US Dollar Outlook: AUD/USD

AUD/USD appears to be halting the selloff from the start of the week as it no longer carves a series of lower highs and lows, but the exchange rate may stage further attempts to test the yearly low (0.6349) amid waning speculation for a Federal Reserve rate-cut in December.

US Dollar Forecast: AUD/USD Halts Bearish Price Series

AUD/USD trades near the weekly low (0.6441) as the US Retail Sales report shows a 0.4% rise in October versus forecasts for a 0.3% print, and developments coming out of the US may continue to sway the exchange rate as Fed Chairman Jerome Powell insists that ‘in considering additional adjustments to the target range for the federal funds rate, we will carefully assess incoming data, the evolving outlook, and the balance of risks.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

At the same time, Chairman Powell acknowledged that ‘the economy is not sending any signals that we need to be in a hurry to lower rates,’ and went onto say that ‘the strength we are currently seeing in the economy gives us the ability to approach our decisions carefully’ while speaking at an event held by the Dallas Regional Chamber.

Source: CME

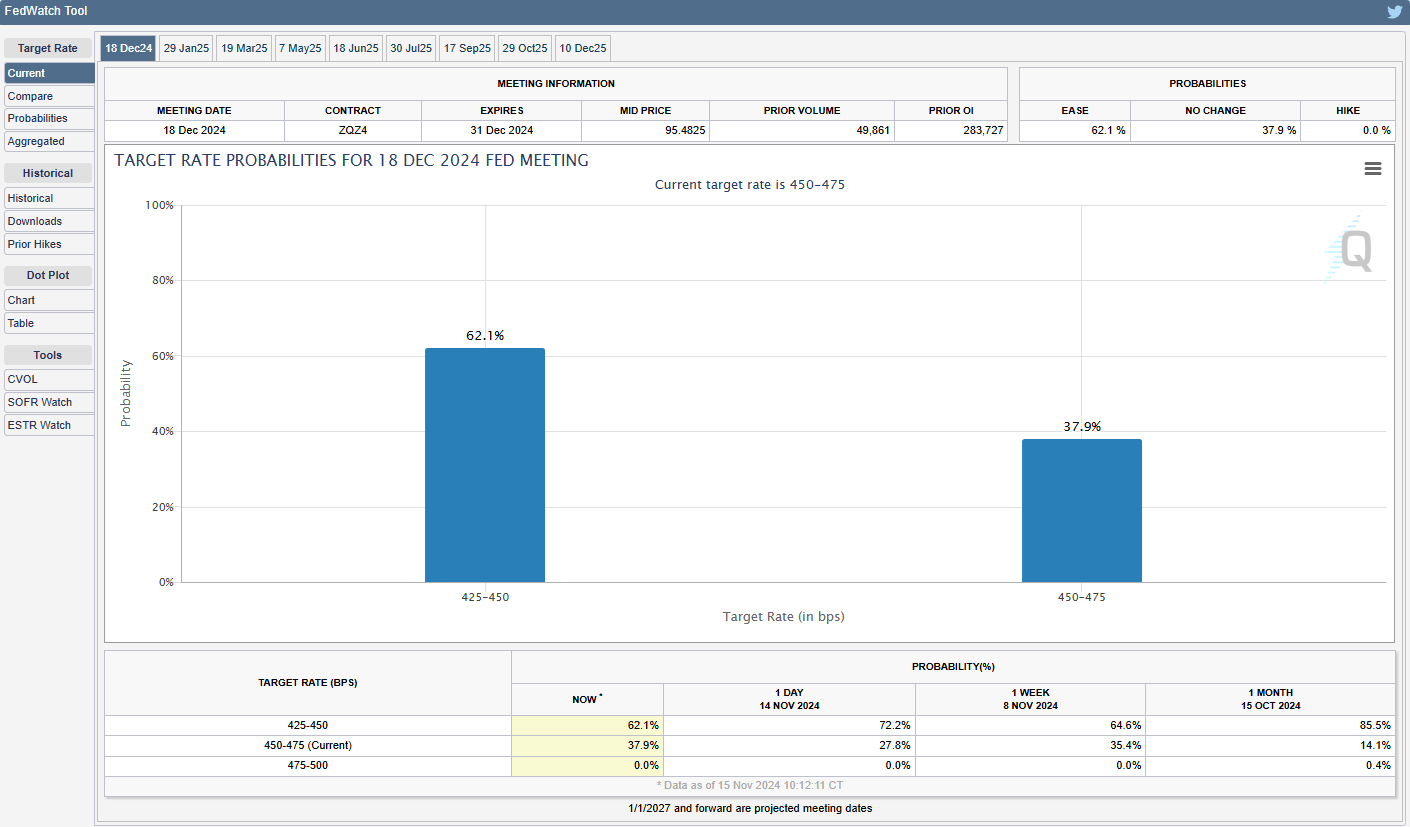

In turn, the CME FedWatch Tool now reflects a greater than 60% probability for a December rate-cut compared to the 86% seen one-month ago, and it remains to be seen if the Federal Open Market Committee (FOMC) will adjust its forward guidance at their last meeting for 2024 as Chairman Powell and Co. are slated to update the Summary of Economic Projections (SEP).

Until then, speculation surrounding Fed policy may influence the US Dollar as the central bank moves toward a neutral stance, and the recent strength in the Greenback may persist as the world’s largest economy shows little signs of an imminent recession.

With that said, failure to hold above the weekly low (0.6441) may push AUD/USD towards the yearly low (0.6349), but the exchange rate may attempt to retrace the decline from the monthly high (0.6688) as it no longer carves a series of lower highs and lows.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD appeared to be on track to test the yearly low (0.6349) amid the bearish prices series but lack of momentum to break/close below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region may push the exchange rate back towards the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) zone.

- Next area of interest comes in around 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) but the recent rebound in AUD/USD may unravel should if fail to defend the weekly low (0.6441).

- A break/close below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) region raises the scope for a move towards the yearly low (0.6349), with the next area of interest coming in around the 2023 low (0.6270).

Additional Market Outlooks

GBP/USD Trades Below 200-Day SMA for First Time Since May

EUR/USD Eyes 2023 Low as RSI Flirts with Oversold Zone

Gold Price Outlook Mired by Close Below 50-Day SMA

US Dollar Forecast: USD/CAD on Cusp of Testing 2022 High

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong