US Dollar Outlook: EUR/USD

EUR/USD appears to be defending the yearly low (1.0333) as it rebounds from a fresh monthly low (1.0343), with the recovery in the exchange rate keeping the Relative Strength Index (RSI) above 30.

US Dollar Forecast: EUR/USD Defends Yearly Low to Keep RSI Above 30

EUR/USD may track the November range as the RSI moves away from oversold territory, and the exchange rate may attempt to retrace the decline following the Federal Reserve interest rate decision amid the limited reaction to the US Personal Consumption Expenditure (PCE) Price Index, which showed the core rate of inflation holding steady at 2.8% in November versus forecasts for a 2.9% print.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

With that said, the failed attempt to test the yearly low (1.0333) may push EUR/USD back towards the monthly high (1.0630), but the exchange rate may track the negative slope in the 50-Day SMA (1.0644) as it holds below the moving average.

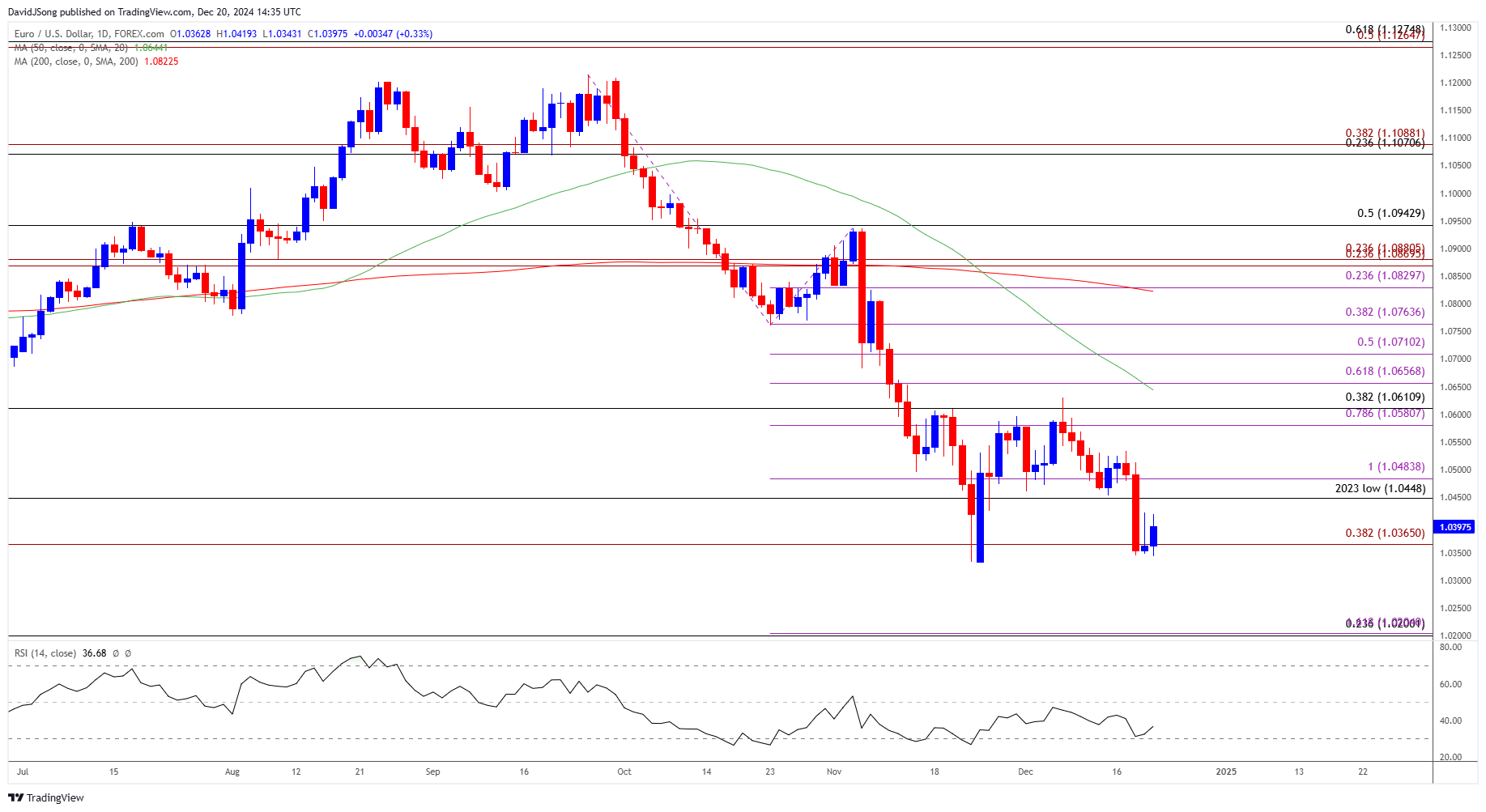

EUR/USD Chart – Daily

Chart Prepared by David Song, Senior Strategist; EUR/USD on TradingView

- EUR/USD trades back above 1.0370 (38.2% Fibonacci extension) after failing to test the November low (1.0333), with a move back above the 1.0448 (2023 low) to 1.0480 (100% Fibonacci extension) zone bringing the 1.0580 (78.6% Fibonacci extension) to 1.0610 (38.2% Fibonacci retracement) region back on the radar.

- A breach above the monthly high (1.0630) may push EUR/USD towards 1.0660 (61.8% Fibonacci extension), but the exchange rate may struggle to retain the rebound from the monthly low (1.0343) should it track the negative slope in the 50-Day SMA (1.0644).

- Need a breach below the November low (1.0333) to open up 1.0200 (23.6% Fibonacci retracement), with the next area of interest coming in around 0.9950 (50% Fibonacci extension).

Additional Market Outlooks

GBP/USD Holds Below Pre-Fed Levels Even as BoE Keeps Bank Rate Steady

US Dollar Forecast: AUD/USD Approaches November 2023 Low

USD/CAD Pullback Keeps RSI Below Overbought Territory

Gold Price Forecast: Bullion Remains Below Pre-US Election Prices

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong