Unsurprisingly, the US dollar is still holding strong, following its big 2% rise last week against a basket of foreign currencies. The greenback has been supported by a few key factors ahead of the release of US CPI on Thursday. First, the escalating conflict in the Middle East has traders on edge, and second, September's jobs report was much stronger than expected. The big concern right now is the potential for an oil shock, should Israel retaliate forcefully against Iran against the advice of basically all the countries in the region, and now some western powers. This has the potential to trigger stagflation, which is never good for the global economy. But let’s not get too ahead of ourselves and focus on near-term factors that could drive the FX markets. Well, there's not much out there that suggests a big sell-off for the US dollar, unless we see some de-escalation in the Middle East. The idea of a 50-basis point Fed rate cut is pretty much off the table now, and even this week's US inflation data isn’t likely to shift that sentiment. Markets seem to have settled into this expectation for now, meaning that the US dollar forecast remains positive for now.

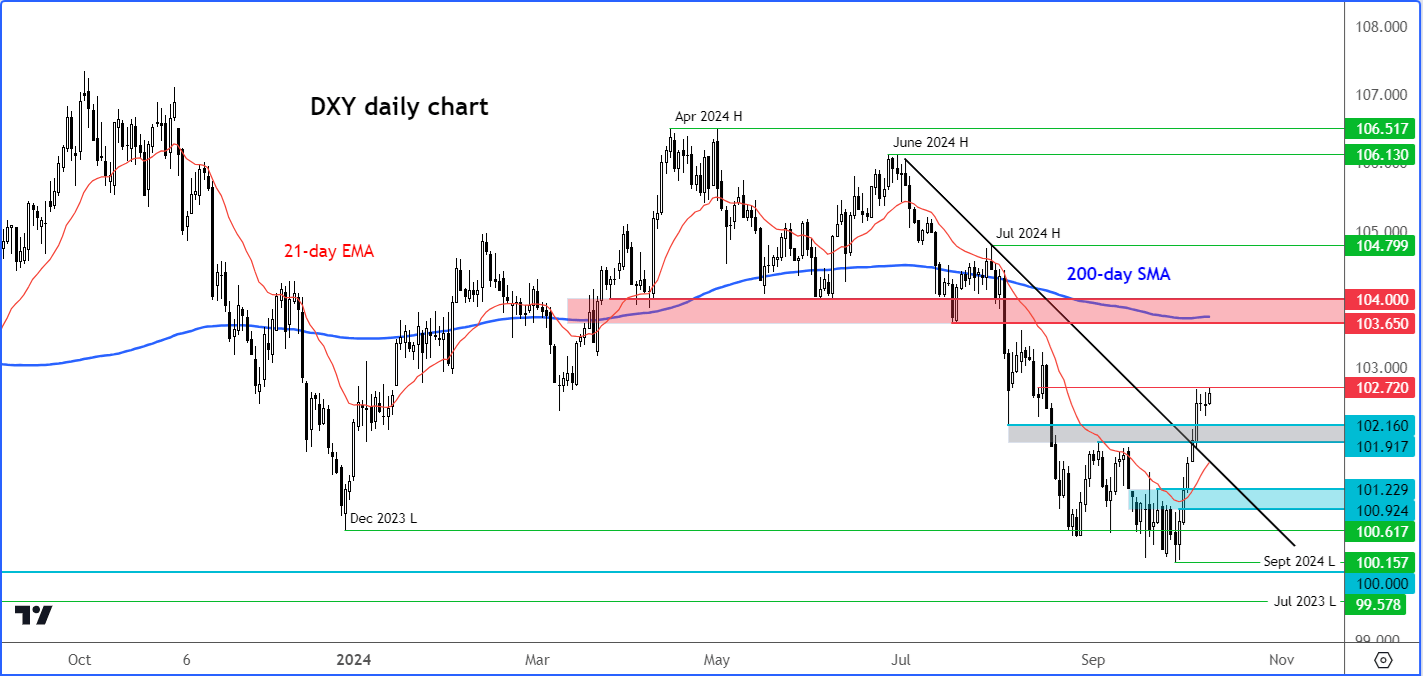

Before discussing the macro factors in greater detail, let’s have a quick look at the chart of the Dollar Index first…

Dollar Index (DXY) extends gains after bullish reversal last week

Source: TradingView.com

Following last week’s big bullish engulfing candle, the dollar index has remined on the front foot at the start of this week, holding comfortably above the broken bearish trend and support in the 101.90-102.15 region. At the time of writing, it was probing liquidity above last week’s high, testing 102.72. The big area of resistance is still quite far around 103.65 to 104.00 (where the 200-day average meets a former pivotal zone), meaning there is further room for the dollar rally before it potentially fades.

US dollar forecast: FOMC minutes coming up before attention turns US CPI

There is not much in the way of market moving data today and the release of the September FOMC minutes tonight, when the Fed cut rates by 50 bp, should not cause a major shift given Powell has already spoken and was less dovish than expected. Stronger US economic data releases since that meeting means the market has already scaled back expectations for further aggressive rate cuts. Until we see fresh evidence of a slowing labour market again, investors are unlikely to re-price an aggressive Fed easing cycle again.

This week, all eyes are on Thursday when we’ll get the latest CPI estimate. Then, on Friday, the PPI measure of inflation will come out. Overall, these inflation figures probably won’t shake up the Fed's stance or the bullish dollar forecast too much—unless we see a major surprise. For September, core CPI is expected to dip to 0.2% month-on-month, down from 0.3% in August. Even if it comes in at 0.1%, it’s likely not going to pull focus from the labour market. With the Fed shifting its emphasis to employment, any unexpected inflation numbers are probably just going to cause a bit of dollar volatility here and there.

Meanwhile, most major foreign currencies remain week, further alleviating pressure on the US dollar. The sharp decline in Chinese markets over the last couple of sessions has put some pressure on commodity currencies. Additionally, the RBNZ cut rates by 50 basis points, sending the kiwi lower.

Middle East tensions and US election aiding bullish dollar forecast

While tensions in the Middle East might not escalate any further, a meaningful de-escalation seems unlikely, which means we could see oil prices stay elevated. They did take a sharp dive on Tuesday, along with some other commodities, largely due to developments in China. But if oil rebounds because of heightened tensions in the Middle East, that could lend renewed support to the dollar.

On another note, with the US presidential election looming, defensive strategies are likely to favour the dollar. The polls are quite tight, indicating a close race. Kamala Harris has a narrow lead at 49% compared to Trump's 46%, according to a recent New York Times/Siena College poll conducted from September 29 to October 6. Meanwhile, a Reuters/Ipsos poll shows Harris leading Trump by a slimmer margin of 46% to 43%.

Interestingly, betting odds on the blockchain-based platform Polymarket shifted significantly in Trump’s favour on Monday. If this signals an uptick in his chances, it could positively impact the US dollar forecast, especially given Trump's protectionist policies, which should hinder the likes of the euro.

How to trade the US elections

We have explored how the results, both actual and anticipated, of the US Presidential Election could impact the EUR/USD and offer insights on how traders can leverage the election dynamics to enhance their trading strategies before, during, and after the November 5 vote. (Click on the link to find out more).

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R