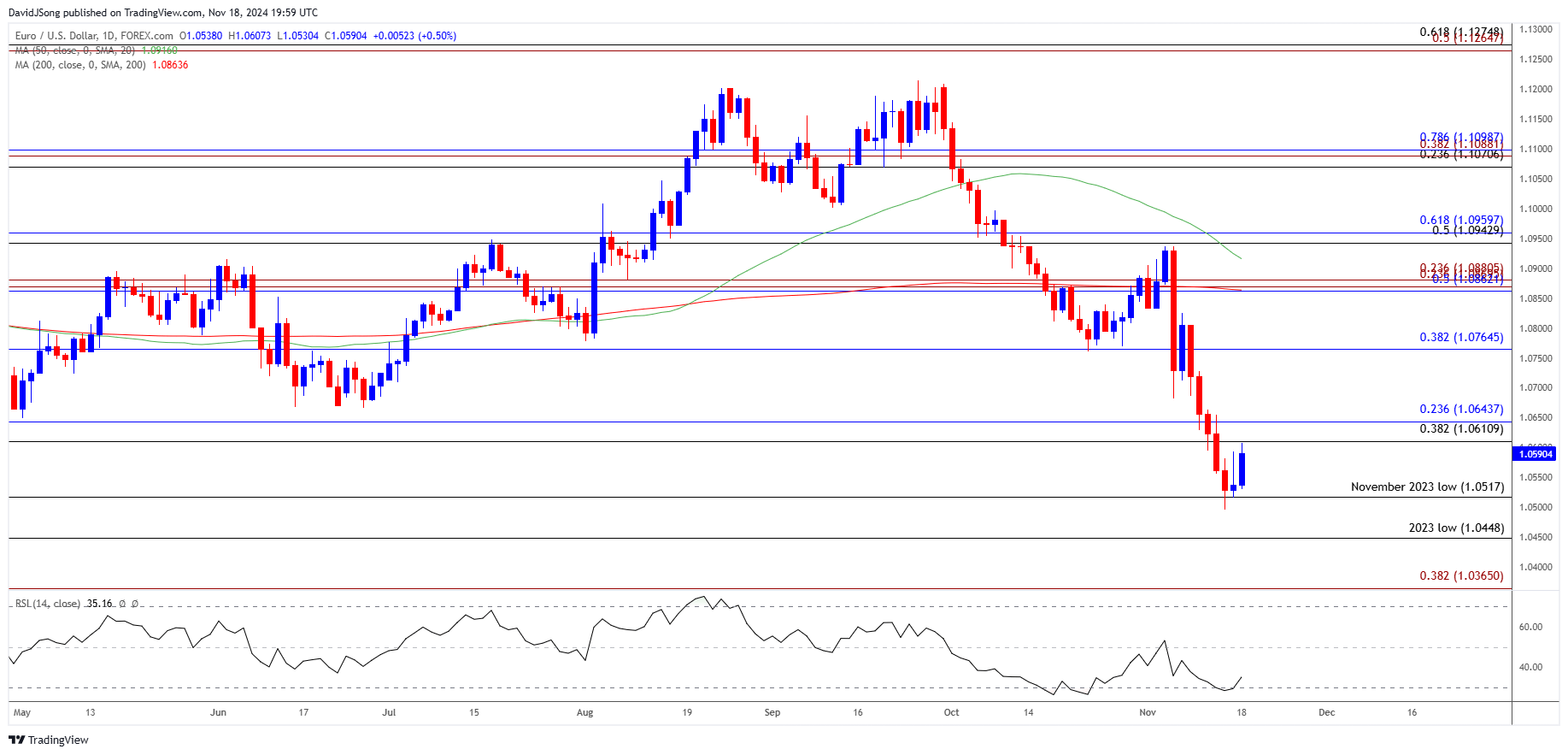

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD initiates a series of higher highs and lows after failing to close below the November 2023 low (1.0517), with a close back above the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region raising the scope for a move towards 1.0770 (38.2% Fibonacci retracement).

- Next area of interest comes in around 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) but the recent rebound in EUR/USD may unravel if it struggles to trade back above the former-support zone around the April low (1.0601).

- Failure to close back above the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region may push EUR/USD back towards the monthly low (1.0496), with a breach below the 2023 low (1.0448) opening up 1.0370 (38.2% Fibonacci extension).

Additional Market Outlooks

USD/JPY Rebounds as BoJ Ueda Pledges to Support Economic Activity

Canadian Dollar Forecast: USD/CAD Rally Clears 2022 High

US Dollar Forecast: AUD/USD Halts Bearish Price Series

GBP/USD Trades Below 200-Day SMA for First Time Since May

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong