DAX drops as banking fears linger

- UBS buys Credit Suisse, worries linger

- German PPI cools less than expected

- DAX sellers look to 14500

The DAX is falling at the start of the week, extending losses from the previous week as investors continue fretting over the risk of contagion in the banking sector, despite UBS buying Credit Suisse over the weekend and plenty of liquidity support.

In an emergency deal, UBS bought the troubled lender Credit Suisse for CHF 3 billion, with billions in SNB and government support. While this briefly shored up confidence in the Asian session, the upbeat mood quickly faded as attention quickly shifted to the massive hit that some Credit Suisse bondholders would take under the acquisition.

Credit Suisse tier 1 bonds, with a notional value of $17 billion will be valued at 0, raising fears for holders of tier 1 bondholders at other banks.

Despite several steps of intervention in Europe and the US, jitters over the banking crisis are not going away.

On the data front, German PPI came in hotter than expected at 15.8% YoY in February, down from 17.6% in January but missing forecasts of 14.5%.

The data comes after the ECB hiked rates by 50 basis points last week to tackle stickier-than-expected inflation.

ECB President Christine Lagarde is due to speak later.

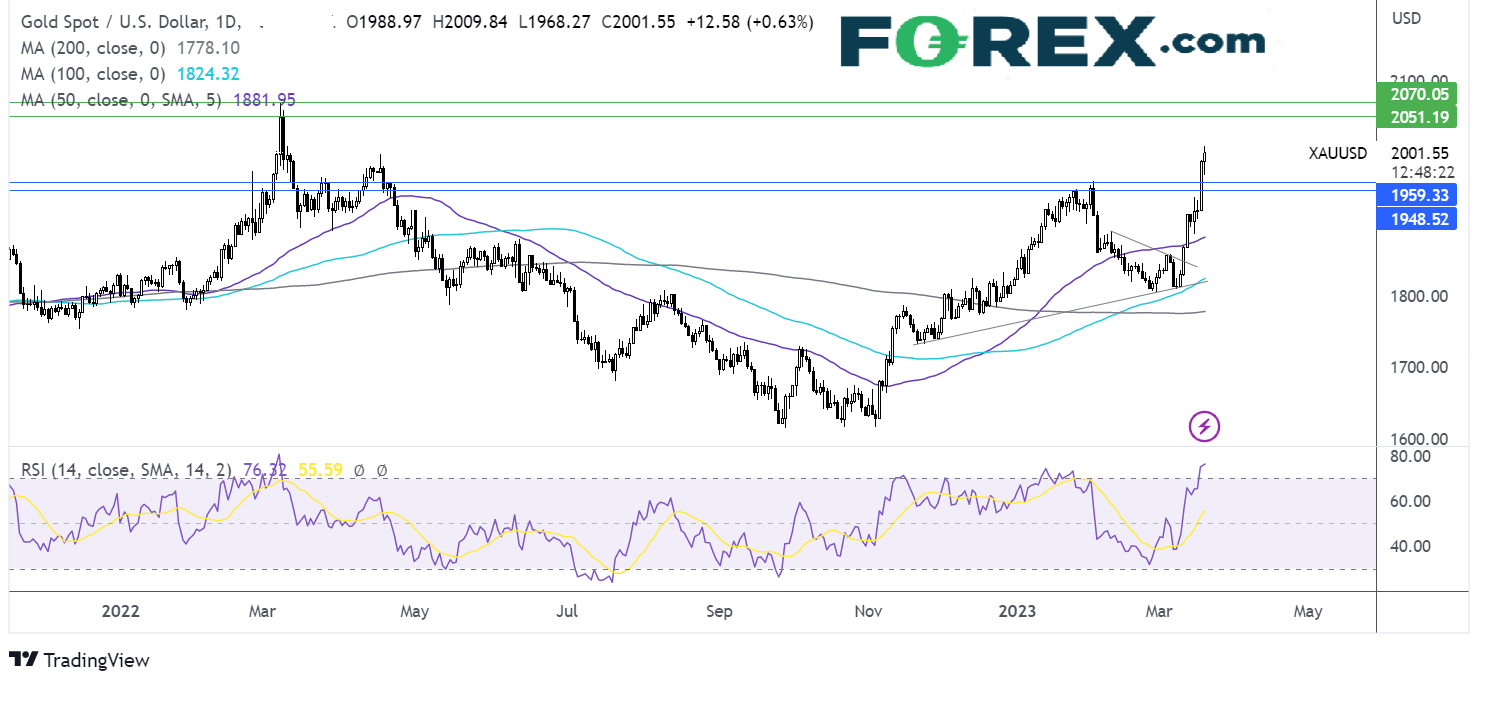

Where next for the DAX?

The DAX has fallen below its 100 & 50 sma and has broken out below the multi-month rising trendline. This, as well as the bearish RSI, keeps sellers hopeful of further downside.

