A surprise raise in US wage pressures weighed on sentiment on the eve of the Fed meeting, sending the US dollar broadly higher and Wall Street lower. Labour costs rose 1.2% in Q1, up from 0.9% in Q4 whilst wages and benefits rose 1.1% (up from 0.9% and 0.7% respectively).

There really is no reason at all for the Fed to slightly tease the notion of cuts this year, not that they had much reason to before. But it might be enough to raise concerns another cut this year as a real concern, which seems apparent look at how markets responded.

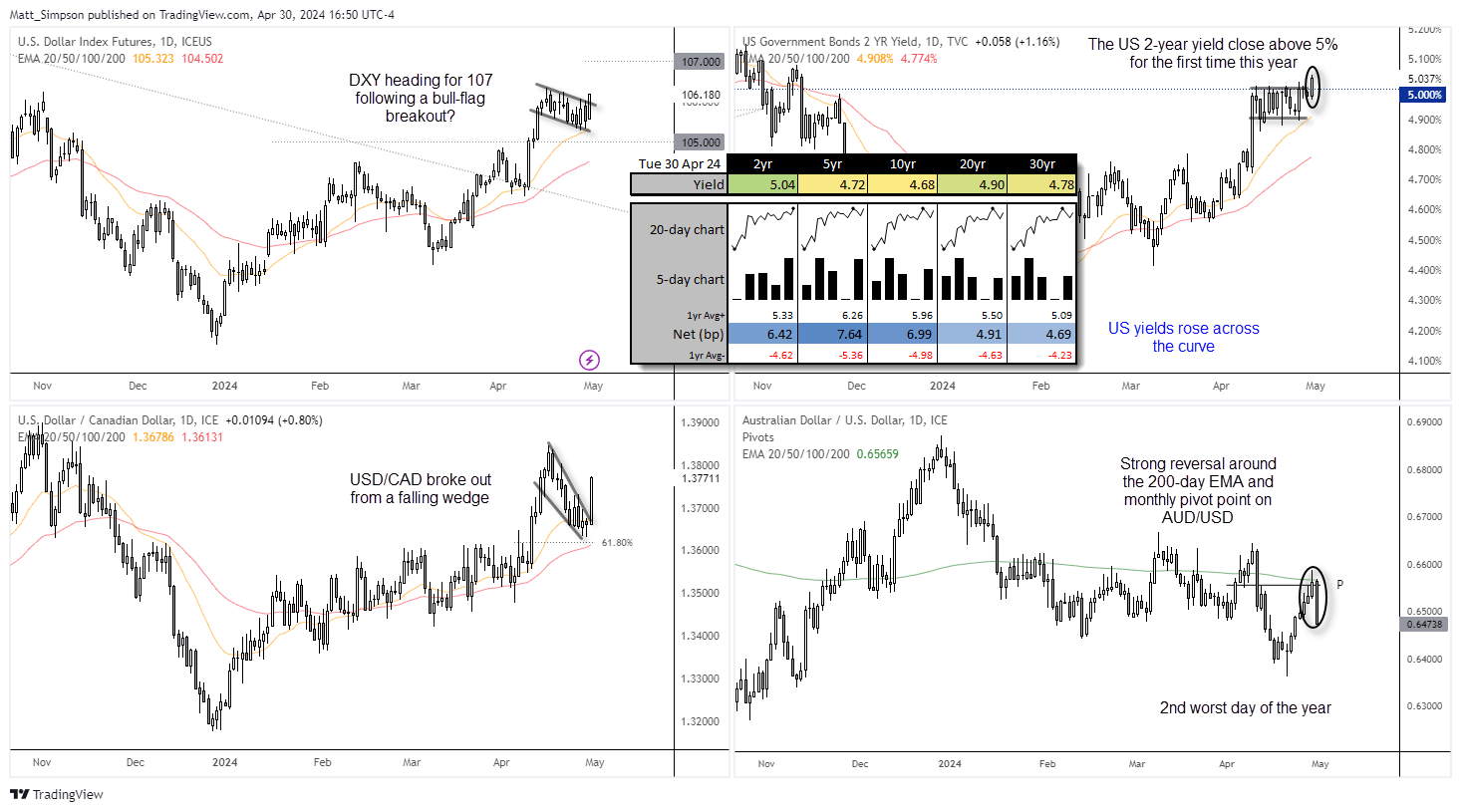

- US yields were higher across the board, with the 2-year up 6.4 basis points to 5.4%, closing above the five handle for the first time since November and the 5 and 10-year yield rose 7.6 and 7 bp respectively

- This firmly placed the US dollar as the strongest FX major, with NZD/USD and AUD/USD leading the way lower as they fell alongside other risk assets

- Oddly, Fed fund futures are still implying a 3.9% chance of a cut today when practically no chance likely exists in the current environment

- It was the second worst day of the year for AUD/USD, notching up its fifth fall in excess of -1% time this year

- Bearish engulfing days formed on the Dow Jones, S&P 500 and Nasdaq, with Nasdaq futures rolling over nicely beneath the 50-day EMA in line with yesterday’s analysis

- Even gold prices were lower as traders presumably moved into cash or close out their holdings to nurse losses on equities

- USD/CAD saw a sold bullish breakout of its falling wedge pattern, which now brings the April high back into focus for bulls

Economic events (times in AEST)

With inflation reports for New Zealand and Australia rising last week and now growing wage pressure in the US on the radar, today’s NZ labour costs index and speech from RBNZ governor Orr may warrant a closer look. And with traders particularly sensitive to stronger economic data from the US, eyes will be on today’s ADP employment and ISM manufacturing reports for further signs of inflationary pressures and strong labour market. But of course, the big event is the FOMC meeting.

