US Dollar Outlook: EUR/USD

EUR/USD trades near the monthly low (1.0683) as it gives back the advance following the Federal Reserve rate-cut, and developments coming out of the US may continue to sway the exchange rate as the Consumer Price Index (CPI) is anticipated to show sticky inflation.

US Dollar Forecast: EUR/USD Opening Range in Focus Ahead of US CPI

EUR/USD struggles to retrace the decline following the US election even though Fed Chairman Jerome Powell insists that ‘in the near term, the election will have no effects on our policy decisions,’ and it seems as though the central bank will continue to switch gears over the coming months as ‘we think that even with today's cut policy is still restrictive.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

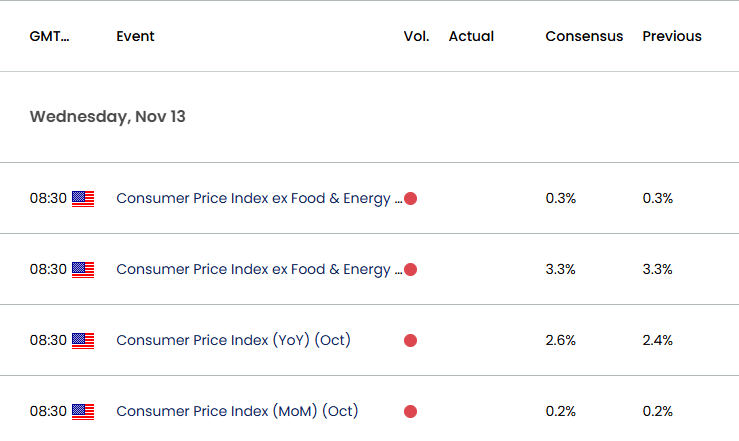

US Economic Calendar

However, the update to the US CPI may put pressure on the Federal Open Market Committee (FOMC) to further combat inflation as the headline reading is projected to increase to 2.6% in October from 2.4% per annum the month prior, while the core index is anticipated to hold steady at 3.3% during the same period.

With that said, signs of persistent inflation may keep EUR/USD under pressure as it curbs speculation for a Fed rate-cut in December, but a softer-than-expected US CPI report may produce headwinds for the Greenback as it encourages the FOMC to further unwind its restrictive policy.

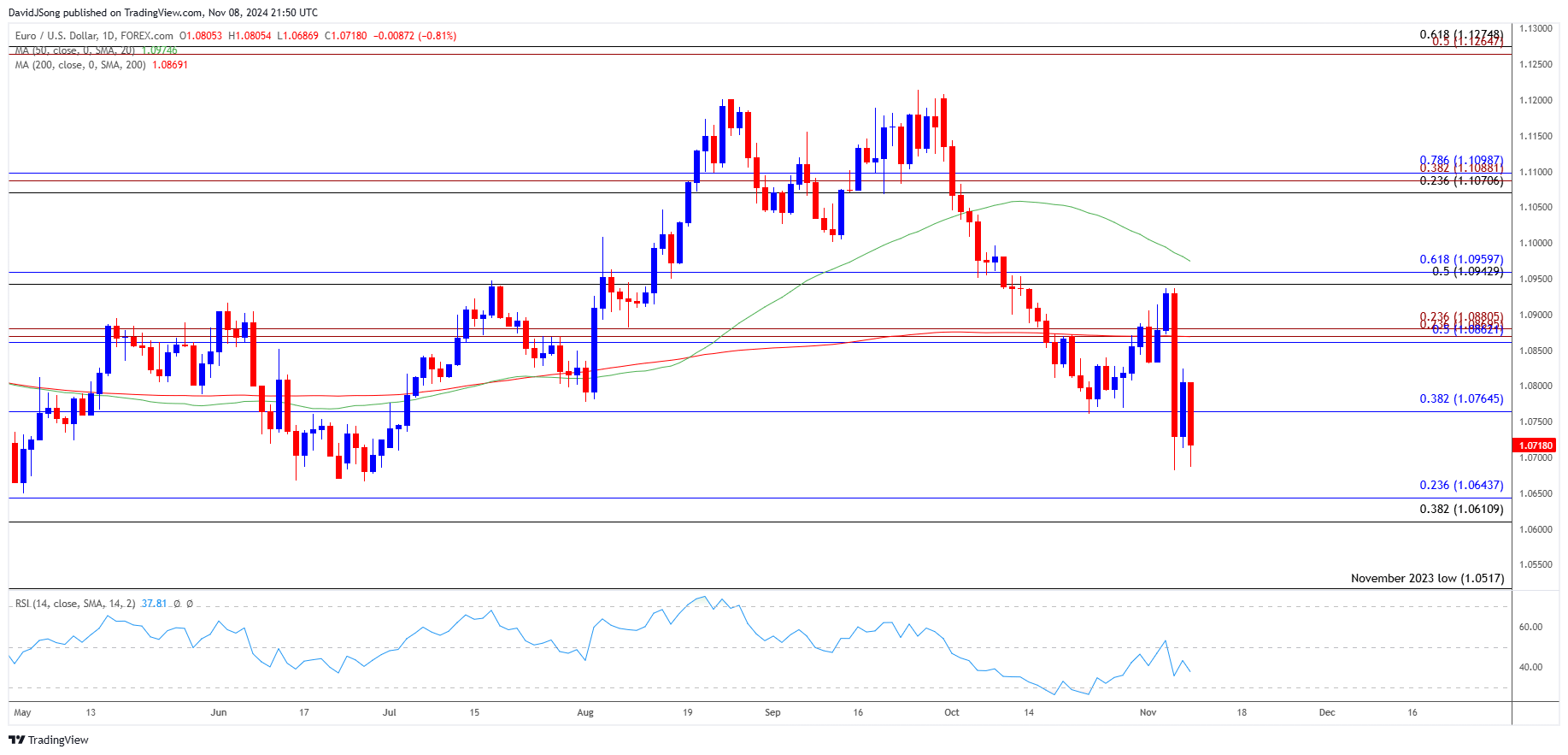

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may threaten the opening range for November as it struggles to hold above 1.0770 (38.2% Fibonacci retracement), with a breach below the weekly low (1.0683) raising the scope for a test of the June low (1.0666).

- Failure to defend the May low (1.0650) may push EUR/USD towards the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region but EUR/USD may attempt to retrace the decline from earlier this month if it defends the week low (1.0683).

- Need a move back above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) area to bring the monthly high (1.0937) on the radar, with a break/close above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone opening up the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) region.

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

Gold Price Rebound Emerges Ahead of the 50-Day SMA

USD/CAD Still Holds Below Monthly High Following Dovish Fed Rate Cut

GBP/USD Recovers Ahead of 200-Day SMA amid Hawkish BoE Rate Cut

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong