Rational pricing may not win a rational earnings reaction, as options point to sharp rise in volatility

Key points to watch

- Investors will breathe a sigh of relief tonight if the self-styled transportation and logistics group meets expectations and reports the loss of ‘only’ about $1.46bn in the third quarter on an operating basis. That’s far narrower than losses of some $5bn posted in Q2.

- The stock has dropped around 30% since its previous quarterly results early in August, so whilst a series of one-off circumstances boosted costs in the quarter in a way that compounded Uber’s routinely high expenditure, a relatively smaller loss in the past quarter is likely to—paradoxically—help underpin the shares.

- The $52.5bn group had in fact begun a programme of ‘rationalisation’—in more ways than one, in the second quarter. Without the distraction of a bigger than expected bonfire of cash, investors ought to have the headspace to focus more on progress in a move to ‘rational’ pricing as well as job cuts and other cost controls.

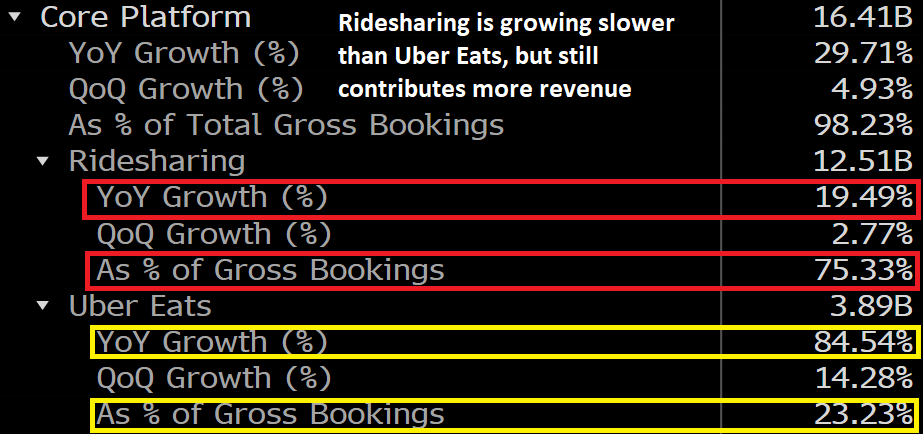

- In terms of growth, Uber Eats is where it’s at as expansion in food delivery appears to accelerate at a higher pace than in ride sharing. Still, ride sharing will continue to contribute the bulk of gross bookings, suggesting that Uber’s market share remains relatively stable.

- The table excerpt below shows ride sharing is expected to have contributed 75.33% of gross bookings in Q3. That would be up from a 74.2% contribution in the quarter before. Uber Eats growth is forecast at a stonking 84.5% relative to the same quarter in 2018 vs. Ride sharing is seen rising 19.5% rise. But Eats still contributes less than a quarter of total bookings.

Ridesharing & Uber Eats: Q2 2019 growth and contribution

Source: Bloomberg

- Uber is expected to have deployed fewer promos in terms of rider subsidies, whilst placing a greater onus on profitable niches, e.g. shared rides and corporate deals. Together with a trend of higher prices in some major cities, rider growth will almost certainly slow.

- California’s push to classify drivers as employees, under state legislation known as the AB5 bill, has massive cost implications and will be a major focus during the post earnings conference call. Adjusted revenue forecast: $3.39bn, up 15% year-on-year.

Key forecasts (Bloomberg Consensus)

Q3 revenue: $3.39bn, up 18% qtr.-on-qtr., up 15.3% yr.-on-yr.

Q3 operating loss: $1.46bn vs. $5.48bn loss in Q2

Q3 pre-tax loss: $1.485bn vs. $5.24bn loss in Q2

Q3 Adjusted loss per share: $0.626 vs. $0.477 in Q2

Possible stock reaction

Obviously, with the shares down around 30% from August peaks and still below their IPO prices, sentiment is likely to be bolstered if Uber’s Q3 report meets expectations, or preferably better. However, options pricing suggests a bearish set up is a foot, making a volatile reaction regardless of how well results map against expectations. Options expiring at the end of this week point to a 14% post-earnings move. However, puts (bearish trades) outnumber calls (usually bullish) by more than 2-to-1, whilst Monday’s mild decline marks a third straight day of Uber stock selling. Current implied volatility is elevated at 165%, more than three times the 90-day historical average of 46%.