Sellers could look to break below 14500, the daily low, to bring 14000, the psychological level into target.

Meanwhile, buyers could look for a rise over 14700, the December high, and 50 sma, before 15000 the rising trendline resistance. A rise above the 100 sma at 15270 could negate the near-term downtrend.

Gold rises above $2000

- Gold rises as aggressive Fed bets ease

- Safe haven flows lift the metal as banking worries linger

- Gold in overbought territory

Gold jumped 6.4% last week and is extending those gains on Monday. The precious metal is finding support from the weaker USD and falling treasury yields as investors rein in Fed rate hike expectations and from safe-haven flows amid fears of a banking crisis.

What a difference a week makes. Just 10 days ago, the market was pricing in a 70% probability of a 50 bps hike. Today, the 50 bps hike is off the table, and the market sees a 40% likelihood of the Fed keeping policy unchanged and a 60% chance of a 25 bps hike.

The expected terminal Fed rate has also come down to 4.8% from 5.5%. Banking sector news will remain in focus ahead of the FOMC rate decision.

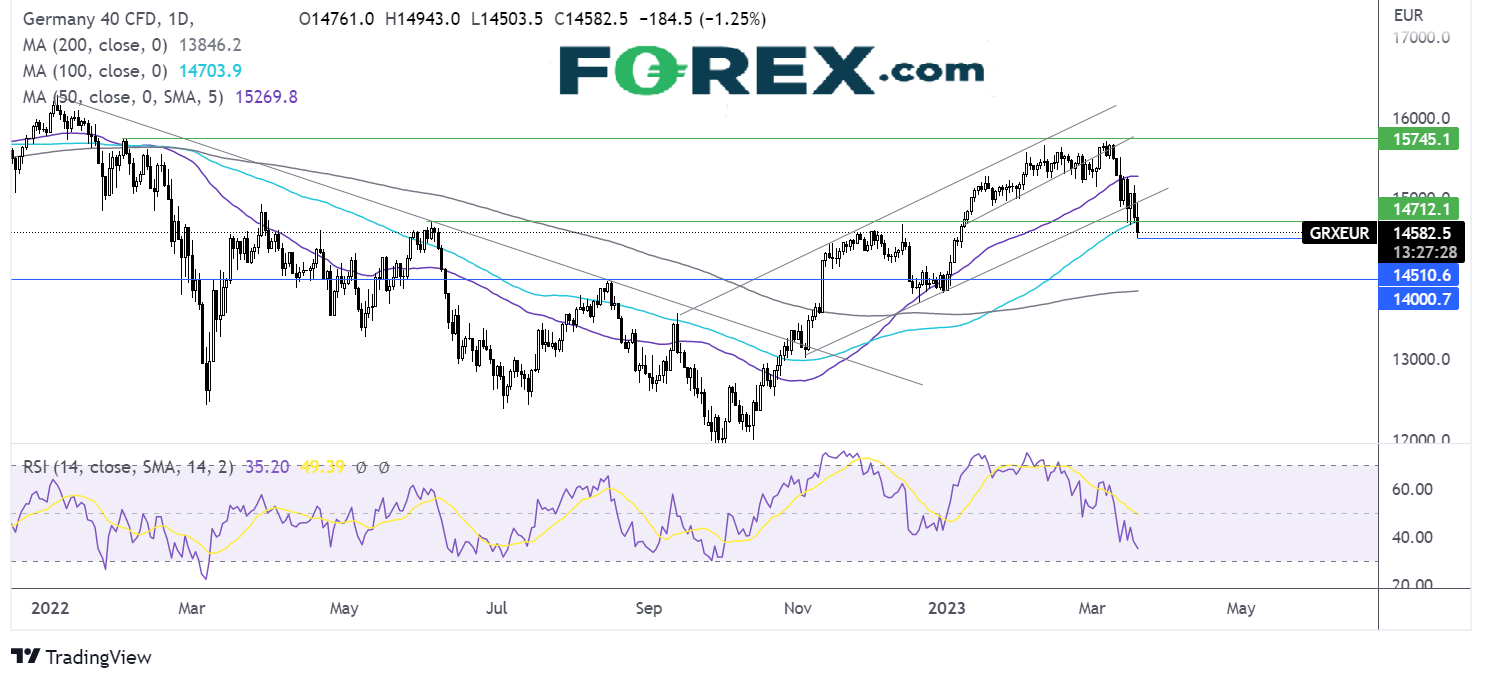

Where next for Gold prices?

Gold jumped 3.5% on Friday, rising above resistance at 1959 the February high. Today, the price has risen above 2000 ahead of the European open. Still, the RSI in overbought territory could spark a corrective move lower.

Immediate support can be seen at 1959, with a break below here opening the door to 1950 round number

Meanwhile, buyers could look for a close above 2000 psychological level, which could open the door to 2050 and 2070 the March ’22 high.