- 08:45 – New Zealand labour market report, labour cost index

- 09:00 – Australian manufacturing, construction indices (AIG)

- 09:00 – RBNZ governor Orr speaks

- 10:30 – Japan’s manufacturing PMI

- 22:15 – US ADP nonfarm payroll report

- 22:15 – Canada’s manufacturing PMI, BOC Macklem speaks

- 23:45 – US final manufacturing PMI (S&P Global)

- 00:00 – US ISM manufacturing, JOLT job openings, construction spending

- 04:00 – Fed interest rate decision, FOMC statement

- 04:30 – FOMC press conference

AUD/USD technical analysis:

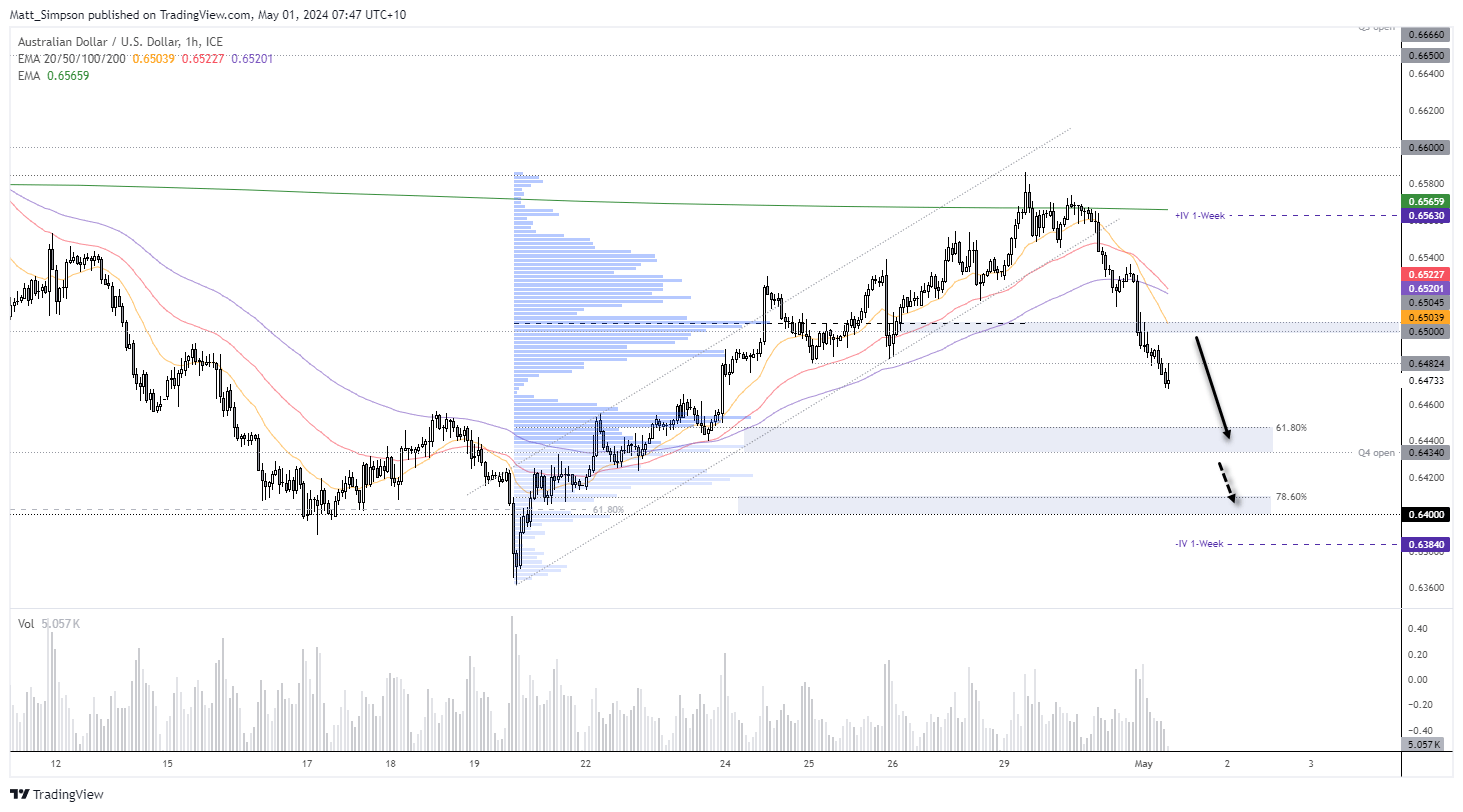

The Australian dollar managed to rise for six days before bearish momentum arrived, which came with such force it wiped out four days of those prior gains. A firm close beneath 65c, weak China data and a pending FOMC meeting (which risks being hawkish) could keep AUD/USD under pressure.

The 1-hour chart shows bearish momentum allowed little in the way of retracements, which usually implies there could be further losses to materialise. 65c makes a viable area for bears to reload should they be treated to a retracement higher, but there’s a reasonable chance prices may only trade in a tight range near yesterday’s lows in a limp fashion. As we approach the Fed meeting, volatility tends to pick up so traders holding ‘overnight’ from APAC may wat to allow quite a bit of wriggle room, assuming they want to hod risk at al overnight. But referring to the higher timeframes, I suspect a swing high has now formed on AUD/USD and a move to 64c at a minimum is now on the cards as the week progresses.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge